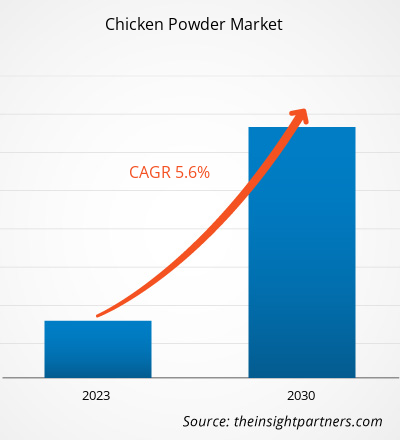

Se proyecta que el tamaño del mercado de polvo de pollo alcance los US$ 902,14 millones para 2031, desde los US$ 607,05 millones de 2024. Se espera que el mercado registre una tasa de crecimiento anual compuesta (TCAC) del 5,9 % entre 2025 y 2031.

Análisis del mercado de polvo de pollo

La demanda de pollo en polvo se ve influenciada por la creciente preferencia de los consumidores por ingredientes alimentarios prácticos, sabrosos y versátiles. Con el auge de los estilos de vida ajetreados, los fabricantes incorporan pollo en polvo para mejorar el sabor de fideos instantáneos, sopas, refrigerios y comidas preparadas, lo que genera oportunidades en la industria de alimentos preparados. La creciente urbanización y el crecimiento de los servicios de alimentación incrementan el consumo de condimentos, marinadas y alimentos procesados. La demanda de los consumidores preocupados por la salud se ve impulsada por fórmulas naturales, bajas en sodio y de etiqueta limpia que promueven la innovación y la calidad superior de los productos. En las economías en desarrollo, el aumento de la renta disponible y la tendencia hacia los alimentos envasados ofrecen un gran potencial de crecimiento. Mientras tanto, la globalización de la gastronomía y la creciente popularidad de la cocina casera favorecen el uso más amplio de sabores avícolas. Estos factores ofrecen cada vez más posibilidades a los fabricantes para establecer productos de pollo en polvo diferenciados y de alta calidad que satisfagan las necesidades cambiantes de los consumidores y la industria.

Descripción general del mercado de polvo de pollo

El polvo de pollo es un saborizante deshidratado compuesto por carne de pollo, caldo, grasas y compuestos naturales de sabor, comúnmente mezclados con sal, especias y, en algunos casos, extractos vegetales para formar un aditivo rico que realza el sabor umami. Se produce mediante métodos que incluyen el secado por aspersión o la deshidratación, que transforman la esencia líquida de pollo en un polvo estable, que se utiliza en sopas, botanas, marinadas y comidas preparadas. El mercado está evolucionando rápidamente, con consumidores y fabricantes que exigen formulaciones de etiqueta limpia, naturales y bajas en aditivos, sin perder el sabor auténtico. Las tendencias emergentes incluyen el auge de variedades orgánicas y bajas en sodio, productos premium elaborados con caldo de pollo real e innovaciones dirigidas a los consumidores preocupados por la salud. Existe un creciente desarrollo de productos basado en cocinas globales, cocina casera y condimentos de valor añadido. A medida que el producto se desarrolla según las tendencias culinarias emergentes, las marcas ofrecen sabores más diferenciados y mezclas funcionales.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de polvo de pollo: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Mercado de polvo de pollo: impulsores y oportunidades

Factores impulsores del mercado:

- Aumento de la demanda de alimentos preparados: el aumento del consumo de fideos instantáneos, sopas, bocadillos y comidas listas para comer aumenta la demanda de pollo en polvo como potenciador del sabor.

- Industria de servicios de alimentación en crecimiento: los restaurantes, las cocinas en la nube y los servicios de catering que utilizan el pollo como su ingrediente básico principal dependen de su condimento para garantizar un sabor uniforme y reducir el tiempo de preparación.

- Cambio hacia sabores globales y ricos en umami: los sabores atrevidos y sabrosos están ganando popularidad y están impulsando a los fabricantes a agregar polvo de pollo a adobos y salsas, y en platos de fusión.

- Creciente demanda de ingredientes naturales y de etiqueta limpia: la demanda de polvo de pollo con menos aditivos, bajo contenido de sodio y formulaciones naturales es estimulada por los consumidores preocupados por la salud.

- Creciente urbanización e ingresos disponibles: los mercados emergentes aceptan más los productos procesados y la demanda de saborizantes a base de aves de corral se mantiene constante.

Oportunidades de mercado:

- Polvos de pollo orgánicos y de primera calidad: el alto potencial de crecimiento reside en el desarrollo de formulaciones de pollo real, orgánicas y de alta calidad.

- Innovación en productos centrados en la salud: versiones sin aditivos, sin alérgenos y bajas en sodio atraen a los clientes preocupados por la salud.

- Adopción en mercados emergentes: el creciente consumo de alimentos preparados en Asia Pacífico, África y América del Sur y Central ofrece enormes perspectivas de crecimiento.

- Diversificación en sabores especiales y mezclas funcionales: Existen perspectivas disponibles en el desarrollo de polvos de pollo gourmet, regionales y fortificados para satisfacer las cambiantes demandas culinarias.

- Expansión del comercio electrónico y de los canales directos al consumidor: con el crecimiento del comercio minorista en línea, los fabricantes llegarán a más clientes potenciales, comercializarán variedades específicas de polvo de pollo y venderán grandes cantidades o paquetes de condimentos personalizados directamente a los consumidores.

Análisis de segmentación del informe de mercado de polvo de pollo

El mercado del pollo en polvo se divide en diferentes segmentos para ofrecer una visión más clara de su funcionamiento, su potencial de crecimiento y las últimas tendencias. A continuación, se presenta el enfoque de segmentación estándar utilizado en los informes del sector:

Por tipo

- Polvo de carne de pollo: se aplica en condimentos, bocadillos y comidas preparadas, contiene altas cantidades de umami y se sabe que es rico y concentrado en el sabor y gusto del pollo.

- Polvo de caldo de pollo: Hecho a partir de caldo de pollo deshidratado, se utiliza en sopas, salsas e incluso fideos instantáneos debido a su sabor aromático y parecido al caldo.

- Polvo de proteína de pollo: debido a su alto contenido de proteínas, encuentra una amplia aplicación en suplementos dietéticos, alimentos funcionales y nutrición deportiva para mejorar el valor nutricional.

- Otros: Esta categoría incluye polvo de grasa de pollo, polvo de hueso y cartílago de pollo hidrolizado y polvo de extracto de pollo.

Por naturaleza

- Orgánico: El pollo criado orgánicamente y los ingredientes naturales atraen a los consumidores preocupados por la salud y que buscan etiquetas limpias y que exigen condimentos sin químicos.

- Convencional: Popular y asequible, está diseñado para ser utilizado en mercados masivos en procesamiento de alimentos, servicios de comidas y cocina casera.

Por categoría

- Bajo en grasa: desarrollado para satisfacer las necesidades de productos saludables donde se necesitan bajas cantidades de grasa, pero se requiere un sabor sabroso.

- Regular: Formulaciones con contenidos de grasa estándar, que se utilizan predominantemente en snacks, alimentos instantáneos y mezclas de sabores.

Por aplicación

- Alimentos y bebidas: este segmento comprende comidas RTE y RTC; sopas, salsas y aderezos; bocadillos salados; fideos y pastas; y otras aplicaciones de alimentos y bebidas.

- Suplementos dietéticos: El polvo de pollo se utiliza como fuente de enriquecimiento de proteínas y como nutrición funcional debido a su composición de aminoácidos.

- Alimentos para mascotas: ofrece sabor y beneficios nutricionales de alimentos para mascotas en croquetas, alimentos húmedos y golosinas para mascotas.

- Alimento animal: Actúa como factor de requerimiento de proteínas y de mejora del sabor para promover el crecimiento y el consumo dietético en el ganado y las aves de corral.

Por geografía:

- América del norte

- Europa

- Asia Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de pollo en polvo

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de pollo en polvo durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de pollo en polvo en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de polvo de pollo

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | US$ 607,05 millones |

| Tamaño del mercado en 2031 | US$ 902,14 millones |

| CAGR global (2025-2031) | 5,9% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de pollo en polvo: comprensión de su impacto en la dinámica empresarial

El mercado del polvo de pollo está creciendo rápidamente, impulsado por la creciente demanda del consumidor final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de polvo de pollo

Análisis de la cuota de mercado del polvo de pollo por geografía

Asia Pacífico dominó el mercado debido a la expansión de la industria de procesamiento de alimentos en la región. Los mercados emergentes de Sudamérica, Centroamérica y Oriente Medio y África ofrecen oportunidades sin explotar para la expansión de los proveedores de pollo en polvo.

El crecimiento del mercado del pollo en polvo varía según la región. La demanda de indulgencias premium continúa creciendo, lo que posiciona al pollo en polvo en un panorama de consumo en constante evolución. A continuación, se presenta un resumen de la participación de mercado y las tendencias por región:

1. América del Norte

- Cuota de mercado: posee una cuota de mercado significativa

- Factores clave: Creciente consumo de productos alimenticios listos para comer y de conveniencia

- Tendencias: Cambio hacia condimentos en polvo para pollo con etiqueta limpia y bajos en grasa.

2. Europa

- Cuota de mercado: posee una cuota de mercado significativa

- Factores clave: Creciente demanda de ingredientes alimentarios de primera calidad en sopas, snacks y comidas preparadas.

- Tendencias: Creciente preferencia por los condimentos orgánicos.

3. Asia Pacífico

- Cuota de mercado: Dominó el mercado, con una cuota de mercado en aumento cada año.

- Factores clave: aumento del ingreso disponible y expansión de la industria de servicios de alimentación.

- Tendencias: Creciente demanda de condimentos con sabores regionales y de fusión.

4. América del Sur y Central

- Cuota de mercado: Mercado en rápido crecimiento, con una cuota de mercado en aumento cada año.

- Factores clave: Crecimiento rápido en el sector de procesamiento de alimentos.

- Tendencias: Creciente demanda de polvos de pollo fortificados y con valor añadido.

5. Oriente Medio y África

- Cuota de mercado: Aunque pequeña, está creciendo rápidamente

- Factores clave: creciente demanda de alimentos envasados y procesados.

- Tendencias: Creciente adopción de condimentos a base de aves en restaurantes de servicio rápido.

Actores del mercado de polvo de pollo: Densidad: Comprensión de su impacto en la dinámica empresarial

Alta densidad de mercado y competencia

La competencia es intensa debido a la presencia de actores establecidos como Lee Kum Kee Co Ltd, BRF SA, Proliver SRL, Weijia Food Ingredients Co Ltd, International Dehydrated Foods Inc, Ajinomoto Co Inc, Nestle SA, Kerry Group plc, Hangzhou Focus Corp y Fuji Foods Inc.

Este alto nivel de competencia impulsa a las empresas a destacar ofreciendo:

- Oferta diversa de productos

- Abastecimiento sostenible y ético

- Modelos de precios competitivos

- Fuerte soporte al cliente y fácil integración

Oportunidades y movimientos estratégicos

- Centrarse en actividades de investigación y desarrollo para diferenciarse en el mercado

- Ampliar la presencia y las capacidades globales mediante adquisiciones de fabricantes de especias y condimentos.

- Ampliación del portafolio de productos con el lanzamiento de productos orgánicos

Otras empresas analizadas durante el curso de la investigación:

- Zhongshan Jolion Foodstuffs Co. Ltd.

- Massel Australia Pty Ltd

- AS Harrison & Co Pty Ltd

- Caldos del Norte SL

- Alimentos básicos de Krio Krush

- BIN DAWOOD

- HE Stringer Flavours Ltd

- La Compañía Scoular

- ARIAKE JAPAN Co. Ltd.

- Symrise AG

Mercado de polvo de pollo: noticias y novedades

- Grupo Kerry – Lanzamiento de producto en marzo de 2025. Grupo Kerry presentó una nueva línea de caldos de pollo en polvo con etiqueta limpia, formulados con bajo contenido de sodio y sin aditivos artificiales. Esta gama está diseñada para su uso en sopas, salsas y platos preparados premium, satisfaciendo la creciente demanda de sabores avícolas naturales y auténticos.

- Givaudan – Expansión. En enero de 2025, Givaudan amplió su planta de ingredientes salados en Singapur para aumentar la capacidad de producción de pollo en polvo y concentrados de caldo. Esta expansión responde a la creciente demanda en la región Asia-Pacífico, especialmente de fideos instantáneos, snacks y alimentos precocinados.

Informe de mercado sobre el polvo de pollo: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de pollo en polvo (2021-2031)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño y pronóstico del mercado de polvo de pollo a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de polvo de pollo, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y FODA

- Análisis del mercado de polvo de pollo que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de pollo en polvo.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de polvo de pollo

Obtenga una muestra gratuita para - Mercado de polvo de pollo