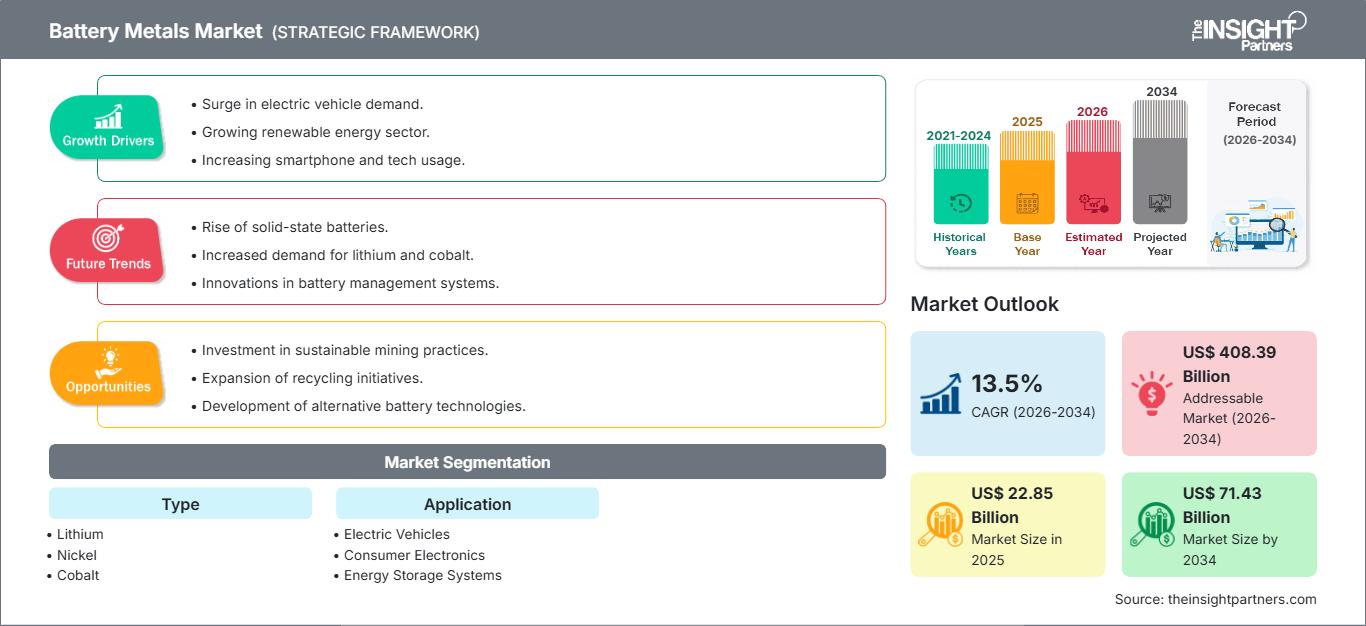

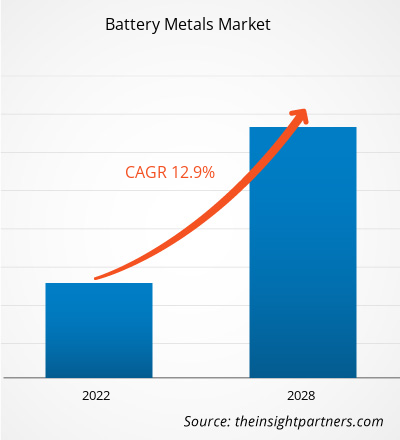

Se proyecta que el tamaño del mercado global de metales para baterías alcance los 71.430 millones de dólares estadounidenses para 2034, desde los 22.850 millones de dólares estadounidenses de 2025. Se prevé que el mercado registre una tasa de crecimiento anual compuesta (TCAC) del 13,5 % durante el período de pronóstico 2026-2034. Las dinámicas clave del mercado incluyen la rápida transición global hacia la descarbonización, la expansión agresiva del ecosistema de vehículos eléctricos (VE) y el importante apoyo de las políticas gubernamentales, como subsidios y créditos fiscales para energías renovables. Además, se espera que el mercado se beneficie de los avances en la química de las baterías, incluyendo la transición hacia baterías de alto contenido de níquel y de estado sólido, y la creciente integración de sistemas de almacenamiento de energía (ESS) a gran escala en las redes eléctricas nacionales para gestionar la intermitencia de las energías renovables.

Análisis del mercado de metales para baterías

El análisis del mercado de metales para baterías destaca un cambio estratégico crucial hacia la resiliencia de la cadena de suministro y la integración vertical. A medida que aumentan las tensiones geopolíticas y el nacionalismo de los recursos, las tendencias de adquisición indican que las principales empresas automotrices y tecnológicas están abandonando las compras en el mercado abierto para centrarse en la inversión directa en operaciones mineras y en acuerdos de compra a largo plazo. Están surgiendo oportunidades estratégicas en el desarrollo de cadenas de suministro circulares, donde el reciclaje de baterías y la minería urbana ofrecen una fuente secundaria de litio, cobalto y níquel para mitigar los déficits de suministro primario. El análisis también indica que los actores del mercado deben centrarse en diversificar su presencia geográfica para reducir la dependencia de regiones específicas, a la vez que invierten en tecnologías de extracción sostenibles como la Extracción Directa de Litio (EDL) para cumplir con los estrictos requisitos ambientales, sociales y de gobernanza (ESG).

Descripción general del mercado de metales para baterías

Los metales para baterías han pasado de ser un sector industrial de nicho a ser el pilar fundamental de la transición energética global. Centrada en elementos clave como el litio, el níquel y el cobalto, esta industria actúa como motor principal para la electrificación del transporte y la estabilización de las redes de energía renovable. Si bien históricamente el mercado estaba impulsado por la electrónica de consumo a pequeña escala, el panorama actual está dominado por la enorme demanda de la industria de los vehículos eléctricos. Este cambio ha provocado una volatilidad sin precedentes en los precios de las materias primas y una fiebre por la exploración global. El mercado se caracteriza por una combinación de gigantes mineros tradicionales y diversificados y empresas dedicadas exclusivamente a metales energéticos, que se desenvuelven en un complejo panorama de químicas de baterías fluctuantes y marcos regulatorios en constante evolución. Por ejemplo, el mercado estadounidense está experimentando una revitalización significativa impulsada por iniciativas federales para establecer una cadena de suministro nacional de mina a batería. El aumento de las inversiones en instalaciones locales de refinación y procesamiento busca reducir la dependencia de las importaciones. Existe un fuerte énfasis en las prácticas mineras sostenibles y el desarrollo de tecnologías de baterías de última generación para apoyar la fabricación nacional de automóviles.

Personalice este informe según sus necesidades

Obtenga PERSONALIZACIÓN GRATUITAMercado de metales para baterías: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de metales para baterías

Factores impulsores del mercado:

- Aumento en la adopción de vehículos eléctricos (VE): El impulso global de los fabricantes de automóviles para eliminar gradualmente los motores de combustión interna es el principal impulsor de la demanda de metales para baterías. Las estrictas regulaciones sobre emisiones y el interés de los consumidores por el transporte sostenible están impulsando un aumento masivo en la producción de baterías de iones de litio de alta capacidad.

- Impulso global a la integración de energías renovables: A medida que los países hacen la transición a la energía solar y eólica, la necesidad de sistemas estacionarios de almacenamiento de energía se ha disparado. Estos sistemas requieren grandes cantidades de metales para baterías para almacenar el exceso de energía, garantizando así la estabilidad de la red y un suministro eléctrico fiable durante los períodos de baja productividad.

- Avances en la química de las baterías: La continua I+D para aumentar la densidad energética y reducir los tiempos de carga impulsa la demanda de metales específicos de alta pureza. La evolución hacia las químicas NCM (níquel-cobalto-manganeso) y LFP (fosfato de hierro y litio) crea un entorno de demanda dinámico para diversos tipos de metales.

Oportunidades de mercado:

- Inversión en reciclaje y recuperación de baterías: ahora que la primera generación de vehículos eléctricos está llegando al final de su ciclo de vida, existe una creciente oportunidad para que las empresas se especialicen en la recuperación de metales de alto valor de las celdas gastadas, reduciendo el impacto ambiental y el costo de obtención de materia prima.

- Exploración de tecnologías de extracción alternativas: Los avances tecnológicos en la extracción directa de litio (DLE) y la lixiviación ácida a alta presión para níquel ofrecen oportunidades para desbloquear depósitos minerales que antes no eran rentables o de menor calidad, ampliando la base de suministro global.

- Asociaciones estratégicas a lo largo de la cadena de valor: la formación de alianzas entre empresas mineras, procesadores químicos y fabricantes de baterías puede agilizar la cadena de suministro, garantizando un flujo constante de materiales y reduciendo los riesgos asociados con la volatilidad de los precios.

Análisis de segmentación del informe de mercado de metales para baterías

La cuota de mercado de los metales para baterías se analiza en varios segmentos para comprender mejor su estructura, potencial de crecimiento y tendencias emergentes. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector:

Por tipo:

- Litio: reconocido como el componente central de la tecnología de baterías modernas, este segmento está impulsado por su papel irremplazable en aplicaciones de alta densidad energética.

- Níquel: cada vez más vital para los vehículos eléctricos de largo alcance, y las composiciones químicas con alto contenido de níquel se están convirtiendo en el estándar de la industria para el rendimiento.

- Cobalto: un estabilizador clave en las baterías, aunque el mercado está experimentando un cambio hacia formulaciones con menor contenido de cobalto debido a preocupaciones sobre el abastecimiento ético y los costos.

- Otros: Incluye metales como el manganeso, el grafito y el aluminio, que son esenciales para los ánodos, los cátodos y los componentes estructurales de las baterías.

Por aplicación:

- Vehículos eléctricos: el segmento principal de consumo, que abarca los automóviles de pasajeros, las flotas comerciales y los vehículos de dos ruedas, determina la trayectoria general del mercado.

- Electrónica de consumo: un segmento maduro que continúa demandando metales de alta pureza para teléfonos inteligentes, computadoras portátiles y tecnología portátil.

- Sistemas de almacenamiento de energía: un área de alto crecimiento centrada en baterías residenciales y de gran escala utilizadas para almacenar energía renovable.

- Otros: Incluye aplicaciones industriales, aeroespaciales y dispositivos médicos especializados que requieren soluciones de energía portátiles.

Por geografía:

- América del norte

- Europa

- Asia Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de metales para baterías

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de metales para baterías durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de metales para baterías en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de metales para baterías

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | US$ 22.85 mil millones |

| Tamaño del mercado en 2034 | US$ 71.43 mil millones |

| CAGR global (2026-2034) | 13,5% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de metales para baterías: comprensión de su impacto en la dinámica empresarial

El mercado de metales para baterías está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de metales para baterías

Análisis de la cuota de mercado de metales para baterías por geografía

Se prevé que Asia-Pacífico experimente el mayor crecimiento en los próximos años. Los mercados emergentes de América del Sur y Central, Oriente Medio y África también ofrecen numerosas oportunidades sin explotar para la expansión de los fabricantes.

El mercado de metales para baterías está experimentando una transformación significativa, pasando de ser un producto industrial tradicional a un activo estratégico global de alto valor. El crecimiento se ve impulsado por la creciente demanda mundial de vehículos eléctricos (VE), el auge de la integración de energías renovables mediante sistemas de almacenamiento y la expansión del sector de la electrónica de consumo de alto rendimiento. A continuación, se presenta un resumen de la cuota de mercado y las tendencias por región:

América del norte

- Cuota de mercado: Un segmento en rápida expansión impulsado por un agresivo apoyo de políticas federales y la localización de la cadena de suministro de baterías.

-

Factores clave:

- Incentivos gubernamentales sustanciales, como la Ley de Reducción de la Inflación (IRA), favorecen el procesamiento nacional de minerales y la fabricación de vehículos eléctricos.

- Rápida expansión de gigafábricas e instalaciones de refinación nacionales para reducir la dependencia de las cadenas de suministro extranjeras

- Creciente preferencia de los consumidores por baterías con alto contenido de níquel para respaldar las capacidades de los vehículos de largo alcance

- Tendencias: Escalamiento de la extracción de litio de salmueras geotérmicas y desarrollo de una economía circular a través del reciclaje avanzado de baterías e iniciativas de minería urbana localizada.

Europa

- Cuota de mercado: posee una participación global significativa, respaldada por estrictos objetivos de descarbonización y un sólido ecosistema de fabricación automotriz.

- Factores clave:

-

Mandatos agresivos para la eliminación progresiva de los motores de combustión interna (ICE) en toda la Unión Europea

- Los marcos regulatorios estrictos, incluido el Pasaporte de Batería, están impulsando altos estándares ESG en el abastecimiento de metales.

- Fuerte apoyo institucional a los proyectos de gigafábricas regionales para garantizar la seguridad energética y la resiliencia industrial

- Tendencias: Un cambio estratégico hacia la priorización de la extracción de minerales sostenible y baja en carbono, con un enfoque creciente en la refinación local de precursores y la producción de níquel de alta pureza.

Asia-Pacífico

- Cuota de mercado: La región global dominante, que actúa como el motor principal del mundo para el procesamiento de metales de baterías y la fabricación de celdas de baterías.

-

Factores clave:

- Producción manufacturera masiva en China, Japón y Corea del Sur, que controlan una gran mayoría del mercado mundial de productos químicos para baterías.

- Políticas gubernamentales favorables y la adopción masiva de vehículos de nueva energía (NEV) en China

- Acceso a diversos recursos minerales regionales y a una cadena de suministro altamente integrada y rentable

- Tendencias: Fuerte inversión en productos químicos de última generación, como iones de sodio y LFP (fosfato de hierro y litio), para atender a segmentos de mercado de gran volumen, junto con una importante I+D en materiales para baterías de estado sólido.

América del Sur y Central

- Cuota de mercado: Un mercado crítico en términos de oferta, particularmente dentro del Triángulo del Litio de Chile, Argentina y Bolivia.

-

Factores clave:

- Posesión de las reservas de litio en salmuera más grandes y competitivas en costos del mundo

- Modernización de tecnologías de extracción, como la Extracción Directa de Litio (DLE), para mejorar los rendimientos y la sostenibilidad

- Enfoque estratégico en ascender en la cadena de valor mediante el desarrollo de refinación localizada y fabricación de precursores

- Tendencias: Transición de un modelo puramente exportador de materias primas hacia un centro de valor agregado, respaldado por asociaciones estratégicas con fabricantes de equipos originales (OEM) automotrices globales que buscan asegurar el acceso directo a los minerales.

Oriente Medio y África

- Cuota de mercado: Mercado en desarrollo con profundas raíces minerales, en transición hacia la producción comercial formalizada y la fabricación regional.

-

Factores clave:

- Papel fundamental en el suministro mundial de cobalto (RDC) y níquel/manganeso (Sudáfrica)

- Inversiones estratégicas en el CCG para construir centros localizados de fabricación de baterías y apoyar la diversificación económica

- Alta demanda de almacenamiento de energía a escala de red para gestionar proyectos de energía solar a gran escala en climas áridos

- Tendencias: Implementación de estándares modernos de ESG y transparencia para formalizar el sector minero, sumado a inversiones en tecnologías de Minería Inteligente para optimizar la recuperación mineral.

Alta densidad de mercado y competencia

La competencia se está intensificando debido a la presencia de líderes establecidos como Albemarle Corporation, Bolt Metals, Ganfeng Lithium Co., Ltd., Umicore, LG Chem, Honjo Metal Co., Ltd., Vale, Lithium Australia NL y BASF SE, que también contribuyen a un panorama de mercado diverso y en rápida expansión.

Este entorno competitivo impulsa a los proveedores a diferenciarse mediante:

- Integración de la cadena de suministro vertical: Posicionarse como socios confiables a largo plazo controlando toda la cadena de valor, desde los activos mineros upstream hasta la refinación química midstream, para garantizar la transparencia y cumplir con los estándares éticos de etiqueta limpia exigidos por los OEM automotrices globales.

- Tecnologías avanzadas de extracción y refinación: Las empresas compiten cada vez más mediante la implementación de la extracción directa de litio (DLE) y la lixiviación ácida a alta presión (HPAL) para el níquel. Estas tecnologías permiten el procesamiento de minerales de menor calidad con un menor impacto ambiental, lo que proporciona una importante ventaja competitiva en un mercado con conciencia ambiental, social y de gobernanza (ESG).

- Modelos de adquisición estratégica y empresas conjuntas: Los principales productores están yendo más allá de las simples ventas al contado para formar alianzas estratégicas sólidas con fabricantes de baterías (p. ej., CATL, LG Chem) y gigantes de la automoción (p. ej., Tesla, GM). Estos acuerdos plurianuales estabilizan los ingresos y reducen el riesgo de las enormes inversiones de capital que requieren los nuevos proyectos mineros.

- Sostenibilidad y marca circular: Diferenciación mediante perfiles de producción bajos en carbono y capacidades integradas de reciclaje. Al ofrecer metales de ciclo cerrado recuperados de baterías al final de su vida útil, los proveedores pueden atraer a clientes europeos y norteamericanos que enfrentan estrictas exigencias en materia de materiales secundarios.

Oportunidades y movimientos estratégicos

- Desarrollar centros nacionales de refinación y procesamiento: asociarse con los gobiernos de América del Norte y Europa para aprovechar subsidios y créditos fiscales significativos (como la Ley de Reducción de la Inflación de los EE. UU.) destinados a localizar la cadena de suministro de la mina a la batería y reducir las dependencias de las importaciones.

- Invertir en química metálica de próxima generación: centrar la I+D en materiales de alta pureza compatibles con las tecnologías de baterías emergentes, como las baterías de litio-azufre, de iones de sodio y de estado sólido, que se prevé que entren en fases iniciales de producción comercial en 2030.

- Expandirse a verticales emergentes de reciclaje y recuperación: establecer instalaciones mineras urbanas dedicadas a recuperar cobalto, níquel y litio de la primera generación de baterías de vehículos eléctricos fuera de servicio, creando un flujo de ingresos secundario y sostenible que mitigue la volatilidad del suministro primario.

Las principales empresas que operan en el mercado de metales para baterías son:

- Corporación Albemarle

- Metales para pernos

- Ganfeng litio Co., Ltd.

- Umicore

- LG Chem

- Compañía Metalúrgica Honjo, Ltd.

- DE ACUERDO

- Litio Australia NL

- BASF SE

Descargo de responsabilidad: Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

Noticias y desarrollos recientes del mercado de metales para baterías

- En agosto de 2025, Glencore Plc. adquirió Li-Cycle. Esta decisión estratégica integró Li-Cycle en las operaciones de Glencore, garantizando que el especialista en metales para baterías siguiera ofreciendo valor y un servicio mejorado a sus clientes globales conjuntos.

- En octubre de 2024, Rio Tinto y Arcadium Lithium plc anunciaron un acuerdo definitivo por el cual Rio Tinto adquirió Arcadium en una transacción íntegramente en efectivo por 5,85 dólares estadounidenses por acción. Esta adquisición, que valoró el capital social diluido de Arcadium en aproximadamente 6.700 millones de dólares estadounidenses, fortaleció significativamente la posición de Rio Tinto en el mercado global de metales para baterías.

Informe de mercado sobre metales para baterías: cobertura y resultados

El informe Tamaño y pronóstico del mercado de metales para baterías (2021-2034) proporciona un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de metales para baterías y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de metales para baterías, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de metales para baterías que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y la competencia que cubre la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes en el mercado de metales para baterías.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de metales para baterías

Obtenga una muestra gratuita para - Mercado de metales para baterías