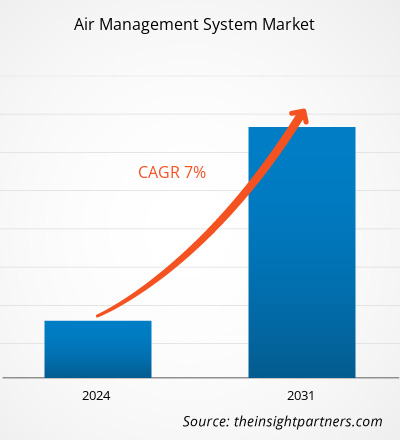

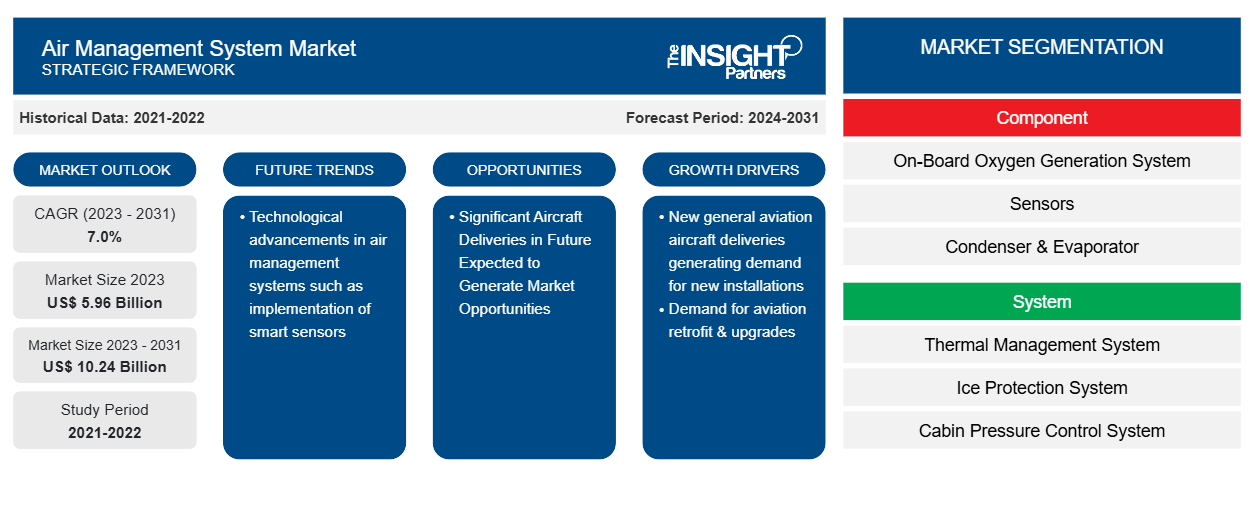

Der Markt für Luftmanagementsysteme soll von 5,96 Milliarden US-Dollar im Jahr 2023 auf 10,24 Milliarden US-Dollar im Jahr 2031 anwachsen. Der Markt wird zwischen 2023 und 2031 voraussichtlich eine durchschnittliche jährliche Wachstumsrate von 7,0 % verzeichnen. Technologische Fortschritte bei Luftmanagementsystemen wie die Implementierung intelligenter Sensoren dürften weiterhin ein wichtiger Trend auf dem Markt bleiben.

Luftmanagementsystem Marktanalyse

Das Ökosystem des Marktes für Luftmanagementsysteme ist vielfältig und entwickelt sich ständig weiter. Seine Interessenvertreter sind Zulieferer, Komponentenhersteller, Flugzeughersteller und Endverbraucher. Führende Akteure besetzen verschiedene Knotenpunkte des Marktökosystems. Rohstofflieferanten liefern Materialien an Komponentenhersteller und verwenden diese zur Herstellung und Konstruktion der Endprodukte. Das Endprodukt wird dann über verschiedene Kanäle an die Flugzeughersteller geliefert, beispielsweise über Direktverkäufe über Unternehmensvertriebshändler oder Drittverkäufe über Drittvertriebshändler. Flugzeughersteller oder OEMs integrieren dann Flugzeugkomponenten in ihre jeweiligen Flugzeugmodelle.

Marktübersicht für Luftmanagementsysteme

Der Markt für Luftmanagementsysteme besteht aus mehreren etablierten Akteuren, wobei die fünf größten Anbieter etwa 25 % davon erwerben und ihre jeweiligen Produkte regelmäßig von Endverbrauchern beziehen. Die Akteure auf dem Markt für Luftmanagementsysteme konkurrieren untereinander hinsichtlich verschiedener Parameter, darunter Technologie, Lieferzeit und Preisgestaltung. Diese Parameter steigern die Wettbewerbsfähigkeit der Marktteilnehmer und werden voraussichtlich ein hohes Maß an Wettbewerbsrivalität zwischen den Akteuren auf dem Markt für Luftmanagementsysteme aufrechterhalten.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Markttreiber und Chancen für Luftmanagementsysteme

Nachfrage nach Nachrüstungen und Upgrades für die Luftfahrt

Die weltweite Präsenz einer großen Anzahl älterer kommerzieller Flugzeugflotten erzeugt eine Nachfrage nach Nachrüstungen und Aufrüstungen der bestehenden Flotte. Außerdem ist die Eröffnung neuer MRO- Hangars und MRO-Buchten für Flugzeuge direkt proportional zur Nachfrage nach verschiedenen Luftmanagementsystemen, einem der starken Katalysatoren des Marktes für Luftmanagementsysteme. Darüber hinaus kurbeln die kontinuierlichen Investitionen der Fluggesellschaften in Flugzeugaufrüstungen aufgrund der Erweiterung ihrer bestehenden Flugzeugflotte die Nachfrage nach Luftmanagementsystemen weltweit an. So unterzeichnete beispielsweise einer der führenden indischen Luftfahrtkonzerne, InterGlobe Aviation Ltd. (Indigo Airlines), 2019 einen 20-Jahres-Vertrag mit Bangalore International Airport Limited (BIAL) zum Bau seiner zweiten MRO-Anlage in Indien. Laut Aussage des Unternehmens kann der neue Hangar zwei Schmalrumpfflugzeuge und eine Triebwerks-MRO abwickeln.

Bedeutende Flugzeugauslieferungen in der Zukunft dürften Marktchancen schaffen

Der kommerzielle Luftfahrtsektor hat im Laufe der Jahre eine starke Flottengröße beibehalten, wobei Airbus und Boeing in Bezug auf die Auslieferungsstatistiken die beiden bedeutendsten Flugzeughersteller sind. Die kommerzielle Luftfahrtindustrie hat in den letzten Jahren mit der Entstehung neuer Billigflieger (LCCs) und der Flottenerweiterungsstrategien der Full-Service-Carrier (FSCs) ein enormes Wachstum erlebt. Die kommerzielle Luftfahrt wird in den kommenden Jahren aufgrund der steigenden Zahl von Fluggästen und der Flugzeugbeschaffung voraussichtlich einen Aufschwung erleben. Darüber hinaus sind die erwarteten zukünftigen Auslieferungen von Verkehrs- und Militärflugzeugen einer der Hauptfaktoren, die in den kommenden Jahren wahrscheinlich neue Möglichkeiten für Marktanbieter schaffen werden. So werden laut den Prognosen von Boeing und Airbus zwischen 2023 und 2042 voraussichtlich weltweit mehr als 40.800 Verkehrsflugzeuge ausgeliefert.

Segmentierungsanalyse des Marktberichts zum Luftmanagementsystem

Wichtige Segmente, die zur Ableitung der Marktanalyse für Luftmanagementsysteme beigetragen haben, sind Komponente, System und Plattform.

- Basierend auf den Komponenten ist der Markt für Luftmanagementsysteme in Bordsauerstofferzeugungssysteme, Sensoren, Kondensatoren und Verdampfer, Luftkreislaufmaschinen, Steuer- und Überwachungselektronikeinheiten und andere unterteilt. Das Segment der Luftkreislaufmaschinen hatte im Jahr 2023 einen größeren Marktanteil.

- Basierend auf dem System ist der Markt für Luftmanagementsysteme in Wärmemanagementsysteme, Eisschutzsysteme, Kabinendruckkontrollsysteme, Kraftstofftank-Inertisierungssysteme, Sauerstoffsysteme und Triebwerkzapfluftsysteme unterteilt. Das Segment Wärmemanagementsysteme hatte im Jahr 2023 einen größeren Marktanteil.

- Basierend auf der Plattform ist der Markt für Luftmanagementsysteme in Starrflügel- und Drehflügelflugzeuge unterteilt. Das Starrflügelsegment hatte im Jahr 2023 einen größeren Marktanteil.

Luftmanagementsystem Marktanteilsanalyse nach Geografie

Der geografische Umfang des Marktberichts zum Luftmanagementsystem ist hauptsächlich in fünf Regionen unterteilt: Nordamerika, Europa, Asien-Pazifik, Naher Osten und Afrika sowie Südamerika.

Im Jahr 2023 dominierte der asiatisch-pazifische Raum den Markt, gefolgt von Nordamerika und Europa. Darüber hinaus wird der asiatisch-pazifische Raum in den kommenden Jahren voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate verzeichnen. China hatte den größten Anteil am Markt für Luftmanagementsysteme im asiatisch-pazifischen Raum, während Indien in den kommenden Jahren voraussichtlich einer der attraktivsten Märkte für Luftmanagementsysteme weltweit sein wird. China hat den größten Luftfahrtmarkt der USA überholt und ist einer der am schnellsten wachsenden Luftfahrtmärkte der Welt. Das Land wird in den nächsten 20 Jahren voraussichtlich eine hohe Nachfrage nach Flugzeugen verzeichnen. Laut den Prognosen von Airbus werden beispielsweise in den Jahren 2023 und 2042 voraussichtlich mehr als 9.400 Verkehrsflugzeuge in China ausgeliefert. Abgesehen von der steigenden Anzahl der produzierten Flugzeuge von in- und ausländischen Herstellern werden sich die MRO-Aktivitäten für Flugzeuge langfristig in Richtung der APAC-Region verlagern, da China und Südostasien ihre Bedeutung als MRO-Zentren etablieren wollen. Unternehmen auf der ganzen Welt konzentrieren sich darauf, ihr Geschäft nach China auszuweiten. So hat beispielsweise Safran SA seine MRO-Dienstleistungen auf China ausgeweitet und bietet chinesischen Fluggesellschaften Dienstleistungen für verschiedene Komponenten an. Darüber hinaus ist das Land nach den USA das Land mit den zweithöchsten Verteidigungsausgaben. China investiert beträchtliche Summen in seine Verteidigungsstreitkräfte, wodurch die Luftwaffe neue Flugzeugflotten anschaffen kann. Dennoch wird erwartet, dass das Wachstum der Militärausgaben und die Nachfrage nach Flugzeugen neue Wachstumschancen für den Markt für Luftmanagementsysteme in China schaffen werden.

Regionale Einblicke in den Markt für Luftmanagementsysteme

Die regionalen Trends und Faktoren, die den Markt für Luftmanagementsysteme im gesamten Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch Marktsegmente und Geografie für Luftmanagementsysteme in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Erhalten Sie regionale Daten zum Markt für Luftmanagementsysteme

Umfang des Marktberichts zum Luftmanagementsystem

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2023 | 5,96 Milliarden US-Dollar |

| Marktgröße bis 2031 | 10,24 Milliarden US-Dollar |

| Globale CAGR (2023 - 2031) | 7,0 % |

| Historische Daten | 2021-2022 |

| Prognosezeitraum | 2024–2031 |

| Abgedeckte Segmente |

Nach Komponente

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Marktteilnehmerdichte: Der Einfluss auf die Geschäftsdynamik

Der Markt für Luftmanagementsysteme wächst rasant, angetrieben durch die steigende Nachfrage der Endnutzer aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung der Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Markt für Luftmanagementsysteme tätigen Unternehmen sind:

- Parker Hannifin Corporation

- Honeywell International Inc.

- Diehl Stiftung & Co. KG

- Collins Luft- und Raumfahrt

- Liebherr-International Deutschland GmbH

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für Luftmanagementsysteme

Neuigkeiten und aktuelle Entwicklungen zum Markt für Luftmanagementsysteme

Der Markt für Luftmanagementsysteme wird durch die Erhebung qualitativer und quantitativer Daten nach Primär- und Sekundärforschung bewertet, die wichtige Unternehmensveröffentlichungen, Verbandsdaten und Datenbanken umfasst. Nachfolgend sind einige der Entwicklungen auf dem Markt für Luftmanagementsysteme aufgeführt:

- AMETEK Singapore PTE hat seine Kapazitäten durch Investitionen in Wartungslösungen für den Airbus A350 erweitert. Die Entscheidung, die Kunden im asiatisch-pazifischen Raum eine regionale Supportoption für die gesamte Palette an Fracht- und Bordküchenheizungen für diesen Flugzeugtyp bietet, wird durch AMETEKs aktuelle Lufttüchtigkeitszulassungen ergänzt, darunter CAAS, CAAC, FAA, EASA, JCAB, CAAM, CAAV und DGCA. (Quelle: AMETEK Singapore PTE, Pressemitteilung, Januar 2022)

- Honeywell (NYSE: HON) hat die nächste Generation seines Kabinendruckkontroll- und -überwachungssystems vorgestellt, das sowohl in kommerziellen als auch in militärischen Flugzeugen zum Einsatz kommen kann. Diese neue Version des Systems ist vollelektrisch, leichter und ab sofort für die Geschäfts- und Regionalluftfahrt sowie taktische oder militärische Trainingsflugzeuge erhältlich. (Quelle: Honeywell Internaitonal Inc, Pressemitteilung, Januar 2021)

Marktbericht zum Luftmanagementsystem – Umfang und Ergebnisse

Der Bericht „Marktgröße und Prognose für Luftmanagementsysteme (2021–2031)“ bietet eine detaillierte Analyse des Marktes, die die folgenden Bereiche abdeckt:

- Marktgröße und Prognose für Luftmanagementsysteme auf globaler, regionaler und Länderebene für alle wichtigen Marktsegmente, die im Rahmen des Berichts abgedeckt sind

- Markttrends für Luftmanagementsysteme sowie Marktdynamik wie Treiber, Einschränkungen und wichtige Chancen

- Detaillierte Porter-Fünf-Kräfte-Analyse

- Marktanalyse für Luftmanagementsysteme, die wichtige Markttrends, globale und regionale Rahmenbedingungen, wichtige Akteure, Vorschriften und aktuelle Marktentwicklungen umfasst

- Branchenlandschaft und Wettbewerbsanalyse, die die Marktkonzentration, Heatmap-Analyse, prominente Akteure und aktuelle Entwicklungen auf dem Markt für Luftmanagementsysteme umfasst

- Detaillierte Firmenprofile

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für Luftmanagementsysteme

Kostenlose Probe anfordern für - Markt für Luftmanagementsysteme