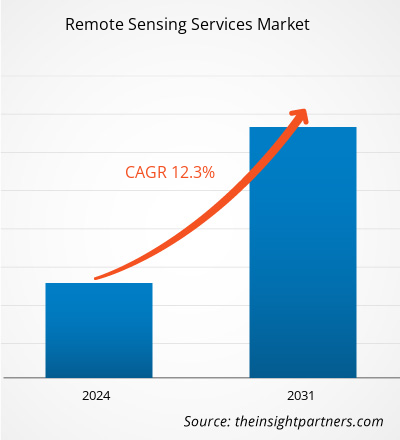

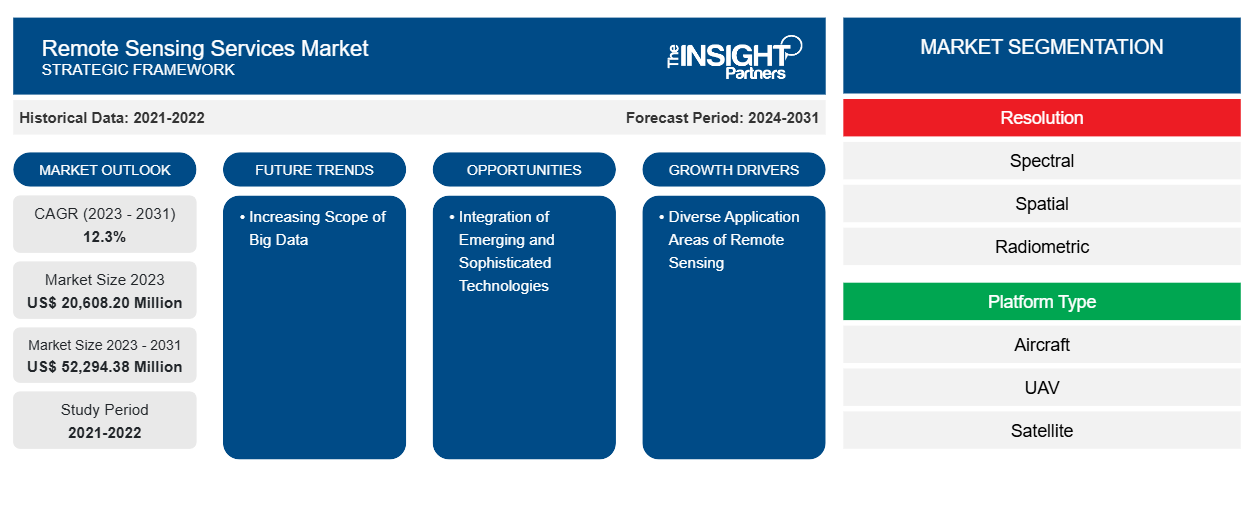

Se proyecta que el tamaño del mercado de servicios de teledetección alcance los 52.294,38 millones de dólares estadounidenses en 2031, frente a los 20.608,20 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 12,3 % durante el período 2023-2031. Es probable que el creciente alcance del big data en los servicios de teledetección siga siendo una tendencia clave en el mercado.

Análisis del mercado de servicios de teledetección

Los desarrolladores de tecnología de teledetección crean la tecnología para fines de monitoreo, mapeo y detección de características físicas en la superficie de la Tierra. Más tarde viene la parte de los integradores de sistemas que incluye satélites, equipos terrestres y vehículos aéreos no tripulados . La tecnología de teledetección final se integra en sensores, que son utilizados por los integradores de sistemas mencionados para su uso final en diferentes partes del país. Este producto, con la ayuda de proveedores de servicios como AABSyS IT, se proporciona para satisfacer las necesidades de los mercados comerciales y de defensa. El mercado comercial incluye el clima, la silvicultura, la agricultura y más.

Descripción general del mercado de servicios de teledetección

El mercado de servicios de teledetección comprende principalmente fabricantes de sensores, desarrolladores de tecnología de teledetección, integradores de sistemas, proveedores de servicios y usuarios finales. Los fabricantes de sensores producen sensores activos y pasivos, que se utilizan en aplicaciones de teledetección que operan en las porciones infrarrojas, visibles, de microondas y térmicas del espectro electromagnético.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de servicios de teledetección

Diversas áreas de aplicación de la teledetección favorecen el mercado

Entre los usuarios de los servicios de teledetección se encuentran las fuerzas militares, los departamentos de agricultura, los departamentos forestales y de previsión meteorológica. En el ámbito militar, las fuerzas utilizan imágenes satelitales y teledetección en una amplia gama de aplicaciones, entre las que se incluyen inteligencia, cartografía, análisis del terreno, gestión del campo de batalla, gestión de instalaciones militares y vigilancia de la actividad terrorista. Se espera que el uso de la teledetección se amplíe para garantizar el correcto funcionamiento de las aplicaciones mencionadas en el ámbito militar.

Incorporación de tecnologías emergentes y sofisticadas

La implementación de tecnologías de punta, como la aplicación de lotes en la agricultura, la automatización, la creación de imágenes por computadora, la robótica y la teledetección, está creciendo. La teledetección basada en IoT utiliza sensores colocados en granjas, como estaciones meteorológicas, para recopilar datos que se transmiten a una herramienta analítica para su análisis. A través de sensores, los agricultores pueden monitorear los cultivos desde un tablero analítico y tomar decisiones basadas en la información recopilada. A continuación se mencionan algunas de las características que ofrece la teledetección. A medida que los agricultores se conectan más debido al entorno digital, el uso de vanguardia de las tecnologías de lotes, la nube y la teledetección ayudaría a los agricultores a adoptar un ecosistema agrícola abierto. Aprovechar las tecnologías de punta tiene una probabilidad elevada de satisfacer globalmente la demanda de una creciente producción agrícola. Este aspecto de la integración de tecnologías avanzadas magnificaría el alcance de la teledetección, contribuyendo así al desarrollo del mercado.

Análisis de segmentación del informe de mercado de servicios de teledetección

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de servicios de teledetección son la resolución, el tipo de plataforma y el usuario final.

- Según la resolución, el mercado de servicios de teledetección se divide en espectral, espacial, radiométrico y temporal. El segmento espacial tuvo una mayor participación de mercado en 2023.

- Según el tipo de plataforma, el mercado de servicios de teledetección se divide en aeronaves, vehículos aéreos no tripulados, satélites y terrestres. El segmento de satélites tuvo una mayor participación de mercado en 2023.

- Según el usuario final, el mercado de servicios de teledetección se divide en comercial y de defensa. El segmento comercial tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de los servicios de teledetección por geografía

El alcance geográfico del informe del mercado de servicios de teledetección se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

El alcance del informe de mercado de servicios de teledetección abarca América del Norte (EE. UU., Canadá y México), Europa (Rusia, Reino Unido, Francia, Alemania, Italia y el resto de Europa), Asia Pacífico (Corea del Sur, India, Australia, Japón, China y el resto de Asia Pacífico), Oriente Medio y África (Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos y el resto de Oriente Medio y África) y América del Sur y Central (Argentina, Brasil y el resto de América del Sur y Central). En términos de ingresos, América del Norte dominó la cuota de mercado de servicios de teledetección en 2023. Europa es el segundo mayor contribuyente al mercado mundial de servicios de teledetección, seguida de Asia Pacífico.

Perspectivas regionales del mercado de servicios de teledetección

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de servicios de teledetección durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de servicios de teledetección en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de servicios de teledetección

Alcance del informe de mercado de servicios de teledetección

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 20.608,20 millones |

| Tamaño del mercado en 2031 | US$ 52.294,38 millones |

| CAGR global (2023 - 2031) | 12,3% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por resolución

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de servicios de teledetección: comprensión de su impacto en la dinámica empresarial

El mercado de servicios de teledetección está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de servicios de teledetección son:

- Corporación Antrix limitada

- Empresa de tecnología de la información CyberSWIFT.

- Geo Sense Sdn. Bhd.

- Tecnología Mallon

- EKOFASTBA SL

- Corporación de imágenes por satélite

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de servicios de teledetección

Noticias y desarrollos recientes del mercado de servicios de teledetección

El mercado de servicios de teledetección se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de investigaciones primarias y secundarias, que incluyen importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación se enumeran algunos de los avances en el mercado de servicios de teledetección:

- Mallon Technology ganó el premio a la mejor categoría de servicio en los premios GO Awards de Irlanda del Norte 2020. El premio reconoce el excelente servicio al cliente que brinda la empresa. (Fuente: Mallon Technology, comunicado de prensa, marzo de 2020)

- NorthStar Earth & Space Inc. anunció una asociación comercial estratégica con SpecTIR Hyperspectral & Remote Sensing Solutions de Reno, Nevada, para brindar servicios integrales de imágenes hiperespectrales. Los servicios de imágenes hiperespectrales aerotransportadas de SpecTIR complementarán los servicios de imágenes hiperespectrales basados en el espacio que ofrece NorthStar, la primera plataforma de información global del mundo para monitorear la Tierra, su entorno y el espacio cercano. (Fuente: SpecTIR, comunicado de prensa, enero de 2019)

Cobertura y resultados del informe de mercado de servicios de teledetección

El informe “Tamaño y pronóstico del mercado de servicios de teledetección (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de servicios de teledetección y pronóstico a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de servicios de teledetección, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallados

- Análisis del mercado de servicios de teledetección que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de servicios de teledetección

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de servicios de teledetección

Obtenga una muestra gratuita para - Mercado de servicios de teledetección