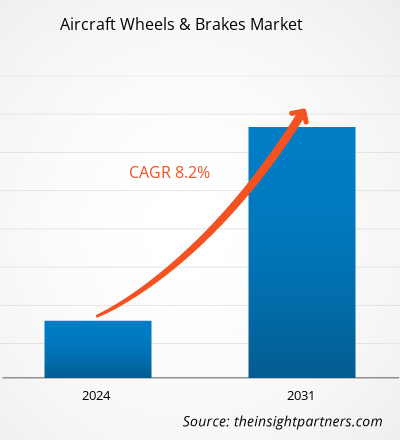

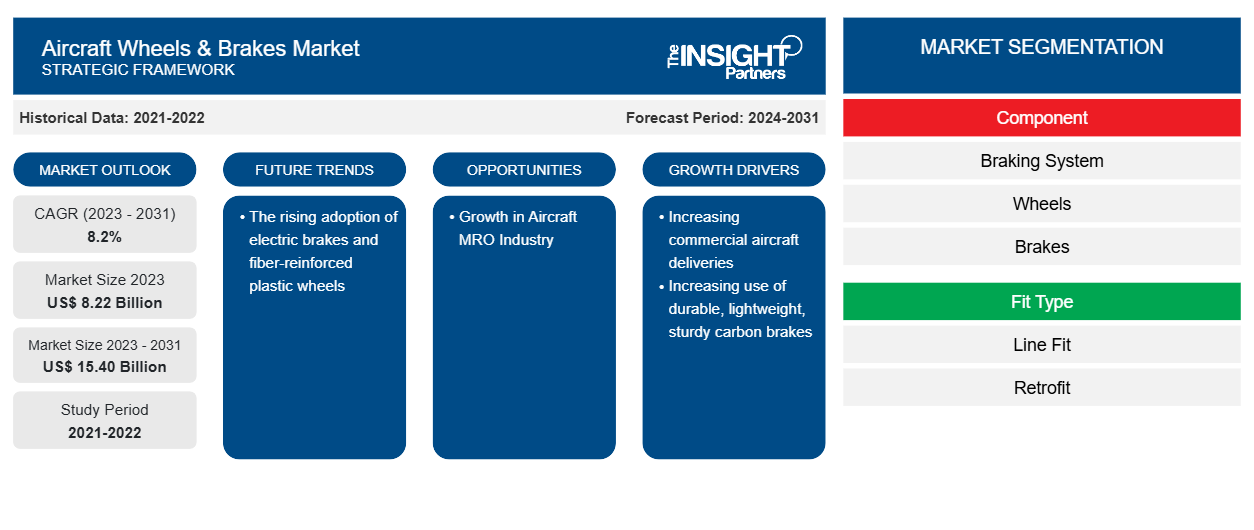

Si prevede che il mercato delle ruote e dei freni per aeromobili raggiungerà i 15,40 miliardi di dollari entro il 2031, passando dagli 8,22 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR dell'8,2% nel periodo 2023-2031. È probabile che la crescente adozione di freni elettrici e ruote in plastica rinforzata con fibre rimanga una tendenza chiave nel mercato.CAGR of 8.2% during 2023–2031. The rising adoption of electric brakes and fiber-reinforced plastic wheels is likely to remain a key trend in the market.

Analisi di mercato delle ruote e dei freni per aeromobili

Il mercato delle ruote e dei freni per aeromobili è dominato principalmente da attori affermati come Honeywell International Inc, Parker Hannifin Corporation, Safran Group e Crane Aerospace & Electronics, tra gli altri. La domanda di ruote e freni tra i produttori di aeromobili è in forte aumento. Tuttavia, la maggior parte dei contratti viene assegnata a attori affermati. Inoltre, la produzione di queste ruote e freni richiede la conformità a diversi standard stabiliti dall'autorità di governo. Ciò comporta l'ottenimento di varie certificazioni e investimenti significativi in R&S, che limitano l'ingresso di nuovi attori nel settore. Pertanto, la minaccia per il business dei nuovi entranti è elevata nello scenario attuale; tuttavia, con l'aumento del volume di produzione di aeromobili, è prevista l'emergere di nuovi attori. Si prevede che ciò ridurrà la minaccia per i nuovi entranti poiché diversi produttori di aeromobili di piccole o medie dimensioni si acquisteranno le loro ruote e freni da nuovi entranti che offrono ruote e freni con tecnologia avanzata a un prezzo competitivo.

Panoramica del mercato delle ruote e dei freni per aeromobili

L'ecosistema del mercato delle ruote e dei freni per aeromobili comprende i seguenti stakeholder: fornitori di materie prime e componenti, produttori di ruote e freni per aeromobili, produttori di aeromobili e utenti finali. I produttori di ruote e freni per aeromobili si procurano materie prime e componenti come acciaio, alluminio, lega di magnesio e materiali di carbonio, tra gli altri, e componenti come sensori e attuatori, tra gli altri, provengono da vari fornitori di materie prime e componenti. I produttori di ruote e freni per aeromobili assemblano materie prime e componenti e li trasformano in prodotti finiti. I produttori di ruote e freni per aeromobili lavorano in tandem con le autorità aeronautiche, i fornitori di materie prime, i produttori di aeromobili e gli utenti finali. Tra i principali attori che operano nel mercato ci sono Collins Aerospace, Honeywell International Inc, Safran Group e Parker Hannifin Corporation, tra gli altri. Inoltre, i produttori di aeromobili si procurano ruote e freni dai player sopra menzionati e li installano sulla flotta di aeromobili tramite attività di adattamento della linea. Infine, gli utenti finali come compagnie aeree, forze armate di vari paesi e fornitori di servizi MRO acquisiscono contratti per attività MRO di ruote e freni per aeromobili. I fornitori di servizi di manutenzione, riparazione e revisione (MRO) acquistano continuamente ruote e freni dagli operatori del mercato per poter continuare a offrire i propri servizi in risposta alla domanda in continua crescita di ruote e freni per aeromobili.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Approfondimenti regionali sul mercato delle ruote e dei freni per aeromobili

Le tendenze regionali e i fattori che influenzano il mercato Aircraft Wheels & Brakes durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato Aircraft Wheels & Brakes in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato delle ruote e dei freni degli aeromobili

Ambito del rapporto di mercato sulle ruote e sui freni degli aeromobili

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 8,22 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 15,40 miliardi di dollari USA |

| CAGR globale (2023-2031) | 8,2% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per componente

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato Aircraft Wheels & Brakes Market sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato delle ruote e dei freni per aeromobili sono:

- Beringer Aero

- Azienda aerospaziale Collins

- Honeywell International Inc.

- Società a responsabilità limitata Meggitt

- Società Parker Hannifin

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni la panoramica dei principali attori del mercato delle ruote e dei freni per aeromobili

Notizie e sviluppi recenti sul mercato delle ruote e dei freni per aeromobili

Il mercato delle ruote e dei freni per aeromobili viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato delle ruote e dei freni per aeromobili:

- Safran Landing Systems ha inaugurato, presso il suo sito di Vélizy-Villacoublay (Francia), un laboratorio completamente rinnovato, dedicato ai test delle sue ruote e dei freni in carbonio, e dotato di un nuovo banco di prova. L'azienda avrà investito un totale di 10 milioni di euro per realizzare questo ambizioso progetto. Il risultato è un ambiente di lavoro responsabile e la promessa di rafforzare la capacità di Safran di sviluppare e qualificare freni più performanti, più durevoli e competitivi, nonché di tenere il passo con i ramp-up dei suoi clienti. Ciò vale per quasi tutti i segmenti dell'aviazione civile, militare e commerciale. (Fonte: Safran, comunicato stampa, aprile 2024)

- Parker-Hannifin Corporation (NYSE: PH, "Parker"), leader mondiale nelle tecnologie di movimento e controllo, ha annunciato oggi di aver completato la transazione precedentemente annunciata per vendere la sua divisione Aircraft Wheel and Brake, con sede ad Avon, Ohio, negli Stati Uniti, a Kaman Corporation (NYSE: KAMN). Kaman, con sede a Bloomfield, Connecticut, è un produttore leader di componenti e materiali per i mercati aerospaziale e della difesa, industriale e medico. (Fonte: Parker-Hannifin Corporation, comunicato stampa, settembre 2022)

Copertura e risultati del rapporto di mercato sulle ruote e sui freni degli aeromobili

Il rapporto "Dimensioni e previsioni del mercato delle ruote e dei freni per aeromobili (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato delle ruote e dei freni per aeromobili a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Tendenze del mercato delle ruote e dei freni per aeromobili, nonché dinamiche di mercato come conducenti, sistemi di ritenuta e opportunità chiave

- Analisi dettagliata delle cinque forze di Porter

- Analisi di mercato del mercato delle ruote e dei freni per aeromobili che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato delle ruote e dei freni degli aeromobili

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle ruote e dei freni per aeromobili

Ottieni un campione gratuito per - Mercato delle ruote e dei freni per aeromobili