Gas Turbine Market Insights & Forecast 2024-2031

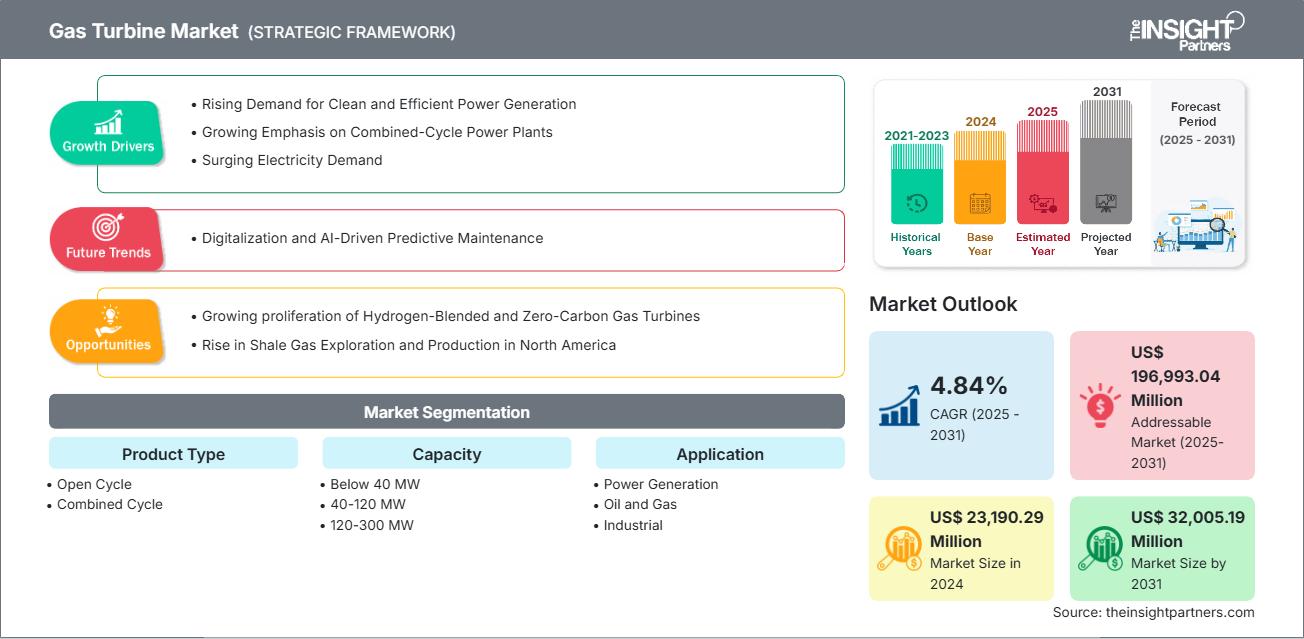

Gas Turbine Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Open Cycle and Combined Cycle), Capacity (Below 40 MW, 40--120 MW, 120--300 MW, and Above 300 MW), Application (Power Generation, Oil and Gas, and Industrial), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00010050

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 208

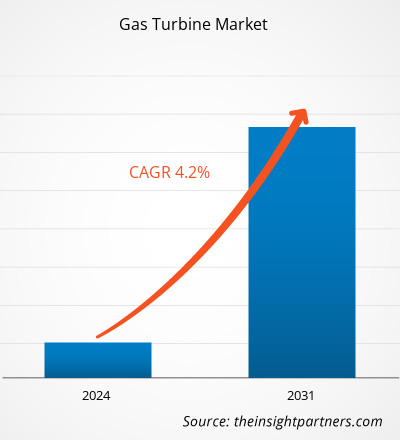

The gas turbine market size is projected to reach US$ 32,005.19 million by 2031 from US$ 23,190.29 million in 2024. The market is expected to register a CAGR of 4.84% during 2025–2031.

Gas Turbine Market Analysis

The rising demand for clean and efficient power generation, growing emphasis on combined-cycle power plants, surging demand for electricity, and availability of natural gas and infrastructure development are driving market growth. The growing proliferation of hydrogen-blended and zero-carbon gas turbines and the rise in shale gas exploration and production in North America are projected to provide lucrative opportunities to the market during the forecast period. Digitalization and AI-driven predictive maintenance are expected to emerge as a trend in the gas turbine market during 2025–2031.

Gas Turbine Market Overview

The global gas turbine market is crucial in the overall energy and industrial landscape. Growing demands for energy, rising stringent environmental regulations, and increasing advancements in turbine technology drive the gas turbine market growth. Gas turbines are pivotal in power generation, industrial applications, and the transition toward cleaner energy sources. Stringent environmental regulations are pushing utilities and industries to adopt cleaner energy solutions. Gas turbines, which release less carbon dioxide than coal-fired power plants, are becoming a preferred alternative for power generation. This aligns with the global drive toward decarbonization and the adoption of low-carbon energy technologies.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGas Turbine Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gas Turbine Market Drivers and Opportunities

Market Drivers:

- Rising Demand for Clean Energy: Gas turbines are increasingly used in combined cycle power plants due to their lower emissions compared to coal, supporting global decarbonization goals.

- Growth in Industrial Applications: Industries such as oil & gas, manufacturing, and chemicals are adopting gas turbines for reliable and efficient power generation.

- Technological Advancements: Innovations in turbine materials, cooling technologies, and digital monitoring systems are improving efficiency, lifespan, and performance.

- Energy Security and Grid Stability: Gas turbines offer quick ramp-up capabilities, making them ideal for balancing renewable energy sources and ensuring grid reliability.

- Government Incentives and Policies: Supportive regulations and incentives for cleaner energy technologies are encouraging investment in gas turbine infrastructure.

Market Opportunities:

- Hybrid Systems Integration: Combining gas turbines with renewable sources and energy storage systems opens up new possibilities for flexible and sustainable power generation.

- Emerging Markets Expansion: Rapid urbanization and industrialization in regions like Southeast Asia, Africa, and Latin America are creating demand for efficient power solutions.

- Retrofitting and Upgrades: Aging power plants present opportunities for modernization through turbine upgrades, improving efficiency and reducing emissions.

- Hydrogen-Fueled Turbines: Development of turbines capable of running on hydrogen or hydrogen-natural gas blends is a major opportunity in the transition to net-zero.

- Digitalization and Predictive Maintenance: Adoption of AI and IoT for real-time monitoring and predictive maintenance is reducing downtime and operational costs.

Gas Turbine Market Report Segmentation Analysis

The gas turbine market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Technology:

- Open Cycle Gas Turbines These turbines operate without a heat recovery system, making them ideal for applications requiring rapid start-up and lower capital investment. They are commonly used in peak load power stations and emergency backup systems. While less efficient than combined cycle systems, they offer flexibility and simplicity in operation.

- Combined Cycle Gas Turbines These systems integrate gas and steam turbines to maximize energy output by utilizing waste heat. They are preferred for base-load power generation due to their high efficiency and lower emissions. Combined cycle plants are dominant in regions focusing on cleaner and more sustainable energy solutions.

By Capacity:

- Below 40 MW Small-capacity turbines are used in decentralized power generation, mobile units, and backup systems. Their compact size and quick deployment make them suitable for remote or off-grid locations.

- 40–120 MW Mid-range turbines serve industrial facilities, small utilities, and regional grids. They balance efficiency and scalability, often used in cogeneration setups where both electricity and heat are needed.

- 120–300 MW These turbines are deployed in large industrial complexes and utility-scale power plants. They offer high efficiency and are often part of combined cycle systems, contributing significantly to regional energy supply.

- Above 300 MW High-capacity turbines are used in major utility power stations. They are engineered for maximum output and efficiency, often incorporating advanced materials and digital monitoring systems. This segment is crucial for meeting national grid demands and integrating with renewable energy sources.

By Application:

- Power Generation

- Oil and Gas

- Industrial

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The gas turbine market in Asia Pacific is expected to witness the fastest growth.

Gas Turbine

Gas Turbine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 23,190.29 Million |

| Market Size by 2031 | US$ 32,005.19 Million |

| Global CAGR (2025 - 2031) | 4.84% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Gas Turbine Market Players Density: Understanding Its Impact on Business Dynamics

The Gas Turbine Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Gas turbine market Share Analysis by Geography

The gas turbine market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South America (SAM). North America dominated the market in 2024, followed by Europe and Asia Pacific.

North America dominates the global gas turbine market, owing to advanced infrastructure, technological innovation, and strong demand across the power generation and industrial sectors. The US has led the widespread deployment of combined-cycle gas turbines, supported by abundant natural gas resources and a shift from coal. The region is also pioneering hydrogen-compatible and carbon capture-ready turbine technologies. Gas turbines are vital to grid reliability, especially with increasing renewable integration. North America’s robust aerospace and defence industries contribute significantly to turbine development, reinforcing its leadership in both stationary and aviation turbine segments.

Below is a summary of market share and trends by region:

1. North America

- Market Share: Significant share due to established energy infrastructure and technological leadership.

-

Key Drivers:

- Aging power plants being upgraded with efficient gas turbines.

- Strong demand for flexible power generation to support renewable integration.

- Presence of major OEMs like GE and Siemens Energy.

- Trends: Growth in combined cycle installations and hydrogen-ready turbine development.

2. Europe

- Market Share: Substantial, driven by decarbonization goals and energy transition policies.

-

Key Drivers:

- EU climate targets encouraging low-emission technologies.

- Replacement of coal with gas in several countries.

- High adoption of combined cycle systems for efficiency.

- Trends: Increasing focus on hydrogen-compatible turbines and digital monitoring solutions.

3. Asia Pacific

- Market Share: Rapidly growing due to industrial expansion and urbanization.

-

Key Drivers:

- Rising electricity demand in countries like China, India, and Southeast Asia.

- Government investments in gas-based power plants.

- Infrastructure development in emerging economies.

- Trends: Shift toward mid- and high-capacity turbines and integration with renewables.

4. Middle East and Africa

- Market Share: Moderate but expanding, especially in oil-rich nations.

-

Key Drivers:

- Use of gas turbines in oil & gas operations and desalination plants.

- Investments in energy diversification and grid reliability.

- Availability of natural gas resources.

- Trends: Growth in open cycle turbines for peak load and industrial use.

5. South America

- Market Share: Emerging market with potential for growth.

-

Key Drivers:

- Need for reliable power in remote and industrial regions.

- Transition from hydro to gas in some countries due to climate variability.

- Government support for energy infrastructure.

- Trends: Adoption of small- to mid-capacity turbines and hybrid systems.

Gas Turbine Market Players Density: Understanding Its Impact on Business Dynamics

Medium Market Density and Competition

Competition is medium due to the presence of established players such as GE Vernova Inc.; Siemens AG; Mitsubishi Heavy Industries Ltd; Caterpillar Inc; Kawasaki Heavy Industries Ltd are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Diverse product types and materials cater to varied consumer needs, increasing rivalry.

- Low entry barriers allow many small and regional players to enter the market.

- Customization demand pushes brands to innovate and differentiate constantly.

- Strong presence of global and local manufacturers intensifies price and feature competition.

- E-commerce growth enables direct-to-consumer sales, increasing market saturation.

- Technological advancements like smart sheds and modular designs raise innovation stakes.

- Price-sensitive consumers drive aggressive pricing and promotional strategies.

Opportunities and Strategic Moves

- Hybrid Energy Integration Combine gas turbines with renewable energy sources (solar, wind) and energy storage systems to enhance grid flexibility and reliability.

- Low-Carbon and Hydrogen Fuel Adoption Develop turbines capable of running on hydrogen or hydrogen-natural gas blends to support decarbonization and meet climate targets.

- Digitalization & Smart Monitoring Integrate IoT and AI for predictive maintenance, real-time performance optimization, and remote diagnostics to reduce downtime and operational costs.

- Modular & Scalable Designs Offer modular turbine systems that can be scaled based on demand, especially useful for industrial and remote applications.

- Expansion in Emerging Markets Tap into growing energy demand in Asia Pacific, Africa, and South America through infrastructure development and localized manufacturing.

- E-commerce & Direct Sales Channels Utilize digital platforms for equipment sales, service subscriptions, and virtual configuration tools for industrial clients.

- Flexible Ownership Models Introduce leasing, performance-based contracts, and service-as-a-product models to reduce upfront costs and attract new customers.

- Strategic Partnerships & Alliances Collaborate with EPC firms, energy utilities, and technology providers to expand market reach and accelerate innovation.

Major Companies operating in the Gas turbine market are:

- GE Vernova Inc.

- Siemens AG

- Mitsubishi Heavy Industries Ltd

- Caterpillar Inc

- Kawasaki Heavy Industries Ltd

- Baker Hughes Co

- Capstone Green Energy Holdings, Inc.

- Industrial Boilers America

- Doncasters Group

- Vericor Power Systems.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Aurelia Turbines Oy

- Jereh Energy Equipment and Technologies Corporation

- Power Systems Mfg., LLC

- APR Energy

- Mapna Group

- Dongfang Electric Corporation

- Shanghai Electric

- Doosan Enerbility Co.

- AECC Gas Turbine

- Rostec United Engine Corporation

- Rolls-Royce plc

- IHI Power Systems, Co. Ltd.

Gas turbine market News and Recent Developments

- GE Vernova Signed EPC Contract GE Vernova (NYSE: GEV) has secured an order for five 7H-Class gas turbines - three 7HA.03 and two 7HA.02 units from Técnicas Reunidas and Orascom Construction (TR & ORASCOM CONSTRUCTION). Under a 50-50 joint venture, these companies have signed the Engineering, Procurement and Construction (EPC) contract for Qurayyah Independent Power Plant (IPP) Expansion Project in the Eastern Province in Saudi Arabia. (Source: GE Vernova, Press Release, May 2025)

- Capstone Green Energy Holdings, Inc. Signed Supply Agreement Capstone Green Energy Holdings, Inc. and Capstone Green Energy, LLC., announced that its Australian distributor, Optimal Group, has been selected as the EPC (engineering, procurement, and construction) contractor for a remote community power generation project in Oceania. The project will deploy two Capstone C1000S Signature Series microturbines in a scalable configuration to deliver an initial 2 megawatts (MW) of reliable, low-emission power to an isolated community. This system is designed for expansion, with the ability to scale up to 5MW of power. (Source: Capstone Green Energy Holdings, Inc., Press Release, May 2025)

Gas Turbine Market Report Coverage and Deliverables

The "Gas Turbine Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Gas turbine market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Gas turbine market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Gas turbine market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Gas turbine market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For