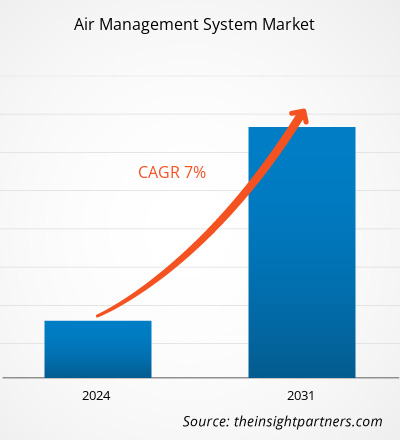

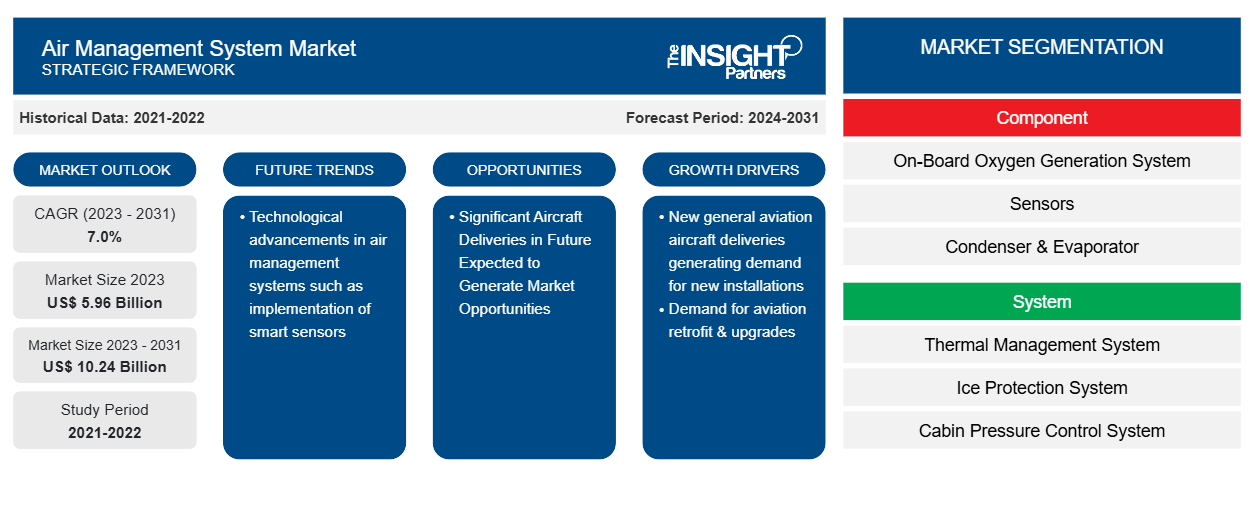

Se proyecta que el tamaño del mercado de sistemas de gestión del aire alcance los 10.240 millones de dólares en 2031, frente a los 5.960 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 7,0 % durante el período 2023-2031. Es probable que los avances tecnológicos en los sistemas de gestión del aire, como la implementación de sensores inteligentes, sigan siendo una tendencia clave en el mercado.

Análisis del mercado de sistemas de gestión del aire

El ecosistema del mercado de sistemas de gestión del aire es diverso y está en constante evolución. Sus partes interesadas son proveedores, componentes, fabricantes de aeronaves y usuarios finales. Los actores principales ocupan lugares en varios nodos del ecosistema del mercado. Los proveedores de materias primas suministran materiales a los fabricantes de componentes, que los utilizan para fabricar y diseñar los productos finales. El producto final se suministra luego a los fabricantes de aeronaves a través de diferentes medios, como ventas directas a través de distribuidores de la empresa o ventas a terceros a través de distribuidores externos. Los fabricantes de aeronaves o los OEM luego integran los componentes de las aeronaves en sus respectivos modelos de aeronaves.

Descripción general del mercado de sistemas de gestión del aire

El mercado de sistemas de gestión del aire está compuesto por varios actores bien establecidos, en el que los cinco principales proveedores adquieren alrededor del 25% y experimentan compras regulares de sus respectivos productos por parte de los usuarios finales. Los actores del mercado de sistemas de gestión del aire compiten entre sí en varios parámetros, como la tecnología, el plazo de entrega y el precio, entre otros. Estos parámetros mejoran la competitividad entre los actores del mercado y se espera que mantengan un alto nivel de rivalidad competitiva entre los actores del mercado de sistemas de gestión del aire.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de sistemas de gestión del aire

Demanda de modernización y modernización de la aviación

La presencia de un gran número de flotas de aviación comercial antiguas en todo el mundo está generando la demanda de modernización y actualizaciones de la flota existente. Además, el lanzamiento de nuevos hangares y bahías de MRO para aeronaves es directamente proporcional a la demanda de diferentes sistemas de gestión del aire, uno de los fuertes catalizadores del mercado de sistemas de gestión del aire. Además, las continuas inversiones de las aerolíneas para modernizar las aeronaves debido a la expansión de su flota de aeronaves existente están impulsando la demanda de sistemas de gestión del aire a nivel mundial. Por ejemplo, uno de los líderes de la aviación india, InterGlobe Aviation Ltd. (Indigo Airlines), firmó un acuerdo de 20 años con Bangalore International Airport Limited (BIAL) en 2019 para construir su segunda instalación de MRO en India. Según el comunicado de la empresa, el nuevo hangar puede dar servicio a dos aviones de fuselaje estrecho y a un MRO de motores.

Se espera que en el futuro se produzcan importantes entregas de aeronaves que generen oportunidades de mercado

El sector de la aviación comercial ha mantenido un tamaño de flota fuerte a lo largo de los años, siendo Airbus y Boeing los dos fabricantes de aeronaves más destacados en términos de estadísticas de entregas. La industria de la aviación comercial ha sido testigo de un enorme crecimiento en los últimos años con la aparición de nuevas aerolíneas de bajo costo (LCC) y las estrategias de expansión de la flota adoptadas por las aerolíneas de servicio completo (FSC). Se prevé que la aviación comercial aumente en los próximos años debido al creciente número de pasajeros de viajes aéreos y la adquisición de aeronaves. Además, las futuras entregas esperadas de aeronaves comerciales y militares son uno de los principales factores que probablemente generen nuevas oportunidades para los proveedores del mercado en los próximos años. Por ejemplo, según las previsiones de Boeing y Airbus, es probable que se entreguen más de 40.800 aeronaves comerciales en todo el mundo durante 2023-2042.

Análisis de segmentación del informe de mercado del sistema de gestión del aire

Los segmentos clave que contribuyeron a la derivación del análisis del mercado del sistema de gestión del aire son el componente, el sistema y la plataforma.

- Según los componentes, el mercado de sistemas de gestión del aire se segmenta en sistemas de generación de oxígeno a bordo, sensores, condensadores y evaporadores, máquinas de ciclo de aire, unidades electrónicas de control y monitoreo, entre otros. El segmento de máquinas de ciclo de aire tuvo una mayor participación de mercado en 2023.

- Según el sistema, el mercado de sistemas de gestión del aire se segmenta en sistemas de gestión térmica, sistemas de protección contra el hielo, sistemas de control de presión de la cabina, sistemas de inertización del tanque de combustible, sistemas de oxígeno y sistemas de purga de aire del motor. El segmento de sistemas de gestión térmica tuvo una mayor participación de mercado en 2023.

- Según la plataforma, el mercado de sistemas de gestión del aire se segmenta en ala fija y ala rotatoria. El segmento de ala fija tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de los sistemas de gestión del aire por geografía

El alcance geográfico del informe de mercado del sistema de gestión de aire se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

Asia Pacífico ha dominado el mercado en 2023, seguida de las regiones de América del Norte y Europa. Además, es probable que Asia Pacífico también sea testigo de la CAGR más alta en los próximos años. China representó una participación importante en el mercado de sistemas de gestión del aire de Asia Pacífico, mientras que es probable que India sea uno de los mercados de sistemas de gestión del aire más atractivos del mundo en los próximos años. China ha superado al mercado de aviación más grande de EE. UU. (EE. UU.) y es uno de los mercados de aviación de más rápido crecimiento en todo el mundo. Se espera que el país prevea una alta demanda de aeronaves durante los próximos 20 años. Por ejemplo, según las previsiones de Airbus, es probable que se entreguen más de 9.400 aviones comerciales en China durante 2023 y 2042. Además, el aumento del número de producción de aeronaves de fabricantes locales y extranjeros, a largo plazo, las actividades de MRO de aeronaves se trasladarán hacia la región APAC, ya que China y el sudeste asiático están alineados para establecer su importancia como centros de MRO. Las empresas de todo el mundo se están centrando en expandir su negocio a China; Por ejemplo, Safran SA ha ampliado sus servicios de MRO a China y ofrece servicios sobre diversos componentes a las aerolíneas chinas. Además, el país es el segundo con mayor gasto en defensa después de Estados Unidos. China invierte cantidades sustanciales en sus fuerzas de defensa, lo que permite a la fuerza aérea adquirir nuevas flotas de aviones. No obstante, se espera que el crecimiento del gasto militar y la demanda de aviones generen nuevas oportunidades de crecimiento para el mercado de sistemas de gestión aérea en China.

Perspectivas regionales del mercado de sistemas de gestión del aire

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sistemas de gestión del aire durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sistemas de gestión del aire en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sistemas de gestión del aire

Alcance del informe de mercado del sistema de gestión del aire

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 5.960 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 10,24 mil millones |

| CAGR global (2023 - 2031) | 7.0% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por componente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de sistemas de gestión del aire está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sistemas de gestión del aire son:

- Corporación Parker Hannifin

- Compañía: Honeywell International Inc.

- Fundación Diehl & Co. KG

- Aeroespacial Collins

- Liebherr-International Deutschland GmbH

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sistemas de gestión del aire

Noticias y desarrollos recientes del mercado de sistemas de gestión del aire

El mercado de sistemas de gestión del aire se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de sistemas de gestión del aire:

- AMETEK Singapore PTE ha aumentado sus capacidades invirtiendo en soluciones de mantenimiento para el Airbus A350. La decisión, que proporcionará a los clientes de la región de Asia Pacífico una opción de soporte regional para el conjunto completo de calentadores de carga y cocina para este tipo de aeronave, se complementará además con las aprobaciones de aeronavegabilidad actuales de AMETEK, incluidas las de CAAS, CAAC, FAA, EASA, JCAB, CAAM, CAAV y DGCA. (Fuente: AMETEK Singapore PTE, comunicado de prensa, enero de 2022)

- Honeywell (NYSE: HON) ha presentado la próxima generación de su sistema de control y monitoreo de presión de cabina con aplicaciones tanto en aeronaves comerciales como militares. Esta nueva versión del sistema es totalmente eléctrica, más liviana y ya está disponible para la aviación comercial y regional, así como para aeronaves de entrenamiento táctico o militar. (Fuente: Honeywell International Inc, comunicado de prensa, enero de 2021)

Informe de mercado sobre sistemas de gestión del aire: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sistemas de gestión del aire (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de sistemas de gestión del aire y pronóstico a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de sistemas de gestión del aire, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado de sistemas de gestión del aire que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de sistemas de gestión del aire.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sistemas de gestión del aire

Obtenga una muestra gratuita para - Mercado de sistemas de gestión del aire