Frozen Entree Market Outlook and Strategic Insights by 2030

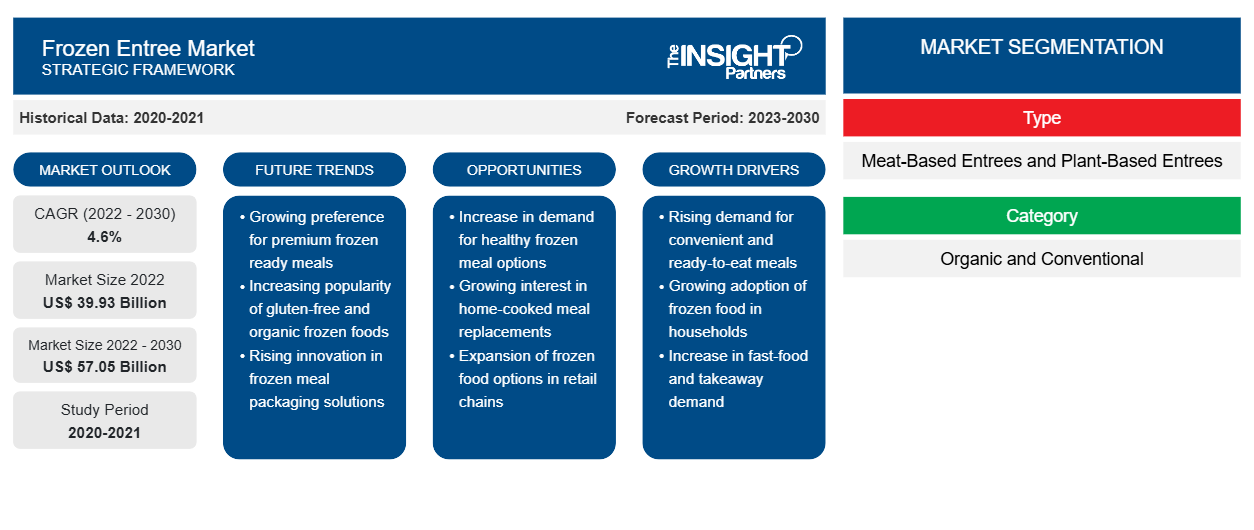

Frozen Entree Market Forecast to 2030 - Global Analysis by Type [Meat-Based Entrees and Plant-Based Entrees (Plant-Based Meat Entrees, Sweet Potato Entrees, Vegetable Entrees, and Others)], Category (Organic and Conventional), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Aug 2023

- Report Code : TIPRE00030009

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 167

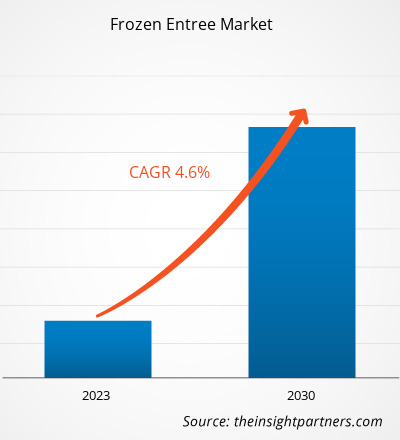

[Research Report] The Frozen entrée market size was valued at US$ 39,925.58 million in 2022 and is projected to reach US$ 57,054.53 million by 2030; it is expected to register a CAGR of 4.6% from 2022 to 2030.

Market Insights and Analyst View:

Frozen entrée is a kind of pre-packed meal consisting of combination of meat or plant-based meat, vegetables, rice, pasta, sauces, and other ingredients. Frozen food has extended shelf life compared to fresh products. Freezing also retains the nutritional content of the food making them appealing among health-conscious consumers. Frozen entrées are gaining huge traction among consumers, especially, among working professionals as they help in saving cooking time and efforts. These factors are significantly driving the growth of frozen entrée market.

Growth Drivers and Challenges:

Convenience foods, such as frozen snacks, frozen meals, frozen entrée, and ready-to-eat products, allow consumers to save time and effort associated with ingredient shopping, meal preparation, cooking, consumption, and post-meal cleaning activities. The development and popularity of these food items are ascribed to many social changes; the most notable of these are the increasing number of smaller households and the rising millennial population worldwide. Due to hectic work schedules, millennials prefer quick and easy meals without compromising on taste and nutrition. These factors are significantly promoting the demand for convenience food among consumers, thereby propelling the frozen entrée market growth. Frozen meals have extended shelf life and are suitable for single serve. The frozen entrées are ready-to-eat meals, which saves time on food preparation. According to a report titled “Power of Frozen,” published by the American Frozen Food Institute and Food Industry Association, sales of frozen food in the US increased by 21% in 2020. Thus, the rising demand for convenience food is supporting the growth of the frozen entrée market.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFrozen Entree Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Frozen Entree Market” is segmented based on type, category, distribution channel, and geography. Based on type, the frozen entree market is segmented into meat-based entrees and plant-based entrees. The plant-based entrees segment is further divided into plant-based meat entrees, sweet potato entrees, vegetable entrees, and other plant-based entrees. Based on category, the frozen entrée market is bifurcated into organic and conventional. Based on distribution channel, the frozen entree market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The frozen entree market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on type, the frozen entree market is bifurcated into meat-based entrees and plant-based entrees. The plant-based entrees segment is further segmented into plant-based meat entrees, sweet potato entrees, vegetable entrees, and other plant-based entrees. In 2022, the meat-based entrees segment held a larger market share and the plant-based entrées segment is projected to register a faster CAGR from 2022 to 2030. The rising demand from consumers for protein-rich food items such as steaks, sausages, kebabs, and salami has benefited the meat-based entrée segment. Consumer preference for frozen, meat-based packaged meals is rising due to increasing hygiene issues associated with fresh products. Amy’s Kitchen and MorningStar Farms are some of the major brands of meat-based entrée. Further, key players have been launching new products in recent years. In January 2021, India-based The Taste Company expanded its product portfolio to include meat-based pre-packed frozen meals. These are made with traditional home-style cooking methods to eliminate the need for preservatives or artificial colors. Such product launches by manufacturers drive the frozen entrée market for the meat-based segment.

Based on distribution channel, the frozen entree market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. In 2022, the supermarkets & hypermarkets segment held the largest share in the frozen entrée market and the online retail segment is expected to register the highest CAGR during the forecast period. Online retail stores offer a wide variety of products with heavy discounts; consumers can conveniently buy desirable products remotely. Additionally, doorstep service attracts a large group of customers to shop through e-commerce platforms. Moreover, these websites offer product information and user reviews, which help buyers compare products and make informed decisions. During the COVID-19 pandemic, frozen food sales through online retail channels increased dramatically as they offered home delivery services. Thus, all the aforementioned factors are projected to boost the frozen entrée market for the online retail segment in the foreseeable future.

Regional Analysis:

Based on geography, the frozen entree market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, Europe held the largest share of the global frozen entree market, and Asia Pacific is estimated to register the highest CAGR from 2022 to 2030. Frozen entrée manufacturers are expanding their operations across Asia Pacific due to a potential customer base, cheap labor, and good manufacturing facilities. Companies such as Conagra Brands, Inc and Tyson Foods, Inc are actively operating in the frozen entrée market in the region and are unveiling new products. In June 2021, Tyson Foods, Inc. launched the frozen entrée category in Asia Pacific and expanded its roots. The firm also reported that retail sale of the plant-based products category in Asia Pacific gained US$ 16.3 billion in 2020 and is anticipated to surpass US$ 20 billion by 2025. Thus, all the aforementioned factors are expected to boost the Asia Pacific frozen entrée market growth.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global frozen entree market are listed below:

- In May 2023, Amy’s Kitchen launched frozen entrée product line that includes a multipack of burritos and six new family-pack items featuring its cheese enchiladas, poblano enchiladas, vegetable lasagna, broccoli cheddar bake, and Chinese noodles.

- In July 2020, Happi Foodi announced the expanded distribution of select products to additional retailers across the US, including Meijer, Safeway, Albertsons and Winn-Dixie. Meijer shoppers can find Happi Foodi's Keto Bowls in all stores as well as Street Tacos and Flatbreads in nearly every location.

- In April 2020, Nestle SA launched ‘Life Cuisine,’ a new brand designed to “feed modern lifestyles.” The lineup includes frozen bowls, egg bites, and pizzas that cater to four consumer preferences: high-protein, low-carb, meatless, and gluten-free.

The regional trends and factors influencing the Frozen Entree Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Frozen Entree Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Frozen Entree Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 39.93 Billion |

| Market Size by 2030 | US$ 57.05 Billion |

| Global CAGR (2022 - 2030) | 4.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frozen Entree Market Players Density: Understanding Its Impact on Business Dynamics

The Frozen Entree Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Frozen Entree Market top key players overview

COVID-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries across the globe. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the food & beverages industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and nonessential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. Consumers started panic-buying due to lockdowns and travel bans. They stocked their pantries which increased the demand for frozen and prepared meals. The corporate sector announced work-from-home mandates. Additionally, cafe and restaurant visits of people decreased. Thus, the demand for in-home consumption of frozen meals witnessed a huge surge. This factor had a positive impact on the frozen entrée market. However, manufacturers with lack of inventories and raw material shortage faced significant losses. In 2021, as governments of various countries announced relaxation of several restrictions such as lockdowns, travel bans, and trade barriers, the marketplace witnessed recovery. The manufacturers of frozen entree could operate at full capacity, which helped them to overcome the demand-supply gap. Online grocery shopping trends emerged rapidly as consumers enjoyed shopping remotely during lockdowns. This factor is expected to boost the frozen entree market during the forecast period.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global frozen entree market are Impossible Foods Inc, Kellogg Co, Conagra Brands Inc, Daiya Foods Inc, Nestle SA, Del monte Foods Inc, B&G Foods Inc, Waffle Waffle LLC, Mars Inc, and Amy's Kitchen Inc. Players operating in the global frozen entrée market focus on providing high quality and innovative products with vegan, GMO-free, organic, and gluten-free claims to fulfil the changing customer preferences.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For