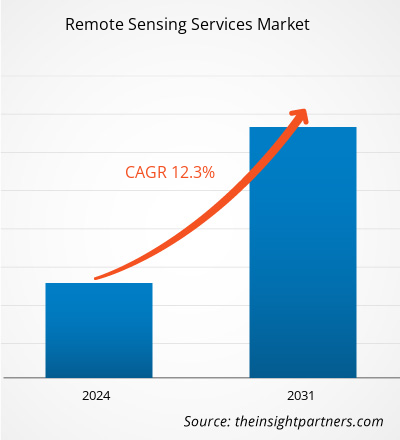

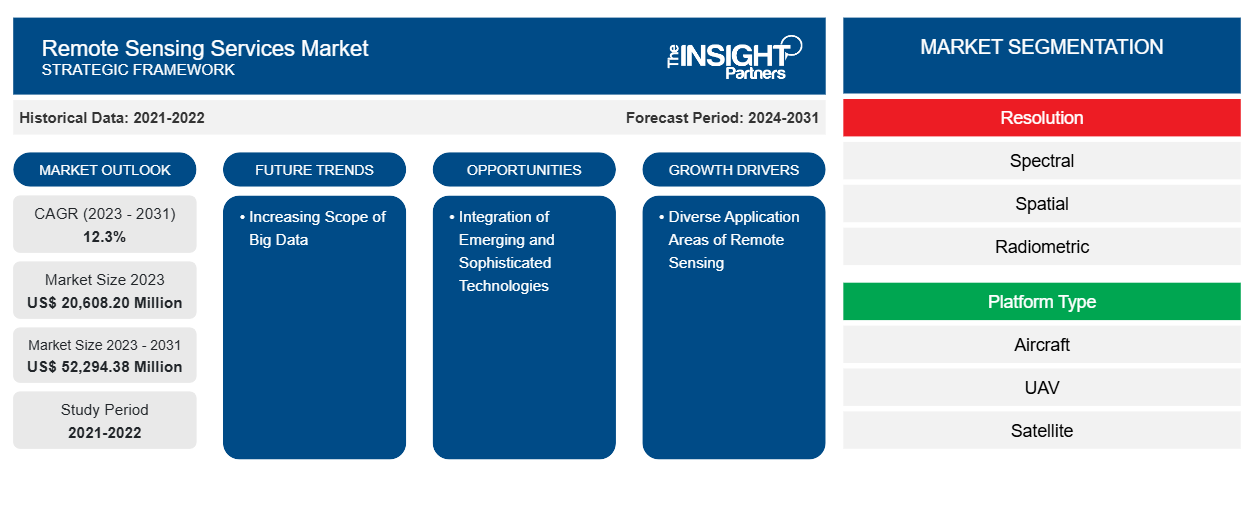

Le marché des services de télédétection devrait atteindre 52 294,38 millions USD d'ici 2031, contre 20 608,20 millions USD en 2023. Le marché devrait enregistrer un TCAC de 12,3 % au cours de la période 2023-2031. La portée croissante du big data dans les services de télédétection devrait rester une tendance clé du marché.

Analyse du marché des services de télédétection

Les développeurs de la technologie de télédétection créent la technologie à des fins de surveillance, de cartographie et de détection des caractéristiques physiques à la surface de la terre. Vient ensuite la partie des intégrateurs de systèmes qui comprend les satellites, les équipements terrestres et les véhicules aériens sans pilote . La technologie de télédétection finale est intégrée dans des capteurs, qui sont utilisés par les intégrateurs de systèmes mentionnés pour leur utilisation finale dans différentes parties du pays. Ce produit, avec l'aide de fournisseurs de services tels que AABSyS IT, est fourni pour répondre aux besoins des marchés commerciaux et de la défense. Le marché commercial comprend la météorologie, la foresterie, l'agriculture, etc.

Aperçu du marché des services de télédétection

Le marché des services de télédétection comprend principalement les fabricants de capteurs, les développeurs de technologies de télédétection, les intégrateurs de systèmes, les fournisseurs de services et les utilisateurs finaux. Les fabricants de capteurs produisent des capteurs actifs et passifs, qui sont utilisés dans les applications de télédétection qui fonctionnent dans les parties infrarouge, visible, micro-ondes et infrarouge thermique d'un spectre électromagnétique.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché des services de télédétection

Divers domaines d'application de la télédétection pour favoriser le marché

Les forces armées, le département de l'agriculture, le département des forêts et le département des prévisions météorologiques font partie des utilisateurs des services de télédétection. Dans l'armée, les forces utilisent les images satellite et la télédétection dans un large éventail d'applications, notamment le renseignement, la cartographie, l'analyse du terrain, la gestion du champ de bataille, la gestion des installations militaires et la surveillance des activités terroristes. L'utilisation de la télédétection devrait se développer afin d'assurer le bon fonctionnement des applications mentionnées dans l'armée.

Incorporation de technologies émergentes et sophistiquées

La mise en œuvre de technologies de pointe, telles que l'application de lots dans l'agriculture, l'automatisation, l'imagerie par ordinateur, la robotique et la télédétection, est en pleine croissance. La télédétection basée sur l'IoT utilise des capteurs placés dans les fermes comme les stations météorologiques pour collecter des données transmises à un outil d'analyse pour analyse. Grâce aux capteurs, les agriculteurs peuvent surveiller les cultures à partir d'un tableau de bord analytique et prendre des décisions en fonction des informations recueillies. Vous trouverez ci-dessous certaines des fonctionnalités fournies par la télédétection. Les agriculteurs étant de plus en plus connectés en raison de l'environnement numérique, l'utilisation de pointe des technologies de lot, de cloud et de télédétection aiderait les agriculteurs à adopter un écosystème agricole ouvert. Tirer parti des technologies de pointe a une probabilité élevée de répondre à la demande mondiale de production agricole croissante. Cet aspect de l'intégration de technologies avancées amplifierait la portée de la télédétection, contribuant ainsi au développement du marché.

Analyse de segmentation du rapport sur le marché des services de télédétection

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des services de télédétection sont la résolution, le type de plate-forme et l’utilisateur final.

- En fonction de la résolution, le marché des services de télédétection est divisé en segments spectral, spatial, radiométrique et temporel. Le segment spatial détenait une part de marché plus importante en 2023.

- En fonction du type de plate-forme, le marché des services de télédétection est divisé en aéronefs, drones, satellites et terrestres. Le segment des satellites détenait une part de marché plus importante en 2023.

- En fonction de l'utilisateur final, le marché des services de télédétection est divisé en deux segments : commercial et militaire. Le segment commercial détenait une part de marché plus importante en 2023.

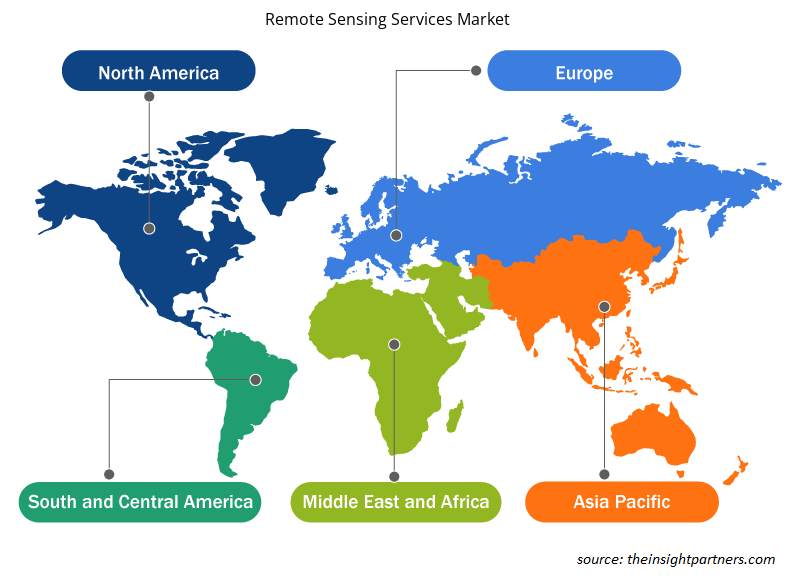

Analyse des parts de marché des services de télédétection par zone géographique

La portée géographique du rapport sur le marché des services de télédétection est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

Français Le rapport sur le marché des services de télédétection couvre l'Amérique du Nord (États-Unis, Canada et Mexique), l'Europe (Russie, Royaume-Uni, France, Allemagne, Italie et reste de l'Europe), l'Asie-Pacifique (Corée du Sud, Inde, Australie, Japon, Chine et reste de l'Asie-Pacifique), le Moyen-Orient et l'Afrique (Arabie saoudite, Afrique du Sud, Émirats arabes unis et reste du Moyen-Orient et de l'Afrique) et l'Amérique du Sud et centrale (Argentine, Brésil et reste de l'Amérique du Sud et centrale). En termes de chiffre d'affaires, l'Amérique du Nord a dominé la part de marché des services de télédétection en 2023. L'Europe est le deuxième contributeur au marché mondial des services de télédétection, suivie de l'Asie-Pacifique.

Aperçu régional du marché des services de télédétection

Les tendances et facteurs régionaux influençant le marché des services de télédétection tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des services de télédétection en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des services de télédétection

Portée du rapport sur le marché des services de télédétection

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 20 608,20 millions de dollars américains |

| Taille du marché d'ici 2031 | 52 294,38 millions de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 12,3% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par résolution

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des services de télédétection : comprendre son impact sur la dynamique des entreprises

Le marché des services de télédétection connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des services de télédétection sont :

- Société Antrix limitée

- CyberSWIFT Infotech Pvt. Ltd.

- Geo Sense Sdn. Bhd.

- Technologie Mallon

- EKOFASTBA SL

- Société d'imagerie par satellite

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des services de télédétection

Actualités et développements récents du marché des services de télédétection

Le marché des services de télédétection est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements du marché des services de télédétection sont énumérés ci-dessous :

- Mallon Technology a remporté le prix de la catégorie « Meilleur service » des GO Awards Northern Ireland 2020. Ce prix récompense l'excellent service client fourni par l'entreprise. (Source : Mallon Technology, communiqué de presse, mars 2020)

- NorthStar Earth & Space Inc. a annoncé un partenariat commercial stratégique avec SpecTIR Hyperspectral & Remote Sensing Solutions de Reno, Nevada, pour fournir des services complets d'imagerie hyperspectrale. Les services d'imagerie hyperspectrale aéroportée de SpecTIR complèteront les services d'imagerie hyperspectrale basés dans l'espace fournis par NorthStar, la première plate-forme d'information mondiale au monde pour surveiller la Terre, son environnement et l'espace proche. (Source SpecTIR, communiqué de presse, janvier 2019)

Rapport sur le marché des services de télédétection : couverture et livrables

Le rapport « Taille et prévisions du marché des services de télédétection (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des services de télédétection aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché des services de télédétection ainsi que dynamique du marché telles que les facteurs moteurs, les contraintes et les opportunités clés

- Analyse PEST et SWOT détaillée

- Analyse du marché des services de télédétection couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents du marché des services de télédétection

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des services de télédétection

Obtenez un échantillon gratuit pour - Marché des services de télédétection