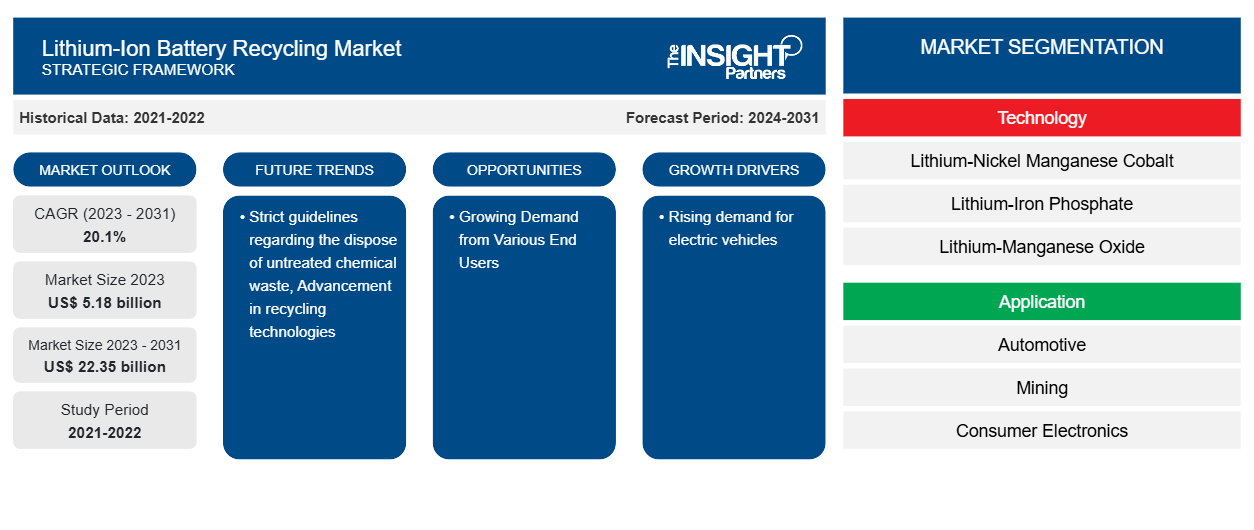

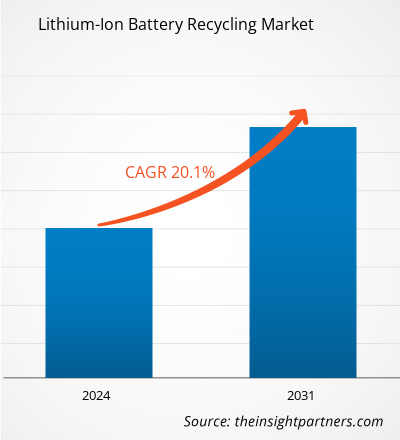

The lithium-ion battery recycling market size is expected to grow from US$ 5.18 billion in 2023 to US$ 22.35 billion by 2031; it is estimated to grow at a CAGR of 20.1% from 2023 to 2031. Strict guidelines regarding the disposal of untreated chemical waste and advancement in recycling technologies are likely to remain key lithium-ion battery recycling market trends.

Lithium-Ion Battery Recycling Market Analysis

The automobile sector has seen a huge increase in demand for recycled lithium-ion batteries in recent years, particularly in the United States, Germany, Sweden, Norway, the Netherlands, and China, as well as in a few developing Southeast Asian nations. The IEA reports that, compared to 2020, sales of electric cars nearly doubled to 6.6 million (or nearly 9%) in 2021, with 16.5 million electric cars on the road overall. Furthermore, the IEA projects that by 2030, there will be over 300 million electric vehicles on the road, which will likely lead to an increase in the recycling of lithium-ion batteries. In essence, growing consumer knowledge of the region's developing nations' electric vehicles' positive environmental effects is expected to spur industry growth. Manufacturers are concentrating on recycling spent Li-ion batteries in order to meet the demand for them in cars.

Lithium-Ion Battery Recycling Market Overview

A lithium-ion battery (LIB) is a type of electrochemical cell that contains components such as electrodes and catalysts to support power generation for a variety of applications. The cathode and anode tubes contain a variety of precious metals with finite reserves and high resale prices. As a result, the recycling process of Li-ion batteries is used to recover and sell the raw materials collected in the electrode composition, lowering the overall project cost and impact. These causes will aid the growth of the lithium-ion battery recycling market

The increasing use of lithium-ion batteries in a variety of applications has raised worries about the restricted supply of the basic metal. The mining of this metal has a negative influence on the environment, including water pollution caused by chemical leakage. As a result of this, Li-ion battery recycling has recently increased. Furthermore, because no other material currently offers properties similar to lithium, battery producers are increasingly focusing on the reuse of lithium batteries to provide a suitable amount of metal for batteries for various uses. In this regard, the German chemical company BASF announced plans in June 2021 to begin construction of a new battery recycling and prototype production plant at its cathode active material (CAM) facility in Schwarzheide. When lithium-ion batteries reach the end of their useful life, the company intends to extract cobalt, manganese, lithium, and nickel using an enhanced method.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lithium-Ion Battery Recycling Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lithium-Ion Battery Recycling Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lithium-Ion Battery Recycling Market Drivers and Opportunities

Rising Demand for Electric Vehicles to Favor Market Growth

The rising popularity of electric vehicles is one of the main factors driving the lithium-ion battery recycling market. With the increasing volume of electric vehicles manufactured and sold, the need to recycle batteries at the end of their life cycle has become increasingly important. With collective awareness of environmental issues and the impact of greenhouse gas emissions, there is a global movement towards cleaner and more sustainable transportation options. The electric vehicle has proven to be a viable alternative to conventional internal combustion engines due to its zero emissions. Continuous improvements in battery technology and electric vehicle design have increased driving range, reduced charging time, and improved the overall performance of electric vehicles. This has made electric cars more practical and attractive to a wider demographic, increasing demand. The utility of lithium-ion batteries in electric vehicles is increasing. The utilization of electric vehicles is increasing due to an array of factors, such as lower energy efficiency, pollution, and consumer acceptance, which are among the factors driving the adoption of lithium-ion batteries. The development of advanced battery technology and the minimal maintenance requirements of these lithium-ion batteries are also contributing factors to the growth of electric vehicles. Therefore, the lithium-ion battery recycling market is projected to continue to increase due to the increasing use of lithium-ion batteries.

According to estimates of BILITI Electric, there are approximately 3 million (55,555) electric vehicles in the United States or approximately 1% of the total number of vehicles on the road. In 2022 alone, 55,555 companies produced approximately 442,000 electric vehicles. This indicates a significant increase in the production of electric vehicles by automakers.

Growing Demand from Various End Users - An Opportunity in the Lithium-Ion Battery Recycling Market

The electrical and electronics sector is among the biggest users of lithium-ion batteries because of its use in tablets, computers, mobile phones, and other electronic devices. The need for these energy sources has increased due to the expansion of the electrical and electronics industries, especially in the growing APAC countries like China, India, and Japan. Furthermore, the market for recycled lithium-ion batteries has a great chance of expanding in the upcoming years, owing to increasing demand from end-user industries. Moreover, several governments are introducing advanced battery recycling technology. For instance, in June 2023, The United States Department of Energy (DOE) announced more than $192 million in additional financing for recycling batteries from consumer items, the formation of an advanced battery research and development (R&D) collaboration, and the continuance of the Lithium-Ion Battery Recycling Prize, which was established in 2019. With the demand for electric vehicles (EVs) and stationary energy storage expected to increase more than tenfold by 2027, it is critical to invest in sustainable, low-cost consumer battery recycling to support a secure, resilient, and circular domestic supply chain for critical materials.

Lithium-Ion Battery Recycling Market Report Segmentation Analysis

Key segments that contributed to the derivation of the lithium-ion battery recycling market analysis are technology and application.

- Based on the technology, the lithium-ion battery recycling market is segmented into lithium-nickel manganese cobalt, lithium-iron phosphate, lithium-manganese oxide, lithium-titanate oxide, and lithium-nickel cobalt aluminum oxide.

- Based on application, the lithium-ion battery recycling market is segmented into automotive, mining, consumer electronics, industrial, and power.

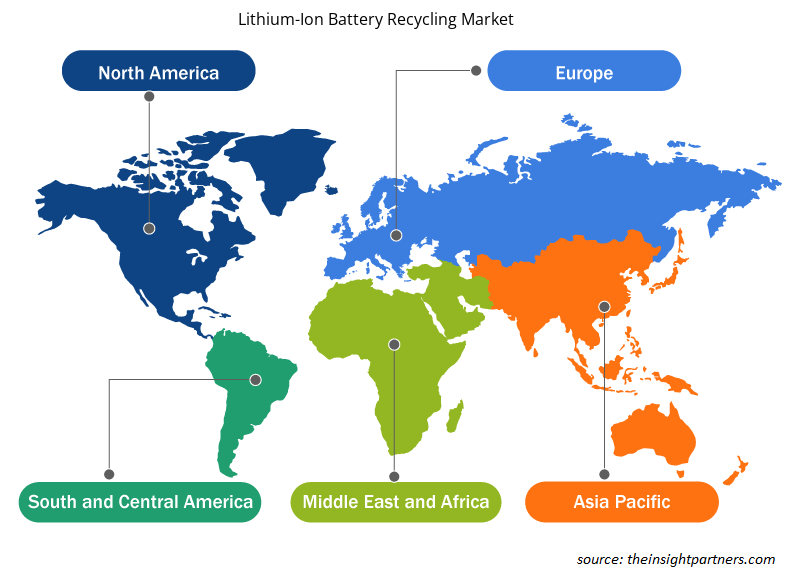

Lithium-Ion Battery Recycling Market Share Analysis by Geography

- The lithium-ion battery recycling market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. APAC dominated the market in 2023

- The presence of innovative and prominent suppliers such as GS Yuasa Corporation, Umicore SA, and others across the region has been ascribed to the market's dominant expansion. The emergence of new and attractive markets, such as electric vehicles and energy storage systems (ESS) for commercial and residential applications, is driving demand for LIBs. Moreover, the combined use of ESS with renewable energies such as wind, solar, and hydropower is technically and economically necessary to increase grid stability and advance the LIB segment.

Lithium-Ion Battery Recycling Market Regional Insights

The regional trends and factors influencing the Lithium-Ion Battery Recycling Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Lithium-Ion Battery Recycling Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Lithium-Ion Battery Recycling Market

Lithium-Ion Battery Recycling Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.18 billion |

| Market Size by 2031 | US$ 22.35 billion |

| Global CAGR (2023 - 2031) | 20.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

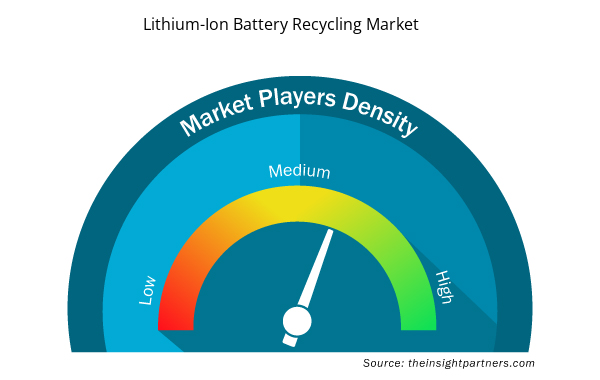

Lithium-Ion Battery Recycling Market Players Density: Understanding Its Impact on Business Dynamics

The Lithium-Ion Battery Recycling Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Lithium-Ion Battery Recycling Market are:

- Ecobat Technologies

- American Manganese Inc. (RecycLico Battery Material Inc.)

- Fortum

- GEM Co. Ltd

- International Metals Reclamation Company (INMETCO)

- Li-Cycle Corp.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Lithium-Ion Battery Recycling Market top key players overview

Lithium-Ion Battery Recycling Market News and Recent Developments

The peer to the peer insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the lithium-ion battery recycling market:

- In February 2024, Omega Seiki Private Ltd (OSPL) announced it had signed an agreement with Attero for the recycling of lithium-ion batteries. Under the collaboration, OSPL, along with e-waste management firm Attero, planned to recycle over 100MWh of batteries in the next 3-4 years.

(Source: Omega Seiki Private Ltd, Press Release)

- In May 2024, Lithium-metal battery manufacturer SES AI Corp., Boston, announced their plans to fund a new research initiative at Worcester Polytechnic Institute (WPI) to develop a “state-of-the-art” recycling technology for lithium-metal batteries.

(Source: SES AI Corp, Press Release)

Lithium-Ion Battery Recycling Market Report Coverage and Deliverables

The "Lithium-Ion Battery Recycling Market Size and Forecast (2021-2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Lithium-Ion Battery Recycling Market Forecast to 2027 - COVID-19 Impact and Global Analysis Byy Technology and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the estimated market size for the global lithium-ion battery recycling market in 2023?

The global lithium-ion battery recycling market was estimated to be US$ 5.18 billion in 2023 and is expected to grow at a CAGR of 20.1% during the forecast period 2024 - 2031.

What are the driving factors impacting the global lithium-ion battery recycling market?

Rising demand for electric vehicles is the major factor driving the lithium-ion battery recycling market.

What are the future trends of the global lithium-ion battery recycling market?

Strict guidelines regarding the disposal of untreated chemical waste and advancement in recycling technologies are anticipated to play a significant role in the global lithium-ion battery recycling market in the coming years.

Which are the key players holding the major market share of the lithium-ion battery recycling market?

The key players holding majority shares in the global lithium-ion battery recycling market are Ecobat Technologies, Li-Cycle Corp, Recupyl Battery Solutions, Fortum, and GEM Co.

Which region is expected to hold the highest market share in the lithium-ion battery recycling market?

Asia Pacific is expected to hold the highest market share in the lithium-ion battery recycling market

Get Free Sample For

Get Free Sample For