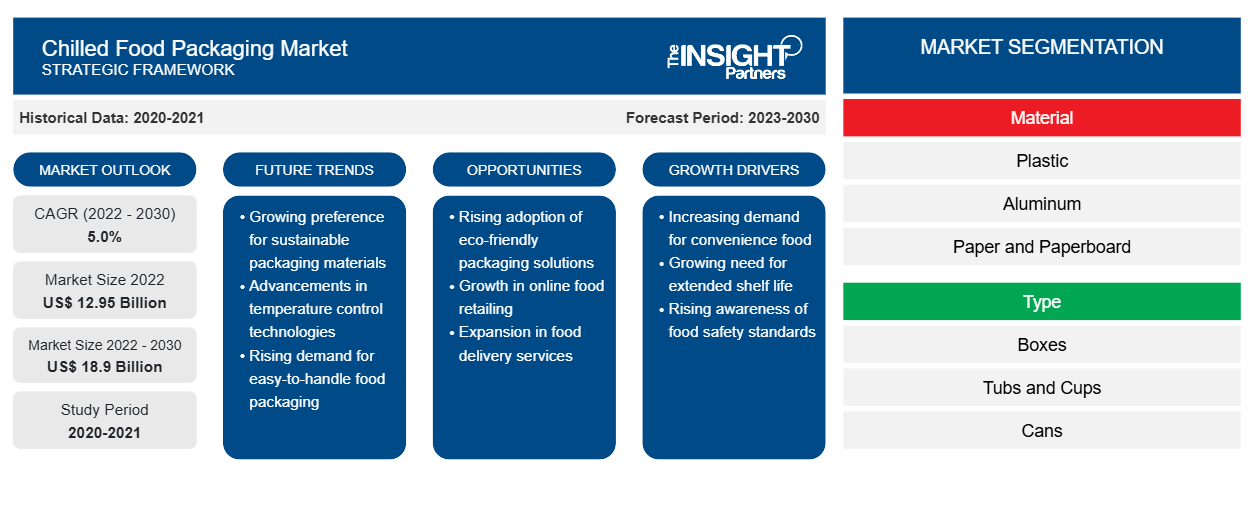

Chilled Food Packaging Market Size, Share, and Analysis by 2030

Chilled Food Packaging Market Forecast to 2030 - Industry Analysis by Material (Plastic, Aluminum, Paper and Paperboard, and Others), Type (Boxes, Tubs and Cups, Cans, Pouches and Bags, and Others), and Application (Dairy Products, Meat and Poultry, Seafood, Fruits and Vegetables, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Jul 2023

- Report Code : TIPRE00029948

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 177

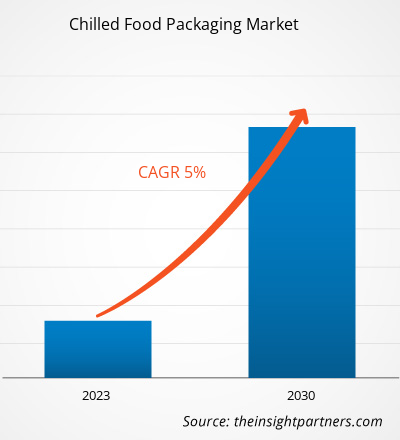

[Research Report] The chilled food packaging market size is expected to grow from US$ 12,948.11 million in 2022 to US$ 18,902.73 million by 2030; it is estimated to register a CAGR of 5.0% from 2023 to 2030.

MARKET ANALYSIS

The global chilled food packaging market refers to the packaging of perishable food items that require refrigeration to maintain their quality and freshness. The market includes a range of packaging materials, such as plastic, paper and paperboard, aluminum, and wood, designed to keep the food products at a low temperature during transportation and storage. The market is driven by the growing demand for convenience foods, increasing urbanization, and changing lifestyles. The rising awareness of food safety and hygiene is also driving the demand for chilled food packaging. Additionally, the growth of e-commerce and online grocery shopping is expected to fuel the demand for chilled food packaging during the forecast period.

GROWTH DRIVERS AND CHALLENGES

Expansion of organized retail and e-commerce is boosting the global chilled food packaging market growth significantly. Organized retail and e-commerce platforms provide a broader reach and greater visibility for chilled food products. Consumers increasingly prefer organized retail formats due to the convenience and wide range of products they offer. Organized retail, such as supermarkets, hypermarkets, and specialty stores, offers a wide range of produce, dairy products, meat, seafood, ready-to-eat (RTE) meals, and more. The convenience of having multiple products under one roof attracts consumers and encourages them to choose organized retail over traditional retail formats. The diverse product assortment requires appropriate packaging to ensure product integrity, hygiene, and presentation on store shelves. Moreover, increase in demand for convenience or ready-to-eat food is further boosting the global chilled food packaging market growth. The consumption of high-quality convenience food is increasing, which is currently one of the biggest trends in the food industry. Convenience foods, such as RTE products, allow consumers to save time and effort associated with shopping for ingredients, meal preparation and cooking, consumption, and post-meal activities. The development of this food segment is ascribed to many social changes; the most notable of these include the growing number of smaller households and the rising millennial population worldwide. However, the stringent government regulations associated with chilled food packaging, might limit chilled food packaging market growth. Stringent government regulations can impose certain restrictions on chilled food packaging. While these regulations are implemented to ensure consumer safety and environmental sustainability, they can present challenges and limitations for packaging manufacturers and suppliers. Complying with stringent norms often requires significant investments in research, testing, certification, and ongoing compliance monitoring.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONChilled Food Packaging Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Chilled Food Packaging Market Analysis to 2030" is a specialized and in-depth study with a major focus on the global chilled food packaging market trends and growth opportunities. The report aims to provide an overview of the global chilled food packaging market with detailed market segmentation by material, type, application, and geography. The global chilled food packaging market has been witnessing high growth over the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of chilled food packaging worldwide along with their demand in major regions and countries. In addition, the report provides the qualitative assessment of various factors affecting the chilled food packaging market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the chilled food packaging market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative chilled food packaging market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global chilled food packaging market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global chilled food packaging market is segmented on the basis of material, type, and application. Based on material, the chilled food packaging market is segmented into plastic, aluminum, paper and paperboard, and others. Based on type, the chilled food packaging market is segmented into boxes, tubs and cups, cans, pouches and bags, and others. Based on application, the chilled food packaging market is segmented into dairy products, meat and poultry, seafood, fruits and vegetables, and others. Based on material, plastic segment accounted for the largest share of the global chilled food packaging market. Plastic is the most preferred material for packaging refrigerated products. Plastic packaging is a flexible form of packaging, allowing food service providers to customize its shape, style, and size as per customers’ requirements. Plastic packaging is preferred in the food service industry since it is lightweight. Furthermore, plastic packaging products used in food packaging are easy to transport. Owing to their durability and resistance to external influences, they help preserve chilled packaged food products. Chilled desserts, ready meals, dairy products, meats, seafood, pasta dishes, poultry, fruits, and vegetables are often packaged in plastic or plastic-based materials. Based on type, the pouches and bags segment held the largest chilled food packaging market share in 2022. Bags and pouches are manufactured from materials such as foils and food-grade plastics. They are utilized mostly for packaging frozen vegetables, meats, seafood, and other foods. They are preferred because of their lightweight and compactness. Based on application, the dairy products segment accounted for a significant share in the global chilled food packaging market. The majority of dairy products are perishable. Numerous types of packaging concepts are needed to pack different types of dairy products. The demand for different dairy products has resulted in improvements in processes and packaging concepts, which significantly raises the shelf life of dairy products in cold chain distribution. Chilled food is packaged to keep the food products fresh and for protection against external factors, such as temperature changes, moisture, and vapor. This will further attract new growth opportunities for the overall industry growth.

REGIONAL ANALYSIS

The report provides a detailed overview of the global chilled food packaging market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. The Middle East & Africa accounted for a significant share of the market; the market in the Middle East & Africa was valued at over US$ 700 million in 2022 and is expected to witness considerable growth over the forecast period. Rapid increase in e-commerce positively contributed to the market growth in Middle East & Africa. Asia Pacific also witnessed considerable growth; the market is expected to reach over US$ 5 billion in 2030, attributed to increasing demand from e-commerce and organized retail for chilled food packaging. The North America chilled food packaging market is expected to grow at a CAGR of over 5%; the increased preference of ready-to-eat food is expected to further boost the chilled food packaging market growth in North America.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnership, acquisitions, and new product launches were found to be the major strategies adopted by the players operating in the global chilled food packaging market.

In May 2023, Graphic Packaging partnered with Cranswick Plc to commercialize a recyclable PaperLite pack for Tesco Plc.

In April 2020, Elopak and GLS announced a joint venture in which the two companies will each have 50% ownership. The newly formed company, GLS Elopak, will leverage the expertise, assets, and networks of Elopak and GLS to capitalize on the significant consumer demand in India.

Chilled Food Packaging

Chilled Food Packaging Market Regional InsightsThe regional trends influencing the Chilled Food Packaging Market have been analyzed across key geographies.

Chilled Food Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 12.95 Billion |

| Market Size by 2030 | US$ 18.9 Billion |

| Global CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Chilled Food Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Chilled Food Packaging Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

IMPACT OF COVID/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

The COVID-19 pandemic led to a decline in the progress of many industries across the world. Shutdown of manufacturing plants and restricted trade across the globe led to supply chain constraints for the manufacturers worldwide. The COVID-19 pandemic adversely affected the growth of the chemicals & materials sector and the chilled food packaging market. The implementation of measures to combat the spread of SARS-CoV-2 hindered the growth of different industries. The pandemic caused disruptions in the global supply chain due to factory shutdowns, transportation restrictions, and labor shortages. These upheavals affected the availability of raw materials and packaging components, leading to potential supply chain delays and increased operating costs for chilled food packaging manufacturers. The scarcity of raw materials and higher transportation expenses contributed to rising production costs. In addition, the food service sector, including restaurants, cafes, and catering services, experienced a sharp decline in demand because of lockdowns and social distancing measures. This decline directly impacted the demand for chilled food products and their associated packaging in food service operations. As a result, manufacturers of packaging materials operating in the food service sector faced reduced orders and revenue loss. Nevertheless, the chilled food packaging market has recovered quite well from the aftermath of the pandemic and is expected to grow over the coming years.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Some of the key players operating in the chilled food packaging market are Mondi Plc; Amcor Plc; Sealstrip Corp; Sonoco Products Co; Amerplast Ltd; Berry Global Group Inc; Westrock Co; Graphic Packaging Holding Co; Tetra Pak International SA; and Sealed Air Corp.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For