Embedded Systems Market Growth and Forecast by 2030

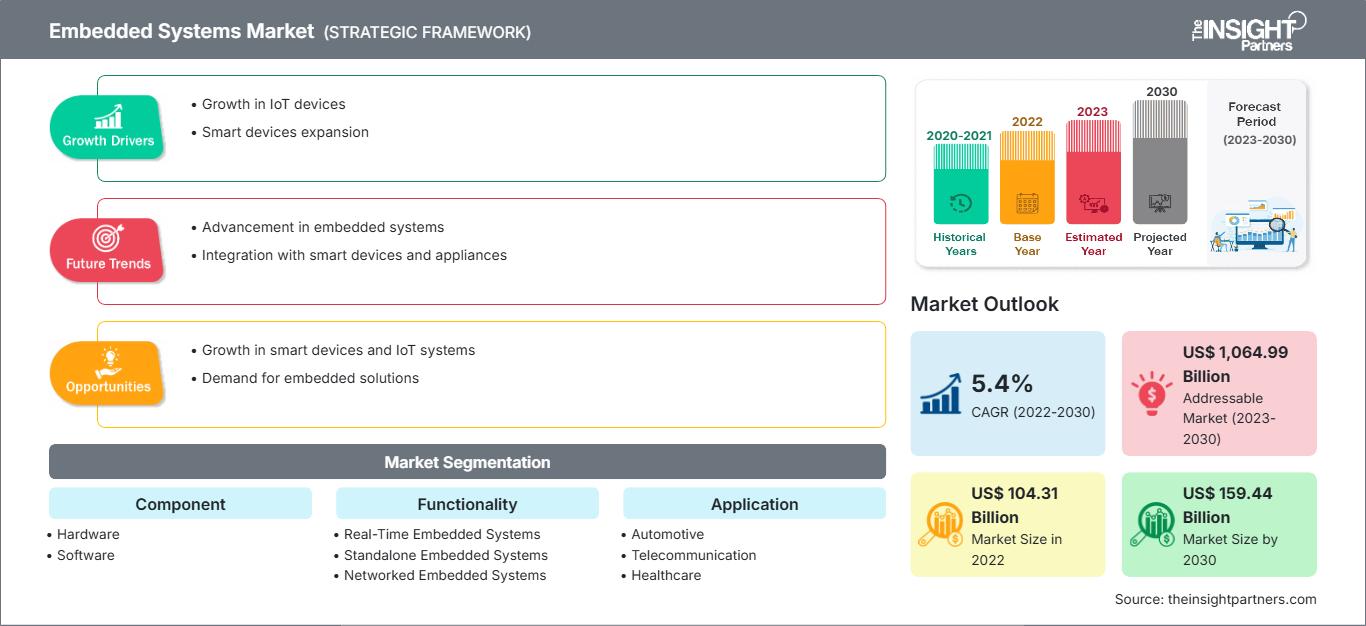

Embedded Systems Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Sensor, Microcontroller, Processors and ASICS, Memory, and Others) and Software], Functionality (Real-Time Embedded Systems, Standalone Embedded Systems, Networked Embedded Systems, and Mobile Embedded Systems), and Application (Automotive, Telecommunication, Healthcare, Industrial, Consumer Electronics, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPTE100000905

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 227

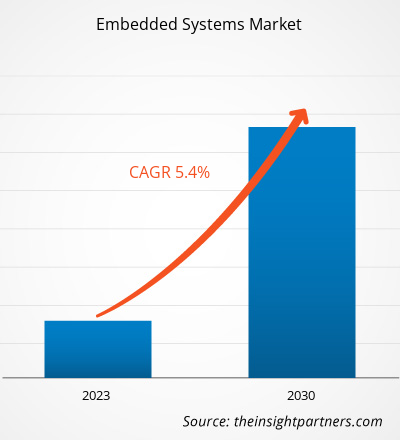

[Research Report] The embedded systems market was valued at US$ 104.31 billion in 2022, and it is expected to reach US$ 159.44 billion by 2030. The embedded systems market is estimated to register a CAGR of 5.4% from 2022 to 2030.

Embedded Systems Market Analyst Perspective:

Rising need for automation, connected devices, microprocessor advancements, IoT usage, smart homes and buildings, and medical devices is boosting the embedded systems market. Furthermore, the proliferation of new technologies and innovations and the rise in demand for electric and hybrid vehicles are driving the embedded systems market. The adoption of the Internet of Things (IoT) fuels the demand for embedded systems that gather and send data from linked devices to cloud-based applications. This information can then be analyzed and used to make decisions. Advances in microprocessor technology, such as miniaturization, low power consumption, and high processing power, have propelled the growth of the global embedded systems market in the last few decades.

Embedded Systems Market Overview:

Computer systems integrated into other devices or systems to manage or monitor their operations are known as embedded systems. These systems are intended to execute certain tasks and are utilized in a variety of applications, such as automotive, healthcare, industrial automation, and consumer electronics. They are often built to be extremely dependable and efficient, with low power consumption and tiny form factors. They can be programmed to control machinery, monitor sensors, gather and communicate data, and manage electricity and resources, among other things, which is expected to propel the embedded systems market growth during the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEmbedded Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rise in Demand in Automotive Industry is Fueling the Growth of Embedded Systems Market

The impact of modern technology has shaped the industry. The advent of digital technology across the world made it possible to implement advanced solutions in automobiles. Today, cars are equipped with a range of sophisticated technologies for making driving safer, comfortable, and enjoyable for users. Embedded systems are highly used in both regular and hybrid automotive vehicles. These systems are playing a significant role in redesigning the automotive industry. The systems are used in ADAS technology incorporated in electric and hybrid vehicles. The growing demand for electric and hybrid vehicles is driving the market. For instance, according to the International Energy Agency (IEA), electric vehicle sales increased by 10 million in 2022. A total of 14% of all new cars sold across the globe were electric. The increasing sales of electric cars globally raises the adoption of embedded systems among automotive manufacturers. These systems are used to monitor and control various features of an electric vehicle, including charging systems and battery management systems.

The embedded hardware is integrated into vehicle systems to reduce overheating and the release of gases. These systems are used even in luxury automobiles to make them more network-savvy, energy-efficient, and safe to drive. The expansion of the automotive industry is fueling the embedded system market growth. The key players in the embedded systems market are partnering to develop high-performance embedded systems used in autonomous vehicles. For instance, in May 2022, Magna International Inc. partnered with BlackBerry Limited to develop next-generation ADAS solutions for automotive original equipment manufacturers (OEMs). Magna International Inc. is leveraging BlackBerry Limited's various QNX software platforms, such as QNX Software Development Platform, QNX Platform for ADAS, and QNX OS for Safety in design engineering, validation and performance optimization roles, and systems integration. The partnership helps Magna International to develop high-performance and secure embedded systems for ADAS, autonomous driving, and infotainment systems, driving the embedded systems market.

Report Segmentation and Scope:

The embedded systems market is segmented on the basis of component, functionality, and application. Based on components, the embedded system market is segmented into hardware and software. The hardware segment is further sub-segmented into sensor, microcontroller, processors & ASICS, memory, and others. The functionality segment is further divided into real-time embedded systems, standalone embedded systems, networked embedded systems, and mobile embedded systems. Based on application, the embedded systems market is bifurcated into automotive, telecommunication, healthcare, industrial, consumer electronics, and others. The embedded systems market, based on geography, is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Segmental Analysis:

Based on component, the embedded systems market is categorized into hardware and software. The hardware segment is sub-segmented into sensor, microcontroller, processors & ASICs, memory, and others. The hardware segment held the largest embedded systems market share in 2022 and is anticipated to register the highest CAGR in the market during 2022–2030. Sensors enable embedded systems to observe changes in their surroundings and collect valuable real-time data. An embedded system receives relevant data from sensors, processes it, makes a decision based on the data from the sensors, and acts on the decision. In IoT, robotics, and AI systems, embedded systems and sensors operate simultaneously to perform intelligence tasks. Additionally, sensors can be categorized according to their function, output, and measurement. Temperature, pressure, humidity, light, motion, sound, and gas sensors are examples of typical sensor types. Specifications for each sensor type explain its performance and features, such as range, resolution, sensitivity, accuracy, precision, response time, and noise. This versatile nature of the sensors can be a parameter to boost the embedded systems market growth.

Regional Analysis:

The embedded systems market is broadly segmented into five major regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America. North America held the largest embedded systems market share in 2022, followed by APAC and Europe. This region contributes a significant share of the global embedded systems market owing to greater investment in automation and software coupled with the growing number of investments in IoT technology. The increasing adoption of IoT solutions among consumers is driving the embedded systems market in North America. IoT technology is highly deployed in electric vehicles (EVs). Manufacturers are engaging in investing to increase their EV supply in order to meet growing consumer demand.

For instance, according to the International Energy Agency (IEA), in April 2023, EV manufacturers announced investments totaling ~US$ 52 billion in EV supply chains in North America. Embedded systems are highly used in electric vehicles to empower constant communication, information processing, control, and criticism components that enhance the user's experience. The increasing adoption of electric vehicles among consumers is fueling the embedded systems market. Embedded system encourages energy management system in EVs. The system controls power circulation and energy usage by ensuring proficient utilization of stored energy.

Market players operating in the region are also raising awareness about the benefits embedded system provides in cybersecurity practices. For instance, in September 2023, Digi International Inc. announced its participation in upcoming events at Arrow University in October 2023. These events are premeditated to educate OEMs as well as software developers about the designing of embedded systems and software and their benefits in cybersecurity practices. The growing number of cyber-attacks has increased the adoption of embedded systems. Cybersecurity specialists work with user's systems design teams to ensure that the embedded system has the necessary security mechanisms to mitigate the damage from these attacks. The system ensures security by requiring regular firmware updates. Embedded system is highly utilized for intrusion detection and prevention in network security. They monitor network traffic and automate actions to migrate threats. However, integrating embedded systems in cybersecurity practices protects the user's system from all types of malicious behavior.

Key Player Analysis:

Infineon Technologies AG, Intel Corp, NXP Semiconductors NV, Qualcomm Inc, Renesas Electronics Corp, STMicroelectronics NV, Texas Instruments Inc, Microchip Technology Inc, Advantech Co Ltd, and Marvell Technology Inc are the top embedded systems market players as they offer diversified product portfolios.

Embedded System

Embedded Systems Market Regional InsightsThe regional trends and factors influencing the Embedded Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Embedded Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Embedded Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 104.31 Billion |

| Market Size by 2030 | US$ 159.44 Billion |

| Global CAGR (2022 - 2030) | 5.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Embedded Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Embedded Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Embedded Systems Market top key players overview

Recent Developments:

Inorganic and organic strategies are highly adopted by the embedded systems market players. A few recent key market developments are listed below:

- In July 2023, Microchip Technology Inc. launched a new research and development (R&D) facility in Hyderabad and announced a US$ 300 million investment over the next five years to grow its activities in India.

- In May 2023, Renesas unveiled three new MCU groups designed for applications involving motor control. Devices from the RX and RA families are among the more than 35 new products that Renesas launched. With several MCU and MPU families, analog and power solutions, sensors, communications equipment, signal conditioners, and other devices, the new MCUs expanded the leading motor control range in the market.

- In September 2022, Marvell introduced its LiquidSecurity 2 (LS2) hardware security module (HSM) adapter, which is intended for general use and payment processing. LS2 is based on the company's technologies and is used in top-tier hyperscale clouds. The new Marvell HSM adapter provides high-performance cryptographic acceleration and processing, as well as hardware-secured storage of up to one million AES, RSA, and ECC encryption keys and 45 partitions for multi-tenant use cases.

- In September 2022, Intel launched the 12th Generation Intel Core processor family, which includes the all-new 12th Generation Intel Core H-series mobile CPUs, led by the Intel Core i9-12900HK, the fastest mobile processor ever developed. The 12th Generation Intel Core family would feature 60 processors and over 500 designs.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For