Bitumen Additives Market Key Companies and SWOT Analysis by 2030

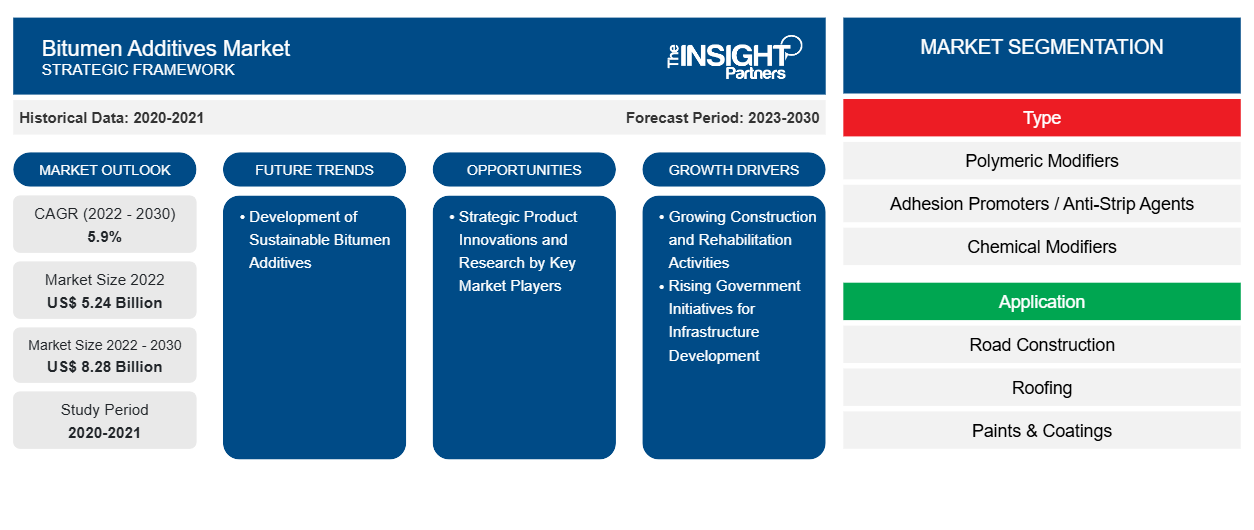

Bitumen Additives Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Polymeric Modifiers, Adhesion Promoters / Anti-Strip Agents, Chemical Modifiers, Antioxidants, Fibers, Fillers, Emulsifiers, and Others) and Application (Road Construction, Roofing, Paints & Coatings, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Dec 2023

- Report Code : TIPRE00014345

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 191

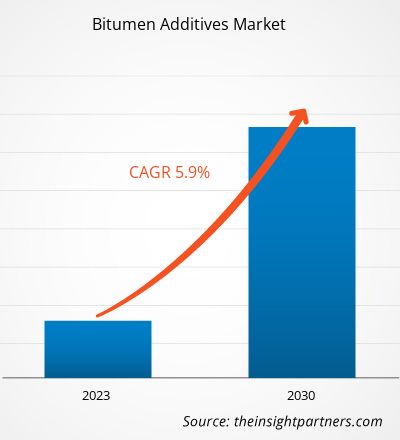

[Research Report] The bitumen additives market size is expected to grow from US$ 5,237.07 million in 2022 to US$ 8,275.37 million by 2030; it is estimated to register a CAGR of 5.9% from 2022 to 2030.

Market Insights and Analyst View:

Bitumen additives are substances that are added to the bitumen binder to alter the characteristics of final mixture, to make them resistant to the detrimental effects of the load from traffic and the environment. Additives used for bitumen are polymeric modifiers, anti-strip agents, adhesion promoters, emulsifiers, surfactants, rejuvenators, fibers, organic materials, and rubber modifiers. The additives mainly affect thermos viscous and viscoelastic properties of original binder. The polymer can form a three-dimensional network structure within the modified bitumen. Polymer modification improves the temperature susceptibility of bitumen and its resistance to permanent deformation, thermal and fatigue cracking. Technologies used for mixing additives with asphalt include hot mix, cold mix, and warm mix.

Growth Drivers and Challenges:

The major factor driving the bitumen additives market growth is growing construction and rehabilitation activities in various countries across the world. According to the US Census Bureau, the total construction spending in the US accounted for US$ 740.8 billion during the first five months of 2023. The investment was spent on the development of offices, commercial spaces, transportation, highways, and streets. The spending on private and public construction was US$ 585.7 billion and US$ 133.8 billion, respectively, during the first five months of 2023. In 2022, Webuild, in partnership with IHI Infrastructure Systems Co, built one of the longest suspension bridges, Braila Bridge, measuring 2,277 km, in Romania. In 2022, China began the construction of second bridge across the Pangong Lake. The bridge can accommodate heavy armored vehicles. Further, the requirement for repair and rehabilitation of aging infrastructure creates a constant demand for bitumen additives. Bitumen additives enhance the performance of asphalt pavements and extend the service life of roads. However, fluctuation in raw material prices is hampering the bitumen additives market growth. Polymer additives and other chemical additives are derived from various sources, including petrochemical feedstocks or renewable resources. Other bitumen additives such as emulsifiers, rejuvenators, and anti-strip agents are indirectly derived from crude oil. Disruption in transportation and supply chain, rise in demand for crude oil, inflation in raw material prices, and limited supply of raw materials caused due to the COVID-19 pandemic raised petroleum product prices. The rising crude oil prices due to fluctuating global economic conditions are increasing the resin prices. The rise in raw material prices leads to strain on product profitability and margins. Thus, fluctuations in the prices of raw materials restrain the bitumen additives market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBitumen Additives Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Bitumen Additives Market” is segmented on the basis of type, application, and geography. Based on type, the bitumen additives market is segmented into polymeric modifiers, adhesion promoters / anti-strip agents, chemical modifiers, antioxidants, fibers, fillers, emulsifiers, and others. The bitumen additives market, based on application, is segmented into road construction, roofing, paints & coatings, and others. The bitumen additives market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on type, the bitumen additives market is segmented into polymeric modifiers, adhesion promoters / anti-strip agents, chemical modifiers, antioxidants, fibers, fillers, emulsifiers, and others. The polymeric modifiers segment held the significant bitumen additives market share in 2022, and the market for the segment is expected to grow significantly from 2022 to 2030. Polymers help to improve the mechanical properties and performance of the asphalt and significantly reduce surface deformations under high temperatures. This results in increasing the road surface life.Polymer-modified binders are used to enhance the performance of binders on heavily trafficked or distressed pavement surfaces, often in adverse climatic conditions. Polymer-modified bitumen is made by the mechanical mixing or chemical reactions of bitumen and polymer in a certain percentage. Polymers include various modifiers with elastomers, and plastomers are the most commonly used types. Corresponding elastomers are styrene butadiene styrene (SBS), styrene isoprene styrene (SIS), and styrene-ethylene/butylene-styrene (SEBS).

Regional Analysis:

Based on geography, the bitumen additives market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global bitumen additives market, and the regional market accounted for approx. US$ 1,798 million in 2022. Europe is a second major contributor holding more than 26% global bitumen additives market share. North America is expected to register a considerable CAGR of around 5.3% from 2022 to 2030. The construction sector in North America is witnessing growth due to a robust economy and increased federal and state financing for commercial and institutional structures in the region. According to a report published by the US Census Bureau in 2022, the spending on residential construction in the US increased from US$ 815.48 billion in 2021 to US$ 929.67 billion in 2022. In the construction industry, bitumen additives are utilized in various building & construction applications such as waterproofing, roofing, and road & pavement construction. The demand for bitumen additives is increasing due to growing construction activities and rising government support for new infrastructure rehabilitation projects in the region.

Industry Developments and Future Opportunities:

The following are initiatives taken by the key players operating in the bitumen additives market:

- In August 2022, Kao Corporation developed the first-ever asphalt additive made from recycled plastic bottles. It features NEWTLAC 5000, a new additive with exceptionally high durability, oil resistance, and environmental features. NEWTLAC 5000 is made by chemical recycling of waste PET (polyethylene terephthalate) plastics. NEWTLAC 5000 pavement is less susceptible to damage from heavy vehicles and is highly resistant to oil and other liquids.

- In April 2019, Nouryon expanded its offering for the asphalt market with Wetfix G400, a versatile non-amine adhesion promoter derived from renewable resources. Wetfix G400 meets customers’ needs for a sustainable alternative that maintains asphalt mixture performance and durability.

- In June 2020, BASF SE launched a bitumen additive designed to make roads more durable. BASF SE has spent several years developing the additive together with the Institute of Highway Engineering in Aachen, and the product is available under the name B2Last.

Bitumen Additives

Bitumen Additives Market Regional InsightsThe regional trends and factors influencing the Bitumen Additives Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Bitumen Additives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Bitumen Additives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5.24 Billion |

| Market Size by 2030 | US$ 8.28 Billion |

| Global CAGR (2022 - 2030) | 5.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Bitumen Additives Market Players Density: Understanding Its Impact on Business Dynamics

The Bitumen Additives Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

COVID-19 Pandemic Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units of bitumen additives companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Most of the construction projects were closed during the pandemic, negatively impacting the bitumen additives market growth.

Various industries are coming on track after supply constraints affecting these industries are resolving gradually. Moreover, the rising demand for bitumen additives from the industrial and residential construction sectors substantially promotes the bitumen additives market growth

Competitive Landscape and Key Companies:

A few players operating in the global bitumen additives market are KRATON CORPORATION, BASF SE, Ingevity, Nouryon, Arkema, Kao Chemicals Europe, Dow, Honeywell International Inc, Huntsman International LLC, and Sasol Limited. Players operating in the bitumen additives market focus on providing high-quality products to fulfill customer demand.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For