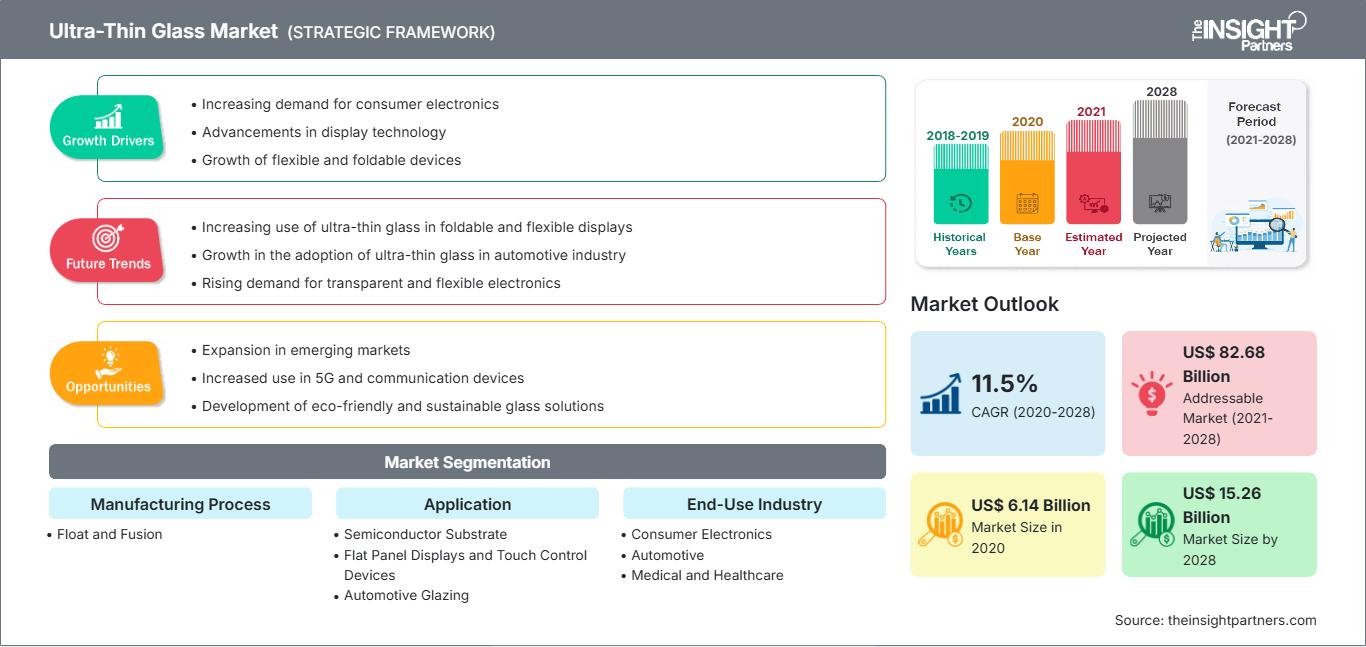

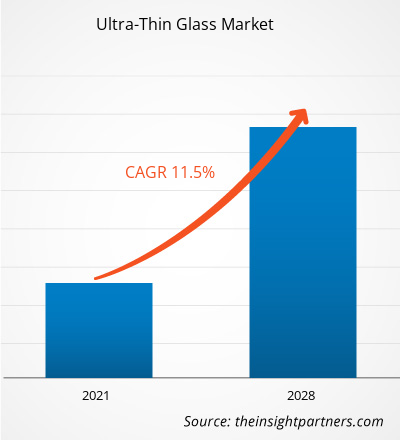

[調査レポート]超薄板ガラス市場は2020年に61億3,956万米ドルと評価され、2028年には152億6,474万米ドルに達すると予測されています。また、2021年から2028年にかけて年平均成長率11.5%で成長すると見込まれています。

超薄板ガラスとは、厚さが1~2mm未満のガラスのことです。

イオン交換による化学強化は、ハイテク用途の超薄板ガラスを強化するために一般的に使用されています。硬化した超薄板ガラスは傷がつきにくく、半径数ミリメートルまで曲げることができます。耐腐食性、透明性、柔軟性、優れたガス・水バリア性、高耐衝撃性などの超薄板ガラスの特性により、フラットパネルディスプレイ、自動車のグレージングなど、さまざまな用途に適しています。 2020年、アジア太平洋地域は世界の超薄板ガラス市場で最大の収益シェアを占めました。中国は超薄板ガラスの最大の消費国であり、アジア太平洋地域の市場シェアの50%以上を占めています。中国はスマートフォンやLCDなど、あらゆる種類の消費者向け電子製品の主要な製造拠点です。現在進行中のCOVID-19パンデミックは、化学品・材料セクターの状況を劇的に変え、超薄板ガラス市場の成長に悪影響を及ぼしました。

新型コロナウイルスの蔓延を防ぐための対策の実施は状況を悪化させ、いくつかのセクターの成長に悪影響を及ぼしました。自動車や家電製品などの業界は、国境や国際的な境界線が突然閉鎖されたことによる業務効率の急激な低下やバリューチェーンの混乱により、悪影響を受けています。いくつかのセクターの成長の低下は、世界市場における超薄板ガラスの需要に悪影響を及ぼしました。しかし、各国経済が事業再生を計画していることから、今後数年間で超薄板ガラスの需要は世界的に増加すると予想されています。パンデミックの影響で、リモートワークやオンライン教育の導入が拡大しており、ノートパソコン、スマートフォン、その他の通信機器などの製品の需要が高まっています。自動車や家電製品など、様々な業界における超薄板ガラスの需要拡大と、大手メーカーによる大規模な投資は、予測期間中の超薄板ガラス市場の成長を牽引すると予想されます。要件に合わせてレポートをカスタマイズ

レポートの一部、国レベルの分析、Excelデータパックなどを含め、スタートアップ&大学向けに特別オファーや割引もご利用いただけます(無償)

超薄板ガラス市場: 戦略的洞察

-

このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

スマートフォン、ノートパソコン、テレビなどの電子機器の利用増加に伴い、コンシューマーエレクトロニクス業界は活況を呈しています。コンシューマーエレクトロニクス製品は、テクノロジーの世界で必需品となっています。あらゆる世代の人々が、スマートフォン、スマートウォッチ、ノートパソコンに何らかの形で依存しています。コンシューマーエレクトロニクス業界の成長に伴い、メーカーは先進的で高品質な製品の提供に継続的に注力しています。超薄板ガラスは、コンシューマーエレクトロニクス業界で重要な役割を果たしています。タッチパネル、ディスプレイパネル、センサー、カメラシステムに使用されています。耐腐食性、透明性、柔軟性、ガスバリア性など、超薄板ガラスは様々な特性を備えているため、コンシューマーエレクトロニクス業界の様々な用途に適しています。中国はコンシューマーエレクトロニクス業界を席巻しており、フラットパネルディスプレイの主要生産国の一つです。中国製のスマートフォン、フィットネストラッカー、テレビ、その他の電子機器の需要は急速に増加しており、超薄板ガラスメーカーにとって大きなビジネスチャンスとなっています。中国は新たなインフラの建設を強化し、人工知能、産業インターネット、モノのインターネットの構築を推進し、5G商用化のペースを加速させ、電子情報製造産業を新たな発展段階に押し上げ、関連産業のハイエンド発展をさらに促進しています。ワールド・ポピュレーション・レビューによると、中国の携帯電話ユーザー数は16億人、インドは12億8千万人です。2018年、アップルはスマートウォッチを約2,250万台出荷しました。この数字は2017年から増加しており、同社は2017年に1,770万台を販売しました。2018年、フィットビットは約550万台のスマートウォッチを出荷し、サムスンは約530万台を出荷しました。このように、急速に成長する民生用電子機器業界は、超薄型ガラスの需要を押し上げています。

エンドユース業界の洞察

2020年、民生用電子機器セグメントは世界の超薄型ガラス市場で最大のシェアを占めました。超薄型ガラスは、LCD、OLED、スマートフォン、ウェアラブルデバイスなど、さまざまなデバイス用のフラットパネルディスプレイやタッチパネルディスプレイなどの電子製品の製造に広く使用されています。革新的で技術的に高度な電子製品に対する需要が世界中で高まる中、超薄型ガラスの需要は今後数年間で急増すると予想されています。

製造プロセスの洞察

製造プロセス別では、2020年の超薄型ガラス市場の収益において、フュージョンセグメントが圧倒的なシェアを占めました。オーバーフローダウンドロー法として知られるフュージョンプロセスは、ディスプレイパネル用の平らな超薄型ガラスの製造に広く使用されています。コーニング社は、フュージョン法の重要な特徴である、空中に浮遊する特殊ガラスを初めて開発した企業です。ガラスは溶融金属と接触しないため、フロートガラス法に対するフュージョン法の基本的な利点です。

超薄板ガラス市場で活動している主な市場プレーヤーには、コーニング社、AGC株式会社、日本電気硝子株式会社、ショット社、セントラル硝子株式会社、CSGホールディングス株式会社、エマージガラス、日本板硝子株式会社、信義硝子ホールディングス株式会社、洛陽硝子株式会社などがあります。市場の主要プレーヤーは、合併や買収、新製品の発売などの戦略を採用して、地理的プレゼンスと顧客ベースを拡大しています。

超薄板ガラス市場

The Insight Partnersのアナリストは、予測期間全体を通して超薄板ガラス市場に影響を与える地域的な傾向と要因を詳細に解説しています。このセクションでは、北米、ヨーロッパ、アジア太平洋、中東・アフリカ、中南米における超薄板ガラス市場のセグメントと地域についても解説しています。

超薄板ガラス市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| の市場規模 2020 | US$ 6.14 Billion |

| 市場規模別 2028 | US$ 15.26 Billion |

| 世界的なCAGR (2020 - 2028) | 11.5% |

| 過去データ | 2018-2019 |

| 予測期間 | 2021-2028 |

| 対象セグメント |

By 製造プロセス

|

| 対象地域と国 |

北米

|

| 市場リーダーと主要企業の概要 |

|

超薄板ガラス市場のプレーヤーの密度:ビジネスダイナミクスへの影響を理解する

超薄板ガラス市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認知度の高まりといった要因により、エンドユーザーの需要が高まり、急速に成長しています。需要の増加に伴い、企業は製品ラインナップの拡充、消費者ニーズへの対応、新たなトレンドの活用を進めており、これが市場の成長をさらに加速させています。

- 入手 超薄板ガラス市場 主要プレーヤーの概要

- 超薄板ガラス業界の進歩的な動向。企業が効果的な長期戦略を策定するのに役立ちます

- 先進国市場と発展途上国市場での成長を確保するために企業が採用しているビジネス成長戦略

- 2019年から2028年までの世界の超薄板ガラス市場の定量分析

- さまざまな業界における超薄板ガラスの需要の推定

- 市場で事業を展開しているバイヤーとサプライヤーの有効性を示すポーター分析。市場の成長を予測するために

- 競争の激しい市場シナリオと超薄板ガラスの需要を理解するための最近の動向

- 超薄板ガラス市場の成長を促進および抑制する要因と相まって、市場の動向と見通し

- 世界の超薄板ガラス市場の成長に関する商業的関心を支える戦略に関する理解。意思決定プロセスに役立ちます

- さまざまなノードにおける超薄板ガラス市場の規模市場

- 世界の超薄板ガラス市場の詳細な概要とセグメンテーション、および業界の動向

- 有望な成長機会のある様々な地域における超薄板ガラス市場の規模

製造プロセス別超薄板ガラス市場

- フロート

- フュージョン

用途別超薄板ガラス市場

- 半導体基板

- フラットパネルディスプレイおよびタッチコントロールデバイス

- 自動車用グレージング

- その他

最終用途産業別超薄板ガラス市場

- 民生用電子機器

- 自動車

- 医療およびヘルスケア

- その他

企業プロファイル

- コーニング社

- AGC Inc.

- 日本電気硝子株式会社

- SCHOTT AG

- セントラル硝子株式会社

- CSGホールディング株式会社

- エマージグラス

- 日本板硝子株式会社

- 信義硝子控股有限公司

- 洛陽硝子有限公司

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

最新レポート

関連レポート

お客様の声

購入理由

- 情報に基づいた意思決定

- 市場動向の理解

- 競合分析

- 顧客インサイト

- 市場予測

- リスク軽減

- 戦略計画

- 投資の正当性

- 新興市場の特定

- マーケティング戦略の強化

- 業務効率の向上

- 規制動向への対応

無料サンプルを入手 - 超薄板ガラス市場

無料サンプルを入手 - 超薄板ガラス市場