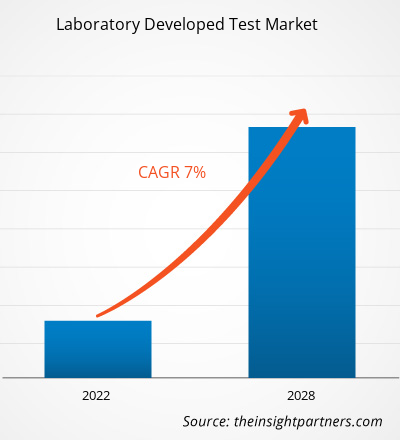

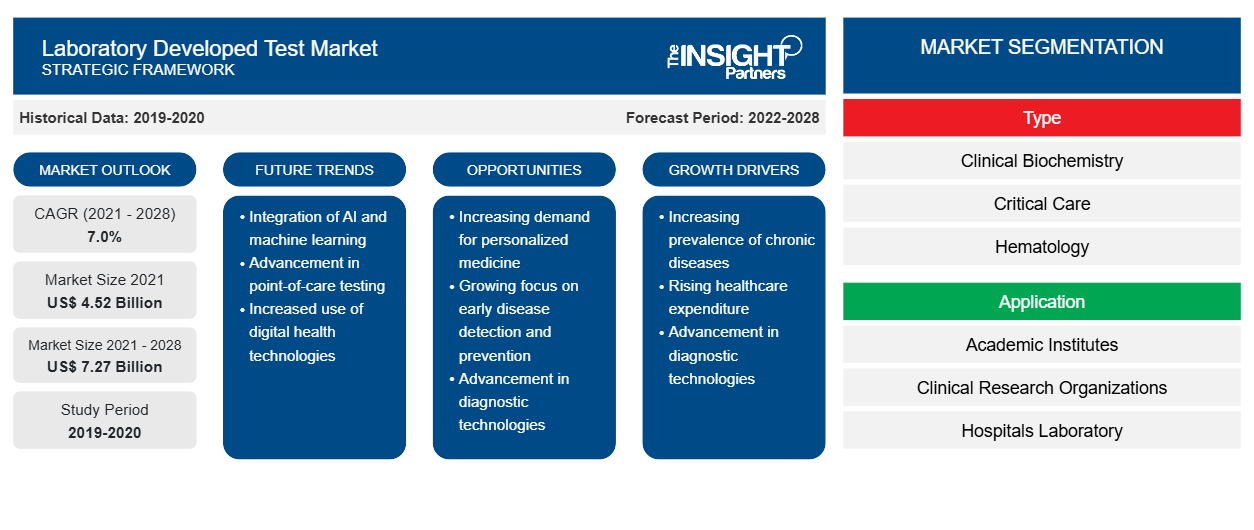

Der Markt für im Labor entwickelte Tests soll von 4.524,75 Millionen US-Dollar im Jahr 2021 auf 7.269,3 Millionen US-Dollar im Jahr 2028 anwachsen; für den Zeitraum 2021–2028 wird ein durchschnittliches jährliches Wachstum von 7,0 % erwartet.

Ein im Labor entwickelter Test (LDT) ist eine Art In-vitro-Diagnosetest, der in einem einzelnen Labor entwickelt und verwendet wird. Diese Tests können verwendet werden, um Analyten wie Proteine, Biomoleküle/Verbindungen (Glukose, Cholesterin usw.) und DNA, die aus Proben menschlicher Probanden extrahiert wurden, zu schätzen oder zu unterscheiden. Die Ausweitung automatisierter In-vitro-Diagnostikmethoden (IVD) für Labore und Apotheken zur Ermöglichung präziser und fehlerfreier Analysen treibt das Wachstum des Marktes für im Labor entwickelte Tests voran.

Das Wachstum des Marktes für im Labor entwickelte Tests ist hauptsächlich auf Faktoren wie die zunehmende Zahl von Krebserkrankungen und genetischen Störungen sowie die große Zahl von Produkteinführungen zurückzuführen. Das sich ändernde regulatorische Umfeld behindert jedoch das Marktwachstum. In Europa beispielsweise wird die Einhaltung der In-Vitro Device Regulation (IVDR) ab Mai 2022 für alle In-vitro-Diagnostiktests verpflichtend. Die Verordnung zielt darauf ab, die klinische Wirksamkeit und Sicherheit medizinischer Tests zu gewährleisten und so die Diagnostikbranche zu verändern, was den Marktteilnehmern große Sorgen bereitet.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlose Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Markteinblicke

Kontinuierliche Forschung zu personalisierten Medikamenten bietet Wachstumschancen für Akteure auf dem Markt für im Labor entwickelte Tests

LDTs spielen eine entscheidende Rolle bei der Entwicklung personalisierter Medikamente, die sich wahrscheinlich als vielversprechendes Mittel zur Bekämpfung von Krankheiten durch bislang unerreichte wirksame Behandlungen oder Heilmittel erweisen werden. Laut der Personalized Medicine Coalition machten personalisierte Medikamente 2005 nur 5 % der neuen von der FDA zugelassenen molekularen Einheiten aus; 2016 stieg diese Zahl jedoch auf über 25 %. Darüber hinaus haben 42 % aller Verbindungen und 73 % der in der Pipeline befindlichen onkologischen Verbindungen das Potenzial, als personalisierte Medikamente zu dienen. Biopharmazeutische Unternehmen haben ihre F&E-Investitionen in personalisierte Medikamente in den letzten fünf Jahren fast verdoppelt, und es wird erwartet, dass sie ihre Investitionen in den nächsten fünf Jahren um weitere 33 % erhöhen werden. Biopharmazeutische Forscher prognostizieren außerdem einen Anstieg der Entwicklung personalisierter Medikamente um 69 % in den nächsten fünf Jahren. Labortests werden verwendet, um Krankheiten zu diagnostizieren und die Reaktion auf Medikamente vorherzusagen und zu überwachen sowie um Informatikdaten zu erhalten, die für komplexe Vorhersagealgorithmen erforderlich sind. play a vital role in the development of personalized medicines that are likely to prove as promising means of tackling diseases through far eluded effective treatments or cures. As per the Personalized Medicine Coalition, personalized medicines accounted for only 5% of the new FDA-approved molecular entities in 2005; however, in 2016, this number rose to more than 25%. Additionally, 42% of all compounds and 73% of oncology compounds in the pipeline have the potential to serve as personalized medicines. Biopharmaceutical companies have nearly doubled their R&D investments in personalized drugs in the last five years, and they are further expected to increase their investments by 33% in the next five years. Biopharmaceutical researchers also predict a 69% increase in the development of personalized medicines in the next five years. Laboratory tests are used to diagnose illness and predict and monitor drug response as well as to obtain informatics data needed for complex predictive algorithms.

Personalisierte Medikamente werden zum Markenzeichen der Krebsbehandlung. Dabei handelt es sich um einen sich ständig weiterentwickelnden Ansatz, der auf der Anpassung der Behandlungen an die individuelle genetische Ausstattung basiert. Im Jahr 2019 genehmigte die FDA 12 personalisierte Medikamente zur Erforschung und Behandlung der Grundursachen von Krankheiten und kombinierte so Präzisionsmedizin mit der klinischen Versorgung. Die steigende Nachfrage nach personalisierter Medizin bietet erhebliche Wachstumschancen für das Wachstum der Akteure auf dem Markt für im Labor entwickelte Tests.

Typbasierte Erkenntnisse

Der Markt für im Labor entwickelte Tests ist nach Typ in klinische Biochemie, Intensivmedizin, Hämatologie, Mikrobiologie, Molekulardiagnostik, Immunologie und andere unterteilt. Das Segment der Molekulardiagnostik wird voraussichtlich im Jahr 2021 den größten Marktanteil haben. Es wird jedoch erwartet, dass das Segment Hämatologie im Prognosezeitraum die höchste durchschnittliche jährliche Wachstumsrate (CAGR) auf dem Markt verzeichnet.CAGR in the market during the forecast period.

Anwendungsbasierte Erkenntnisse

Durch Anwendung entwickelte das Labor Testmarktanwendungen in akademischen Instituten, klinischen Forschungsorganisationen, Krankenhauslaboren, Spezialdiagnosezentren und anderen. Schätzungen zufolge wird das Segment der Krankenhauslabore im Jahr 2021 den größten Marktanteil haben. Es wird jedoch erwartet, dass das Segment der Spezialdiagnosezentren im Prognosezeitraum die höchste durchschnittliche jährliche Wachstumsrate auf dem Markt verzeichnet.CAGR in the market during the forecast period.

Produkteinführungen und Zulassungen sind häufig von Unternehmen angewandte Strategien, um ihre globale Präsenz und ihr Produktportfolio zu erweitern. Darüber hinaus konzentrieren sich die Marktteilnehmer für im Labor entwickelte Tests auf die Partnerschaftsstrategie, um ihren Kundenstamm zu vergrößern, was ihnen wiederum ermöglicht, ihren Markennamen weltweit aufrechtzuerhalten.

Der Bericht segmentiert den von Laboren entwickelten Testmarkt wie folgt

Basierend auf dem Typ ist der Markt für im Labor entwickelte Tests in klinische Biochemie, Intensivmedizin, Hämatologie, Mikrobiologie, Molekulardiagnostik, Immunologie und andere unterteilt. Basierend auf der Anwendung ist der Markt für im Labor entwickelte Tests in akademische Institute, klinische Forschungsorganisationen, Krankenhauslabore, spezialisierte Diagnosezentren und andere unterteilt. Basierend auf der Geografie ist der Markt für im Labor entwickelte Tests in Nordamerika (USA, Kanada und Mexiko), Europa (Großbritannien, Deutschland, Frankreich, Italien, Spanien und der Rest von Europa), Asien-Pazifik (China, Japan, Indien, Australien, Südkorea und der Rest des Asien-Pazifik-Raums), den Nahen Osten und Afrika (die Vereinigten Arabischen Emirate, Saudi-Arabien, Südafrika und der Rest des Nahen Ostens und Afrikas) und Süd- und Mittelamerika (Brasilien, Argentinien und der Rest von Süd- und Mittelamerika) unterteilt.

Regionale Einblicke in den Markt für im Labor entwickelte Tests

Die regionalen Trends und Faktoren, die den Markt für im Labor entwickelte Tests während des gesamten Prognosezeitraums beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie für im Labor entwickelte Tests in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Erhalten Sie regionale Daten zum Markt für im Labor entwickelte Tests

Umfang des Marktberichts über im Labor entwickelte Tests

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2021 | 4,52 Milliarden US-Dollar |

| Marktgröße bis 2028 | 7,27 Milliarden US-Dollar |

| Globale CAGR (2021 - 2028) | 7,0 % |

| Historische Daten | 2019-2020 |

| Prognosezeitraum | 2022–2028 |

| Abgedeckte Segmente |

Nach Typ

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für im Labor entwickelte Tests: Die Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für im Labor entwickelte Tests wächst rasant, angetrieben durch die steigende Nachfrage der Endnutzer aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung der Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten Unternehmen auf dem Markt für im Labor entwickelte Tests sind:

- Quest Diagnostics GmbH

- F. HOFFMANN-LA ROCHE LTD.,

- QIAGEN

- Illumina, Inc.,

- Eurofins Scientific

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für im Labor entwickelte Tests

Firmenprofile

- Quest Diagnostics GmbH

- F. HOFFMANN-LA ROCHE LTD.,

- QIAGEN

- Illumina, Inc.,

- Eurofins Scientific

- Biodesix

- Adaptive Biotechnologien

- Biotheranostik

- Rosetta Genomics Ltd.,

- Wächter Gesundheit

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Im Labor entwickelter Testmarkt

Kostenlose Probe anfordern für - Im Labor entwickelter Testmarkt