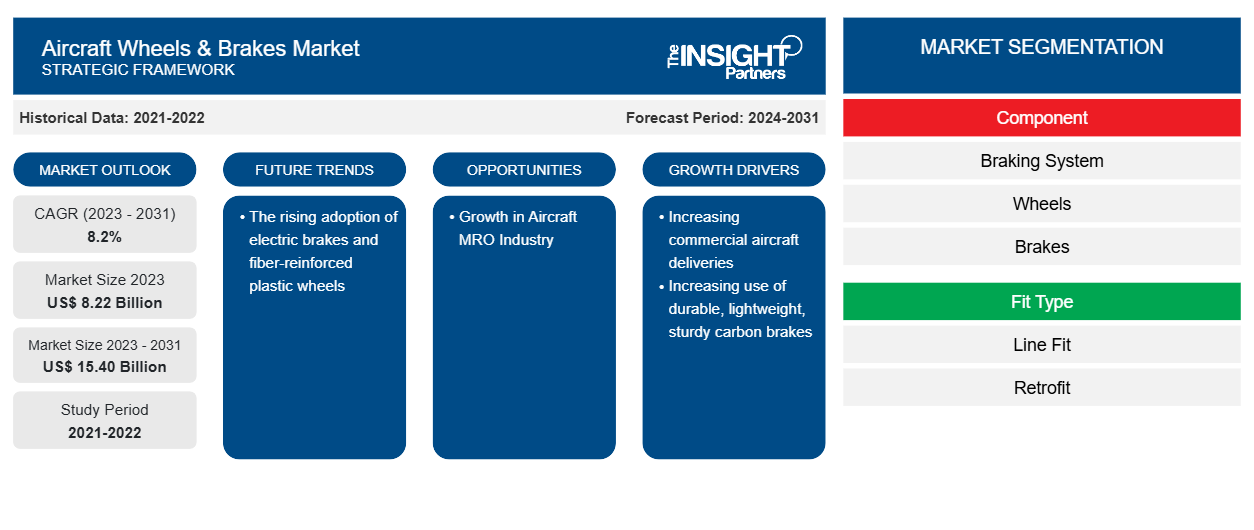

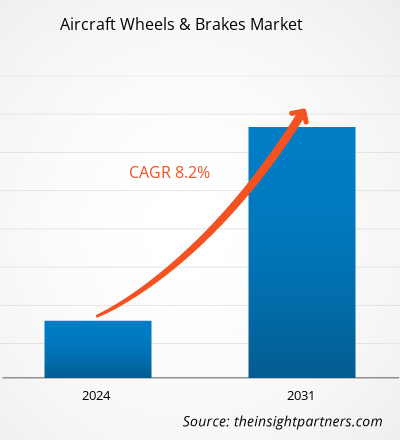

Le marché des roues et freins d'avions devrait atteindre 15,40 milliards USD d'ici 2031, contre 8,22 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 8,2 % au cours de la période 2023-2031. L'adoption croissante des freins électriques et des roues en plastique renforcé de fibres devrait rester une tendance clé du marché.

Analyse du marché des roues et freins d'avions

Le marché des roues et freins d'avions est largement dominé par des acteurs bien établis tels que Honeywell International Inc, Parker Hannifin Corporation, Safran Group et Crane Aerospace & Electronics, entre autres. La demande de roues et freins parmi les constructeurs aéronautiques est en forte augmentation. Cependant, la plupart des contrats sont attribués à des acteurs bien établis. De plus, la fabrication de ces roues et freins nécessite le respect de plusieurs normes fixées par l'autorité de régulation. Cela implique l'obtention de diverses certifications et des investissements importants en R&D, ce qui limite l'entrée de nouveaux acteurs dans le domaine. Ainsi, la menace pour les entreprises de nouveaux entrants est élevée dans le scénario actuel ; cependant, avec l'augmentation du volume de production d'avions, l'émergence de nouveaux acteurs est prévue. Cela devrait réduire la menace pour les nouveaux entrants, car plusieurs constructeurs d'avions de petite ou moyenne taille s'approvisionneraient en roues et freins auprès de nouveaux entrants proposant des roues et freins de technologie avancée à un prix compétitif.

Aperçu du marché des roues et freins d'avions

L'écosystème du marché des roues et freins d'avion comprend les parties prenantes suivantes : fournisseurs de matières premières et de composants, fabricants de roues et freins d'avion, constructeurs d'avions et utilisateurs finaux. Les fabricants de roues et freins d'avion achètent des matières premières et des composants tels que l'acier, l'aluminium, l'alliage de magnésium et les matériaux de fiction en carbone, entre autres, et des composants tels que des capteurs et des actionneurs, entre autres, auprès de divers fournisseurs de matières premières et de composants. Les fabricants de roues et freins d'avion assemblent des matières premières et des composants et les produisent en produits finis. Les fabricants de roues et freins d'avion travaillent en tandem avec les autorités aéronautiques, les fournisseurs de matières premières, les constructeurs d'avions et les utilisateurs finaux. Parmi les acteurs importants qui opèrent sur le marché, on trouve Collins Aerospace, Honeywell International Inc, Safran Group et Parker Hannifin Corporation, entre autres. En outre, les constructeurs d'avions achètent des roues et des freins auprès des acteurs mentionnés ci-dessus et les installent sur la flotte d'avions par le biais d'une activité d'ajustement en ligne. Enfin, les utilisateurs finaux tels que les compagnies aériennes, les forces armées de divers pays et les prestataires de services MRO acquièrent des contrats pour l'activité MRO des roues et freins d'avion. Les prestataires de services MRO achètent en permanence des roues et des freins auprès des acteurs du marché afin de proposer en permanence leurs services à la demande toujours croissante de MRO de roues et de freins d'avions.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

Marché des roues et freins d'avions : informations stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

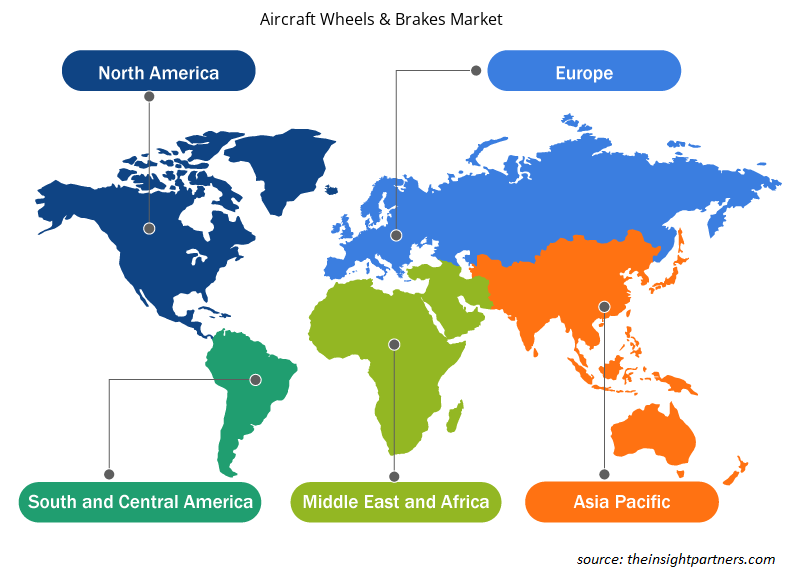

Aperçu régional du marché des roues et freins d'avion

Les tendances et facteurs régionaux influençant le marché des roues et freins d’aéronefs tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des roues et freins d’aéronefs en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des roues et freins d'avion

Portée du rapport sur le marché des roues et freins d'avions

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 8,22 milliards de dollars américains |

| Taille du marché d'ici 2031 | 15,40 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 8,2% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par composant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des roues et freins d'aéronefs connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des roues et freins d'avions sont :

- Beringer Aéro

- Collins Aérospatiale

- Honeywell International Inc.

- Automate programmable Meggitt

- Société Parker Hannifin

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des roues et freins d'avions

Actualités et développements récents du marché des roues et freins d'avions

Le marché des roues et freins d'avions est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements sur le marché des roues et freins d'avions sont répertoriés ci-dessous :

- Safran Landing Systems a inauguré, sur son site de Vélizy-Villacoublay (France), un laboratoire entièrement rénové dédié aux essais de ses roues et freins carbone, et équipé d'un nouveau banc d'essais. L'entreprise aura investi au total 10 millions d'euros pour mener à bien ce projet ambitieux. Le résultat est un environnement de travail responsable et la promesse de renforcer la capacité de Safran à développer et qualifier des freins plus performants, plus durables et plus compétitifs ainsi qu'à accompagner les montées en cadence de ses clients. Cela s'applique à la quasi-totalité des segments de l'aviation civile, militaire et d'affaires. (Source : Safran, Communiqué de presse, avril 2024)

- Parker-Hannifin Corporation (NYSE : PH, « Parker »), leader mondial des technologies de mouvement et de contrôle, a annoncé aujourd'hui avoir finalisé la transaction précédemment annoncée visant à vendre sa division de roues et de freins d'aéronefs, située à Avon, dans l'Ohio, aux États-Unis, à Kaman Corporation (NYSE : KAMN). Kaman, dont le siège social est situé à Bloomfield, dans le Connecticut, est un important fabricant de composants et de matériaux pour les marchés de l'aérospatiale et de la défense, de l'industrie et de la médecine. (Source : Parker-Hannifin Corporation, communiqué de presse, septembre 2022)

Rapport sur le marché des roues et freins d'avion : couverture et livrables

Le rapport « Taille et prévisions du marché des roues et freins d’aéronefs (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des roues et freins d'avions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché des roues et freins d'avion ainsi que dynamique du marché telles que les facteurs déterminants, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces du porteur

- Analyse du marché des roues et freins d'avions couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents pour le marché des roues et freins d'avions

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des roues et freins d'avions

Obtenez un échantillon gratuit pour - Marché des roues et freins d'avions