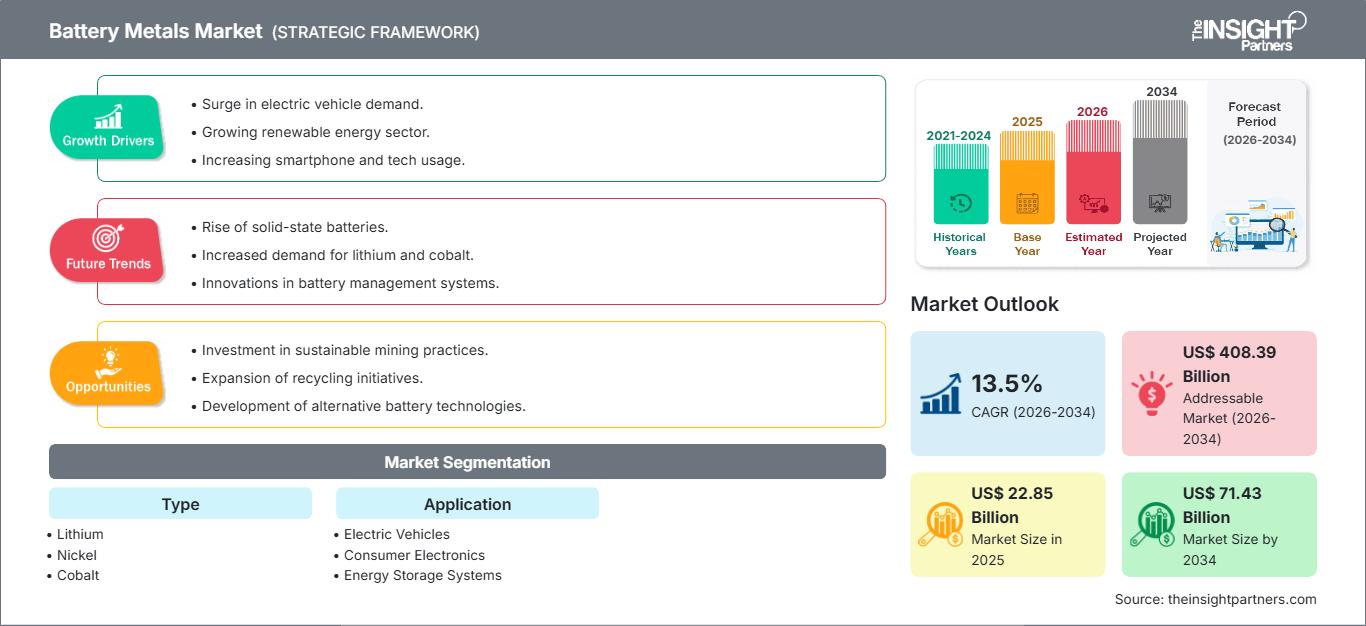

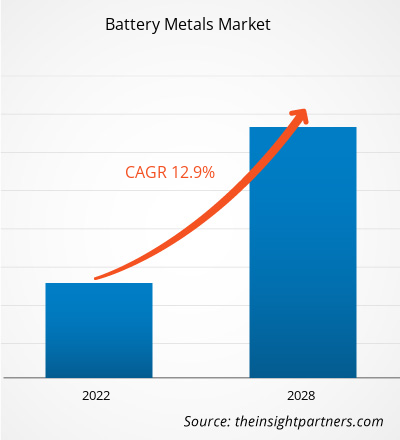

Der globale Markt für Batteriemetalle wird bis 2034 voraussichtlich ein Volumen von 71,43 Milliarden US-Dollar erreichen, gegenüber 22,85 Milliarden US-Dollar im Jahr 2025. Für den Prognosezeitraum 2026–2034 wird ein jährliches Wachstum von 13,5 % erwartet. Zu den wichtigsten Markttreibern zählen der rasche globale Übergang zur Dekarbonisierung, die starke Expansion des Ökosystems der Elektrofahrzeuge und umfangreiche staatliche Förderprogramme wie Subventionen und Steuervergünstigungen für grüne Energie. Darüber hinaus dürfte der Markt von Fortschritten in der Batterietechnologie – insbesondere dem Trend zu Nickel- und Festkörperbatterien – sowie der zunehmenden Integration von großflächigen Energiespeichersystemen in die nationalen Stromnetze zur Kompensation der schwankenden Einspeisung erneuerbarer Energien profitieren.

Marktanalyse für Batteriemetalle

Die Marktanalyse für Batteriemetalle unterstreicht einen entscheidenden strategischen Wandel hin zu resilienteren Lieferketten und vertikaler Integration. Angesichts zunehmender geopolitischer Spannungen und des wachsenden Ressourcennationalismus deuten Beschaffungstrends darauf hin, dass große Automobil- und Technologieunternehmen vom freien Marktkauf abrücken und stattdessen direkt in Bergbaubetriebe investieren und langfristige Abnahmeverträge abschließen. Strategische Chancen ergeben sich durch die Entwicklung zirkulärer Lieferketten, in denen Batterierecycling und Urban Mining eine sekundäre Quelle für Lithium, Kobalt und Nickel darstellen, um primäre Versorgungsengpässe zu verringern. Die Analyse zeigt zudem, dass Marktteilnehmer ihre geografische Präsenz diversifizieren müssen, um die Abhängigkeit von einzelnen Regionen zu reduzieren und gleichzeitig in nachhaltige Gewinnungstechnologien wie die direkte Lithiumgewinnung (DLE) zu investieren, um strenge ESG-Vorgaben (Umwelt, Soziales und Unternehmensführung) zu erfüllen.

Marktübersicht Batteriemetalle

Batteriemetalle haben sich von einem Nischensektor zur tragenden Säule der globalen Energiewende entwickelt. Im Zentrum stehen Schlüsselelemente wie Lithium, Nickel und Kobalt. Die Branche ist der Hauptmotor für die Elektrifizierung des Verkehrs und die Stabilisierung erneuerbarer Energienetze. Während der Markt historisch von der Unterhaltungselektronik getrieben wurde, dominiert heute der enorme Bedarf der Elektroautoindustrie. Dieser Wandel hat zu einer beispiellosen Volatilität der Rohstoffpreise und einem weltweiten Ansturm auf die Rohstoffexploration geführt. Der Markt ist geprägt von einer Mischung aus traditionellen, diversifizierten Bergbaukonzernen und spezialisierten Energiemetallunternehmen, die sich alle in einem komplexen Umfeld schwankender Batterietechnologien und sich entwickelnder regulatorischer Rahmenbedingungen bewegen. Beispielsweise erlebt der US-Markt eine bedeutende Revitalisierung, die durch staatliche Initiativen zum Aufbau einer inländischen Lieferkette vom Rohstoffabbau bis zur Batterieherstellung vorangetrieben wird. Steigende Investitionen in lokale Raffinerien und Verarbeitungsanlagen zielen darauf ab, die Importabhängigkeit zu verringern. Nachhaltige Bergbaupraktiken und die Entwicklung von Batterietechnologien der nächsten Generation zur Unterstützung der heimischen Automobilproduktion stehen im Fokus.

Passen Sie diesen Bericht Ihren Anforderungen an.

Kostenlose AnpassungMarkt für Batteriemetalle: Strategische Einblicke

-

Ermitteln Sie die wichtigsten Markttrends dieses Berichts.Diese KOSTENLOSE Probe beinhaltet eine Datenanalyse, die von Markttrends bis hin zu Schätzungen und Prognosen reicht.

Markttreiber und Chancen für Batteriemetalle

Markttreiber:

- Starker Anstieg der Elektromobilität: Der weltweite Vorstoß der Automobilhersteller, Verbrennungsmotoren schrittweise abzuschaffen, treibt die Nachfrage nach Batteriemetallen maßgeblich an. Strenge Emissionsvorschriften und das Interesse der Verbraucher an nachhaltiger Mobilität führen zu einer massiven Steigerung der Produktion von Lithium-Ionen-Batterien mit hoher Kapazität.

- Weltweiter Vorstoß zur Integration erneuerbarer Energien: Mit dem Übergang der Nationen zu Solar- und Windenergie ist der Bedarf an stationären Energiespeichersystemen sprunghaft angestiegen. Diese Systeme benötigen große Mengen an Batteriemetallen, um überschüssige Energie zu speichern und so die Netzstabilität und eine zuverlässige Stromversorgung in Zeiten geringer Nachfrage zu gewährleisten.

- Fortschritte in der Batterietechnologie: Kontinuierliche Forschung und Entwicklung zur Steigerung der Energiedichte und Reduzierung der Ladezeiten treibt die Nachfrage nach hochreinen Metallen an. Die Entwicklung hin zu NCM- (Nickel-Kobalt-Mangan) und LFP-Batterien (Lithium-Eisenphosphat) schafft ein dynamisches Nachfrageumfeld für verschiedene Metallarten.

Marktchancen:

- Investitionen in Batterierecycling und -rückgewinnung: Da die erste Generation von Elektrofahrzeugen das Ende ihres Lebenszyklus erreicht, bietet sich für Unternehmen eine wachsende Chance, sich auf die Rückgewinnung hochwertiger Metalle aus verbrauchten Zellen zu spezialisieren und so die Umweltbelastung und die Kosten der Rohstoffbeschaffung zu reduzieren.

- Erforschung alternativer Extraktionstechnologien: Technologische Durchbrüche bei der direkten Lithiumextraktion (DLE) und der Hochdruck-Säurelaugung von Nickel bieten Möglichkeiten, bisher unwirtschaftliche oder minderwertige Mineralvorkommen zu erschließen und die globale Versorgungsbasis zu erweitern.

- Strategische Partnerschaften entlang der Wertschöpfungskette: Durch die Bildung von Allianzen zwischen Bergbauunternehmen, Chemieverarbeitern und Batterieherstellern kann die Lieferkette optimiert, ein stetiger Materialfluss sichergestellt und die mit Preisschwankungen verbundenen Risiken reduziert werden.

Marktbericht für Batteriemetalle: Segmentierungsanalyse

Der Marktanteil von Batteriemetallen wird in verschiedenen Segmenten analysiert, um ein besseres Verständnis seiner Struktur, seines Wachstumspotenzials und der sich abzeichnenden Trends zu ermöglichen. Nachfolgend ist der in den meisten Branchenberichten verwendete Standard-Segmentierungsansatz dargestellt:

Nach Typ:

- Lithium: Dieses Segment, das als Kernkomponente moderner Batterietechnologie anerkannt ist, wird durch seine unersetzliche Rolle in Anwendungen mit hoher Energiedichte angetrieben.

- Nickel: Wird für Elektrofahrzeuge mit großer Reichweite immer wichtiger, wobei Legierungen mit hohem Nickelgehalt zum Industriestandard für Leistung werden.

- Kobalt: Ein wichtiger Stabilisator in Batterien, allerdings ist auf dem Markt aufgrund von Bedenken hinsichtlich der ethischen Beschaffung und der Kosten eine Verlagerung hin zu kobaltärmeren Formulierungen zu beobachten.

- Sonstige: Dazu gehören Metalle wie Mangan, Graphit und Aluminium, die für Anoden, Kathoden und strukturelle Batteriekomponenten unerlässlich sind.

Auf Antrag:

- Elektrofahrzeuge: Das primäre Kundensegment, zu dem Pkw, Nutzfahrzeugflotten und Zweiräder gehören, gibt die Gesamtentwicklung des Marktes vor.

- Unterhaltungselektronik: Ein ausgereiftes Segment, das weiterhin hochreine Metalle für Smartphones, Laptops und tragbare Technologie nachfragt.

- Energiespeichersysteme: Ein Wachstumsmarkt mit Schwerpunkt auf Großbatterien und Heimspeichern zur Speicherung erneuerbarer Energien.

- Sonstige: Dazu gehören industrielle Anwendungen, Luft- und Raumfahrt sowie spezialisierte medizinische Geräte, die tragbare Stromversorgungslösungen erfordern.

Nach Geographie:

- Nordamerika

- Europa

- Asien-Pazifik

- Süd- und Mittelamerika

- Naher Osten und Afrika

Regionale Einblicke in den Markt für Batteriemetalle

Die regionalen Trends und Einflussfaktoren auf den Markt für Batteriemetalle im gesamten Prognosezeitraum wurden von den Analysten von The Insight Partners eingehend erläutert. Dieser Abschnitt behandelt außerdem die Marktsegmente und die geografische Verteilung des Batteriemetallmarktes in Nordamerika, Europa, Asien-Pazifik, dem Nahen Osten und Afrika sowie Süd- und Mittelamerika.

Berichtsumfang zum Markt für Batteriemetalle

| Berichtattribute | Details |

|---|---|

| Marktgröße im Jahr 2025 | 22,85 Milliarden US-Dollar |

| Marktgröße bis 2034 | 71,43 Milliarden US-Dollar |

| Globale durchschnittliche jährliche Wachstumsrate (2026 - 2034) | 13,5 % |

| Historische Daten | 2021-2024 |

| Prognosezeitraum | 2026–2034 |

| Abgedeckte Segmente |

Nach Typ

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Marktdichte der Batteriemetalle: Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für Batteriemetalle wächst rasant, angetrieben durch die steigende Nachfrage der Endverbraucher. Gründe hierfür sind unter anderem sich wandelnde Verbraucherpräferenzen, technologische Fortschritte und ein wachsendes Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln innovative Lösungen, um den Verbraucherbedürfnissen gerecht zu werden, und nutzen neue Trends, was das Marktwachstum zusätzlich beflügelt.

- Verschaffen Sie sich einen Überblick über die wichtigsten Akteure des Batteriemetallmarktes.

Marktanteilsanalyse für Batteriemetalle nach Regionen

Der asiatisch-pazifische Raum dürfte in den kommenden Jahren das schnellste Wachstum verzeichnen. Auch die aufstrebenden Märkte in Süd- und Mittelamerika, dem Nahen Osten und Afrika bieten Herstellern zahlreiche ungenutzte Expansionsmöglichkeiten.

Der Markt für Batteriemetalle befindet sich in einem tiefgreifenden Wandel und entwickelt sich von einem traditionellen Industrierohstoff zu einem globalen, strategisch wichtigen Vermögenswert. Das Wachstum wird durch die steigende weltweite Nachfrage nach Elektrofahrzeugen, den zunehmenden Einsatz erneuerbarer Energien durch Speichersysteme und die Expansion des Marktes für leistungsstarke Unterhaltungselektronik angetrieben. Nachfolgend finden Sie eine Zusammenfassung der Marktanteile und Trends nach Regionen:

Nordamerika

- Marktanteil: Ein schnell wachsendes Segment, das durch aggressive staatliche Förderprogramme und die Lokalisierung der Lieferkette für Batterien vorangetrieben wird.

-

Wichtigste Einflussfaktoren:

- Umfangreiche staatliche Anreize, wie beispielsweise der Inflation Reduction Act (IRA), begünstigen die inländische Mineralverarbeitung und die Herstellung von Elektrofahrzeugen.

- Rasanter Ausbau von Gigafabriken und inländischen Raffinerien zur Verringerung der Abhängigkeit von ausländischen Lieferketten

- Die wachsende Verbraucherpräferenz für Batterien mit hohem Nickelgehalt zur Unterstützung der Reichweite von Fahrzeugen

- Trends: Ausweitung der Lithiumgewinnung aus geothermischen Solen und Entwicklung einer Kreislaufwirtschaft durch fortschrittliches Batterierecycling und lokale urbane Bergbauinitiativen.

Europa

- Marktanteil: Besitzt einen bedeutenden globalen Marktanteil, der auf strengen Dekarbonisierungszielen und einem robusten Ökosystem für die Automobilproduktion beruht.

- Wichtigste Einflussfaktoren:

-

Aggressive Vorgaben für die Abschaffung von Verbrennungsmotoren in der gesamten Europäischen Union

- Strenge regulatorische Rahmenbedingungen, darunter der Battery Passport, drängen auf hohe ESG-Standards bei der Metallbeschaffung.

- Starke institutionelle Unterstützung für regionale Gigafactory-Pipelines zur Sicherstellung von Energiesicherheit und industrieller Resilienz

- Trends: Eine strategische Neuausrichtung hin zur Priorisierung einer nachhaltigen und kohlenstoffarmen Mineraliengewinnung mit zunehmendem Fokus auf die lokale Vorläuferraffination und die Produktion von hochreinem Nickel.

Asien-Pazifik

- Marktanteil: Die dominierende globale Region, die als weltweit wichtigster Motor für die Verarbeitung von Batteriemetallen und die Herstellung von Batteriezellen dient.

-

Wichtigste Einflussfaktoren:

- Die massive Produktionskapazität in China, Japan und Südkorea, die den Großteil des globalen Marktes für Chemikalien in Batteriequalität kontrollieren, ist ein weiterer wichtiger Faktor.

- Günstige Regierungspolitik und die massive Verbreitung von NEVs (New Energy Vehicles) in China

- Zugang zu vielfältigen regionalen Mineralressourcen und einer hochintegrierten, kosteneffizienten Lieferkette

- Trends: Hohe Investitionen in Chemie der nächsten Generation wie Natrium-Ionen und LFP (Lithium-Eisenphosphat), um Marktsegmente mit hohem Volumen zu bedienen, sowie umfangreiche Forschung und Entwicklung im Bereich Festkörperbatteriematerialien.

Süd- und Mittelamerika

- Marktanteil: Ein entscheidender Markt auf der Angebotsseite, insbesondere innerhalb des Lithiumdreiecks aus Chile, Argentinien und Bolivien.

-

Wichtigste Einflussfaktoren:

- Besitz der weltweit größten und kostengünstigsten Lithiumreserven auf Solebasis

- Modernisierung von Extraktionstechnologien, wie z. B. der direkten Lithiumextraktion (DLE), zur Verbesserung der Ausbeute und Nachhaltigkeit

- Strategischer Fokus auf die Aufwertung der Wertschöpfungskette durch die Entwicklung lokaler Raffinerie- und Vorproduktfertigung

- Trends: Übergang von einem reinen Rohstoffexportmodell hin zu einem Wertschöpfungszentrum, unterstützt durch strategische Partnerschaften mit globalen Automobilherstellern, die sich einen direkten Zugang zu Mineralien sichern wollen.

Naher Osten und Afrika

- Marktanteil: Ein sich entwickelnder Markt mit tiefen mineralischen Wurzeln, der sich in Richtung formalisierter kommerzieller Produktion und regionaler Fertigung entwickelt.

-

Wichtigste Einflussfaktoren:

- Entscheidende Rolle in der globalen Versorgung mit Kobalt (DR Kongo) und Nickel/Mangan (Südafrika)

- Strategische Investitionen in den GCC-Staaten zum Aufbau lokaler Batterieproduktionszentren und zur Unterstützung der wirtschaftlichen Diversifizierung

- Hohe Nachfrage nach Energiespeichern im Netzmaßstab zur Steuerung großflächiger Solarenergieprojekte in ariden Klimazonen

- Trends: Die Implementierung moderner ESG- und Transparenzstandards zur Formalisierung des Bergbausektors, verbunden mit Investitionen in Smart-Mining-Technologien zur Optimierung der Mineralgewinnung.

Hohe Marktdichte und starker Wettbewerb

Der Wettbewerb verschärft sich aufgrund der Präsenz etablierter Marktführer wie Albemarle Corporation, Bolt Metals, Ganfeng Lithium Co., Ltd., Umicore, LG Chem, Honjo Metal Co., Ltd., Vale, Lithium Australia NL und BASF SE, die ebenfalls zu einer vielfältigen und schnell wachsenden Marktlandschaft beitragen.

Dieses wettbewerbsintensive Umfeld zwingt die Anbieter dazu, sich durch Folgendes zu differenzieren:

- Vertikale Integration der Lieferkette: Positionierung als zuverlässiger langfristiger Partner durch die Kontrolle der gesamten Wertschöpfungskette, von den vorgelagerten Bergbauanlagen bis hin zur chemischen Raffinerie, um Transparenz zu gewährleisten und die von globalen Automobilherstellern geforderten ethischen Standards für saubere Kennzeichnung zu erfüllen.

- Fortschrittliche Extraktions- und Raffinationstechnologien: Unternehmen konkurrieren zunehmend durch den Einsatz der direkten Lithiumextraktion (DLE) und der Hochdruck-Säurelaugung (HPAL) für Nickel. Diese Technologien ermöglichen die Verarbeitung minderwertigerer Erze mit geringerer Umweltbelastung und bieten einen bedeutenden Wettbewerbsvorteil in einem ESG-bewussten Markt.

- Strategische Abnahme- und Joint-Venture-Modelle: Führende Produzenten gehen über einfache Spotmarktverkäufe hinaus und schließen enge strategische Partnerschaften mit Batterieherstellern (z. B. CATL, LG Chem) und Automobilkonzernen (z. B. Tesla, GM). Diese mehrjährigen Vereinbarungen stabilisieren die Einnahmen und mindern das Risiko der enormen Investitionen, die für neue Bergbauprojekte erforderlich sind.

- Nachhaltigkeit und Kreislaufwirtschaft: Differenzierung durch CO₂-arme Produktionsprozesse und integrierte Recyclingkapazitäten. Durch das Angebot von Metallen aus Altbatterien im geschlossenen Kreislauf können Anbieter europäische und nordamerikanische Kunden ansprechen, die strengen Sekundärrohstoffvorschriften unterliegen.

Chancen und strategische Schritte

- Entwicklung inländischer Raffinerie- und Verarbeitungszentren: Partnerschaften mit Regierungen in Nordamerika und Europa, um erhebliche Subventionen und Steuervergünstigungen (wie den US Inflation Reduction Act) zu nutzen, die darauf abzielen, die Lieferkette vom Rohstoffabbau bis zur Batterie zu lokalisieren und die Importabhängigkeit zu verringern.

- Investieren Sie in Metallchemie der nächsten Generation: Konzentrieren Sie Ihre Forschung und Entwicklung auf hochreine Materialien, die mit neuen Batterietechnologien wie Lithium-Schwefel-, Natrium-Ionen- und Festkörperbatterien kompatibel sind, deren erste kommerzielle Produktionsphasen voraussichtlich bis 2030 eintreten werden.

- Expansion in aufstrebende Recycling- und Verwertungsbranchen: Errichtung spezieller urbaner Mining-Anlagen zur Rückgewinnung von Kobalt, Nickel und Lithium aus der ersten Generation ausrangierter EV-Batterien, wodurch eine sekundäre, nachhaltige Einnahmequelle geschaffen wird, die die Schwankungen der primären Versorgungslage abmildert.

Die wichtigsten Unternehmen, die auf dem Markt für Batteriemetalle tätig sind, sind:

- Albemarle Corporation

- Bolt Metals

- Ganfeng Lithium Co., Ltd.

- Umicore

- LG Chem

- Honjo Metal Co., Ltd.

- OK

- Lithium Australia NL

- BASF SE

Hinweis: Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge geordnet.

Neuigkeiten und aktuelle Entwicklungen auf dem Markt für Batteriemetalle

- Im August 2025 erwarb Glencore Plc. Li-Cycle. Dieser strategische Schritt integrierte Li-Cycle in die Geschäftstätigkeit von Glencore und stellte sicher, dass der Spezialist für Batteriemetalle seinen gemeinsamen globalen Kunden weiterhin Mehrwert und verbesserten Service bieten würde.

- Im Oktober 2024 gaben Rio Tinto und Arcadium Lithium plc eine endgültige Vereinbarung bekannt, gemäß der Rio Tinto Arcadium in einer reinen Bargeldtransaktion für 5,85 US-Dollar je Aktie erwarb. Diese Akquisition, die das verwässerte Aktienkapital von Arcadium mit rund 6,7 Milliarden US-Dollar bewertete, stärkte Rio Tintos Position auf dem globalen Markt für Batteriemetalle erheblich.

Marktbericht zu Batteriemetallen: Abdeckung und Ergebnisse

Der Bericht „Marktgröße und Prognose für Batteriemetalle (2021–2034)“ bietet eine detaillierte Analyse des Marktes und deckt folgende Bereiche ab:

- Marktgröße und Prognose für Batteriemetalle auf globaler, regionaler und Länderebene für alle wichtigen Marktsegmente, die im Geltungsbereich abgedeckt werden

- Trends im Markt für Batteriemetalle sowie Marktdynamiken wie Treiber, Hemmnisse und wichtige Chancen

- Detaillierte PEST- und SWOT-Analyse

- Marktanalyse für Batteriemetalle: Wichtige Markttrends, globale und regionale Rahmenbedingungen, Hauptakteure, regulatorische Rahmenbedingungen und aktuelle Marktentwicklungen

- Branchenlandschafts- und Wettbewerbsanalyse mit Fokus auf Marktkonzentration, Heatmap-Analyse, prominente Akteure und aktuelle Entwicklungen auf dem Markt für Batteriemetalle.

- Detaillierte Unternehmensprofile

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Batteriemetallmarkt

Kostenlose Probe anfordern für - Batteriemetallmarkt