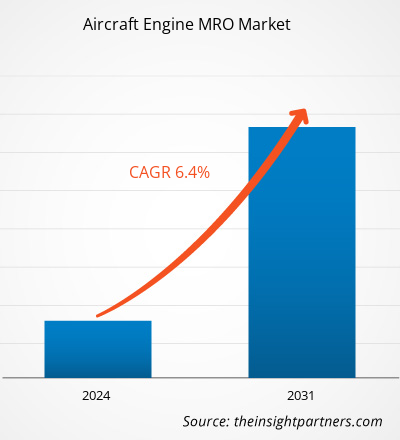

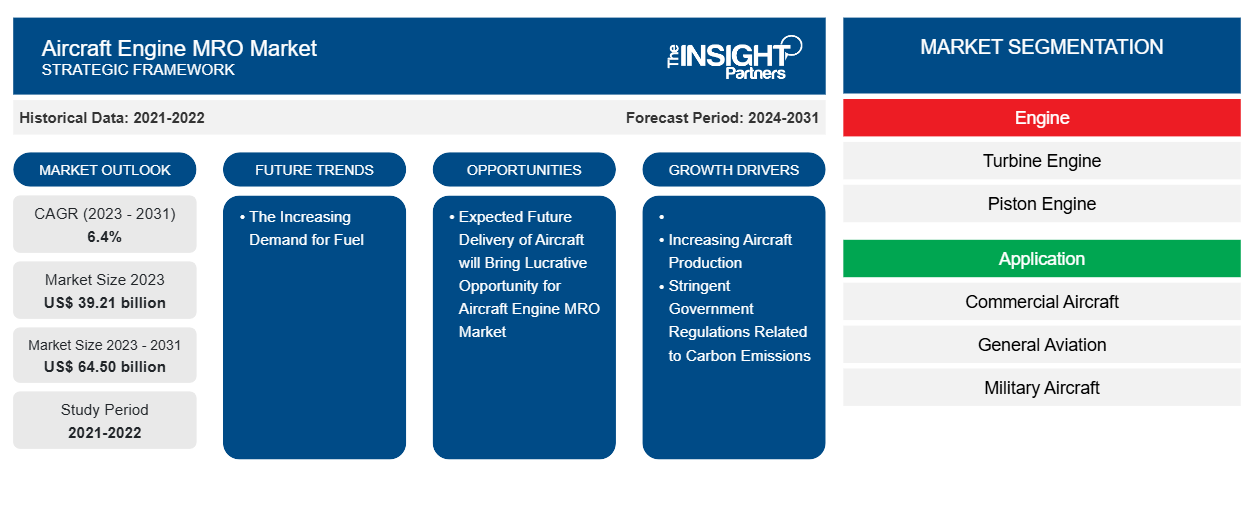

Se proyecta que el tamaño del mercado de MRO de motores de aeronaves alcance los 64,50 mil millones de dólares estadounidenses para 2031, desde los 39,21 mil millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 6,4 % entre 2023 y 2031. Es probable que la creciente demanda de aeronaves de bajo consumo de combustible siga siendo una tendencia clave en el mercado de MRO de motores de aeronaves.

Análisis del mercado de mantenimiento, reparación y revisión de motores de aeronaves

Los aeropuertos de todo el mundo cuentan con distintos tipos de instalaciones de mantenimiento, reparación y revisión de motores. Por lo general, el mantenimiento se realiza en la estructura del avión o en el motor. En la actualidad, los servicios de mantenimiento, reparación y revisión de motores también incluyen el mantenimiento, reparación y revisión de componentes. Según el tipo de servicio, estos servicios se prestan en el aeropuerto y, a veces, en instalaciones fuera del aeropuerto. Las actividades, como las inspecciones de rutina, la resolución de problemas habituales o las comprobaciones diarias del motor, se pueden realizar cuando el avión está estacionado en la terminal aérea.

Descripción general del mercado de mantenimiento, reparación y revisión de motores de aeronaves

Una de las aplicaciones clave del MRO de motores de aeronaves es garantizar que todas las etapas rotatorias del motor estén equilibradas y mantengan niveles mínimos de vibración. Esto mejora la durabilidad del motor y la eficiencia del combustible y limita la cantidad de desgaste del motor por vibración. Al actualizar los motores de aeronaves y los componentes relacionados con ellos, también aumentará la necesidad de infraestructura avanzada y mano de obra calificada para el MRO de motores de aeronaves. El requisito de MRO de los motores varía según el tipo y las categorías de motores. Los motores de aeronaves más antiguos y más pequeños tienen tiempos entre revisiones (TBO) de un máximo de 5000 horas. Los motores modernos tienen más de 6000 horas de TBO. Con más aviones comerciales que vuelan menos de 500 horas al año, el requisito de servicio MRO de motores es de un promedio de 12 años o más.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de mantenimiento, reparación y revisión de motores de aeronaves

Normas gubernamentales estrictas relacionadas con las emisiones de carbono

En 2021, el gobierno de Estados Unidos anunció su objetivo de reducir en un 20% las emisiones de los aviones para 2030. Varias autoridades reguladoras están implementando estrategias para reducir las emisiones de carbono. Por ejemplo, en marzo de 2022, la Asociación Internacional de Transporte Aéreo (IATA) estimó que se realizarán más de 10 mil millones de viajes por año en avión para 2050 y, por lo tanto, anunció que alcanzaría emisiones netas de carbono cero para 2050.

Más del 60% de los países del mundo han anunciado una emisión neta de carbono cero. Empresas como Honeywell Aerospace también se han comprometido a lograr emisiones netas de carbono cero para 2035. En noviembre de 2021, Bell Textron Inc. anunció que el Bell 525 completó su primer vuelo utilizando combustible de aviación sostenible. Boeing y Airbus han anunciado recientemente que para 2030, sus aviones volarán al 100% con SAF. Se anima a los gobiernos de EE. UU. y Europa a producir SAF. Estos factores están impulsando sustancialmente el mercado de MRO de motores de aeronaves.Textron Inc. announced that Bell 525 completed its first flight utilizing sustainable aviation fuel. Boeing and Airbus have recently announced that by 2030, their aircraft will fly 100% on SAF. The US and European governments are encouraged to produce SAFs. These factors are propelling the aircraft engine MRO market substantially.

Entregas futuras previstas de aeronaves comerciales: una oportunidad en el mercado de mantenimiento, reparación y revisión de motores de aeronaves

Con el aumento del tráfico aéreo y la demanda de aeronaves, las compañías aéreas están aumentando la entrega de sus aeronaves. La demanda de nuevas aerolíneas no solo proviene de las aeronaves existentes que restablecen su flota, sino también de las nuevas aeronaves de bajo costo que ingresan al mercado. El interés reprimido de los viajeros de ocio, que son más sensibles a los costos después de la pandemia, el menor interés en los viajes de negocios y la adaptabilidad del plan de acción de aeronaves de costo mínimo están aumentando la demanda de servicios MRO. Además, según las previsiones de Boeing y Airbus, se espera que se entreguen más de 40.800 aeronaves comerciales para fines de 2042, lo que impulsa aún más el despliegue de nuevos motores en la producción de esas aeronaves. Esto aumentará aún más la flota de aeronaves en general a nivel mundial y generará la demanda de MRO de motores, así como de proveedores de mercado en los próximos años.

Análisis de segmentación del informe de mercado de mantenimiento, reparación y revisión de motores de aeronaves

Los segmentos clave que contribuyeron a la derivación del análisis del mercado MRO de motores de aeronaves son el motor, la aplicación y el tipo de aeronave.

Motor [motor de turbina (motor de turbohélice, motor de turbofán, motor de turboeje), motor de pistón], aplicación (aeronaves comerciales, aviación general, aeronaves militares), tipo de aeronave (ala fija, ala giratoria)

- Según el motor, el mercado de mantenimiento, reparación y revisión de motores de aeronaves se segmenta en motores de turbina y motores de pistón. Además, los motores de turbina se han segmentado aún más en motores de turbohélice, motores de turbofán y motores de turboeje. El segmento de motores de turbina tuvo una mayor participación de mercado en 2023.

- Según la aplicación, el mercado se segmenta en aviones comerciales, aviación general y aviones militares. El segmento de aviones comerciales tuvo una mayor participación de mercado en 2023.

- Según el tipo de aeronave, el mercado se segmenta en ala fija y ala rotatoria. El segmento de ala fija tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de MRO de motores de aeronaves por geografía

El alcance geográfico del informe de mercado MRO de motores de aeronaves se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur.

En 2023, Asia Pacífico representó una parte importante del mercado mundial de MRO de motores de aeronaves, seguida de América del Norte y Europa. La economía de Asia se ha visto impulsada por una amplia gama de niveles de ingresos y una clase media en rápida expansión. Esto resultó en un fuerte crecimiento de las ventas en las economías de rápido crecimiento de la región, como India y China. Se prevé que APAC sea el mercado con más perspectivas para los proveedores de servicios de MRO de aeronaves. La región contiene varias economías en desarrollo que están liderando el camino en una variedad de industrias, como la aeroespacial, militar y de defensa, y la tecnología. Muchas economías en crecimiento en APAC están buscando inversiones regulatorias para mejorar sus tecnologías. Esto eventualmente estimularía el desarrollo y uso de nuevas tecnologías para la integración de aeronaves . Varias aerolíneas en APAC, como Singapore Airlines y Malaysian Airlines, están desarrollando sus capacidades de mantenimiento internas. Pratt & Whitney, una empresa aeroespacial con sede en EE. UU., agregó capacidad de MRO para su turbofán engranado PW100G-JM en su planta Eagle Services Asia en Singapur en 2019. A lo largo de los años, esta planta ha estado revisando los motores Pratt & Whitney GTF. Con el lanzamiento del motor PW100G-JM, se espera que la instalación experimente un aumento significativo en los ingresos de varios operadores de aeronaves que utilizan el PW100G-JM. Además, el creciente despliegue de tecnologías de modernización para mejorar las aeronaves y la creciente adopción de la tecnología blockchain se encuentran entre los principales factores que impulsan el crecimiento del mercado de MRO de motores de aeronaves. Además, el crecimiento del mercado en Asia Pacífico se atribuye al aumento de la flota de aeronaves debido al aumento del tráfico de pasajeros; el aumento del gasto en aeronaves militares impulsado por el creciente presupuesto de defensa; y los proyectos en curso de desarrollo de aeronaves comerciales, de aviación general y militares.

Perspectivas regionales del mercado de mantenimiento, reparación y revisión de motores de aeronaves

Los analistas de Insight Partners explicaron en detalle las tendencias regionales y los factores que influyen en el mercado de MRO de motores de aeronaves durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de MRO de motores de aeronaves en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado MRO de motores de aeronaves

Alcance del informe de mercado de mantenimiento, reparación y revisión de motores de aeronaves

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 39,21 mil millones |

| Tamaño del mercado en 2031 | US$ 64.50 mil millones |

| CAGR global (2023 - 2031) | 6,4% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por motor

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de mantenimiento, reparación y revisión de motores de aeronaves está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado MRO de motores de aeronaves son:

- Compañía aérea Delta, Inc.

- GE Aviación

- CFM Internacional

- Tecnología de Lufthansa

- Motores aeronáuticos MTU AG

- Empresa de ingeniería SIA

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de MRO de motores de aeronaves

Noticias y desarrollos recientes del mercado de mantenimiento, reparación y revisión de motores de aeronaves

El mercado de mantenimiento, reparación y revisión de motores de aeronaves se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado en materia de innovaciones, expansión comercial y estrategias:

- En abril de 2024, ITP Aero firmó un contrato con el Ministerio de Defensa de Colombia para el mantenimiento, reparación y revisión (MRO) de los motores T700 que propulsan la flota de helicópteros Black Hawk de sus Fuerzas Armadas. El contrato se extenderá hasta junio de 2026 y los servicios de MRO de los motores se realizarán en las instalaciones de ITP Aero en Albacete (España). (Fuente: ITP Aero, Nota de Prensa)

- En noviembre de 2023, MTU Maintenance firmó un contrato de mantenimiento, reparación y revisión (MRO) del LEAP-1A de cinco años con SriLankan Airlines, basándose en la relación existente entre las dos compañías, que también ha abarcado los motores V2500 y el soporte de arrendamiento. La aerolínea nacional de Sri Lanka opera actualmente una flota de 22 aviones Airbus A330 y A320/A321 y realiza vuelos por el sur de Asia, Europa, el Lejano Oriente y Oriente Medio. (Fuente: MTU Maintenance, Newsletter)

Informe de mercado de mantenimiento, reparación y revisión de motores de aeronaves (MRO) y resultados finales

El informe “Tamaño y pronóstico del mercado de MRO de motores de aeronaves (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de MRO de motores de aeronaves y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Tendencias del mercado de mantenimiento, reparación y revisión de motores de aeronaves

- Las cinco fuerzas de Porter detalladas

- Análisis del mercado de MRO de motores de aeronaves que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Panorama de la industria de MRO de motores de aeronaves y análisis de la competencia que abarca la concentración del mercado, análisis de mapas de calor, actores destacados y desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de MRO de motores de aeronaves

Obtenga una muestra gratuita para - Mercado de MRO de motores de aeronaves