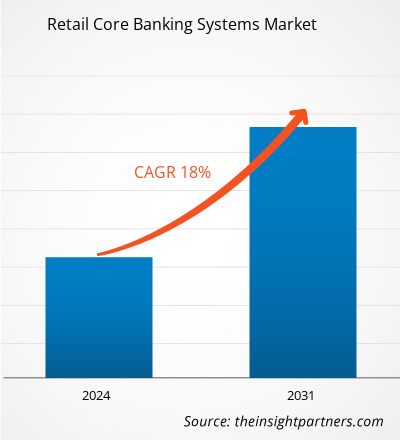

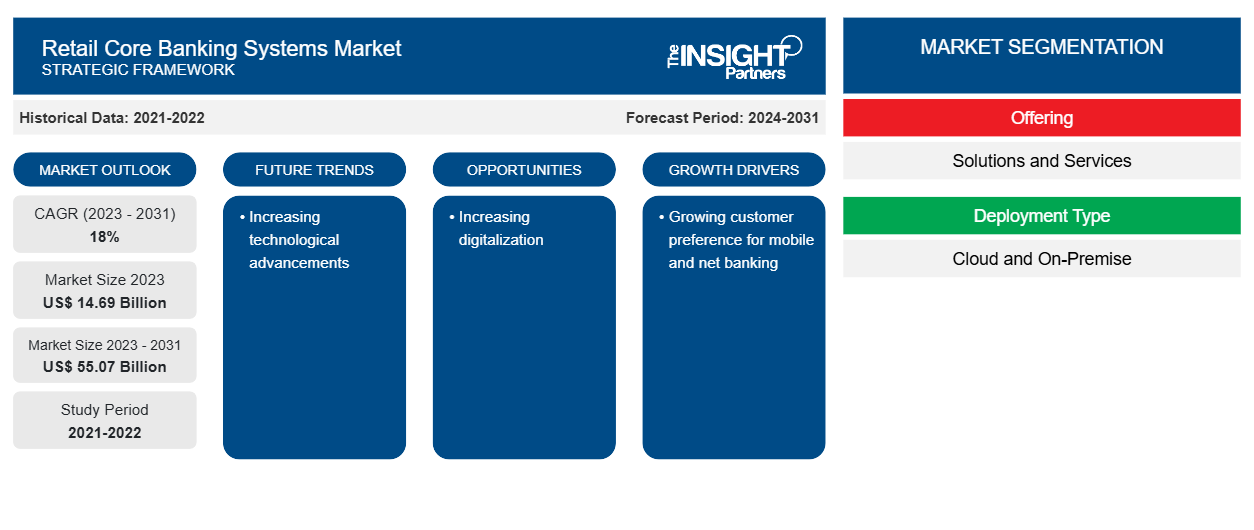

La taille du marché des systèmes bancaires de détail devrait atteindre 55,07 milliards USD d'ici 2031, contre 14,69 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 18 % en 2023-2031.Les avancées technologiques croissantes devraient rester les principales tendances du marché des systèmes bancaires de détail.

Analyse du marché des systèmes bancaires de détail

En raison de l'adoption rapide par le système bancaire de technologies de pointe, le marché mondial des solutions de banque de détail connaît une croissance significative et devrait continuer à croître à l'avenir. Un système bancaire de base est un réseau d'agences bancaires qui permet aux clients d'accéder à une variété de services financiers et de garder un œil sur leurs comptes depuis n'importe quel endroit dans le monde.

De plus, les banques et les sociétés FinTech ont recours aux technologies de l'information (TI) pour améliorer la durabilité et la croissance de leurs activités respectives. Les technologies bancaires de base offrent des moyens de satisfaire les clients, d'améliorer les performances des transactions bancaires et de s'adapter rapidement aux besoins changeants des entreprises. La technologie permet également aux banques de rationaliser les processus, de réduire les retards, d'améliorer les rapports et la conformité et de fournir un accès simple aux clients.

Aperçu du marché des systèmes bancaires de détail

Les systèmes de banque de détail offrent aux banques les outils dont elles ont besoin pour mieux servir leurs clients via les canaux numériques pour les services bancaires personnels ou grand public. En permettant aux clients d'accéder au crédit et de transférer de l'argent en toute sécurité, ces technologies améliorent la gestion de l'argent des clients. L'utilisation de systèmes de banque de détail aide les banques à lever des capitaux à moindre coût, à établir une clientèle stable et à maintenir une gestion efficace de la relation client (CRM), ce qui devrait stimuler le marché des systèmes de banque de détail. En outre, la demande croissante des consommateurs pour les services bancaires mobiles et en ligne soutient l'expansion du marché.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché des systèmes bancaires de détail

La préférence croissante des clients pour les services bancaires mobiles et en ligne

La croissance future du marché des solutions bancaires de détail sera en grande partie attribuée à la demande croissante des clients pour les services bancaires mobiles et en ligne. Grâce aux services bancaires mobiles, les clients peuvent accéder à leurs comptes bancaires et les gérer, ainsi qu'effectuer d'autres tâches financières à l'aide de leurs appareils portables, tels que les smartphones ou les tablettes. Un service bancaire connu sous le nom de « net banking » permet aux utilisateurs d'accéder à diverses ressources bancaires et d'effectuer des transactions financières via Internet. Afin de garantir des opérations de canal plus fluides, la solution de banque de détail est utilisée pour relier les services bancaires en ligne aux canaux d'exploitation conventionnels de la banque.

La numérisation croissanteDigitalization

La croissance future du marché des solutions de banque de détail est en grande partie attribuée à la numérisation croissante du secteur bancaire. Dans le secteur de la banque, des services financiers et de l'assurance (BFSI), la « transformation numérique » fait référence à l'intégration de technologies et de tactiques numériques pour améliorer l'expérience client, rationaliser les processus commerciaux et stimuler la compétitivité du secteur. Les services bancaires multicanaux sont soutenus par des solutions de banque de détail, permettant aux utilisateurs d'accéder aux services via une variété de canaux, notamment les distributeurs automatiques de billets, les applications mobiles , les services bancaires en ligne, etc. Ainsi, la numérisation croissante devrait offrir de nouvelles opportunités aux acteurs du marché des systèmes de banque de détail au cours de la période de prévision.digitalization. In the banking, financial services, and insurance (BFSI) sector, "digital transformation" refers to the integration of digital technologies and tactics to improve client experiences, streamline business processes, and boost industry competitiveness. Multi-channel banking is supported by retail core banking solutions, giving users access to services via a variety of channels, including ATMs, digitalization is anticipated to present new opportunities for the retail core banking systems market players during the forecast period.

Analyse de segmentation du rapport sur le marché des systèmes bancaires de détail

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des systèmes bancaires de détail sont l’offre et le type de déploiement.

Offre (solutions et services), type de déploiement (cloud et sur site) et géographie

- En fonction de l’offre, le marché des systèmes bancaires de détail est divisé en solutions et services.

- En fonction du type de déploiement, le marché est segmenté en cloud et sur site. Le segment cloud détenait la plus grande part du marché en 2023.

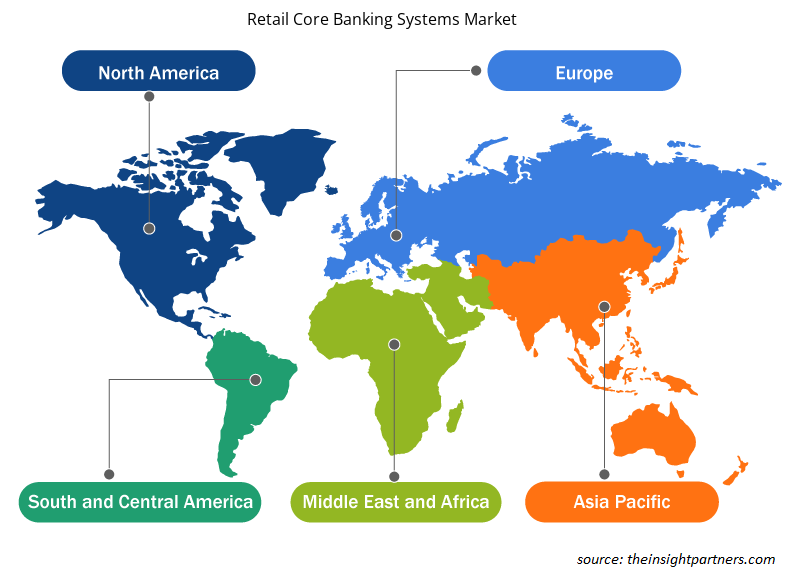

Analyse des parts de marché des systèmes bancaires de détail par zone géographique

La portée géographique du rapport sur le marché des systèmes bancaires de base de détail est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale. En termes de revenus, l'Amérique du Nord représentait la plus grande part de marché des systèmes bancaires de base de détail. En raison des avancées technologiques majeures en cours dans les solutions bancaires de base et de leur adoption par de grandes entreprises, telles que Canadian Western Bank et HSBC Holdings plc, la domination devrait persister au cours de la période projetée.

Aperçu régional du marché des systèmes bancaires de détail

Les tendances et facteurs régionaux influençant le marché des systèmes bancaires de détail tout au long de la période de prévision ont été expliqués en détail par les analystes d'Insight Partners. Cette section traite également des segments et de la géographie du marché des systèmes bancaires de détail en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des systèmes bancaires de détail

Portée du rapport sur le marché des systèmes bancaires de détail

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 14,69 milliards de dollars américains |

| Taille du marché d'ici 2031 | 55,07 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 18% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

En offrant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des systèmes bancaires de détail connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des systèmes bancaires de détail sont :

- Société Oracle

- SAP SE

- Tata Consultancy Services Limited

- Finastra International Limited

- Solutions bancaires en capital

- Systèmes EdgeVerve Limitée

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des systèmes bancaires de base de détail

Actualités et développements récents du marché des systèmes bancaires de détail

Le marché des systèmes bancaires de détail est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Voici une liste des évolutions du marché des troubles de la parole et du langage et des stratégies :

- En avril 2023, Oracle FS a mis à jour le logiciel bancaire de base d'OMO Bank, basé en Éthiopie, en collaboration avec Profinch, le partenaire de mise en œuvre FLEXCUBE d'Oracle, et a intégré de nouvelles technologies de lutte contre le blanchiment d'argent (AML) et de prévention de la fraude.

(Source : Oracle, communiqué de presse)

- En octobre 2023, une start-up fintech appelée Sopra Banking Software (SBS) a lancé une plateforme bancaire de pointe en mode SaaS (Software-as-a-Service). Cette plateforme est une solution entièrement cloud native et basée sur l'IA qui fonctionne en temps réel.

Rapport sur le marché des systèmes bancaires de détail et livrables

Le rapport « Retail Core Banking Systems Market Size and Forecast (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des systèmes bancaires de détail

Obtenez un échantillon gratuit pour - Marché des systèmes bancaires de détail