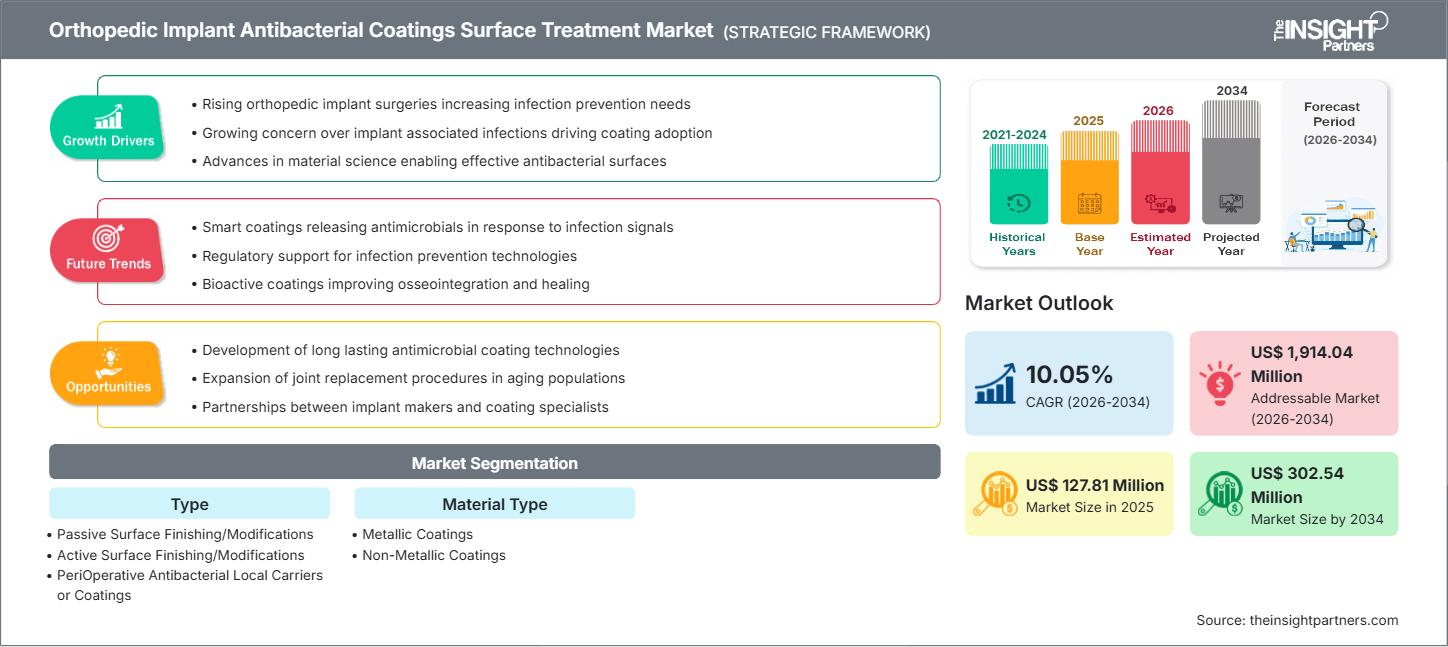

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Opportunities & Trends Analysis 2034

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Passive Surface Finishing/Modifications (PSM), Active Surface Finishing/Modifications (ASM), PeriOperative Antibacterial Local Carriers or Coatings (LCC)); Material Type (Metallic Coatings and Non-Metallic Coatings), and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00017477

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

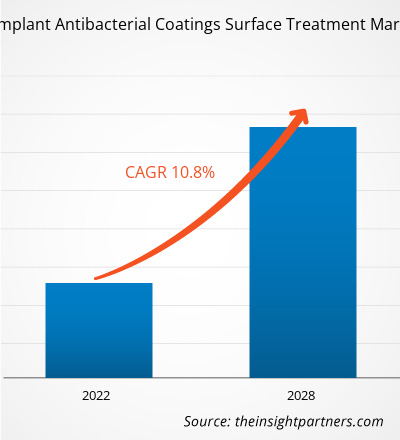

The Orthopedic Implant Antibacterial Coatings Surface Treatment Market size is expected to go from US$ 127.81 Mn in 2025 to US$ 302.54 Mn by 2034, further leading the CAGR to be around 10.05% between 2026-2034.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Analysis

The forecast indicates robust growth, driven primarily by the rising prevalence of implant-associated infections, which has heightened the demand for antibacterial coatings on orthopedic implants. Technological advancements in coating materials, including metallic and non-metallic coatings, and improved surface treatment methods are enabling more effective infection prevention. Additionally, the increasing volume of orthopedic surgeries globally, due to the growing incidence of musculoskeletal disorders and an aging population, fuels demand for implants with antibacterial surface treatments.

However, the high cost of implants with antimicrobial coating remains a deterrent, especially in price-sensitive markets. Regulatory challenges associated with the approval of novel coating materials also pose a restraint to market growth.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Overview

Orthopedic implant antibacterial coatings surface treatment refers to specialized surface treatments applied to implants (e.g., joint replacements, trauma fixation devices, spinal implants) to inhibit microbial colonization and prevent post-surgical infections. These coatings not only aim to reduce the risk of implant-associated infections, a serious complication in orthopedic surgeries, but also improve implant longevity, patient outcomes, and reduce the need for revision surgeries. As demand for orthopedic implants grows globally (driven by degenerative bone diseases, trauma cases, aging demographic), effective antibacterial surface treatment becomes critical to ensure successful surgical outcomes and long-term implant performance.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOrthopedic Implant Antibacterial Coatings Surface Treatment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Orthopedic Implant Antibacterial Coatings Surface Treatment Drivers and Opportunities

Market Drivers:

- Rising Incidence of Implant-Related Infections & Surgical Volume: As orthopedic surgeries increase worldwide, so does concern over post-surgical infections. Antibacterial coatings help mitigate these risks, driving demand.

- Advancements in Coating Technologies: Innovations in metallic (e.g., silver-ion) coatings, nano-coatings, bioactive surfaces, and other advanced surface treatments make implants more resistant to bacterial colonization.

- Increasing Geriatric Population and Orthopedic Disorders: As populations age and conditions such as osteoarthritis, fractures, and degenerative bone diseases rise, demand for orthopedic implants increases, thereby creating a greater need for antibacterial surface treatments.

Market Opportunities:

- Expansion in Emerging Markets: Developing regions with growing healthcare infrastructure and a rising number of orthopedic procedures represent a promising opportunity for wider adoption of antibacterial-coated implants.

- Integration of Nanotechnology & Bioactive Coatings: Use of nano-engineered surfaces, silver-ion coatings, antibiotic-eluting coatings, and other advanced materials offers an opportunity for more effective infection prevention and improved osseointegration.

- Growing Emphasis on Patient Safety & Post-Surgical Outcomes: With increasing awareness among patients and healthcare providers about implant-associated infections and their consequences, demand for safer, long-lasting implants with antibacterial surface treatments is likely to grow.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report Segmentation Analysis

By Type:

- Passive Surface Finishing / Modifications (PSM)

- Active Surface Finishing / Modifications (ASM)

- Peri-Operative Antibacterial Local Carriers or Coatings (LCC)

By Material Type:

- Metallic Coatings

- Non-Metallic Coatings

By Geography:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South & Central America

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Regional Insights

The regional trends and factors influencing the Orthopedic Implant Antibacterial Coatings Surface Treatment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Orthopedic Implant Antibacterial Coatings Surface Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 127.81 Million |

| Market Size by 2034 | US$ 302.54 Million |

| Global CAGR (2026 - 2034) | 10.05% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Orthopedic Implant Antibacterial Coatings Surface Treatment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Orthopedic Implant Antibacterial Coatings Surface Treatment Market top key players overview

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Regional Share Analysis

- North America holds a leading share, driven by advanced healthcare infrastructure, high adoption rate of premium implants with antibacterial coatings, and stringent infection-control regulations.

- Europe also represents a significant share, supported by regulatory standards, growing awareness of implant-associated infections, and demand for high-quality orthopedic care.

- Asia Pacific is anticipated to show strong growth owing to the rising geriatric population, increasing incidence of orthopedic disorders, expanding healthcare infrastructure, and growing number of orthopedic surgeries.

- Other regions (Middle East & Africa, South & Central America) represent emerging markets with potential growth, though adoption may be limited in some due to cost sensitivity and variable healthcare infrastructure.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The market landscape features a combination of large medical device manufacturers and specialized coating/ materials companies. The competition is growing as companies attempt to differentiate through advanced coating technologies, including metallic coatings, nano-coatings, antibiotic-eluting surfaces, and bioactive coatings.

Key strategies among players include:

- Investing in R&D for next-generation antibacterial coatings (nanotechnology, bioactive surfaces) to improve implant safety and longevity

- Partnering with healthcare providers, research institutions, and coating technology firms to accelerate the development and adoption of advanced surface treatments

- Targeting both premium markets (developed geographies with regulatory support) and emerging markets (with rising orthopedic surgery volume) to maximize reach.

This competitive environment is likely to drive innovation and broader adoption over the forecast period, though cost and regulatory approvals will remain critical hurdles.

Major Companies

- DOT GmbH

- Covalon Technologies Ltd.

- Sciessent LLC

- Harland Medical Systems, Inc.

- Isoflux, Inc.

- Allvivo Vascular, Inc.

- aap Implantate AG

- BASF SE

- Agienic Inc.

Other companies analyzed at the time of research are:

- Specialty Coating Systems, Inc. (SCS)

- AST Products, Inc.

- Hydromer, Inc.

- Koninklijke DSM N.V. (often “DSM”)

- PPG Industries, Inc.

- SurModics, Inc.

Market News & Recent Developments

- Advances in nanotechnology-based antibacterial coatings, including metallic (silver-ion), antibiotic-eluting, and bioactive coatings, are emerging as important trends, pushing forward product innovation and adoption.

- Growing global demand for orthopedic implants (hip replacements, knee replacements, trauma devices), driven by aging demographics and rising incidence of bone disorders, is boosting demand for infection-preventive coatings.

- Increasing regulatory scrutiny and quality standards for implant coatings have encouraged manufacturers to invest in safer, biocompatible, and more effective surface treatments.

Report Coverage and Deliverables

The “Orthopedic Implant Antibacterial Coatings Surface Treatment Market” report by The Insight Partners (Forecast to 2034) provides:

- Market size and forecast at global, regional, and country levels across key segments (by Type, Material Type, Implant/Application Type, Geography).

- Analysis of market trends, drivers, restraints, and growth opportunities (technological advancements, rising implant surgeries, infection prevention needs).

- Detailed segmentation analysis and structure of the market (coating type, implant type, end-use, geography).

- Competitive landscape including major players, their technological capabilities, and strategic positioning.

- Insights on market dynamics, adoption trends, barriers (cost, regulatory), and potential growth regions, to support strategic decision-making.

Frequently Asked Questions

2. Europe holds a significant share due to high-quality healthcare demand and regulatory compliance.

3. Asia Pacific is expected to grow rapidly given increasing orthopedic procedures, expanding healthcare infrastructure, and rising awareness about implant-related infections.

2. Technological advancements in coating materials and surface treatment techniques (metallic coatings, nano-coatings, antibiotic-eluting, bioactive coatings).

3. The increasing volume of orthopedic surgeries globally, driven by an aging population and the growing incidence of bone diseases.

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For