Global IT Operations Analytics Market Growth Trends & Insights by 2031

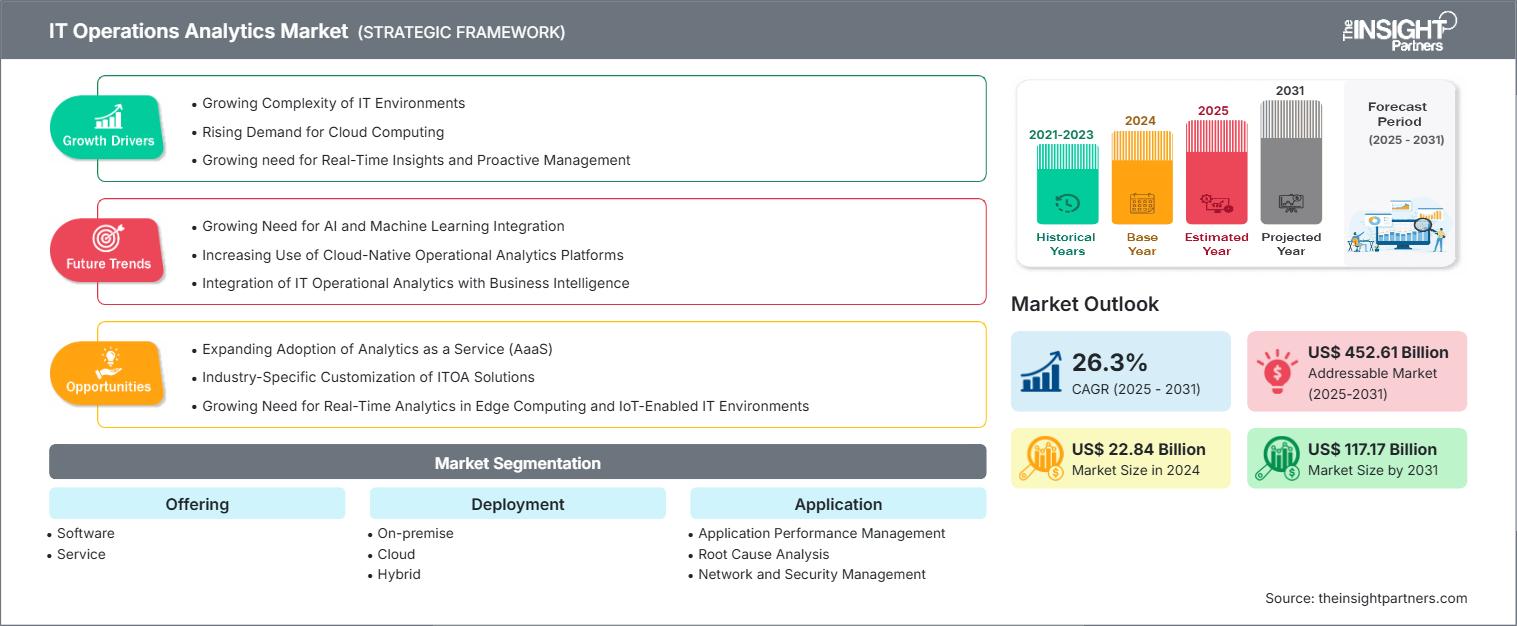

IT Operations Analytics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Offering (Software and Services), Deployment (On-Premises, Cloud, and Hybrid), Application [Application Performance Management (APM), Root Cause Analysis, Network and Security Management, and Others)], Industry Vertical (BFSI, IT and Telecom, Retail and E-Commerce, Healthcare, Manufacturing, and Others), and Region (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00011205

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 275

The IT Operations Analytics Market size is projected to reach US$ 22.84 billion in 2024 and is projected to reach US$ 117.17 billion by 2031. The market is expected to register a CAGR of 26.3% during 2025–2031.

IT Operations Analytics Market Analysis

The global ITOA market is expanding as organizations seek to improve uptime, preserve business continuity, and derive actionable intelligence from complex IT environments. Key market drivers include the relentless growth in data volumes, cloud adoption, increasing system complexity, and the need for proactive security and compliance management. The rise of hybrid and multi-cloud architectures, IoT deployments, and digital transformation initiatives further expands the opportunities for ITOA adoption. However, factors such as the high cost of advanced analytics platforms, challenges in integrating with legacy systems, and talent shortages in analytics and AI can restrain market growth. Despite these constraints, demand is strong for solutions that automate performance monitoring, streamline troubleshooting, and enable data-driven IT strategies.

IT Operations Analytics Market Overview

IT Operations Analytics (ITOA) refers to the use of advanced data analysis, machine learning, and automation techniques to monitor, evaluate, and optimize IT system performance. By analyzing real-time and historical data generated by networks, applications, cloud infrastructure, and devices, ITOA enables IT teams to prevent problems, detect anomalies, and resolve issues proactively. This analytics discipline supports a variety of applications, including root cause analysis, system performance optimization, incident management, resource allocation, and security monitoring. Key usage areas span predictive analytics to anticipate outages, visualization for system mapping, performance monitoring, compliance tracking, and orchestration of automated responses. There are several types of ITOA solutions, such as event correlation tools, machine data platforms, and AI-driven observability suites, all designed to drive faster, more efficient, insight-driven IT operations.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIT Operations Analytics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

IT Operations Analytics Market Drivers and Opportunities

Market Drivers:

- Rising Demand for Cloud Computing: The rise of cloud computing has fundamentally transformed the landscape of IT Operations Analytics (ITOA), accelerating market growth by introducing unprecedented scalability, flexibility, and ease of integration for analytics tools. Modern cloud environments generate large, continuous streams of new data, spanning applications, devices, user interactions, and transactions. IT organizations leverage cloud-based ITOA solutions to process and contextualize this operational data, extracting actionable insights in real time for optimized system performance, proactive incident response, and enhanced service reliability.

- Growing need for Real-Time Insights and Proactive Management: ITOA tools empower IT teams to continuously monitor system health, track key performance indicators (KPIs), detect anomalies, and visualize dependencies across networks and applications. Real-time data analytics enables organizations to pinpoint the root causes of problems quickly, often before they impact end users or the business. For example, an incident affecting system performance can be correlated instantly with changes in infrastructure or usage patterns, and alerts can be routed to the correct teams for swift resolution, reducing mean time to repair dramatically. Major financial institutions have leveraged unified reporting platforms to eliminate manual reporting cycles—transforming days of delayed response into minutes of actionable insight and ultimately strengthening business continuity.

Market Opportunities:

- Expanding Adoption of Analytics as a Service (AaaS): As organizations grapple with exploding volumes of operational data and increased infrastructure complexity, Analytics as a Service (AaaS) is emerging as a powerful delivery model—offering managed, scalable analytics via cloud platforms without the burden of heavy infrastructure investments. AaaS platforms integrate AI and machine learning by default, enabling real-time analytics, , and predictive insight out of the box. This model aligns perfectly with ITOA needs, where enterprises seek immediate, intelligence-driven visibility into IT operations without extensive implementation overhead.

- Industry-Specific Customization of ITOA Solutions: As enterprises across verticals increasingly demand tailored observability capabilities, industry-specific customization becomes a powerful growth lever for the ITOA market. Generic analytics platforms alone often fall short of addressing sector-specific workflows, compliance requirements, or data structures. When ITOA solutions are customized—such as manufacturing-grade analytics, healthcare‑focused observability, or telecom‑centric network intelligence—they deliver greater value by aligning more closely with business and operational realities. For instance, manufacturers with large-scale IoT deployments benefit from real-time machine monitoring and . Observata’s manufacturing observability platform enabled a mid-sized automotive parts plant to reduce energy waste and streamline production protocols, unlocking sustainability and efficiency improvements tailored to the assembly-floor context.

IT Operations Analytics Market Report Segmentation Analysis

The IT operations analytics market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Offering:

- Software: The software segment forms the core of the IT Operations Analytics market, offering platforms and tools that enable enterprises to monitor, analyze, and optimize IT infrastructure and application performance. These software solutions leverage AI, machine learning, and real-time analytics to process vast volumes of operational data, including logs, metrics, events, and traces.

- Services: The services segment complements ITOA software by providing the expertise, customization, and operational support needed to maximize value from analytics platforms. It includes consulting, integration, implementation, training, and ongoing support, as well as managed services where external providers oversee daily IT operations analytics tasks. Service providers help align ITOA tools with business objectives, ensure regulatory compliance, and enable seamless data integration across systems.

By Deployment:

- On-Premises: On-premises deployment remains a critical segment of the IT Operations Analytics market, especially for organizations operating in regulated industries such as banking, government, defense, and healthcare. These entities prioritize data sovereignty, strict compliance, and tighter control over infrastructure—making on-premises ITOA solutions a preferred choice. This model provides enhanced customization and security, allowing organizations to tailor analytics platforms to specific operational environments and internal policies.

- Cloud: Cloud deployment is the fastest-growing segment in the IT Operations Analytics market, driven by the shift toward scalable, flexible, and on-demand digital infrastructure. Cloud-based ITOA platforms offer rapid deployment, minimal maintenance overhead, and continuous updates—making them ideal for modern DevOps and agile environments. These solutions support dynamic resource monitoring, real-time analytics, and seamless integration across SaaS, PaaS, and IaaS ecosystems.

- Hybrid: Hybrid deployment represents a strategic middle ground in the IT Operations Analytics market, offering the flexibility to monitor both cloud-based and on-premises systems. It is increasingly popular among large enterprises undergoing digital transformation but still dependent on legacy infrastructure.

By Application:

- Application Performance Management (APM)

- Root Cause Analysis (RCA)

- Network and Security Management

- Others

Industry Vertical:

- BFSI

- Retail and E-commerce

- IT and Telecom

- Healthcare

- Manufacturing

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The North America IT operations analytics market is the largest globally, driven by early cloud adoption, large-scale enterprise digitalization, and a strong focus on automation and cybersecurity. The U.S. and Canada host a dense concentration of Fortune 500 companies, hyperscale cloud providers, and tech-driven industries such as finance, telecom, e-commerce, and healthcare—all heavily reliant on real-time performance monitoring and AIOps capabilities.

IT Operations Analytics Market Regional Insights

The regional trends and factors influencing the IT Operations Analytics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses IT Operations Analytics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

IT Operations Analytics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 22.84 Billion |

| Market Size by 2031 | US$ 117.17 Billion |

| Global CAGR (2025 - 2031) | 26.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

IT Operations Analytics Market Players Density: Understanding Its Impact on Business Dynamics

The IT Operations Analytics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the IT Operations Analytics Market top key players overview

IT Operations Analytics Market Share Analysis by Geography

The Asia Pacific region is emerging as one of the fastest-growing markets for IT operations analytics, fueled by rapid digital transformation, Industry 4.0 and smart city strategies, and smart infrastructure initiatives. Nations such as China, India, Japan, South Korea, Singapore, and Australia are major contributors, each with different drivers. Startups and telecom firms in the above mentioned countries are implementing ITOA tools to support large-scale, mobile-first consumer platforms.

The IT operations analytics market grows differently in each region. This is because of factors like digital transformation, technological advancement, and industrial expansion. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a major share of the global IT operations analytics market

-

Key Drivers:

- Early cloud adoption

- Large-scale enterprise digitalization

- A strong focus on automation and cybersecurity

- Trends: innovation in cloud-native observability tools, hybrid infrastructure monitoring, and security-integrated ITOA solutions

2. Europe

- Market Share: Substantial share

-

Key Drivers:

- Strict data governance laws

- Industry-specific compliance requirements

- An increasing push for digital sovereignty.

- Trends: Demand for modular, policy-aware analytics platforms, enterprises modernizing legacy infrastructure, and transitioning to cloud or hybrid models

3. Asia Pacific

- Market Share: Fastest-growing region with rising market share every year

-

Key Drivers:

- Accelerating cloud adoption

- Smart infrastructure initiatives

- Large-scale digital transformation across emerging and developed economies

- Trends: Investment in ITOA as part of broader Industry 4.0 and smart city strategies and high focus on real-time anomaly detection

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Increasing government investment in digital infrastructure

- Smart cities and public sector modernization

- Trends: National strategies focused on AI, cloud, and digital transformation

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Digital Transformation

- Growing appetite for intelligent IT operations, especially in sectors like banking, telecom, and government services

- Trends: Organizations are increasingly adopting ITOA tools to handle challenges related to system availability, network latency, and resource optimization.

IT Operations Analytics Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as International Business Machines Corp, Cisco Systems Inc, New Relic Inc, Dynatrace LLC, and ServiceNow Inc. In addition, regional and specialized vendors like Oracle Corp, BMC Software, Inc., Microsoft Corp, Open Text Corp, and Broadcom Inc are contributing to a dynamic and competitive landscape.

This high level of competition urges companies to stand out by offering:

- Advanced investigation technologies (e.g., AI-driven analytics, ML, and Analytics as a Service (AaaS))

- Cross-platform forensic support (supporting hybrid infrastructure including on-premises, cloud, and edge environments)

- Compliance-centric solutions for regulations like GDPR, CCPA, and SOX

- Rapid root cause analysis and automated remediation

Opportunities and Strategic Moves

- Strategic alliances with AIOps vendors, cloud service providers, and DevOps teams are becoming essential for expanding platform capabilities and accelerating digital transformation initiatives.

- Cloud-native ITOA solutions and ITOA-as-a-Service models are gaining momentum, driven by the need for scalability, flexibility, and real-time data processing.

- Expansion into emerging regions (Asia Pacific, Middle East, Latin America) is opening new growth avenues as organizations modernize their IT infrastructure and seek proactive IT management tools.

- R&D investments in artificial intelligence, machine learning, and predictive analytics are enabling automated anomaly detection, root cause analysis, and performance forecasting.

- Integration with ITSM, APM, NPM, and observability platforms is enhancing visibility, reducing mean time to resolution (MTTR), and supporting unified monitoring strategies.

Major Companies operating in the IT Operations Analytics Market are:

- International Business Machines Corp

- Dynatrace LLC

- Open Text Corp

- Cisco Systems Inc

- BMC Software, Inc.

- Microsoft Corp

- New Relic Inc

- Broadcom Inc

- ServiceNow Inc

- Oracle Corp

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Sisense Ltd.

- SolarWinds Worldwiden LLC

- Hitachi Vantara Corp

- NetApp Inc

- Elastic

- Broadcom

- Hewlett Packard Enterprise

- Sumo Logic

- Exabeam

- PagerDuty, Inc.

- LogicMonitor

- Dell Inc.

- ScienceLogic

- Datadog

- Zoho Corporation Pvt. Ltd.

- Atlassian

- Freshworks Inc.

- Anker

- Alteryx

- Nexthink

- HCL Technologies

- Cloud Software Group

- Veritas

- ExtraHop Networks

- Apica

IT Operations Analytics Market News and Recent Developments

- IBM introduced new agentic and automation capabilities In April 2025, IBM introduced new agentic and automation capabilities to its managed detection and response service offerings to help enable autonomous security operations and predictive threat intelligence for clients. IBM is launching Autonomous Threat Operations Machine (ATOM), an agentic AI system providing autonomous threat triage, investigation, and remediation with minimal human intervention. IBM is also introducing the new X-Force Predictive Threat Intelligence (PTI) agent for ATOM, which leverages industry vertical-specific AI foundation models to generate predictive threat insights on potential adversarial activity and minimize manual threat hunting efforts.

- Cisco introduced new capabilities in Cisco XDR and Splunk Security In April 2025, Cisco announced key innovations and partnerships to help security teams face the rising challenges of the AI era. The company introduced new capabilities in Cisco XDR and Splunk Security, a deeper partnership with ServiceNow, and the launch of Foundation AI.

- Dynatrace Announced New AI-powered Log Analytics Capabilities In February 2025, Dynatrace, the leading AI-powered observability platform, announced new AI-powered log analytics capabilities to address the growing challenges organizations face with legacy log management solutions. Legacy solutions often operate independently from existing monitoring tools, perpetuating operational inefficiencies that lead to delayed incident resolution, increased costs, and security vulnerabilities.

- BMC Updated its BMC Helix platform In May 2025, BMC Helix, a global leader in software solutions that help the world’s most forward-thinking IT organizations turn AI into action, announced updates to the BMC Helix platform that transform productivity and improve employee experience through agentic AI. The Helix platform, one of the first market-ready solutions to use gen AI, improves the quality of service interactions and overall operator experience with insights and automation. The BMC Helix IT Operations Management for AIOps 25.2 release includes new and expanded AI agents to extend observability, discovery, and insights that prevent major incidents and optimize application performance.

- BMC Adding Generative AI, Low-Code/No-Code Development In December 2023, BMC, a global leader in software solutions for the Autonomous Digital Enterprise, is adding generative AI, low-code/no-code development, and contextual tooling to the BMC Helix Service Management solution, helping enterprise customers strengthen their security posture and elevate ways of working.

IT Operations Analytics Market Report Coverage and Deliverables

The " IT Operations Analytics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- IT Operations Analytics Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- IT Operations Analytics Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- IT Operations Analytics Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the IT Operations Analytics Market

- Detailed company profiles

Frequently Asked Questions

1. Software

2. Services

1. On-premise

2. Cloud

1. BFSI

2. IT and Telecom

3. Retail and E-Commerce

4. Manufacturing

5. Healthcare

6. Others

Asia-Pacific, especially China and Japan, are witnessing the fastest growth due to growing investments in IT infrastructure and a focus on optimizing IT operations across various industries

1. Application Performance Management (APM)

2. Root Cause Analysis

3. Network and Security Management

4. Others

The IT Operations Analytics (ITOA) market is undergoing a significant transformation, driven primarily by the integration of Artificial Intelligence (AI) and Machine Learning (ML). As enterprises increasingly adopt cloud-native architectures, DevOps practices, and hybrid IT infrastructures, traditional rule-based monitoring systems are struggling to keep pace with the complexity and scale of modern environments. AI and ML are emerging as critical enablers, allowing organizations to transition from reactive to predictive and even prescriptive IT operations.

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For