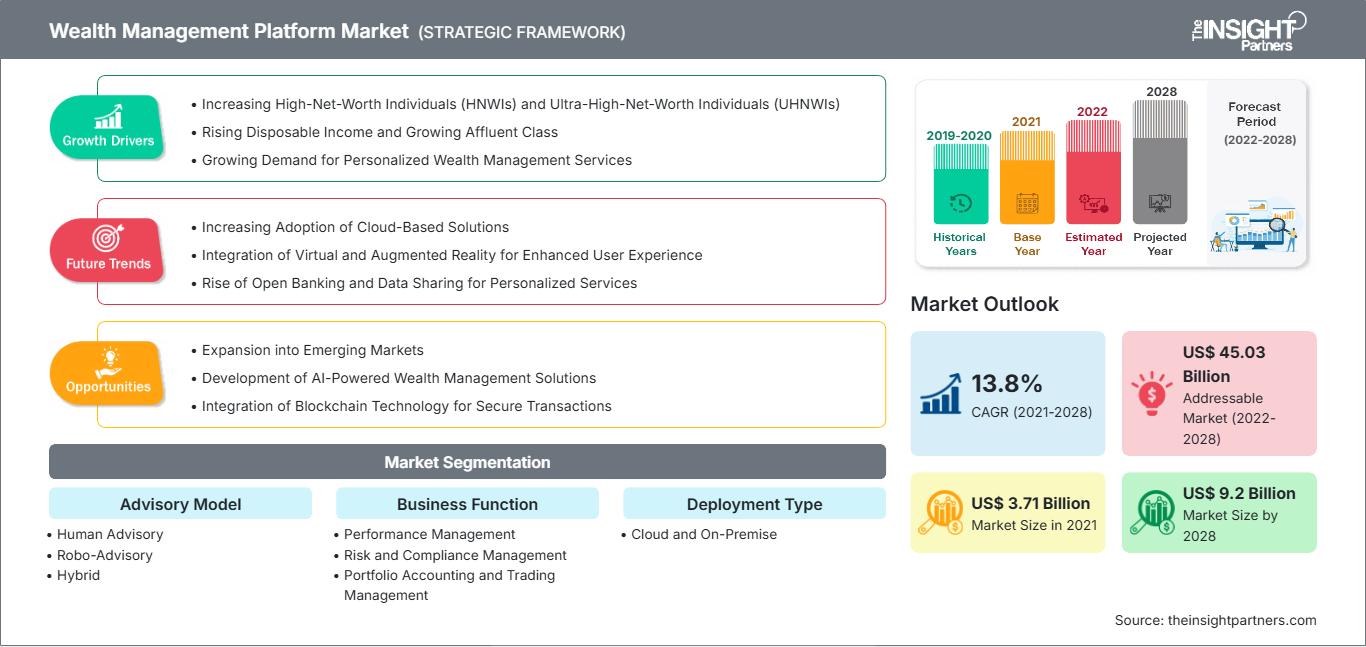

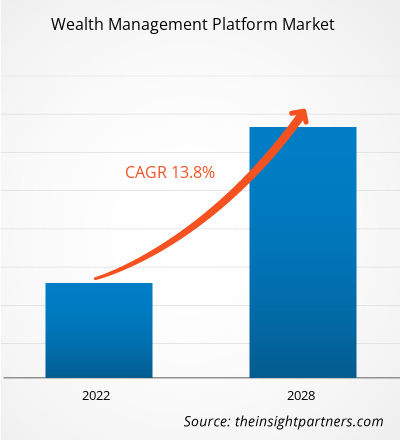

财富管理平台市场预计将从2021年的37.104亿美元增长到2028年的91.976亿美元;预计2021年至2028年的复合年增长率为13.8%。

财富管理平台专为规划和监控金融服务而设计,并结合税务和法律咨询、遗产规划、个人零售银行服务和投资管理。各行各业的数字化进程日益加快,金融机构也持续强调系统自动化,致力于开发工作流程以简化客户的生活。金融服务提供商正在逐步实施开放应用程序接口 (API) 框架,借助银行渠道和其他数字平台,提供其金融服务以及第三方产品。API 允许服务提供商相互访问彼此的产品和服务。然而,传统的财务顾问正在通过采用内部平台来满足客户日益增长的需求,以应对投资者的不同偏好。财富管理平台提供多种优势,例如丰富和精简业务、通过系统自动化提高业务流程效率、合规性、服务标准化、全渠道方法以及卓越的用户体验。财富管理软件包括顾问前台、客户报告、绩效和风险分析、投资组合管理以及多渠道客户前端模块。技术的进步提高了将人工智能和分析技术融入系统的机器人咨询的接受度。

许多行业正专注于其财富管理平台的进步。各经济体的地方政府和联邦政府正在对财富管理活动实施强制性法规和合规性。一些提供财富管理平台的公司将主要精力集中在产品开发上,开发先进高效的软件和解决方案。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

财富管理平台市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

新冠疫情对财富管理平台市场的影响

得益于政府扶持创新和加强基础设施建设的优惠政策,北美拥有最高的先进技术采用率。因此,影响该地区工业表现的每个因素都会阻碍其经济发展。由于新冠疫情爆发,美国已成为全球受影响最严重的国家,各国政府对该国的工业、商业和公共活动施加了一系列限制,以遏制疫情蔓延。根据战略与国际研究中心的数据,受新冠疫情影响,美国的GDP出现萎缩。根据世界卫生组织(WHO)最近的统计,目前,美国是全球受新冠疫情影响最严重的国家,确诊病例和死亡人数最多。高发病率对该国及该地区的经济产生了负面影响。该地区整体商业活动和各行各业的增长均出现下滑。这影响了北美主要财富管理平台市场参与者的收入。美国、加拿大和墨西哥各地的企业停业以及产品发布的取消和推迟,影响了2020年财富管理平台市场的普及。

市场洞察

财富管理领域机器人顾问的采用率不断上升

金融行业不断采用先进技术,以更经济高效的方式提供金融服务。这些先进且富有创意的技术在2007年至2008年全球金融危机期间备受关注,当时传统银行受到了严格的监管,而IT行业的创新则增强了非银行和科技型金融企业扩张的动力。例如,金融领域的一些技术革命包括移动支付、ATM(自动柜员机)和使用区块链的贸易融资。财富管理服务领域的技术突破包括机器人顾问和自动化理财顾问,旨在与人工顾问竞争。机器人顾问为各种投资目标提供建议,例如为大额支出储蓄、退休以及维持稳定的收入来源以有效管理开支。与传统的人工顾问服务相比,机器人顾问财富管理服务的优势在于易于获取、价格实惠,并且能够让客户随时随地通过互联网连接获取财务建议并管理投资。机器人顾问使财富管理平台市场参与者能够以低廉的费用提供服务,从而拓展财富管理平台市场。

部署类型细分洞察

按部署类型划分,财富管理平台市场分为云端和本地部署。云端部署是指应用程序在异地托管;因此,它被中小型组织广泛采用。云部署所需的资本支出有限,可实现每日数据备份,并允许企业仅为其使用的资源付费。这项技术在众多行业中的日益普及,以及对业务运营模式调整的日益增长的需求,正在推动基于云的财富管理平台市场的增长。

咨询模型细分洞察

基于咨询模型的财富管理平台市场细分为人工咨询、机器人咨询和混合型。人工咨询模型负责制定财务策略,并配置机器人咨询模型,进而辅助基于金融工具的投资和交易决策。这种模式为客户提供了平衡的数字服务,并允许客户在重要的投资决策时联系人工顾问。此外,人工顾问并不总是具备足够的带宽、智力或技能来快速消化数据,从而提供及时的互动。尽管如此,这种模式可以帮助投资者处理一些情绪化的问题,例如决定是否支持孩子的教育或为年迈父母不断上涨的医疗费用做好准备。

业务功能细分洞察

按业务功能划分,财富管理平台市场可细分为绩效管理、风险与合规管理、投资组合会计与交易管理、财务建议管理、报告等。投资组合会计是指跟踪股票投资组合中单个证券的表现,评估哪些投资可能增加或减少,并评估投资组合以确保其符合投资者的增长预期。投资组合会计和交易管理帮助高净值人士 (HNW) 成功安全地管理其金融资产。由于全球高净值人士数量的不断增长,投资组合会计和交易管理平台的财富管理平台市场在预测期内将继续增长。

最终用户细分洞察

按最终用户划分,财富管理平台市场可细分为交易和交易所、银行、经纪公司、投资管理公司等。投资管理公司的日常工作包括将从客户处收取的资金进行投资,并代表客户选择最佳的投资方案。所有类型的投资都与一定程度的风险因素相关,公司需要实现良好的投资回报,确保客户能够承受风险。投资管理公司通常会竭尽全力为客户创建投资组合。由于投资复杂、市场波动、组织结构错综复杂以及运营困难,他们在管理财富方面面临着显著的挑战。

财富管理平台市场参与者专注于新产品创新和开发,通过整合先进技术和功能来与竞争对手竞争。2022 年 1 月,Broadridge Financial Solutions, Inc. 与 Santander Investment SA 合作,为西班牙市场上线了新的西班牙发行人“黄金副本”事件通知和投票执行服务。

按部署类型,财富管理平台市场分为云端和本地部署。根据咨询模式,市场细分为人工咨询、机器人咨询和混合咨询。根据业务功能,财富管理平台市场细分为绩效管理、风险与合规管理、投资组合会计与交易管理、财务咨询管理、报告等。根据最终用户,财富管理平台市场细分为交易和交易所公司、银行、经纪公司、投资管理公司等。根据地区,全球财富管理平台市场细分为北美、欧洲、亚太地区、中东和非洲以及南美。

财富管理平台市场

财富管理平台市场The Insight Partners 的分析师已详尽阐述了预测期内影响财富管理平台市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的财富管理平台市场细分和地域分布。

财富管理平台市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2021 | US$ 3.71 Billion |

| 市场规模 2028 | US$ 9.2 Billion |

| 全球复合年增长率 (2021 - 2028) | 13.8% |

| 历史数据 | 2019-2020 |

| 预测期 | 2022-2028 |

| 涵盖的领域 |

By 咨询模式

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

财富管理平台市场参与者密度:了解其对业务动态的影响

财富管理平台市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展其产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 财富管理平台市场 主要参与者概述

财富管理平台市场 – 公司简介

- Broadridge Financial Solutions, Inc.

- Comarch SA

- FIS Global

- InvestCloud

- Fiserv, Inc.

- InvestEdge, Inc.

- Profile Software SA

- SEI Investments Developments, Inc.

- SS&C Technologies, Inc.

- Temenos Headquarters SA

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 财富管理平台市场

获取免费样品 - 财富管理平台市场