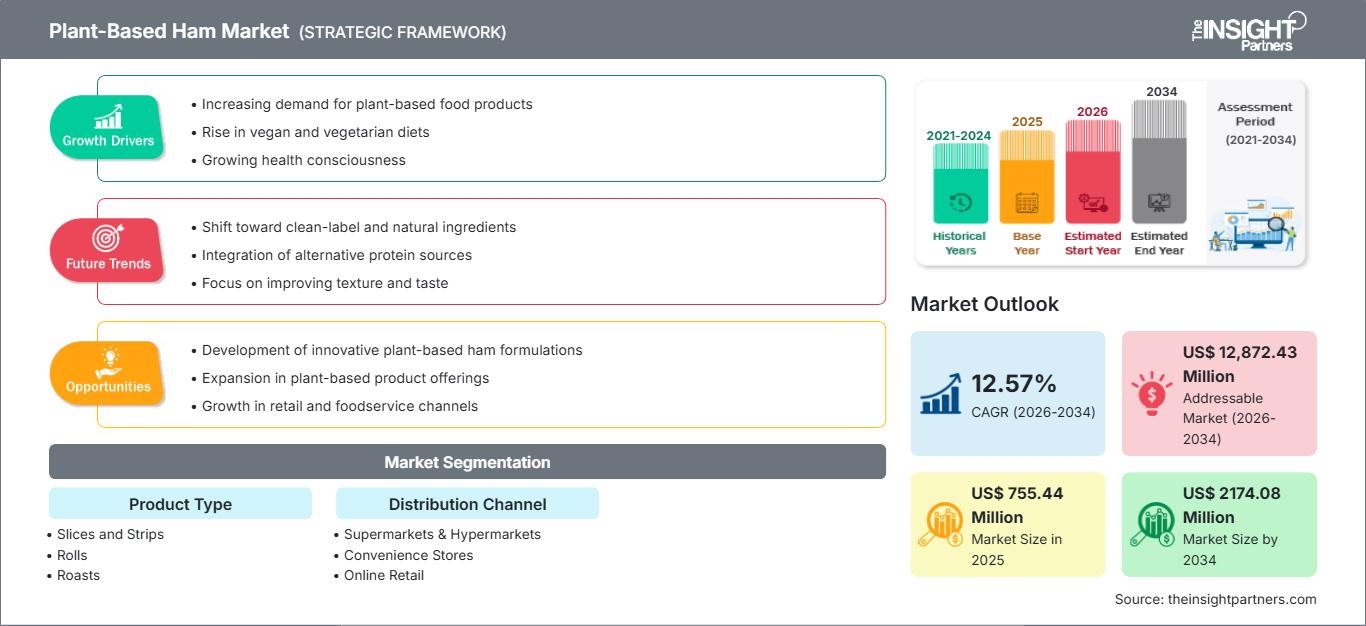

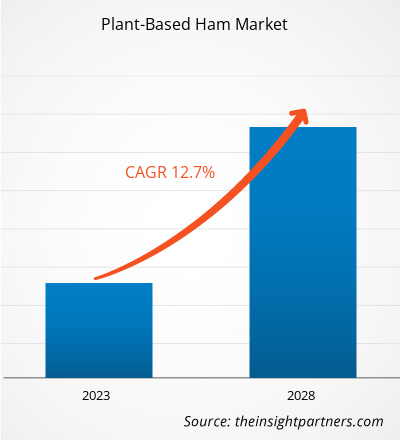

The plant-based ham market size is expected to grow from US$ 494.17 million in 2022 to US$ 1,010.45 million by 2028; it is estimated to grow at a CAGR of 12.7% from 2022 to 2028.

People are rapidly switching to plant-based meat products due to the rising awareness about the negative effects of meat consumption and the livestock industry on the environment, and the ill effects of consuming processed meat products on health. The production of plant-based ham products can help minimize carbon footprints, save water and other natural resources, and reduce the overall environmental impact. These factors are primarily driving the growth of the plant-based ham market.

In 2021, Europe held the largest share of the plant-based ham market. However, North America is estimated to register the highest CAGR during the forecast period. The high nutritional value of plant-based ham products, including slices & strips, rolls, and roasts, has triggered their demand in North America over the last few years, especially among young adults. The plant-based ham market in North America comprises several start-ups and established players. Hain Celestial Canada ULC; Tofurky Co., Inc.; Lightlife Foods Inc.; and Vbites Foods Ltd. are a few companies operating in the region. In addition, people from North American countries are well aware of the harmful effects of frequent meat consumption due to significant public awareness initiatives and publicity campaigns. The rising vegan population is another factor boosting the demand for plant-based ham products in North American countries.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPlant-Based Ham Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Plant-Based Ham Market

During the initial phase of the COVID-19 pandemic, the demand for plant-based ham increased considerably due to a significant shift in the dietary preference of consumers. The World Health Organization (WHO) published a guideline on food products that should be consumed or avoided during the COVID-19 pandemic. The guideline suggested limiting red meat consumption due to its high percentage of saturated fats. Moreover, people focused on reducing their overall meat consumption and shifted to vegetarian and vegan diets to improve their immunity, which created a massive demand for alternate proteins, including plant-based ham. However, manufacturing units were compelled to keep shut in 2020 and early 2021, leading to a decline in production. Small and medium-sized manufacturers faced significant challenges due to raw material shortages and low inventory levels. This created a gap between the demand and supply sides.

Rising health consciousness among the population and growing awareness regarding environmental sustainability and animal welfare were key factors that propelled the growth of the plant-based ham market before the onset of the COVID-19 pandemic. According to the International Food Information Council (IFIC) report published in January 2020, 45% of surveyed consumers believed plant-based meat products are healthier than animal meat, on the basis of the ‘Nutrition Facts’ label. However, after COVID-19 outbreak in 2020, food & beverages and many other industries faced unpredictable challenges as they struggled through supply chain constraints due to lockdowns, trade bans, and travel restrictions. Supply chain disruptions led to a shortage of raw materials, leading to a surge in raw material prices. According to the United States Department of Agriculture (USDA), disruptions in supply chains soared the prices of pea protein, which is one of the common ingredients used in plant-based ham. Moreover, difficulties pertaining to container transportation during the initial months of the COVID-19 pandemic contributed to a spike in prices of pea protein isolate from US$ 3.40/kg to over ~US$ 5.00/kg.

In 2021, various economies resumed operations as governments revoked the restrictions. Manufacturers were allowed to operate at full capacities, which helped them overcome the demand–supply gap and mitigate other repercussions. Moreover, a large percentage of citizens of several countries were fully vaccinated by the end of 2021. These factors are expected to provide profitable growth opportunities to plant-based ham producers in the coming years.

Market Insights

Strategic Developments by Key Market Players to Drive Plant-Based Ham Market During Forecast Period

In September 2022, Quorn Foods Ltd launched vegan deli slices range named Yorkshire Ham, Finely Sliced Ham, and Roast Beef or Roast Chicken Style Slices. The products are ready-to-eat meat-style slices, ideal for sandwiches, salads, and wraps.

Product Type Insights

Based on product type, the plant-based ham market is segmented into slices and strips, rolls, and roasts. The slices and strips segment held the largest market share in 2021. However, the roasts segment is expected to register the highest CAGR from 2022 to 2028. The sliced form of plant-based ham provides a tender mouthfeel. These slices warm faster due to the large, exposed surface area and release flavors distinctly when used in food preparations. Moreover, due to their wide consumption range, plant-based ham slices and strips are broadly available through various distribution channels. These factors are significantly driving the market growth in the segment.

Distribution Channel Insights

Based on Distribution Channel, the plant-based ham market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest market share in 2021, whereas the online retail segment is projected to register the highest CAGR during the forecast period. Supermarkets and hypermarkets are large retail establishments that offer a wide variety of food and beverages, groceries, and other consumer goods. Products from various brands are organized into separate sections for convenient shopping. Moreover, supermarkets and hypermarkets focus on maximizing product sales to increase profit margins. Therefore, these stores offer attractive discounts, multiple payment options, and a better customer experience.

Plant-Based Ham Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 494.17 Million |

| Market Size by 2028 | US$ 1,010.45 Million |

| Global CAGR (2022 - 2028) | 12.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Plant-Based Ham Market Players Density: Understanding Its Impact on Business Dynamics

The Plant-Based Ham Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Hain Celestial Canada ULC; Tofurky Co., Inc.; Lightlife Foods, Inc.; Vbites Foods, Ltd.; Nestle SA; Quorn Foods Ltd.; Meliora Foods Pty Ltd.; Zebra Food Ltd.; Gourmet Evoution, LLC; and Worthington Food Inc. are a few major players operating in the plant-based ham market. These companies mainly focus on product innovation to expand their market size and follow emerging market trends.

Report Spotlights

- Progressive industry trends in the plant-based ham market to help companies develop effective long-term strategies

- Business growth strategies adopted by the plant-based ham market players in the developed and developing countries

- Quantitative analysis of the market from 2020 to 2028

- Estimation of global demand for plant-based ham

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the plant-based ham market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the plant-based ham market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the plant-based ham market at various nodes

- Detailed overview and segmentation of the market, and growth dynamics of the plant-based ham industry

- Size of the plant-based ham market in various regions with promising growth opportunities

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For