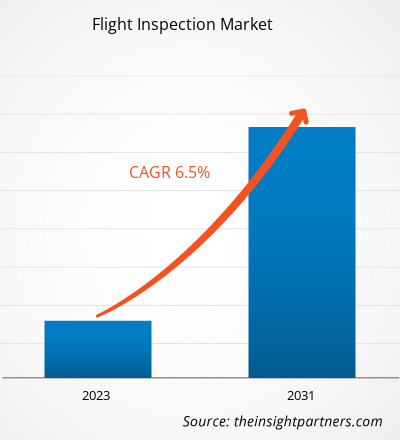

Le marché de l’inspection des vols devrait atteindre 9,25 milliards USD d’ici 2031, contre 5,60 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 6,5 % en 2023-2031. La réduction des coûts d’inspection des vols et l’augmentation des investissements dans les services d’inspection des vols font partie des principales tendances qui stimulent le marché de l’inspection des vols.

Analyse du marché de l'inspection des vols

L'augmentation du trafic aérien a dicté la mise en place d'un système d'inspection de vol commun pour toutes les installations de navigation aérienne afin de gérer plus efficacement les opérations d'atterrissage des avions. Le développement rapide des technologies aéronautiques, telles que les systèmes avancés de navigation et de communication, crée le besoin de systèmes et de services d'inspection améliorés. Le nombre croissant d'avions dans les secteurs commercial et de la défense, en raison de l'augmentation du nombre de passagers et des opérations de défense, alimente la croissance du marché. Les économies en développement sont un marché potentiel pour les entreprises, car le nombre croissant d'aéroports crée une opportunité lucrative pour les systèmes d'inspection de vol au sol. Les progrès des systèmes d'inspection de vol réduisent le temps et les dépenses d'exploitation pour offrir une solution rentable aux clients.

Aperçu du marché de l'inspection des vols

L'industrie aéronautique mondiale connaît une croissance considérable en raison de l'augmentation du nombre de vols internationaux et nationaux. Cela, à son tour, propulse la croissance du marché de l'inspection en vol. Le nombre croissant d'avions dans les aéroports génère une demande de systèmes et de services d'inspection en vol avancés pour garantir que les avions peuvent voler en toute sécurité et sont en état de navigabilité. L'importance de l'inspection en vol augmente car les avions modernes sont dotés d'un système complexe et nécessitent des compétences supplémentaires pour l'inspection. Des inspecteurs formés et agréés effectuent le processus d'inspection pour mesurer les performances des systèmes de navigation, de surveillance et de communication. L'inspection en vol garantit la sécurité au moment du décollage et de l'atterrissage des avions. En outre, des normes de sécurité renforcées et des directives améliorées pour les terminaux d'aéroport renforcent l'importance des systèmes d'inspection en vol. En outre, l'utilisation accrue de systèmes d'inspection en vol automatiques réduit le temps d'exploitation et améliore l'efficacité des processus. La demande de systèmes d'inspection en vol automatisés des installations aéroportuaires pour effectuer des inspections en vol augmente en raison de leurs avantages en termes de gain de temps et d'économies.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché de l'inspection des vols

L'augmentation du volume du trafic aérien stimule la croissance du marché

Le secteur mondial de l'aviation connaît une croissance significative du volume du trafic aérien en termes de nombre de passagers et de flotte d'avions. Avec l'augmentation de la flotte d'avions et du volume de trafic, les inspections de routine sont de la plus haute importance pour les autorités aéroportuaires afin de faciliter l'opérationnalité des mouvements d'avions. Outre les inspections de routine, la mise en service de services d'inspection est également effectuée dans plusieurs pays, car de nombreux nouveaux aéroports voient le jour dans les pays développés et en développement. Au cours des deux dernières années, plusieurs autorités aéroportuaires ont investi dans l'extension des pistes et des terminaux. L'APAC devrait contribuer de manière significative à la croissance du marché de l'inspection des vols, car les autorités aéroportuaires de pays comme la Chine, l'Inde, le Japon et d'autres pays d'Asie du Sud-Est investissent dans l'extension des aéroports existants et la construction de nouveaux aéroports. Ainsi, une plus grande inclination vers les activités d'inspection des vols, la croissance de la construction de nouveaux aéroports, le nombre croissant de prestataires de services d'inspection des vols et l'augmentation des volumes de trafic aérien sont les facteurs clés qui catalysent la croissance du marché de l'inspection des vols.

Utilisation des drones pour l'inspection en vol

Les véhicules aériens sans pilote (UAV) ont démontré d'énormes avantages dans de nombreux secteurs pour diverses applications dans le monde entier. Constatant l'importance de l'inspection en vol au fil des ans, plusieurs fabricants de drones envisagent d'introduire et de faciliter l'utilisation des drones par les autorités aéroportuaires et les fournisseurs de services d'inspection en vol. Canard Drones Ltd., un fabricant espagnol de drones, fait partie des précurseurs dans le développement et la commercialisation de drones pour les activités d'inspection et d'inspection en vol . L'entreprise prévoit que l'utilisation de drones révolutionnerait les activités d'inspection en vol en réduisant le temps nécessaire pour effectuer des inspections de routine à moindre coût. De même, AltiGator, un fabricant belge de drones, a conçu ATLAS, un drone, dans le but de proposer une activité d'inspection en vol. Les drones étant beaucoup plus petits et ayant une capacité de charge utile inférieure à celle des avions, les fabricants d'équipements d'inspection en vol devraient introduire des systèmes compacts, légers et puissants qui peuvent être installés sur les drones pour effectuer des inspections en vol. Ainsi, l'innovation dans le domaine des petits équipements d'inspection en vol légers pour drones devrait également catalyser le marché de l'inspection en vol dans les années à venir. De plus, les autorités responsables de l'inspection en vol mettent l'accent sur la modification des exigences des procédures d'inspection en vol pour effectuer l'inspection en vol par drone (UFIS). Les modifications profiteraient aux autorités aéroportuaires et aux prestataires de services d'inspection en vol, ce qui devrait à son tour propulser la croissance du marché de l'inspection en vol.

Analyse de segmentation du rapport sur le marché de l'inspection des vols

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché de l’inspection en vol sont la solution et l’utilisateur final.

- Sur la base de la solution, le marché de l'inspection des vols a été divisé en systèmes et services. Le segment des systèmes détenait une part de marché plus importante en 2023.

- Sur la base de l'utilisateur final, le marché a été segmenté en aéroport de défense et aéroport commercial. Le segment des aéroports commerciaux a dominé le marché en 2023.

Analyse des parts de marché de l'inspection des vols par zone géographique

La portée géographique du rapport sur le marché de l’inspection des vols est principalement divisée en cinq régions : Amérique du Nord, Europe, Asie-Pacifique, Moyen-Orient et Afrique et Amérique du Sud.

L'Amérique du Nord a dominé le marché de l'inspection des vols en 2023. La région Amérique du Nord comprend les États-Unis, le Canada et le Mexique. L'industrie aérospatiale en Amérique du Nord est arrivée à maturité avec l'existence d'un grand nombre de constructeurs d'avions, de prestataires de services MRO et d'une main-d'œuvre qualifiée. La demande de technologies de pointe est énorme dans la région, tous les utilisateurs finaux mentionnés ci-dessus étant bien conscients des nouvelles technologies. De ce fait, l'adoption de solutions d'inspection des vols dans les aéroports commerciaux a commencé il y a des décennies dans la région et continue d'intégrer la technologie dans les nouvelles installations aéroportuaires. Le secteur de l'aérospatiale commerciale de la région est majoritairement dominé par Boeing, qui intègre également ses modèles B787 et B777 pour l'inspection afin de garantir que les vols répondent aux normes attendues et peuvent voler en toute sécurité. Les prestataires de services d'inspection des vols et les aéroports dotés de systèmes d'inspection des vols propres ont commencé à moderniser les anciens avions avec des aides à la navigation modernes, ce qui constitue également un catalyseur pour le marché nord-américain de l'inspection des vols. La présence d’un grand nombre de fournisseurs de solutions d’inspection de vol dans la région soutient la demande toujours croissante, ce qui stimule ainsi le marché de l’inspection de vol.

Aperçu régional du marché de l'inspection des vols

Les tendances régionales et les facteurs influençant le marché de l’inspection des vols tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché de l’inspection des vols en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché de l'inspection des vols

Portée du rapport sur le marché de l'inspection des vols

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 5,60 milliards de dollars américains |

| Taille du marché d'ici 2031 | 9,25 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 6,5% |

| Données historiques | 2021-2022 |

| Période de prévision | 2023-2031 |

| Segments couverts |

Par Solution

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché de l'inspection des vols : comprendre son impact sur la dynamique des entreprises

Le marché de l'inspection des vols connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché de l'inspection des vols sont :

- Aerodata SA

- Technologie d'aérodrome, Inc.

- Mission spéciale norvégienne AS

- Radiola Limitée

- Bombardier Inc.

- ENAV SpA

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de l'inspection des vols

Actualités et développements récents du marché de l'inspection des vols

Le marché de l'inspection des vols est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Voici une liste des développements sur le marché de l'inspection des vols et des stratégies :

- En février 2024, Asian Corporate Aviation Management (ACAM) a acquis l'opérateur allemand d'inspection en vol Svege. Grâce à cette acquisition, ACAM a étendu sa présence en Europe.

- En mai 2022, Textron Aviation a signé un accord avec Turkish Aerospace Industries pour les missions d'inspection en vol du gouvernement turc.

Rapport sur le marché de l'inspection des vols - Couverture et livrables

Le rapport « Taille et prévisions du marché de l’inspection des vols (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de Porter

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés avec analyse SWOT

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché de l'inspection des vols

Obtenez un échantillon gratuit pour - Marché de l'inspection des vols