Lactic Acid Market Growth and Forecast by 2031

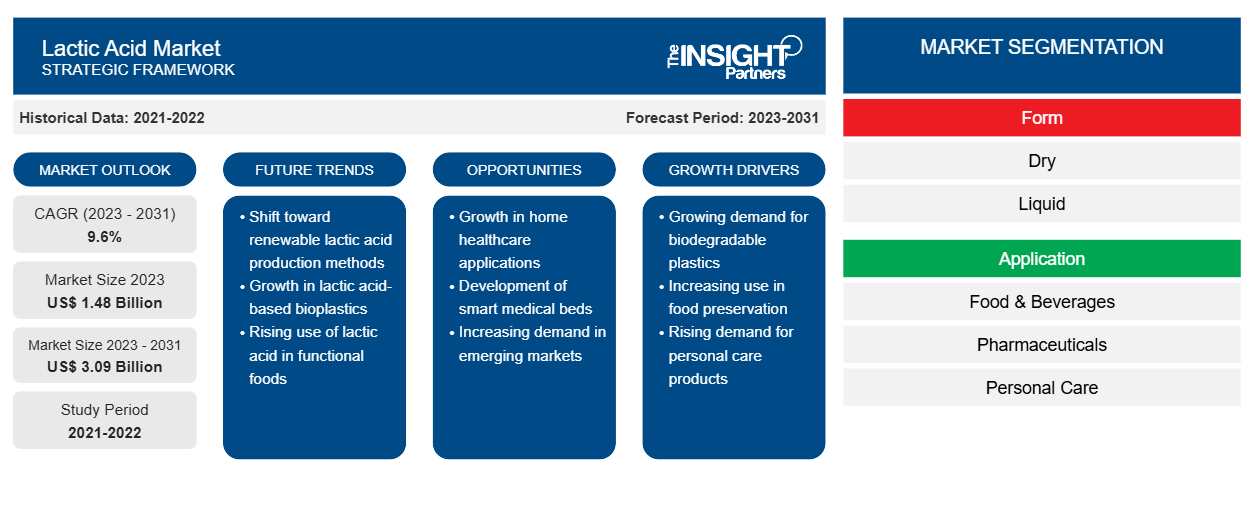

Lactic Acid Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Dry, and Liquid), Application (Food & Beverages, Pharmaceuticals, Personal Care, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00012110

- Category : Chemicals and Materials

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

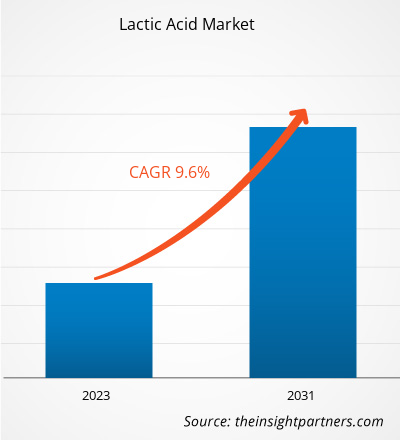

The Lactic Acid Market size is projected to reach US$ 3.09 billion by 2031 from US$ 1.48 billion in 2023. The market is expected to register a CAGR of 9.6% in 2023–2031. Growing product innovations and advancement in technologies, are likely to remain key lactic acid market trends.

Lactic Acid Market Analysis

Lactic acid has wide range of applications across various end-use industries, which has aided the market growth of lactic acid. Lactic acid, an essential organic acid produced by lactic acid bacteria, finds application in various industries such as food & beverages, textile, personal care & cosmetics, and pharmaceuticals. It is naturally present in several foodstuffs and is used in an extensive range of food applications, including bakery & confectionery products, dairy products, meat products, and beverages. Lactic acid is also used in the dairy industry in making cheese and yogurt. Lactic acid is used in food products primarily as a pH regulator, preservative, and flavoring agent. Furthermore, lactic acid is used to formulate cleansing products, shampoos, moisturizers, hair dyes, and other skin care and hair care products in the personal care & cosmetics industry. Lactic acid is also used in the pharmaceutical sector.

Lactic Acid Market Overview

Lactic acid is an organic acid produced during the process of fermentation. It is used in various industries including food & beverages, pharmaceuticals, personal care, and biodegradable polymers. The multi-functionalities of lactic acid render its use in various industries. Surging global demand for processed food is boosting the application of lactic acid in the food industry. In meat, poultry, & seafood products, it is majorly used as a decontaminant. In the personal care industry, lactic acid is mainly used in anti-ageing and skin lightening products as it treats hyperpigmentation and age spots.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLactic Acid Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lactic Acid Market Drivers and Opportunities

Multi-functionalities of Lactic Acid to Favor Market

Lactic acid is usually preferred over synthetic chemicals in the food & beverage sector, as they alter the flavor and texture of products while enhancing their shelf life. Lactic acid is used to produce cheese flavors in the dairy industry. Furthermore, in the brewing industry, lactic acid promotes starch conversion in beer, hence increasing the yield. In the baking industry, lactic acid helps control the dough's acidity and enhances the shelf life of baked products. Additionally, lactic acid is also used to produce emulsifiers such as calcium and sodium stearoyl lactylates, which function as dough conditioners. The multi-functionalities are one of the major drivers of global lactic acid market share.

Increasing Demand for Biodegradable Polymers – An Opportunity in Lactic Acid Market

Polylactic acid (PLA) is the highest potential biopolymer and is most extensively used eco-friendly polymer. Polylactic acid finds a wide range of applications in long-term and temporary implantable devices, tissue engineering, drug delivery systems, and various other emerging areas owing to its biodegradable property. Moreover, in the recent times, it is also being used in foodservice wares, packaging films, and bottles with short shelf life. Since polylactic acid is obtained from 100% natural sources, it has multiple advantages in the packaging industry over petrochemical-based polymers. Using lactic acid in biodegradable polymers is growing significantly, primarily due to the surge in awareness among consumers and increased use of biodegradable plastic packaging in the food application. Therefore, the increasing demand for biodegradable polymers is expected to have a positive impact on the lactic acid market.

Lactic Acid Market Report Segmentation Analysis

Key segments that contributed to the derivation of the lactic acid market analysis are product type, category, and end user.

- Based on form, the lactic acid market is divided into dry, and liquid. Dry segment held a larger market share in 2023.

- Based on application, the lactic acid market is divided into food & beverages, pharmaceuticals, personal care, and others. Food & beverages segment held a larger market share in 2023.

Lactic Acid Market Share Analysis by Geography

The geographic scope of the lactic acid market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Asia Pacific held the significant share in the lactic acid market. The rising usage of lactic acid in various applications such as food & beverages, pharmaceuticals, personal care, and others have resulted in increasing demand for lactic acid, which has anticipated to boost the growth of the market in Asia Pacific. China, India, and Japan are the major markets for lactic acid in the region. China is the largest exporter and manufacturer of lactic acid in the region and the second-largest exporter in the world. Further, Asia Pacific has high concentration of food & beverage, pharmaceuticals and personal care companies. The region also marks presence of polylactic acid manufacturers such as Highchem Co Ltd, Musashino Chemical Laboratory Ltd, Corbion, and NatureWorks LLC, among others.

Lactic Acid Market Regional Insights

The regional trends and factors influencing the Lactic Acid Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Lactic Acid Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Lactic Acid Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.48 Billion |

| Market Size by 2031 | US$ 3.09 Billion |

| Global CAGR (2023 - 2031) | 9.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lactic Acid Market Players Density: Understanding Its Impact on Business Dynamics

The Lactic Acid Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Lactic Acid Market top key players overview

Lactic Acid Market News and Recent Developments

The lactic acid market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion and strategies:

- In August, 2022, LG Chem and ADM announced two joint ventures for the US production of lactic acid and polylactic acid, in order to cater growing demand for a wide variety of plant-based products, including bioplastics. The targeted annual production by two joint ventures was 150,000 tons of lactic acid and 75,000 tons of polylactic acid. (Source: ADM, Press Release)

- In March, 2021, Corbion planned to boost lactic acid capacity through concurrent expansion projects. These productivity initiatives will increase supply of lactic acid, a nature-based ingredient, for the company's customers in Europe and other regions. (Source: Corbion, Press Release)

Lactic Acid Market Report Coverage and Deliverables

The “Lactic Acid Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For