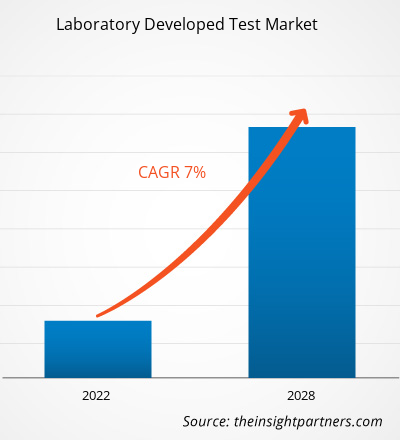

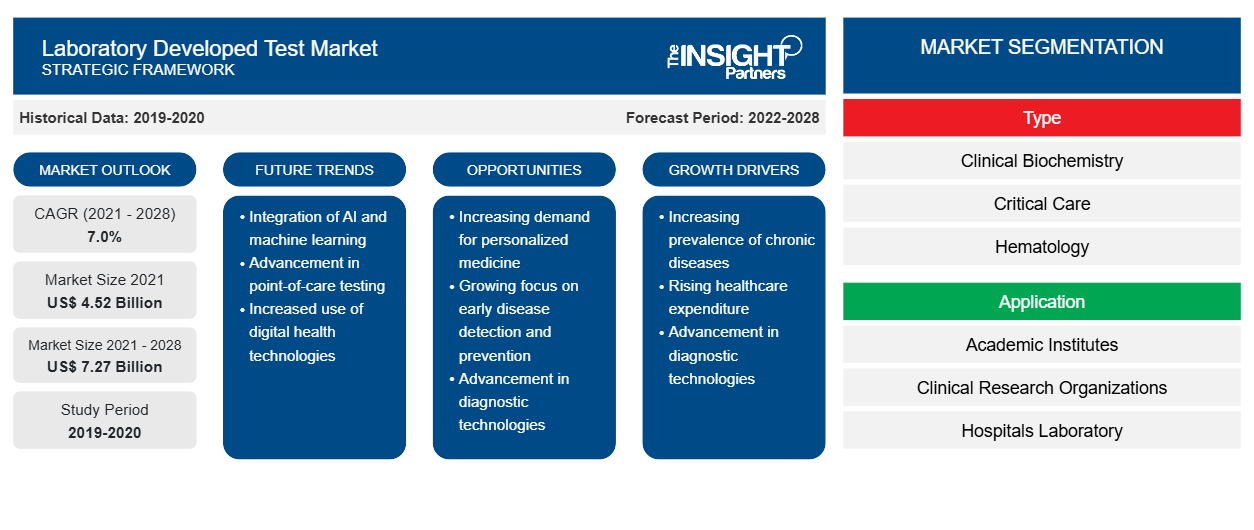

实验室开发测试市场规模预计将从 2021 年的 45.2475 亿美元增至 2028 年的 72.693 亿美元;预计 2021-2028 年期间的复合年增长率为 7.0%。CAGR of 7.0% during 2021–2028.

实验室开发测试 (LDT) 是一种在单个实验室内设计和使用的体外诊断测试。这些测试可用于估计或区分分析物,例如蛋白质、生物分子/化合物(葡萄糖、胆固醇等)以及从人类受试者采集的标本中提取的 DNA。实验室和药房扩大自动化体外诊断 (IVD) 方法的使用范围,以提供精确且无误的分析,这推动了实验室开发测试市场的增长。 LDT) is a type of in vitro diagnostic test designed and used within a single laboratory. These tests can be used to estimate or distinguish an analytes such as proteins, biomolecules/compounds (glucose, cholesterol, etc.), and DNA extracted from specimens collected from human subjects. The expansion of automated in vitro diagnostics (IVD) methods for laboratories and dispensaries to render precise and error-free analysis is fueling the laboratory developed test market growth.

实验室开发测试市场的增长主要归因于癌症和遗传疾病发病率的增加以及大量产品上市等因素。然而,监管环境的变化阻碍了市场的增长。例如,在欧洲,从 2022 年 5 月起,所有体外诊断测试都必须遵守体外设备法规 (IVDR);该法规旨在确保医疗测试的临床有效性和安全性,从而改变诊断行业,这是市场参与者非常关心的问题。In-Vitro Device Regulation (IVDR) compliance will be mandatory for all in vitro diagnostic tests from May 2022; the regulation aims to secure the clinical effectiveness and safety of medical tests, thus transforming the diagnostic industry, which is a great concern for the market players.

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

市场洞察

个性化医疗的持续研究为实验室开发测试市场参与者提供了增长机会

LDT 在个性化药物的开发中发挥着至关重要的作用,个性化药物很可能成为通过目前尚未发现的有效治疗或治愈方法治疗疾病的有效手段。根据个性化药物联盟的数据,个性化药物在 2005 年仅占 FDA 批准的新分子实体的 5%;然而,在 2016 年,这一数字上升到 25% 以上。此外,42% 的所有化合物和 73% 的肿瘤化合物都有可能成为个性化药物。过去五年,生物制药公司在个性化药物方面的研发投资几乎翻了一番,预计未来五年他们的投资将进一步增加 33%。生物制药研究人员还预测,未来五年个性化药物的开发将增长 69%。实验室测试用于诊断疾病、预测和监测药物反应以及获取复杂预测算法所需的信息数据。 play a vital role in the development of personalized medicines that are likely to prove as promising means of tackling diseases through far eluded effective treatments or cures. As per the Personalized Medicine Coalition, personalized medicines accounted for only 5% of the new FDA-approved molecular entities in 2005; however, in 2016, this number rose to more than 25%. Additionally, 42% of all compounds and 73% of oncology compounds in the pipeline have the potential to serve as personalized medicines. Biopharmaceutical companies have nearly doubled their R&D investments in personalized drugs in the last five years, and they are further expected to increase their investments by 33% in the next five years. Biopharmaceutical researchers also predict a 69% increase in the development of personalized medicines in the next five years. Laboratory tests are used to diagnose illness and predict and monitor drug response as well as to obtain informatics data needed for complex predictive algorithms.

个性化医疗正成为癌症治疗的标志;这是一种不断发展的方法,基于根据个人基因组成定制治疗方案。2019 年,FDA 批准了 12 种个性化药物,用于调查和解决疾病的根本原因,从而将精准医疗与临床护理相结合。个性化医疗需求的不断增长为实验室开发测试市场参与者的增长提供了巨大的增长机会。

基于类型的洞察

实验室开发的测试市场按类型分为临床生物化学、重症监护、血液学、微生物学、分子诊断、免疫学等。分子诊断部分预计将在 2021 年占据最大的市场份额。然而,预计血液学部分将在预测期内实现最高的复合年增长率。CAGR in the market during the forecast period.

基于应用的洞察

根据应用,实验室将测试市场应用扩展到学术机构、临床研究组织、医院实验室、专业诊断中心等。预计医院实验室部分将在 2021 年占据最大的市场份额。然而,预计专业诊断中心部分将在预测期内实现最高的复合年增长率。CAGR in the market during the forecast period.

产品发布和审批是企业扩大全球影响力和产品组合的常用策略。此外,实验室开发的测试市场参与者专注于合作策略来扩大客户群,这反过来又使他们能够在全球范围内维护自己的品牌名称。

报告将实验室开发测试市场细分如下

根据类型,实验室开发测试市场细分为临床生物化学、重症监护、血液学、微生物学、分子诊断、免疫学等。根据应用,实验室开发测试市场细分为学术机构、临床研究组织、医院实验室、专业诊断中心等。根据地域,实验室开发测试市场细分为北美(美国、加拿大和墨西哥)、欧洲(英国、德国、法国、意大利、西班牙和欧洲其他地区)、亚太地区(中国、日本、印度、澳大利亚、韩国和亚太其他地区)、中东和非洲(阿联酋、沙特阿拉伯、南非和中东和非洲其他地区)以及南美洲和中美洲(巴西、阿根廷和南美洲和中美洲其他地区)。

实验室开发测试市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响实验室开发测试市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的实验室开发测试市场细分和地理位置。

- 获取实验室开发测试市场的区域特定数据

实验室开发测试市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2021 年市场规模 | 45.2亿美元 |

| 2028 年市场规模 | 72.7 亿美元 |

| 全球复合年增长率(2021 - 2028) | 7.0% |

| 史料 | 2019-2020 |

| 预测期 | 2022-2028 |

| 涵盖的领域 |

按类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

实验室开发测试市场参与者密度:了解其对业务动态的影响

实验室开发测试市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在实验室开发测试市场运营的主要公司有:

- Quest Diagnostics 公司

- F.霍夫曼-拉罗氏有限公司,

- 凯杰公司

- Illumina 公司

- 欧陆科技

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取实验室开发测试市场顶级关键参与者概述

公司简介

- Quest Diagnostics 公司

- F.霍夫曼-拉罗氏有限公司,

- 凯杰公司

- Illumina 公司

- 欧陆科技

- 生物降解塑料

- 自适应生物技术

- 生物诊疗学

- Rosetta Genomics 有限公司

- 卫安医疗

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 实验室开发的测试市场

获取免费样品 - 实验室开发的测试市场