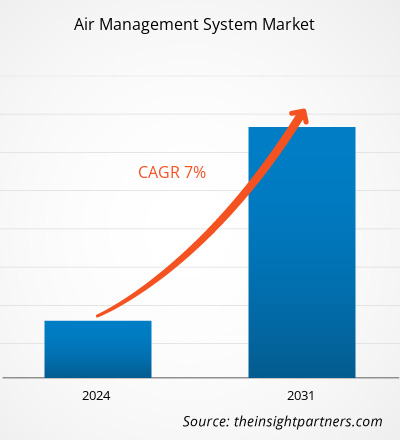

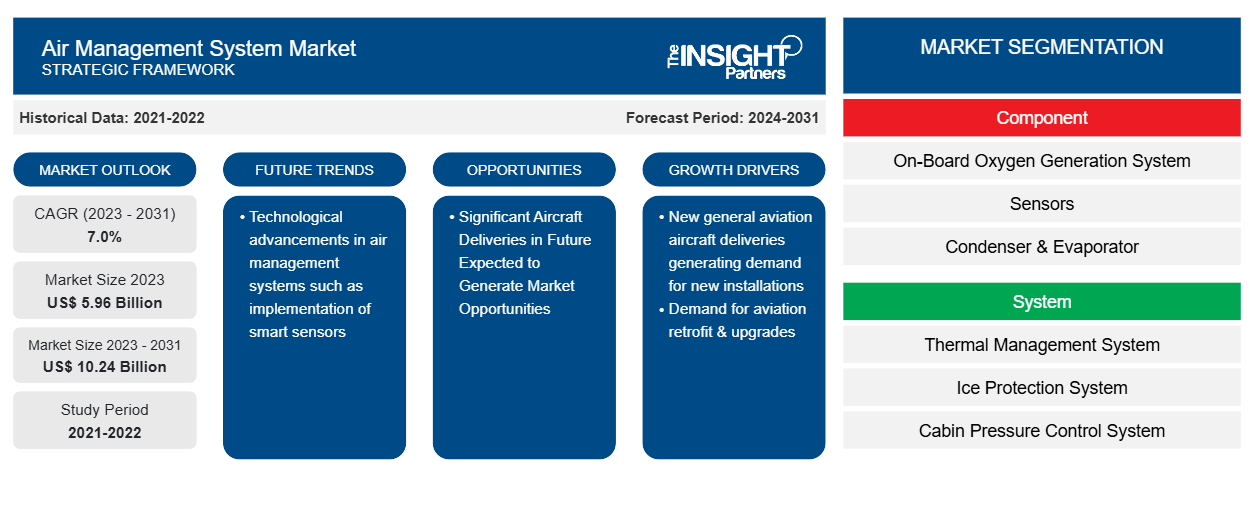

Si prevede che la dimensione del mercato dei sistemi di gestione dell'aria raggiungerà i 10,24 miliardi di dollari entro il 2031, rispetto ai 5,96 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 7,0% nel periodo 2023-2031. I progressi tecnologici nei sistemi di gestione dell'aria, come l'implementazione di sensori intelligenti, rimarranno probabilmente una tendenza chiave nel mercato.

Analisi di mercato del sistema di gestione dell'aria

L'ecosistema del mercato dei sistemi di gestione dell'aria è diversificato e in continua evoluzione. I suoi stakeholder sono fornitori, componenti, produttori di aeromobili e utenti finali. I principali attori occupano posizioni in vari nodi dell'ecosistema di mercato. I fornitori di materie prime forniscono materiali ai produttori di componenti, utilizzandoli per produrre e progettare i prodotti finali. Il prodotto finale viene quindi fornito ai produttori di aeromobili tramite diversi mezzi, come vendite dirette tramite distributori aziendali o vendite a terzi tramite distributori terzi. I produttori di aeromobili o OEM integrano quindi i componenti degli aeromobili nei rispettivi modelli di aeromobili.

Panoramica del mercato dei sistemi di gestione dell'aria

Il mercato dei sistemi di gestione dell'aria comprende diversi attori affermati, in cui i primi cinque venditori acquisiscono circa il 25% e sperimentano un approvvigionamento regolare dei rispettivi prodotti dagli utenti finali. Gli attori del mercato dei sistemi di gestione dell'aria competono tra loro su vari parametri, tra cui tecnologia, tempi di consegna e prezzi, tra gli altri. Questi parametri migliorano la competitività tra gli attori del mercato e si prevede che mantengano un alto livello di rivalità competitiva tra gli attori del mercato dei sistemi di gestione dell'aria.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dei sistemi di gestione dell'aria

Domanda di ammodernamento e aggiornamenti aeronautici

La presenza di un gran numero di flotte di aviazione commerciale più vecchie in tutto il mondo sta generando la domanda di ammodernamento e aggiornamento della flotta esistente. Inoltre, il lancio di nuovi hangar MRO per aeromobili e baie MRO è direttamente proporzionale alla domanda di diversi sistemi di gestione dell'aria, uno dei forti catalizzatori del mercato dei sistemi di gestione dell'aria. Inoltre, i continui investimenti da parte delle compagnie aeree per l'aggiornamento degli aeromobili dovuti all'espansione della loro flotta di aeromobili esistente stanno aumentando la domanda di sistemi di gestione dell'aria a livello globale. Ad esempio, uno dei leader dell'aviazione indiana, InterGlobe Aviation Ltd. (Indigo Airlines), ha firmato un accordo ventennale con Bangalore International Airport Limited (BIAL) nel 2019 per costruire la sua seconda struttura MRO in India. Secondo la dichiarazione dell'azienda, il nuovo hangar può servire due aeromobili a fusoliera stretta e un motore MRO.

Si prevede che in futuro importanti consegne di aeromobili genereranno opportunità di mercato

Il settore dell'aviazione commerciale ha mantenuto una flotta di grandi dimensioni nel corso degli anni, con Airbus e Boeing come i due produttori di aeromobili più noti in termini di statistiche di consegna. Il settore dell'aviazione commerciale ha assistito a una crescita enorme negli ultimi anni con l'emergere di nuovi vettori low-cost (LCC) e strategie di espansione della flotta adottate dai vettori full-service (FSC). Si prevede che l'aviazione commerciale aumenterà nei prossimi anni a causa del crescente numero di passeggeri dei viaggi aerei e dell'approvvigionamento di aeromobili. Inoltre, le consegne future previste di aeromobili commerciali e militari sono uno dei principali fattori che probabilmente genereranno nuove opportunità per i venditori di mercato nei prossimi anni. Ad esempio, secondo le previsioni di Boeing e Airbus, è probabile che più di 40.800 aeromobili commerciali saranno consegnati in tutto il mondo nel periodo 2023-2042.

Analisi della segmentazione del rapporto di mercato del sistema di gestione dell'aria

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato del sistema di gestione dell'aria sono i componenti, il sistema e la piattaforma.

- In base al componente, il mercato dei sistemi di gestione dell'aria è segmentato in sistemi di generazione di ossigeno di bordo, sensori, condensatore ed evaporatore, macchine a ciclo d'aria, unità elettroniche di controllo e monitoraggio e altri. Il segmento delle macchine a ciclo d'aria ha detenuto una quota di mercato maggiore nel 2023.

- In base al sistema, il mercato dei sistemi di gestione dell'aria è segmentato in sistema di gestione termica, sistema di protezione dal ghiaccio, sistema di controllo della pressione della cabina, sistema di inertizzazione del serbatoio del carburante, sistema di ossigeno e sistema di spurgo dell'aria del motore. Il segmento dei sistemi di gestione termica ha detenuto una quota di mercato maggiore nel 2023.

- In base alla piattaforma, il mercato dei sistemi di gestione dell'aria è segmentato in ala fissa e ala rotante. Il segmento ad ala fissa ha detenuto una quota di mercato maggiore nel 2023.

Analisi della quota di mercato del sistema di gestione dell'aria per area geografica

L'ambito geografico del rapporto di mercato sui sistemi di gestione dell'aria è suddiviso principalmente in cinque regioni: Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud America.

L'Asia Pacifica ha dominato il mercato nel 2023, seguita dalle regioni del Nord America e dell'Europa. Inoltre, è probabile che anche l'Asia Pacifica assista al CAGR più elevato nei prossimi anni. La Cina ha rappresentato una quota importante nel mercato dei sistemi di gestione dell'aria dell'Asia Pacifica, mentre è probabile che l'India sia uno dei mercati dei sistemi di gestione dell'aria più interessanti al mondo nei prossimi anni. La Cina ha superato il più grande mercato dell'aviazione degli Stati Uniti (gli Stati Uniti) ed è uno dei mercati dell'aviazione in più rapida crescita al mondo. Si prevede che il paese preveda un'elevata domanda di aeromobili nei prossimi 20 anni. Ad esempio, secondo le previsioni di Airbus, è probabile che più di 9.400 aeromobili commerciali vengano consegnati in Cina nel corso del 2023 e del 2042. Inoltre, con l'aumento del numero di aeromobili prodotti da produttori locali ed esteri, a lungo termine, le attività di MRO degli aeromobili si sposteranno verso la regione APAC, poiché la Cina e il Sud-Est asiatico sono in fila per stabilire la loro importanza come centri MRO. Le aziende di tutto il mondo si stanno concentrando sull'espansione della loro attività in Cina; ad esempio, Safran SA ha esteso i suoi servizi MRO alla Cina e offre servizi su vari componenti alle compagnie aeree cinesi. Inoltre, il paese è la seconda nazione con la spesa per la difesa più grande dopo gli Stati Uniti. La Cina investe somme sostanziali nelle sue forze di difesa che consentono all'aeronautica di procurarsi nuove flotte di aeromobili. Tuttavia, si prevede che la crescita della spesa militare e la domanda di aeromobili genereranno nuove opportunità di crescita per il mercato dei sistemi di gestione aerea in Cina.

Approfondimenti regionali sul mercato dei sistemi di gestione dell'aria

Le tendenze regionali e i fattori che influenzano il mercato dei sistemi di gestione dell'aria durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dei sistemi di gestione dell'aria in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato dei sistemi di gestione dell'aria

Ambito del rapporto di mercato del sistema di gestione dell'aria

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 5,96 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 10,24 miliardi di dollari USA |

| CAGR globale (2023-2031) | 7,0% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per componente

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei sistemi di gestione dell'aria sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dei sistemi di gestione dell'aria sono:

- Società Parker Hannifin

- Honeywell International Inc.

- Fondazione Diehl & Co. KG

- Azienda aerospaziale Collins

- Liebherr-International Deutschland GmbH

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dei sistemi di gestione dell'aria

Notizie di mercato e sviluppi recenti sui sistemi di gestione dell'aria

Il mercato dei sistemi di gestione dell'aria viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato dei sistemi di gestione dell'aria:

- AMETEK Singapore PTE ha aumentato le sue capacità investendo in soluzioni di manutenzione per Airbus A350. La decisione, che fornirà ai clienti della regione Asia-Pacifico un'opzione di supporto regionale per la suite completa di riscaldatori per cargo e cambusa per il tipo di aeromobile, sarà ulteriormente completata dalle attuali approvazioni di aeronavigabilità di AMETEK, tra cui CAAS, CAAC, FAA, EASA, JCAB, CAAM, CAAV e DGCA. (Fonte: AMETEK Singapore PTE, comunicato stampa, gennaio 2022)

- Honeywell (NYSE: HON) ha introdotto la nuova generazione del suo Cabin Pressure Control and Monitoring System con applicazioni sia in aerei commerciali che militari. Questa nuova versione del sistema è completamente elettrica, più leggera e disponibile ora per l'aviazione aziendale e regionale, nonché per aerei da addestramento tattici o militari. (Fonte: Honeywell Internaitonal Inc, comunicato stampa, gennaio 2021)

Copertura e risultati del rapporto di mercato sui sistemi di gestione dell'aria

Il rapporto "Dimensioni e previsioni del mercato dei sistemi di gestione dell'aria (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato dei sistemi di gestione dell'aria a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato dei sistemi di gestione dell'aria e dinamiche di mercato come driver, vincoli e opportunità chiave

- Analisi dettagliata delle cinque forze di Porter

- Analisi di mercato del sistema di gestione dell'aria che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato dei sistemi di gestione dell'aria

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei sistemi di gestione dell'aria

Ottieni un campione gratuito per - Mercato dei sistemi di gestione dell'aria