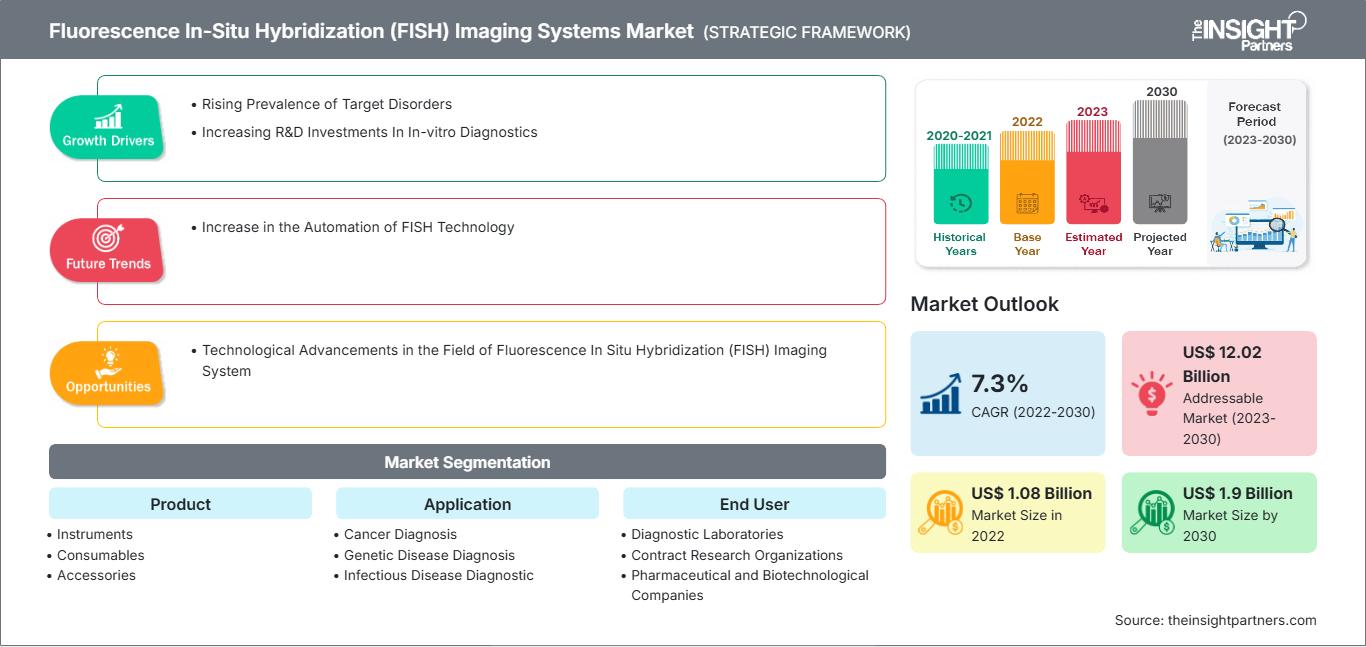

Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market Growth and Forecast by 2030

Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product (Instruments, Consumables, Accessories, and Software), Application (Cancer Diagnosis, Genetic Disease Diagnosis, Infectious Disease Diagnostic, and Others), End User (Diagnostic Laboratories, Contract Research Organizations, Pharmaceutical and Biotechnological Companies, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPHE100001252

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 212

[Research Report] The fluorescence in-situ hybridization (FISH) imaging systems market is expected to grow from US$ 1,084.0 million in 2022 and is expected to reach a value of US$ 1,901.4 million by 2030; it is anticipated to record a CAGR of 7.3% from 2022 to 2030.

Market Insights and Analyst View:

Fluorescence in situ hybridization (FISH) is a molecular technique for cytogenetic analysis. This technique uses fluorescent probes that bind to only particular parts of a nucleic acid sequence with a high degree of sequence complementarity. FISH detects the presence or absence of specific DNA sequences on chromosomes. FISH is often used to find specific features in DNA/RNA targets for medicine, genetic counseling, and species identification. Key factors driving the fluorescence in-situ hybridization (FISH) imaging systems market growth include the rising prevalence of target disorders and increasing R&D investments in in-vitro diagnostics. However, the high cost of FISH imaging systems and procedures hinders the market growth.

Growth Drivers and Restraints:

FISH is a powerful molecular cytogenetic technique that allows the visualization and localization of specific DNA sequences within cells or tissues. This technology has revolutionized the field of genetics and diagnostics, providing researchers and clinicians with valuable insights into genetic abnormalities, chromosomal rearrangements, and various diseases. The increasing prevalence of target disorders such as genetic syndromes, cancer, and other genetic anomalies drives the demand for FISH imaging systems. According to the National Library of Medicine, the US is expected to record 1.96 new cancer cases and 609,820 cancer deaths in 2023. The demand for accurate and reliable diagnostic tools surges with the continued rise in the prevalence of these target disorders. FISH imaging systems provide high-resolution images to aid the detection of subtle genetic changes, enabling early disease diagnosis and personalized treatment approaches. These disorders often involve genetic mutations or variations that can be accurately identified and characterized using FISH imaging systems. The ability to precisely map the location of specific genes or DNA sequences within cells has proven crucial for understanding disease mechanisms, developing targeted therapies, and making informed clinical decisions.

A prominent advantage of FISH lies in its ability to work with various sample types, including formalin-fixed paraffin-embedded tissues, cytological preparations, and fresh tissues. This versatility has made FISH an essential tool in both research and clinical settings, allowing the identification of genetic markers associated with diseases such as leukemia, lymphoma, solid tumors, and congenital disorders.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFluorescence In-Situ Hybridization (FISH) Imaging Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The fluorescence in situ hybridization (FISH) imaging systems market is further driven by continued investments in research and development (R&D) activities related to in-vitro diagnostics (IVD). With its unique capability to visualize specific DNA sequences within cellular environments, the FISH technique has emerged as a key procedure in modern diagnostics, particularly in detecting genetic disorders and rare diseases. An upsurge in R&D funding in IVD has catalyzed transformative advancements in FISH imaging systems by allowing researchers to create cutting-edge platforms providing enhanced image quality with features supporting streamlined automation, culminating in more accurate and rapid diagnostic processes. PNA FISH, a novel diagnostic method that uses FISH with peptide nucleic acid (PNA) probes, combines the ease of traditional staining procedures with the exceptional performance of PNA probes to provide rapid and accurate diagnoses of contagious diseases, which makes PNA FISH suitable for routine application and enables clinical microbiology laboratories to report important information for patient therapy within a time frame that is not possible using classic biochemical methods.

However, FISH imaging analysis is a less commonly used method in cancer detection owing to its relatively higher cost than other methods. In addition to the equipment cost, the expenses associated with reagents, other consumables, and specialized personnel appointments can add to the overall cost of evaluation based on FISH imaging. For instance, the detection of ALK gene non-small cell lung cancer by IHC costs US$ 90.07 in the US and US$ 68.69 in Europe for every test, which is less than either independent or parallel testing by FISH and IHC (costing ~US$ 441.85 in the US and US$ 279.46 in Europe per test). Thus, the high cost of procedures and systems limits the growth of the fluorescence in situ hybridization (FISH) imaging systems market.

Report Segmentation and Scope:

The “Global Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market” is segmented on the basis of the product, application, and end user. Based on product, the market is segmented into instruments, consumables, accessories, and software. In terms of application, the fluorescence in-situ hybridization (FISH) imaging systems market is segmented into cancer diagnosis, genetic disease diagnosis, infectious disease diagnosis, and others. Based on end user, the market is segmented into diagnostic laboratories, contract research organizations, pharmaceutical and biotechnological companies, and others. The fluorescence in-situ hybridization (FISH) imaging systems market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The fluorescence in-situ hybridization (FISH) imaging systems market, by product, is segmented into instruments, consumables, accessories, and software. The consumables segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. Consumables are the most promising segment of the fluorescence in-situ hybridization (FISH) imaging system market that will contribute to tremendous growth in the coming years. FISH consumables include hybridization buffers, probes, tag detection kits, signal amplification detection kits, and others. The presence of manufacturers such as Abbott, F. Abnova, and Thermo Fisher Scientific bolsters the market for the consumables segment. These products are frequently used in various research diagnosis processes, which is expected to propel consumption. Thus, the presence of various market players offering probes & kits and technological advancements by market players are likely to propel the market for the segment in the coming years.

Based on application, the fluorescence in-situ hybridization (FISH) imaging systems market is segmented into cancer diagnosis, genetic disease diagnosis, infectious disease diagnosis, and others. The cancer diagnosis segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. FISH technology has tremendously benefited cancer diagnosis. FISH imaging systems can look for gene changes and help detect anomalies. According to Cancer Research UK, FISH testing is used for the diagnosis of several cancers, including breast cancer, lymphoma, lung cancer, prostate cancer, chronic lymphocytic leukemia (CLL), acute lymphoblastic leukemia (ALL), acute myeloid leukemia (AML), chronic myeloid leukemia (CML), myeloma, Ewings sarcoma, and melanoma skin cancer.

Based on end user, the fluorescence in-situ hybridization (FISH) imaging systems market is segmented into diagnostic laboratories, contract research organization, pharmaceutical and biotechnological companies, and others. The diagnostic laboratories segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. The diagnostic laboratories are involved in various research projects to develop several technologies and products for fluorescence in-situ hybridization (FISH) imaging processes. Unprecedented developments in research and technologies have created the potential for transformation in the healthcare and life sciences sectors. The clinical applications of fluorescence in-situ hybridization (FISH) imaging systems are vast and offer opportunities to enhance diagnosis and treatment capabilities for chronic disease. They offer huge potential in gene discovery and diagnosis of rare genetic disorders. The technologies are increasingly used to analyze rare and common genetic factors influencing the development of common diseases, such as cancer, high blood pressure, diabetes, and renal diseases.

Regional Analysis:

Based on geography, the global fluorescence in-situ hybridization (FISH) imaging systems market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest share of the global fluorescence in-situ hybridization (FISH) imaging systems market size. Asia Pacific is estimated to register the highest CAGR during 2022–2030.

The US is estimated to hold the largest fluorescence in-situ hybridization (FISH) imaging systems market share during the forecast period. The US holds a significant share of the fluorescence in-situ hybridization (FISH) imaging systems market in North America. The growing demand for advanced diagnostic tools in molecular genetics and cytogenetics and the rising prevalence of genetic disorders and cancer fuel the adoption of fluorescence in-situ hybridization (FISH) imaging systems in the US. As per data published by the American Cancer Society in 2022, nearly 1.9 million cancer cases were diagnosed and 609,360 cancer deaths were reported in the US. These systems offer high-resolution imaging of genetic material, enabling researchers and clinicians to detect chromosomal abnormalities and gene mutations with greater accuracy. Furthermore, the increasing focus on personalized medicine and targeted therapies has led to an upsurge in research activities involving genetic analysis, bolstering the demand for FISH imaging systems. The ability of these systems to provide detailed spatial information on gene sequences directly within cells has proven invaluable in both research and clinical applications. The FISH imaging systems have recently gained immense popularity due to their technological advancements such as improved automation, higher throughput, and enhanced image analysis software. As a result, laboratories and medical institutions are better equipped to handle larger volumes of samples and generate precise results efficiently. Thus, the growing demand for advanced diagnostic tools in molecular genetics and cytogenetics and the rising prevalence of genetic disorders and cancer bolster the fluorescence in-situ hybridization (FISH) imaging systems market in the US.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global fluorescence in-situ hybridization (FISH) imaging systems market are listed below:

- In May 2023, Pfizer and Thermo Fisher Scientific Inc collaborated to help increase local access to next-generation sequencing (NGS)-based testing for lung and breast cancer patients in over 30 countries across Latin America, Africa, the Middle East, and Asia where advanced genomic testing was previously limited or unavailable. Access to local NGS testing can help enable faster analysis of related genes, allowing healthcare providers to choose the best medicine for that specific patient.

- In April 2023, Agilent Technologies Inc signed a memorandum of understanding with Theragen Bio in South Korea. As part of the partnership agreement, Agilent and Theragen Bio combined their strengths in cancer genomic profiling design, engineering knowledge, and software expertise to drive localized analysis capabilities and accelerate treatment decisions.

- In April 2023, MetaSystems Probes GmbH launched four new XCyting New MetaSystems Probes—XL t(11;14) CCND1/IGH DF, XL CCND3/IGH DF, XL CUX1/EZH2/7cen, and XL DiGeorge TBX1.

- In May 2022, MetaSystems Probes GmbH launched three new XCyting locus-specific break-apart probes—XL TCL1 BA, XL SPI1 BA, and XL CSF1R BA—to its hematology and oncology portfolio. The XL TCL1 BA is designed to detect TCL1 gene cluster locus involving rearrangements described in several T-cell prolymphocytic leukemia (T-PLL) cases. The XL SPI1 BA is suitable for detecting the SPI1 gene locus involving rearrangements in pediatric T-cell acute lymphocytic leukemia (T-ALL) cases. The XL CSF1R BA is one of the prominent genes involved in multiple rearrangements described in a high-risk subset of ALL disorders, which account for B-cell precursor ALLs.

- In December 2021, BioGenex Laboratories Inc launched three new primary immunohistochemistry (IHC) antibodies for cancer diagnostics—CD8A, CD56, and CD163.

Fluorescence In-Situ Hybridization (FISH) Imaging Systems

Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market Regional InsightsThe regional trends influencing the Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market have been analyzed across key geographies.

Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.08 Billion |

| Market Size by 2030 | US$ 1.9 Billion |

| Global CAGR (2022 - 2030) | 7.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Fluorescence In-Situ Hybridization (FISH) Imaging Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

Euroclone SpA, TissueGnostics GmbH, Agilent Technologies Inc, Abnova Taiwan Corp, BioGenex Laboratories Inc, Leica Biosystems Nussloch GmbH, MetaSystems Probes GmbH, Bio-View Ltd, Thermo Fisher Scientific Inc, Applied Spectral Imaging, and PerkinElmer Inc are among the prominent players operating in the fluorescence in-situ hybridization (FISH) imaging systems market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For