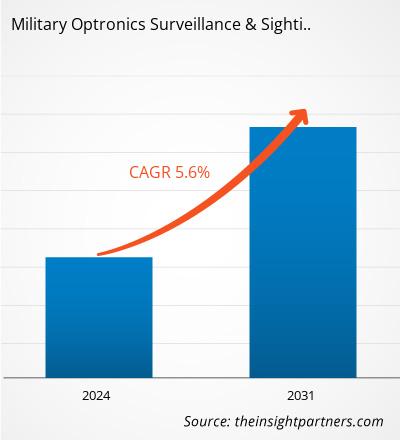

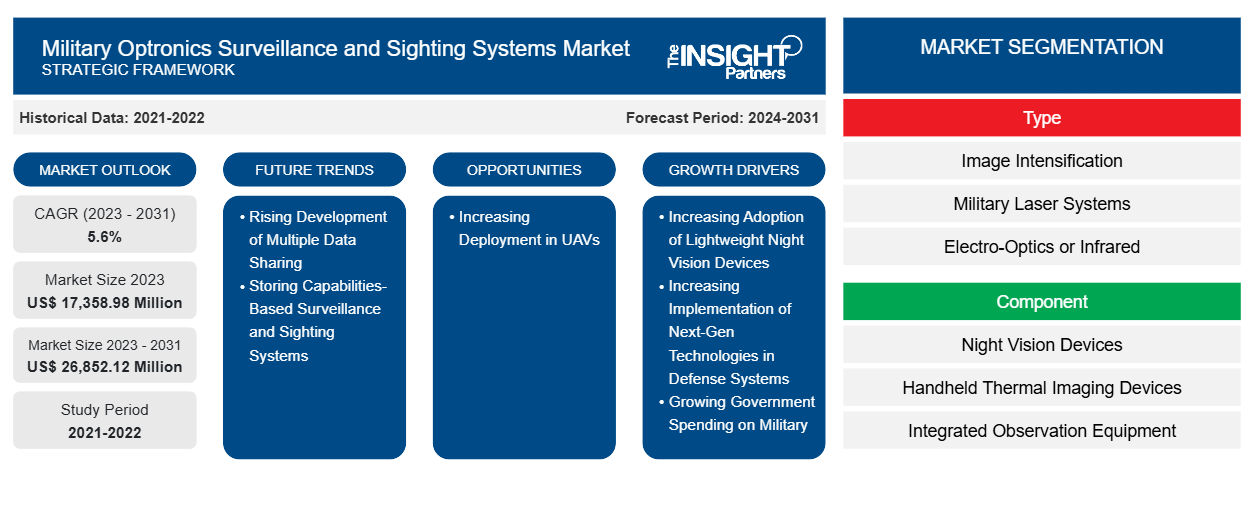

軍事用オプトロニクス監視および照準システム市場規模は、2023年の173億5,898万米ドルから2031年には268億5,212万米ドルに達すると予測されています。市場は2023年から2031年の間に5.6%のCAGRを記録すると予想されています。複数のデータ共有および保存機能に基づく監視および照準システムの開発の増加は、今後数年間で市場に新しい主要なトレンドをもたらす可能性があります。

軍事用オプトロニクス監視および照準システム市場分析

夜間の技術革新とテロ攻撃の脅威が高まる中、暗視装置の採用が増加しています。同様に、熱画像は、視界の悪い状況で兵士がターゲットを見つけるのに役立ちます。熱画像暗視装置は、個々の戦闘員システムを強化するために世界中で人気が高まっています。暗視装置は、夜間の作戦中に周囲を照らすことで、兵士に優れた状況認識を提供します。先進技術に基づく軽量暗視装置の開発と採用に向けた政府の取り組みの増加により、軍用オプトロニクス監視および照準システム市場の成長に対する大きな需要が生まれています。たとえば、2022年1月、米国国防総省の国防高等研究計画局(DARPA)は、アメリカの軍人向けの軽量暗視光学系の開発のために、10の防衛および大学の研究チームを選択しました。同省は、暗視システムを開発するための新技術を採用するために、眼鏡型の強化暗視(ENVision)プログラムを設計しました。

近隣諸国から土地を守るために世界中でUAVの配備が増えていることから、予測期間中にオプトロニクス監視および照準システム市場の成長に十分な機会が生まれると予想されます。たとえば、2022年にインド軍は、イスラエル製のUAV 25機以上を最初に配備したSearcher Mark IIと名付けました。さらに、2024年5月には、米国政府が中国の防衛力に対抗するための政府プログラムの一環として、軍にUAVを配備し始めました。また、2023年3月には、中国の科学者が空中で6つの別々のユニットに急速に分割できる軍用ドローンを開発しました。これらのドローンは、空気分離技術を使用して作られています。このように、いくつかの国の政府によるUAVへの投資と配備が増加していることから、予測期間中にオプトロニクス監視および照準システム市場に十分な機会が生まれると予想されます。

軍事用オプトロニクス監視および照準システム市場の概要

軍用オプトロニクス、監視、照準システムは、空中、地上、海上の戦闘環境における脅威を識別、追跡、監視、対処するための十分なツールを人員に提供します。これらのシステムは、高性能光学部品と高度なセンサーを統合して、軍隊にターゲットの正確な検出、認識、識別、および状況認識を提供します。さらに、オプトロニクス、監視、照準システムは、国境管理、基地保護、偵察、および情報収集ミッションの要件を満たすために応用されています。オプトロニクスおよび監視システムの技術的進歩と、防衛軍が既存の機器やシステムをアップグレードするという継続的な需要が相まって、世界の軍用オプトロニクス、監視、照準システム市場を牽引しています。

要件に合わせてレポートをカスタマイズする

このレポートの一部、国レベルの分析、Excelデータパックなど、あらゆるレポートを無料でカスタマイズできます。また、スタートアップや大学向けのお得なオファーや割引もご利用いただけます。

-

このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

軍事用オプトロニクス監視および照準システム市場の推進要因と機会

軽量暗視装置の採用増加

技術革新の進展と夜間のテロ攻撃の脅威が高まる中、暗視装置の採用が増加しています。以前の暗視装置は比較的重い部品を使用していたため、兵士の体重が増加していました。現在、さまざまな市場プレーヤーが軽量の暗視製品を導入しています。たとえば、ACTinBlackは、高い光学性能と人間工学に基づいたデザインの軽量双眼暗視装置を開発しました。2023年10月、米国を拠点とする熱画像および拡張現実(AR)企業であるThermoteknix Systemsは、高度な拡張現実(FNVG-AR)を備えたFused Night Vision Goggleと呼ばれる暗視ソリューションを発売しました。FNVG-ARシステムは、高度な技術に基づく次世代16mm白色リン光体暗視管と高解像度の熱画像装置を統合した軽量の双眼暗視ゴーグル(NVG)です。ACTinBlack has developed a Thermoteknix Systems, a US-based thermal imaging and augmented reality (AR) company, launched a night-vision solution called the Fused Night Vision Goggle with advanced Augmented Reality (FNVG-AR). FNVG-AR system is a lightweight binocular night vision goggle (NVG) integrated with advanced technology-based next-generation 16 mm white phosphor night vision tubes and a high-resolution thermal imager.

無人航空機の導入拡大UAVs

無人システムは、人命へのリスクを軽減するため、世界中で軍隊の不可欠な部分になっています。無人航空機 (UAV) が提供するさまざまな利点のため、米国、インド、中国などの多くの国は、主に監視アプリケーション用に、軍隊にさらに多くの UAV を配備するために多額の予算を割り当てています。無人プラットフォームにオプトロニクス監視および照準システムを展開すると、監視データと画像データの送信が容易になります。無人システムを通信アンテナやその他の監視機器と統合すると、さまざまな重要なミッションに役立ちます。したがって、空中および海軍の監視およびマッピング ミッションに UAV がますます導入されるにつれて、UAV プラットフォームの全体的な効率を損なうことなく効果的に統合できるオプトロニクス監視および照準システムの必要性が高まっています。したがって、軍事用オプトロニクス監視および照準システム市場では、Rafael Advanced Defense Systems Ltd. や Lockheed Martin など、いくつかの大手業界プレーヤーが、UAV プラットフォーム用のオプトロニクス監視および照準システムの開発と提供に重点を置いています。

軍事用オプトロニクス監視および照準システム市場レポートのセグメンテーション分析

軍事用オプトロニクス監視および照準システム市場分析の導出に貢献した主要なセグメントは次のとおりです。タイプ、コンポーネント、エンドユーザー。

- タイプ別に見ると、軍用オプトロニクス監視および照準システム市場は、画像増強、軍用レーザーシステム、電気光学/赤外線に分類されます。2023年には電気光学セグメントが市場で最大のシェアを占めました。

- コンポーネント別に見ると、市場は暗視装置、ハンドヘルド熱画像装置、統合観測装置、スタンドアロン赤外線、地震および音響センサー、その他に分類されます。地震および音響センサーセグメントは、2023年に市場を支配しました。

- エンドユーザーの観点から見ると、軍用オプトロニクス監視および照準システム市場は、地上、空中、海軍に分類されます。地上セグメントは、2023 年に市場で最大のシェアを占めました。

軍事用オプトロニクス監視および照準システムの市場シェア分析

軍事用オプトロニクス監視および照準システム市場レポートの地理的範囲は、詳細なグローバル分析を提供します。北米、ヨーロッパ、アジア太平洋は、軍事用オプトロニクス監視および照準システム市場で大幅な成長が見られる主要地域です。北米の軍事用オプトロニクス監視および照準システム市場は、さらに米国、カナダ、メキシコに細分化されています。2023年には、米国が北米の軍事用オプトロニクス監視および照準システム市場を支配し、2023年には大きな市場シェアを獲得し、カナダとメキシコがそれに続きました。これらの先進国は、GDPのかなりの部分を軍事費に費やしています。公式に認められた情報源からまとめられた世界銀行の開発指標コレクションによると、米国の軍事費は2023年にGDPの約3.5%と報告されています。また、米国連邦予算省によると、2023年度、米国政府は国防部門に8,200億ドルを費やしました。その額は、米国連邦支出の13%と推定されました。市場の主要企業は、空中オプトロニクス監視システム、高度なデジタル熱画像カメラ、追跡・検索システムなどに基づく高度なテクノロジーを開発しています。たとえば、米国に拠点を置くObsidian Sensors Inc.は、手頃な価格の高解像度センサーを使用して熱画像を処理する新しいテクノロジーを2023年に発売しました。

軍事用オプトロニクス監視および照準システム市場の地域別分析

予測期間を通じて軍事用オプトロニクス監視および照準システム市場に影響を与える地域的な傾向と要因は、Insight Partners のアナリストによって徹底的に説明されています。このセクションでは、軍事用オプトロニクス監視および照準システム市場のセグメントと、北米、ヨーロッパ、アジア太平洋、中東、アフリカ、南米、中米の地域についても説明します。

- 軍事用オプトロニクス監視および照準システム市場の地域別データを入手

軍事用オプトロニクス監視および照準システム市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| 2023年の市場規模 | 173億5,898万米ドル |

| 2031年までの市場規模 | 268億5,212万米ドル |

| 世界のCAGR(2023年~2031年) | 5.6% |

| 履歴データ | 2021-2022 |

| 予測期間 | 2024-2031 |

| 対象セグメント |

タイプ別

|

| 対象地域と国 |

北米

|

| 市場リーダーと主要企業プロフィール |

|

軍事用オプトロニクス監視および照準システム市場のプレーヤー密度:ビジネスダイナミクスへの影響を理解する

軍事用オプトロニクス監視および照準システム市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認識の高まりなどの要因により、エンドユーザーの需要が高まり、急速に成長しています。需要が高まるにつれて、企業は提供を拡大し、消費者のニーズを満たすために革新し、新たなトレンドを活用し、市場の成長をさらに促進しています。

市場プレーヤー密度とは、特定の市場または業界内で活動している企業または会社の分布を指します。これは、特定の市場スペースに、その市場規模または総市場価値に対してどれだけの競合相手 (市場プレーヤー) が存在するかを示します。

軍事用オプトロニクス監視および照準システム市場で事業を展開している主要企業は次のとおりです。

- エアバス

- ロッキード・マーティン社

- タレスグループ

- ゼネラル・ダイナミクス・コーポレーション

- L3ハリステクノロジーズ株式会社

- イスラエル航空宇宙産業

免責事項:上記の企業は、特定の順序でランク付けされていません。

- 軍事用オプトロニクス監視および照準システム市場のトップキープレーヤーの概要を入手

軍事用オプトロニクス監視および照準システム市場のニュースと最近の動向

軍事用オプトロニクス監視および照準システム市場は、重要な企業出版物、協会データ、データベースを含む一次および二次調査後の定性的および定量的データを収集することによって評価されます。軍事用オプトロニクス監視および照準システム市場におけるいくつかの開発を以下に示します。

- センサー専門メーカーのHENSOLDTは、PUMA歩兵戦闘車両向けに最新鋭の光学ビジョンシステムを不特定多数納入しています。顧客はシステムハウスのKNDSとRheinmetallで、両社はPUMA歩兵戦闘車両を製造し、共同設立したPSM GmbHを通じて販売しています。受注額は数百万ドルの範囲です。歩兵戦闘車両の砲塔用ビジョンシステムに加えて、この注文には車両乗組員の訓練用の砲塔トレーナー12台用の機器が含まれています。この納入により、HENSOLDTはKスタンドS1のPUMAの改善に貢献しています。(出典:HENSOLDT、プレスリリース、2024年6月)

- フランス軍は、Bi-NYX契約の一環として、2020年にフランス国防調達庁(DGA)から発注されたタレス暗視ゴーグルの最初の300個を受け取った。DGAに納入された300個のゴーグルは、2023年12月に発注された2,000セットの最初のバッチである。残りの1,700個は今年末までに出荷される予定。(出典:タレス、プレスリリース、2024年10月)

軍事用オプトロニクス監視および照準システム市場レポートの対象範囲と成果物

「軍事用オプトロニクス監視および照準システム市場の規模と予測(2021~2031年)」レポートでは、以下の市場を詳細に分析しています。

- 軍事用光学監視および照準システムの市場規模と予測(対象範囲に含まれるすべての主要市場セグメントの国別)

- 軍事用オプトロニクス監視および照準システム市場の動向、および推進要因、制約、主要な機会などの市場動向

- 詳細なPESTおよびSWOT分析

- 主要な市場動向、国の枠組み、主要プレーヤー、規制、最近の市場動向を網羅した軍事用光電子監視および照準システム市場分析

- 市場集中、ヒートマップ分析、主要プレーヤー、軍事用光学監視および照準システム市場の最近の動向を網羅した業界展望と競争分析

- 詳細な企業プロフィール

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

最新レポート

関連レポート

お客様の声

購入理由

- 情報に基づいた意思決定

- 市場動向の理解

- 競合分析

- 顧客インサイト

- 市場予測

- リスク軽減

- 戦略計画

- 投資の正当性

- 新興市場の特定

- マーケティング戦略の強化

- 業務効率の向上

- 規制動向への対応

無料サンプルを入手 - 軍事用オプトロニクス監視・照準システム市場

無料サンプルを入手 - 軍事用オプトロニクス監視・照準システム市場