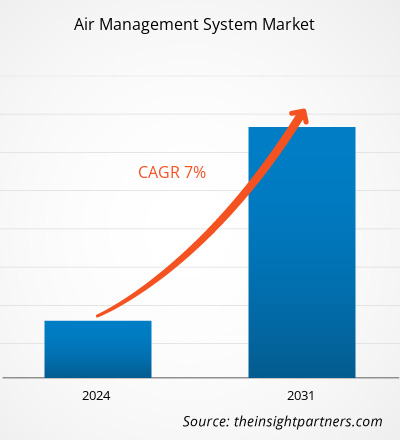

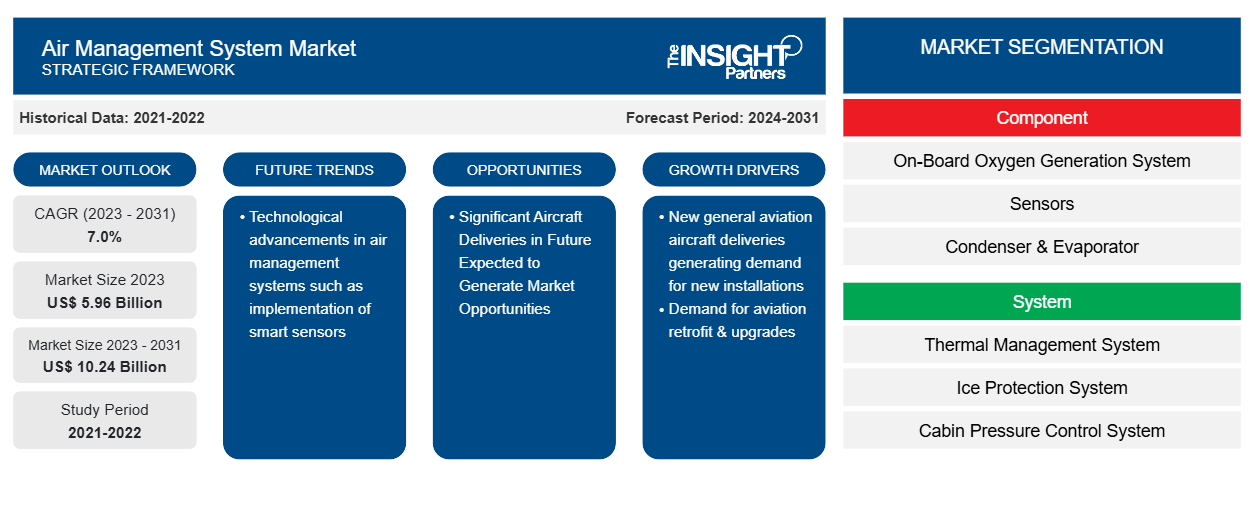

La taille du marché des systèmes de gestion de l’air devrait atteindre 10,24 milliards USD d’ici 2031, contre 5,96 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 7,0 % au cours de la période 2023-2031. Les avancées technologiques dans les systèmes de gestion de l’air, telles que la mise en œuvre de capteurs intelligents, devraient rester une tendance clé du marché.

Analyse du marché des systèmes de gestion de l'air

L'écosystème du marché des systèmes de gestion de l'air est diversifié et en constante évolution. Ses parties prenantes sont les fournisseurs, les composants, les constructeurs d'avions et les utilisateurs finaux. Les principaux acteurs occupent des places dans divers nœuds de l'écosystème du marché. Les fournisseurs de matières premières fournissent des matériaux aux fabricants de composants, les utilisant pour fabriquer et concevoir les produits finis. Le produit final est ensuite fourni aux constructeurs d'avions par différents moyens, tels que les ventes directes par l'intermédiaire de distributeurs de l'entreprise ou les ventes à des tiers par l'intermédiaire de distributeurs tiers. Les constructeurs d'avions ou les OEM intègrent ensuite les composants d'avions dans leurs modèles d'avions respectifs.

Aperçu du marché des systèmes de gestion de l'air

Le marché des systèmes de gestion de l'air comprend plusieurs acteurs bien établis, dont les cinq premiers fournisseurs acquièrent environ 25 % et s'approvisionnent régulièrement en produits respectifs auprès des utilisateurs finaux. Les acteurs du marché des systèmes de gestion de l'air se font concurrence sur divers paramètres, notamment la technologie, les délais et les prix, entre autres. Ces paramètres renforcent la compétitivité entre les acteurs du marché et devraient maintenir un niveau élevé de rivalité concurrentielle entre les acteurs du marché des systèmes de gestion de l'air.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des systèmes de gestion de l'air

Demande de modernisation et de mise à niveau de l'aviation

La présence d'un grand nombre de flottes d'avions commerciaux plus anciennes dans le monde génère une demande de modernisation et de mise à niveau de la flotte existante. En outre, le lancement de nouveaux hangars et baies de maintenance pour avions est directement proportionnel à la demande de différents systèmes de gestion de l'air, l'un des puissants catalyseurs du marché des systèmes de gestion de l'air. En outre, les investissements continus des compagnies aériennes pour la modernisation des avions en raison de l'expansion de leur flotte d'avions existante stimulent la demande de systèmes de gestion de l'air à l'échelle mondiale. Par exemple, l'un des leaders de l'aviation indienne, InterGlobe Aviation Ltd. (Indigo Airlines), a signé un accord de 20 ans avec Bangalore International Airport Limited (BIAL) en 2019 pour construire sa deuxième installation de maintenance et de réparation en Inde. Selon la déclaration de la société, le nouveau hangar peut accueillir deux avions à fuselage étroit et un service de maintenance et de réparation de moteurs.

D'importantes livraisons d'avions à l'avenir devraient générer des opportunités de marché

Le secteur de l'aviation commerciale a maintenu une flotte importante au fil des ans, Airbus et Boeing étant les deux constructeurs aéronautiques les plus remarquables en termes de statistiques de livraison. L' industrie de l'aviation commerciale a connu une croissance considérable au cours des dernières années avec l'émergence de nouveaux transporteurs à bas prix (LCC) et les stratégies d'expansion de la flotte adoptées par les transporteurs à service complet (FSC). L'aviation commerciale devrait connaître une forte croissance dans les années à venir en raison du nombre croissant de passagers aériens et d'achats d'avions. En outre, les livraisons futures attendues d'avions commerciaux et militaires sont l'un des principaux facteurs susceptibles de générer de nouvelles opportunités pour les fournisseurs du marché dans les années à venir. Par exemple, selon les prévisions de Boeing et d'Airbus, plus de 40 800 avions commerciaux devraient être livrés dans le monde entre 2023 et 2042.

Analyse de segmentation du rapport sur le marché des systèmes de gestion de l'air

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des systèmes de gestion de l’air sont les composants, les systèmes et la plate-forme.

- En fonction des composants, le marché des systèmes de gestion de l'air est segmenté en systèmes de génération d'oxygène embarqués, capteurs, condenseurs et évaporateurs, machines à cycle d'air, unités électroniques de contrôle et de surveillance, etc. Le segment des machines à cycle d'air détenait une part de marché plus importante en 2023.

- En fonction du système, le marché des systèmes de gestion de l'air est segmenté en système de gestion thermique, système de protection contre le givre, système de contrôle de la pression de la cabine, système d'inertage du réservoir de carburant, système d'oxygène et système de purge d'air du moteur. Le segment des systèmes de gestion thermique détenait une part de marché plus importante en 2023.

- En fonction de la plateforme, le marché des systèmes de gestion de l'air est segmenté en voilure fixe et voilure tournante. Le segment des voilure fixe détenait une part de marché plus importante en 2023.

Analyse des parts de marché des systèmes de gestion de l'air par zone géographique

La portée géographique du rapport sur le marché des systèmes de gestion de l’air est principalement divisée en cinq régions : Amérique du Nord, Europe, Asie-Pacifique, Moyen-Orient et Afrique et Amérique du Sud.

L'Asie-Pacifique a dominé le marché en 2023, suivie de l'Amérique du Nord et de l'Europe. En outre, l'Asie-Pacifique devrait également connaître le TCAC le plus élevé dans les années à venir. La Chine représente une part importante du marché des systèmes de gestion de l'air en Asie-Pacifique, tandis que l'Inde devrait être l'un des marchés de systèmes de gestion de l'air les plus attractifs au monde dans les années à venir. La Chine a dépassé le plus grand marché de l'aviation des États-Unis (les États-Unis) et est l'un des marchés de l'aviation à la croissance la plus rapide au monde. Le pays devrait prévoir une forte demande d'avions au cours des 20 prochaines années. Par exemple, selon les prévisions d'Airbus, plus de 9 400 avions commerciaux devraient être livrés en Chine en 2023 et 2042. En outre, avec l'augmentation du nombre d'avions produits par les constructeurs locaux et étrangers, à long terme, les activités de MRO des avions se déplaceraient vers la région APAC, car la Chine et l'Asie du Sud-Est sont alignées pour établir leur importance en tant que centres de MRO. Les entreprises du monde entier se concentrent sur l'expansion de leurs activités en Chine ; Par exemple, Safran SA a étendu ses services de MRO à la Chine et propose des services sur divers composants aux compagnies aériennes chinoises. En outre, le pays est le deuxième plus grand pays en termes de dépenses de défense après les États-Unis. La Chine investit des sommes importantes dans ses forces de défense, ce qui permet à l'armée de l'air de se doter de nouvelles flottes d'avions. Néanmoins, la croissance des dépenses militaires et de la demande d'avions devrait générer de nouvelles opportunités de croissance pour le marché des systèmes de gestion de l'air en Chine.

Aperçu régional du marché des systèmes de gestion de l'air

Les tendances et facteurs régionaux influençant le marché des systèmes de gestion de l’air tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des systèmes de gestion de l’air en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des systèmes de gestion de l'air

Portée du rapport sur le marché des systèmes de gestion de l'air

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 5,96 milliards de dollars américains |

| Taille du marché d'ici 2031 | 10,24 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 7,0% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par composant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des systèmes de gestion de l'air connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des systèmes de gestion de l'air sont :

- Société Parker Hannifin

- Honeywell International Inc.

- Fondation Diehl & Co. KG

- Collins Aérospatiale

- Liebherr-International Deutschland GmbH

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des systèmes de gestion de l'air

Actualités et développements récents du marché des systèmes de gestion de l'air

Le marché des systèmes de gestion de l'air est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements sur le marché des systèmes de gestion de l'air sont répertoriés ci-dessous :

- AMETEK Singapore PTE a renforcé ses capacités en investissant dans des solutions de maintenance pour l'Airbus A350. Cette décision, qui offrira aux clients de la région Asie-Pacifique une option de support régional pour la gamme complète de chauffages de fret et de cuisine pour ce type d'avion, sera complétée par les homologations de navigabilité actuelles d'AMETEK, notamment CAAS, CAAC, FAA, EASA, JCAB, CAAM, CAAV et DGCA. (Source : AMETEK Singapore PTE, communiqué de presse, janvier 2022)

- Honeywell (NYSE : HON) a présenté la nouvelle génération de son système de contrôle et de surveillance de la pression de cabine, destiné aux avions commerciaux et militaires. Cette nouvelle version du système est entièrement électrique, plus légère et disponible dès maintenant pour l'aviation d'affaires et régionale ainsi que pour les avions d'entraînement tactiques ou militaires. (Source : Honeywell International Inc, communiqué de presse, janvier 2021)

Rapport sur le marché des systèmes de gestion de l'air et livrables

Le rapport « Taille et prévisions du marché des systèmes de gestion de l’air (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des systèmes de gestion de l'air aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché des systèmes de gestion de l'air ainsi que dynamique du marché telles que les facteurs moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces du porteur

- Analyse du marché des systèmes de gestion de l'air couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents pour le marché des systèmes de gestion de l'air

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des systèmes de gestion de l'air

Obtenez un échantillon gratuit pour - Marché des systèmes de gestion de l'air