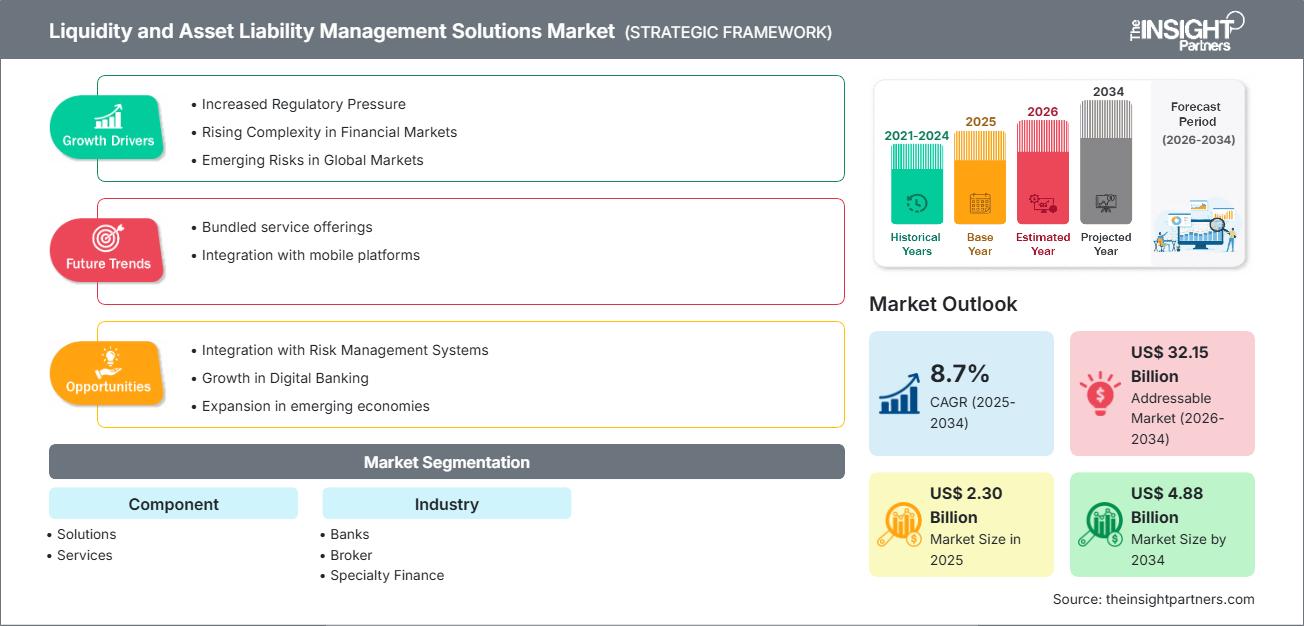

Liquidity and Asset Liability Management Solutions Market Forecast (2026-2034)

Liquidity and Asset Liability Management Solutions Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solutions and Services) and Industry (Banks, Broker, Specialty Finance, Wealth Advisors, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00017757

- Category : Technology, Media and Telecommunications

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The liquidity and asset liability management (ALM) solutions market is projected to grow from US$ 2.30 billion in 2025 to US$ 4.88 billion by 2034, at a CAGR of 8.7% during the forecast period.

Liquidity and Asset Liability Management Solutions Market Analysis

The increasing credit risk in financial institutions and rising regulatory pressure on interest rate risk are driving the liquidity and ALM solutions market. Banks and other financial institutions use this type of solution to run scenario analysis, manage their balance sheet more effectively, and adhere to increased capital and funding requirements. Advanced ALM solutions contain an FTP module that enables the institution to calculate profitability at various levels of the business.

Greater interest rate volatility globally, for example, in the U.S., the UK, and Japan, has increased pressure on net interest margins, making effective ALM paramount.

Liquidity and Asset Liability Management Solutions Market Overview

Liquidity management refers to ensuring enough cash and liquid assets to meet obligations. In contrast, asset liability management involves aligning the maturities, rates, and volumes of assets and liabilities to minimize risk and optimize profitability.

Liquidity & ALM solutions help financial institutions model and control these dynamics efficiently, enabling risk‑based decision-making, forecasting, regulatory compliance, and performance optimization.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLiquidity and Asset Liability Management Solutions Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Liquidity and Asset Liability Management Solutions Market Drivers and Opportunities

Market Drivers:

- Rising Credit Risk in Financial Institutions: Increasing defaults, stressed loan portfolios, and uncertain macro environments push institutions to adopt solutions for managing liquidity and interest rate risk.

- Regulatory Pressures: Most regulations, including the IRRBB or Interest Rate Risk in the Banking Book, funding-planning stress tests, and capital-risk frameworks, compel banks to execute elaborative ALM models.

- Volatile Interest Rate Environment: Global rate volatility compresses margins and thereby increases the need for effective ALM to safeguard profitability.

- Digitalization & Analytics: Institutions base their decision-making more and more on data analytics, the simulation of scenarios, and forecasting in ALM.

Opportunities:

- AI / Machine Learning for Risk Modeling: Advanced AI-powered ALM tools can improve forecasting, liquidity stress testing, and scenario management.

- Cloud-Based ALM Platforms: Cloud deployment can help institutions scale ALM systems more flexibly while reducing infrastructure costs.

- Integration with Treasury Systems: ALM tools can be integrated with treasury, risk, and fund transfer pricing systems to create a unified decision framework.

- Expansion in Emerging Markets: As banks in emerging economies (e.g., Asia Pacific) grow, their need for advanced liquidity and ALM solutions is increasing.

Liquidity and Asset Liability Management Solutions Market Report Segmentation Analysis

By Component:

- Solutions

- Services

By Industry / Institution Type:

- Banks

- Brokers

- Specialty Finance

- Wealth Advisors

- Others

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Liquidity and Asset Liability Management Solutions Market Regional Insights

The regional trends and factors influencing the Liquidity and Asset Liability Management Solutions Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Liquidity and Asset Liability Management Solutions Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Liquidity and Asset Liability Management Solutions Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 2.30 Billion |

| Market Size by 2034 | US$ 4.88 Billion |

| Global CAGR (2025 - 2034) | 8.7% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Liquidity and Asset Liability Management Solutions Market Players Density: Understanding Its Impact on Business Dynamics

The Liquidity and Asset Liability Management Solutions Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Liquidity and Asset Liability Management Solutions Market top key players overview

Liquidity and Asset Liability Management Solutions Market Share Analysis by Geography

- North America: Strong adoption driven by advanced banking infrastructure, regulatory sophistication, and demand for integrated risk‑management platforms.

- Europe: Regulatory demands and sophisticated financial institutions drive ALM adoption; stress testing and interest rate risk mandates are key.

- Asia Pacific: Expected to be a fast-growing region. The increasing banking sector size, digital transformation, and risk awareness are pushing demand for ALM.

- South & Central America: Emerging market for ALM, driven by risk management needs in growing banking sectors.

- Middle East & Africa: Growing financial services adoption and regulatory maturation present opportunities for ALM solution providers.

Liquidity and Asset Liability Management Solutions Market Players Density: Understanding Its Impact on Business Dynamics

Competition is intensifying in the liquidity & ALM solutions market. Key players include large global financial software firms as well as regional specialists. To differentiate, vendors are:

- Offering integrated ALM + liquidity risk platforms with FTP, scenario analysis, and stress-testing.

- Incorporating analytics, AI, and predictive modeling to provide forward-looking risk insights.

- Providing cloud-based ALM services to reduce adoption costs and improve scalability.

- Partnering with banks and financial institutions to customize ALM systems based on local regulatory and market needs.

Major Companies operating in the Liquidity & ALM Solutions Market:

- Experian Information Software, Inc.

- Fidelity National Information Services, Inc.

- Finastra International Limited

- IBM Corporation

- Infosys, Ltd.

- Intellect Design Arena Limited

- Moody’s Corporation

- Oracle Corporation

- SAP SE

Other Companies Analysed During the Research

- FIS Global

- SAS Institute, Inc.

- Fiserv, Inc.

- Accenture PLC

- KPMG LLP

- Deloitte

- PwC

- EY

- Protiviti, Inc.

- Alvarez & Marsal

Liquidity and Asset Liability Management Solutions Market News and Recent Developments

- Digital Transformation Initiatives: Financial institutions are increasingly using real-time analytics, cloud ALM, and AI-driven tools to improve liquidity forecasting and risk management.

- Regulatory Stress-Testing Demands: With stricter capital and liquidity regulation worldwide, banks are investing more in ALM systems that support regulatory stress testing, interest rate risk in the banking book (IRRBB), and funds transfer pricing.

- Partnerships & Implementations: For example, in June 2022, Infosys Finacle (EdgeVerve) implemented its treasury and ALM platforms with a bank, showcasing the deployment of integrated risk‑liquidity systems.

Liquidity and Asset Liability Management Solutions Market Report Coverage and Deliverables

The “Liquidity & Asset Liability Management Solutions Market Size and Forecast (2021–2034)” report from The Insight Partners includes:

- Global, regional, and country-level market size and forecasts for all key segments

- Detailed market dynamics: drivers, restraints, and opportunities

- PEST and SWOT analysis

- Strategic insights: trends, regulatory impacts, and competitive analysis

- Industry landscape: market concentration, heatmap of key players, recent strategic moves

- Detailed company profiles of leading and emerging ALM solution providers

Frequently Asked Questions

2. Higher cost of advanced analytics / AI-based ALM systems.

3. Integration with existing treasury, risk, and FTP systems.

4. Data quality and governance issues for accurate scenario modelling.

2. Regulatory pressure (e.g., IRRBB, stress tests).

3. Volatile interest rate environment impacting margins.

4. Growing adoption of digital, AI-based risk management tools.

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For