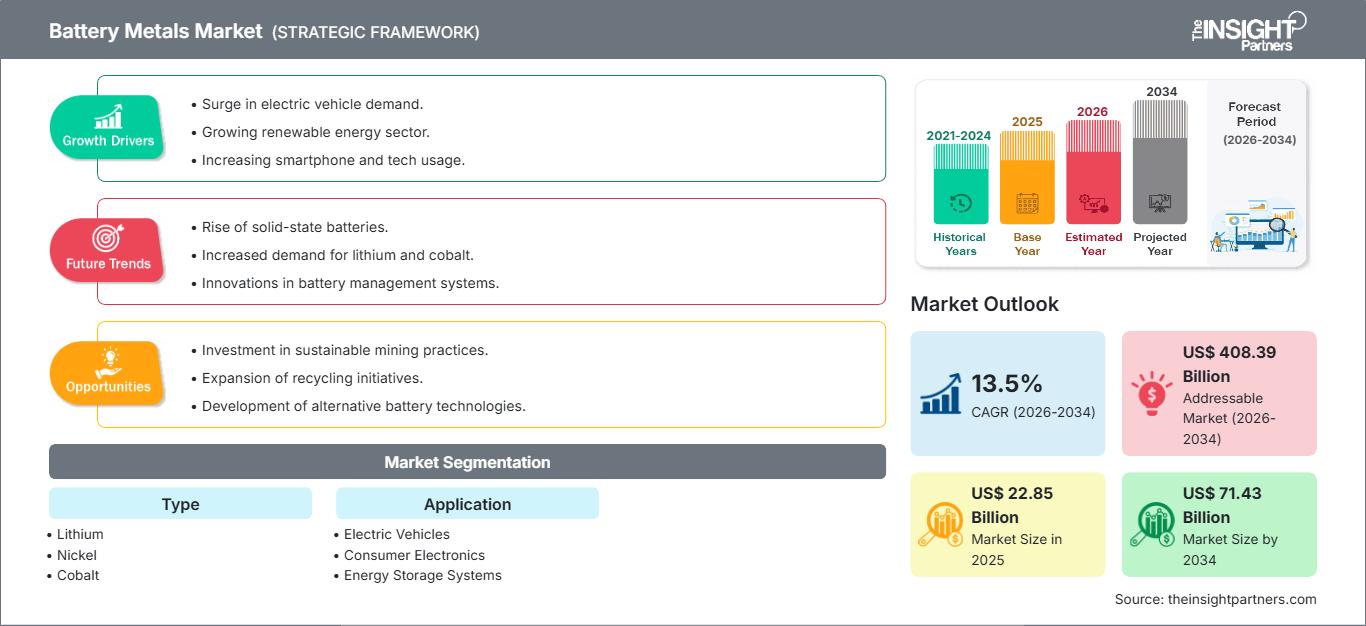

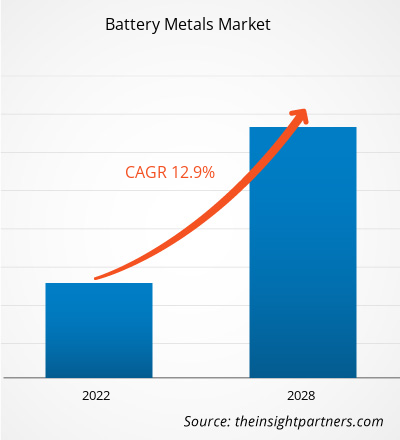

Si prevede che il mercato globale dei metalli per batterie raggiungerà i 71,43 miliardi di dollari entro il 2034, rispetto ai 22,85 miliardi di dollari del 2025. Si prevede che il mercato registrerà un CAGR del 13,5% nel periodo di previsione 2026-2034. Le principali dinamiche di mercato includono la rapida transizione globale verso la decarbonizzazione, l'espansione aggressiva dell'ecosistema dei veicoli elettrici (EV) e il significativo supporto politico governativo, come sussidi e crediti d'imposta per l'energia verde. Inoltre, si prevede che il mercato trarrà vantaggio dai progressi nella chimica delle batterie, incluso il passaggio a batterie ad alto contenuto di nichel e allo stato solido, e dalla crescente integrazione di sistemi di accumulo di energia (ESS) su larga scala nelle reti elettriche nazionali per gestire l'intermittenza delle energie rinnovabili.

Analisi del mercato dei metalli per batterie

L'analisi del mercato dei metalli per batterie sottolinea un cambiamento strategico cruciale verso la resilienza della supply chain e l'integrazione verticale. Con l'intensificarsi delle tensioni geopolitiche e del nazionalismo delle risorse, le tendenze degli acquisti indicano che le principali aziende automobilistiche e tecnologiche si stanno allontanando dagli acquisti sul mercato aperto a favore di investimenti diretti in attività minerarie e accordi di prelievo a lungo termine. Stanno emergendo opportunità strategiche nello sviluppo di supply chain circolari, dove il riciclo delle batterie e l'estrazione mineraria urbana offrono una fonte secondaria di litio, cobalto e nichel per mitigare i deficit di approvvigionamento primario. L'analisi indica inoltre che gli operatori del mercato devono concentrarsi sulla diversificazione della propria presenza geografica per ridurre la dipendenza da regioni specifiche, investendo al contempo in tecnologie di estrazione sostenibili come l'estrazione diretta di litio (DLE) per soddisfare i rigorosi requisiti ambientali, sociali e di governance (ESG).

Panoramica del mercato dei metalli per batterie

I metalli per batterie si sono trasformati da un settore industriale di nicchia a pilastro fondamentale della transizione energetica globale. Incentrata su elementi chiave come litio, nichel e cobalto, l'industria funge da motore principale per l'elettrificazione dei trasporti e la stabilizzazione delle reti di energia rinnovabile. Mentre il mercato è stato storicamente trainato dall'elettronica di consumo su piccola scala, il panorama attuale è dominato dall'enorme richiesta del settore dei veicoli elettrici. Questo cambiamento ha portato a una volatilità senza precedenti nei prezzi delle materie prime e a una corsa all'esplorazione globale. Il mercato è caratterizzato da un mix di tradizionali giganti minerari diversificati e aziende pure-play del settore dei metalli energetici, tutte impegnate in un panorama complesso di fluttuazioni nella composizione chimica delle batterie e quadri normativi in evoluzione. Ad esempio, il mercato negli Stati Uniti sta attraversando una significativa rivitalizzazione guidata da iniziative federali volte a stabilire una filiera nazionale dalla miniera alla batteria. I crescenti investimenti in impianti di raffinazione e lavorazione localizzati mirano a ridurre la dipendenza dalle importazioni. Vi è una forte enfasi sulle pratiche minerarie sostenibili e sullo sviluppo di tecnologie per batterie di nuova generazione a supporto della produzione automobilistica nazionale.

Personalizza questo report in base alle tue esigenze

Ottieni la PERSONALIZZAZIONE GRATUITAMercato dei metalli per batterie: approfondimenti strategici

-

Scopri le principali tendenze di mercato di questo rapporto.Questo campione GRATUITO includerà analisi dei dati, che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dei metalli per batterie

Fattori trainanti del mercato:

- Impennata nell'adozione di veicoli elettrici (EV): la spinta globale delle case automobilistiche a eliminare gradualmente i motori a combustione interna è il principale motore della domanda di metallo per batterie. Le severe normative sulle emissioni e l'interesse dei consumatori per un trasporto sostenibile stanno imponendo un massiccio aumento della produzione di batterie agli ioni di litio ad alta capacità.

- Spinta globale per l'integrazione delle energie rinnovabili: con la transizione dei paesi verso l'energia solare ed eolica, la necessità di sistemi di accumulo di energia fissi è aumentata vertiginosamente. Questi sistemi richiedono enormi quantità di metalli per batterie per immagazzinare l'energia in eccesso, garantendo la stabilità della rete e un'erogazione affidabile di energia durante i periodi non produttivi.

- Progressi nella chimica delle batterie: la continua ricerca e sviluppo per aumentare la densità energetica e ridurre i tempi di ricarica sta alimentando la domanda di metalli specifici ad elevata purezza. L'evoluzione verso le chimiche NCM (nichel-cobalto-manganese) e LFP (litio-ferro-fosfato) crea un ambiente di domanda dinamico per diverse tipologie di metalli.

Opportunità di mercato:

- Investimenti nel riciclaggio e nel recupero delle batterie: con la prima generazione di veicoli elettrici che sta raggiungendo la fine del proprio ciclo di vita, si profila per le aziende una crescente opportunità di specializzarsi nel recupero di metalli di alto valore dalle celle esaurite, riducendo l'impatto ambientale e i costi di approvvigionamento delle materie prime.

- Esplorazione di tecnologie di estrazione alternative: le innovazioni tecnologiche nell'estrazione diretta del litio (DLE) e nella lisciviazione acida ad alta pressione per il nichel offrono l'opportunità di sbloccare giacimenti minerari in precedenza non economici o di qualità inferiore, ampliando la base di approvvigionamento globale.

- Partnership strategiche lungo tutta la catena del valore: la creazione di alleanze tra aziende minerarie, aziende di trasformazione chimica e produttori di batterie può semplificare la catena di fornitura, garantendo un flusso costante di materiali e riducendo i rischi associati alla volatilità dei prezzi.

Analisi della segmentazione del rapporto di mercato sui metalli per batterie

La quota di mercato dei metalli per batterie viene analizzata in diversi segmenti per fornire una comprensione più chiara della sua struttura, del potenziale di crescita e delle tendenze emergenti. Di seguito è riportato l'approccio di segmentazione standard utilizzato nella maggior parte dei report di settore:

Per tipo:

- Litio: riconosciuto come componente fondamentale della moderna tecnologia delle batterie, questo segmento è trainato dal suo ruolo insostituibile nelle applicazioni ad alta densità energetica.

- Nichel: sempre più essenziale per i veicoli elettrici a lungo raggio, con prodotti chimici ad alto contenuto di nichel che stanno diventando lo standard del settore per le prestazioni.

- Cobalto: uno stabilizzatore fondamentale nelle batterie, anche se il mercato sta assistendo a uno spostamento verso formulazioni a basso contenuto di cobalto a causa di problemi di approvvigionamento etico e di costi.

- Altri: includono metalli come manganese, grafite e alluminio, essenziali per anodi, catodi e componenti strutturali delle batterie.

Per applicazione:

- Veicoli elettrici: il segmento di consumatori principale, che comprende autovetture, flotte commerciali e veicoli a due ruote, detta la traiettoria complessiva del mercato.

- Elettronica di consumo: un segmento maturo che continua a richiedere metalli ad alta purezza per smartphone, laptop e dispositivi indossabili.

- Sistemi di accumulo di energia: un settore in forte crescita incentrato sulle batterie residenziali e di pubblica utilità utilizzate per immagazzinare energia rinnovabile.

- Altri: include applicazioni industriali, aerospaziali e dispositivi medici specializzati che richiedono soluzioni di alimentazione portatili.

Per geografia:

- America del Nord

- Europa

- Asia Pacifico

- America meridionale e centrale

- Medio Oriente e Africa

Approfondimenti regionali sul mercato dei metalli per batterie

Le tendenze e i fattori regionali che hanno influenzato il mercato dei metalli per batterie durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la distribuzione geografica del mercato dei metalli per batterie in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto sul mercato dei metalli per batterie

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2025 | 22,85 miliardi di dollari USA |

| Dimensioni del mercato entro il 2034 | 71,43 miliardi di dollari USA |

| CAGR globale (2026 - 2034) | 13,5% |

| Dati storici | 2021-2024 |

| Periodo di previsione | 2026-2034 |

| Segmenti coperti |

Per tipo

|

| Regioni e paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato dei metalli per batterie: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei metalli per batterie è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni una panoramica dei principali attori del mercato dei metalli per batterie

Analisi della quota di mercato dei metalli per batterie per area geografica

Si prevede che la regione Asia-Pacifico crescerà più rapidamente nei prossimi anni. Anche i mercati emergenti in America meridionale e centrale, Medio Oriente e Africa offrono numerose opportunità di espansione inesplorate per i produttori.

Il mercato dei metalli per batterie sta attraversando una profonda trasformazione, passando da una tradizionale commodity industriale a un asset strategico globale di alto valore. La crescita è trainata dalla crescente domanda globale di veicoli elettrici (EV), dall'aumento dell'integrazione delle energie rinnovabili attraverso i sistemi di accumulo e dall'espansione del settore dell'elettronica di consumo ad alte prestazioni. Di seguito è riportato un riepilogo delle quote di mercato e delle tendenze per regione:

America del Nord

- Quota di mercato: un segmento in rapida espansione, trainato da un aggressivo sostegno politico federale e dalla localizzazione della filiera di fornitura delle batterie.

-

Fattori chiave:

- Incentivi governativi sostanziali, come l'Inflation Reduction Act (IRA), favoriscono la lavorazione dei minerali a livello nazionale e la produzione di veicoli elettrici.

- Rapida espansione delle Gigafactory e degli impianti di raffinazione nazionali per ridurre la dipendenza dalle catene di approvvigionamento estere

- Crescente preferenza dei consumatori per le batterie ad alto contenuto di nichel per supportare le capacità dei veicoli a lungo raggio

- Tendenze: ampliamento dell'estrazione del litio dalle salamoie geotermiche e sviluppo di un'economia circolare attraverso il riciclaggio avanzato delle batterie e iniziative di estrazione mineraria urbana localizzata.

Europa

- Quota di mercato: detiene una quota globale significativa, ancorata a rigorosi obiettivi di decarbonizzazione e a un solido ecosistema di produzione automobilistica.

- Fattori chiave:

-

Mandati aggressivi per l'eliminazione graduale dei motori a combustione interna (ICE) in tutta l'Unione Europea

- Rigidi quadri normativi, tra cui il Battery Passport, spingono verso elevati standard ESG nell'approvvigionamento dei metalli.

- Forte sostegno istituzionale per i gasdotti regionali delle gigafactory per garantire la sicurezza energetica e la resilienza industriale

- Tendenze: un cambiamento strategico verso la priorità dell'estrazione mineraria sostenibile e a basse emissioni di carbonio, con un'attenzione crescente alla raffinazione localizzata dei precursori e alla produzione di nichel ad alta purezza.

Asia-Pacifico

- Quota di mercato: la regione dominante a livello mondiale, che funge da motore primario per la lavorazione dei metalli delle batterie e la produzione di celle per batterie.

-

Fattori chiave:

- Enorme produzione manifatturiera in Cina, Giappone e Corea del Sud, che controllano la stragrande maggioranza del mercato globale dei prodotti chimici per batterie

- Politiche governative favorevoli e l'adozione su larga scala di NEV (veicoli a nuova energia) in Cina

- Accesso a diverse risorse minerarie regionali e una catena di fornitura altamente integrata ed efficiente in termini di costi

- Tendenze: forti investimenti in prodotti chimici di nuova generazione come gli ioni di sodio e l'LFP (litio ferro fosfato) per soddisfare i segmenti di mercato ad alto volume, insieme a una significativa attività di ricerca e sviluppo sui materiali per batterie allo stato solido.

America meridionale e centrale

- Quota di mercato: un mercato critico dal lato dell'offerta, in particolare all'interno del Triangolo del litio formato da Cile, Argentina e Bolivia.

-

Fattori chiave:

- Possesso delle riserve di litio in salamoia più grandi e competitive al mondo

- Modernizzazione delle tecnologie di estrazione, come l'estrazione diretta di litio (DLE), per migliorare le rese e la sostenibilità

- Focus strategico sulla risalita della catena del valore attraverso lo sviluppo di raffinazione localizzata e produzione di precursori

- Tendenze: transizione da un modello di esportazione puramente di materie prime a un hub a valore aggiunto, supportato da partnership strategiche con OEM automobilistici globali che cercano di assicurarsi l'accesso diretto ai minerali.

Medio Oriente e Africa

- Quota di mercato: mercato in via di sviluppo con profonde radici minerarie, in transizione verso una produzione commerciale formalizzata e una produzione regionale.

-

Fattori chiave:

- Ruolo critico nell'approvvigionamento globale di cobalto (RDC) e nichel/manganese (Sudafrica)

- Investimenti strategici nel Consiglio di cooperazione del Golfo per costruire centri di produzione di batterie localizzati e supportare la diversificazione economica

- Elevata domanda di stoccaggio di energia su scala di rete per gestire progetti di energia solare su larga scala in climi aridi

- Tendenze: implementazione di moderni standard ESG e di trasparenza per formalizzare il settore minerario, abbinati a investimenti in tecnologie Smart Mining per ottimizzare il recupero dei minerali.

Elevata densità di mercato e concorrenza

La concorrenza si sta intensificando a causa della presenza di leader affermati come Albemarle Corporation, Bolt Metals, Ganfeng Lithium Co., Ltd., Umicore, LG Chem, Honjo Metal Co., Ltd., Vale, Lithium Australia NL e BASF SE, che contribuiscono anch'essi a creare un panorama di mercato diversificato e in rapida espansione.

Questo ambiente competitivo spinge i fornitori a differenziarsi attraverso:

- Integrazione verticale della catena di fornitura: posizionarsi come partner affidabili a lungo termine controllando l'intera catena del valore, dalle attività minerarie a monte alla raffinazione chimica a metà percorso, per garantire la trasparenza e soddisfare gli standard etici "clean-label" richiesti dagli OEM automobilistici globali.

- Tecnologie avanzate di estrazione e raffinazione: le aziende competono sempre più attraverso l'implementazione dell'estrazione diretta del litio (DLE) e della lisciviazione acida ad alta pressione (HPAL) per il nichel. Queste tecnologie consentono la lavorazione di minerali di qualità inferiore con un impatto ambientale ridotto, offrendo un vantaggio competitivo significativo in un mercato attento ai fattori ESG.

- Modelli di prelievo strategico e joint venture: i principali produttori stanno andando oltre le semplici vendite sul mercato spot per formare solide partnership strategiche con produttori di batterie (ad esempio, CATL, LG Chem) e giganti dell'automotive (ad esempio, Tesla, GM). Questi accordi pluriennali stabilizzano i ricavi e riducono il rischio delle ingenti spese in conto capitale richieste per i nuovi progetti minerari.

- Sostenibilità e branding circolare: differenziarsi attraverso profili di produzione a basse emissioni di carbonio e capacità di riciclo integrate. Offrendo metalli a ciclo chiuso recuperati da batterie a fine vita, i fornitori possono attrarre clienti europei e nordamericani sottoposti a rigidi obblighi in materia di materiali secondari.

Opportunità e mosse strategiche

- Sviluppare centri di raffinazione e lavorazione nazionali: collaborare con i governi del Nord America e dell'Europa per attingere a sussidi e crediti d'imposta significativi (come l'US Inflation Reduction Act) volti a localizzare la filiera dalla miniera alla batteria e a ridurre la dipendenza dalle importazioni.

- Investire in sostanze chimiche metalliche di nuova generazione: concentrare la ricerca e sviluppo su materiali ad alta purezza compatibili con le tecnologie emergenti delle batterie, come le batterie al litio-zolfo, agli ioni di sodio e allo stato solido, che si prevede entreranno nelle fasi iniziali di produzione commerciale entro il 2030.

- Espandersi in settori verticali emergenti di riciclaggio e recupero: creare strutture minerarie urbane dedicate per recuperare cobalto, nichel e litio dalla prima generazione di batterie di veicoli elettrici dismesse, creando un flusso di entrate secondario e sostenibile che mitiga la volatilità dell'offerta primaria.

Le principali aziende che operano nel mercato dei metalli per batterie sono:

- Albemarle Corporation

- Bulloni metallici

- Ganfeng litio Co., Ltd.

- Umicore

- LG Chem

- Honjo Metal Co., Ltd.

- OK

- Litio Australia NL

- BASF SE

Disclaimer: le aziende elencate sopra non sono classificate in un ordine particolare.

Notizie e sviluppi recenti sul mercato dei metalli per batterie

- Nell'agosto 2025, Glencore Plc. ha acquisito Li-Cycle. Questa mossa strategica ha integrato Li-Cycle nelle attività di Glencore, garantendo che l'azienda specializzata in metalli per batterie continuasse a offrire valore e un servizio migliore ai clienti globali congiunti.

- Nell'ottobre 2024, Rio Tinto e Arcadium Lithium plc hanno annunciato un accordo definitivo in base al quale Rio Tinto ha acquisito Arcadium in una transazione interamente in contanti per 5,85 dollari USA per azione. Questa acquisizione, che ha valutato il capitale azionario diluito di Arcadium a circa 6,7 miliardi di dollari USA, ha rafforzato significativamente la posizione di Rio Tinto nel mercato globale dei metalli per batterie.

Copertura e risultati del rapporto sul mercato dei metalli per batterie

Il rapporto sulle dimensioni e le previsioni del mercato dei metalli per batterie (2021-2034) fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato dei metalli per batterie a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato dei metalli per batterie, nonché dinamiche di mercato quali fattori trainanti, vincoli e opportunità chiave

- Analisi PEST e SWOT dettagliate

- Analisi del mercato dei metalli per batterie che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che comprende la concentrazione del mercato, l'analisi della mappa termica, i principali attori e gli sviluppi recenti nel mercato dei metalli per batterie.

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei metalli per batterie

Ottieni un campione gratuito per - Mercato dei metalli per batterie