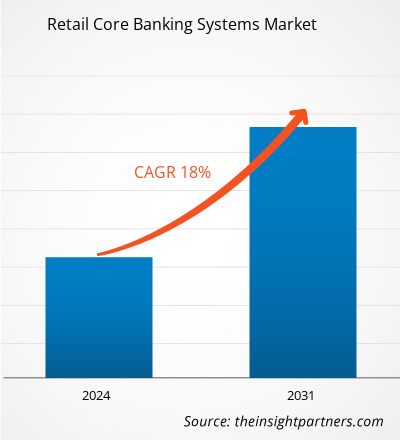

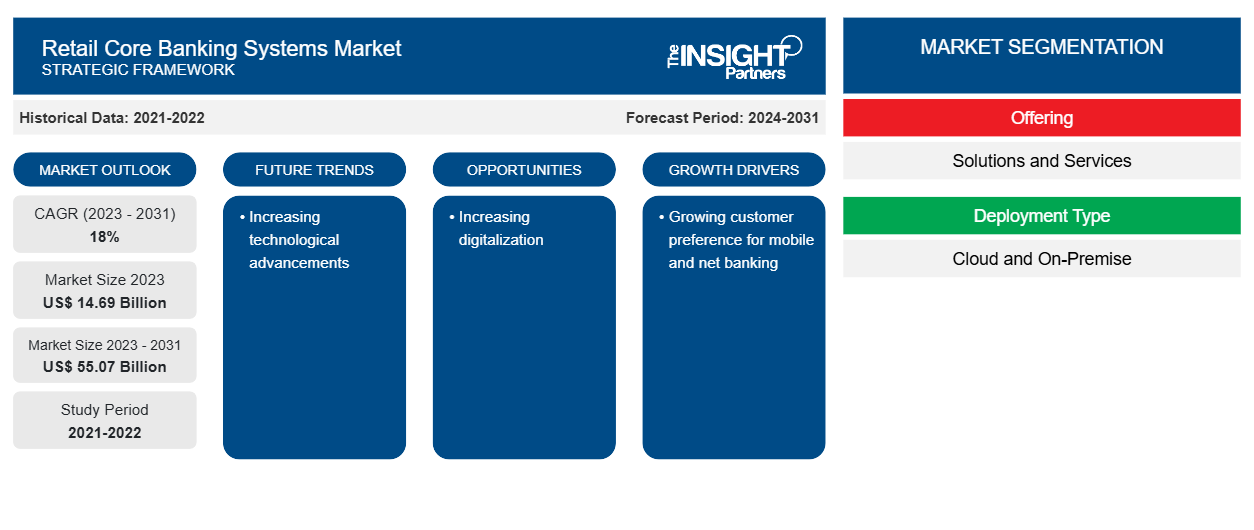

Si prevede che la dimensione del mercato dei sistemi bancari core al dettaglio raggiungerà i 55,07 miliardi di dollari entro il 2031, rispetto ai 14,69 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 18% nel 2023-2031.È probabile che i crescenti progressi tecnologici continuino a rappresentare una tendenza fondamentale nel mercato dei sistemi bancari al dettaglio.

Analisi di mercato dei sistemi bancari core al dettaglio

Grazie alla rapida adozione di tecnologie all'avanguardia da parte del sistema bancario, il mercato globale delle soluzioni di core banking al dettaglio sta crescendo in modo significativo e si prevede che continuerà a farlo anche in futuro. Un sistema di core banking è una rete di filiali bancarie che consente ai clienti di accedere a una varietà di servizi finanziari e di tenere d'occhio i propri conti da qualsiasi luogo nel mondo.

Inoltre, la tecnologia informatica (IT) viene applicata da banche e aziende FinTech per migliorare la sostenibilità e la crescita delle rispettive attività. La tecnologia bancaria di base offre modi per soddisfare i clienti, migliorare le prestazioni delle transazioni bancarie e adattarsi rapidamente alle mutevoli esigenze aziendali. La tecnologia consente inoltre alle banche di semplificare i processi, ridurre i ritardi, migliorare la rendicontazione e la conformità e fornire un accesso semplice ai clienti.

Panoramica del mercato dei sistemi bancari core al dettaglio

I sistemi di retail core banking forniscono alle banche gli strumenti di cui hanno bisogno per servire meglio i propri clienti tramite canali digitali per personal o consumer banking. Consentendo ai clienti di accedere al credito e di spostare denaro in modo sicuro, queste tecnologie migliorano la gestione del denaro dei clienti. L'uso dei sistemi di retail banking aiuta le banche a raccogliere capitale a costi bassi, a stabilire una clientela stabile e a mantenere un'efficace customer relationship management (CRM), tutti aspetti che si prevede guideranno il mercato dei sistemi di retail core banking. Inoltre, la crescente domanda dei consumatori di mobile e net banking sta supportando l'espansione del mercato.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità di mercato per i sistemi bancari core al dettaglio

Crescente preferenza dei clienti per il mobile e il net banking

La crescita futura nel mercato delle soluzioni di retail core banking sarà in gran parte attribuita alla crescente domanda da parte dei clienti di mobile e net banking. Con l'aiuto del mobile banking, i clienti possono accedere e gestire i propri conti bancari, nonché svolgere altre attività finanziarie utilizzando i propri dispositivi portatili, come smartphone o tablet. Un servizio bancario noto come "net banking" consente agli utenti di accedere a una varietà di risorse bancarie e di effettuare transazioni finanziarie tramite Internet. Per garantire operazioni di canale più fluide, la soluzione di retail core banking viene utilizzata per collegare i servizi di net banking con i canali operativi convenzionali della banca.

Aumentare la digitalizzazione

La crescita futura nel mercato delle soluzioni di core banking al dettaglio è in gran parte attribuita alla crescente digitalizzazione del settore bancario. Nel settore bancario, dei servizi finanziari e delle assicurazioni (BFSI), la "trasformazione digitale" si riferisce all'integrazione di tecnologie e tattiche digitali per migliorare le esperienze dei clienti, semplificare i processi aziendali e aumentare la competitività del settore. Il banking multicanale è supportato da soluzioni di core banking al dettaglio, che offrono agli utenti l'accesso ai servizi tramite una varietà di canali, tra cui bancomat, app mobili , online banking e altro ancora. Pertanto, si prevede che la crescente digitalizzazione presenterà nuove opportunità per gli operatori del mercato dei sistemi di core banking al dettaglio durante il periodo di previsione.

Analisi della segmentazione del rapporto di mercato dei sistemi bancari core al dettaglio

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato dei sistemi bancari core al dettaglio sono l'offerta e il tipo di implementazione.

Offerta (soluzioni e servizi), tipo di distribuzione (cloud e on-premise) e geografia

- In base all'offerta, il mercato dei sistemi core banking al dettaglio si divide in soluzioni e servizi.

- In base al tipo di distribuzione, il mercato è segmentato in cloud e on-premise. Il segmento cloud ha detenuto la quota maggiore del mercato nel 2023.

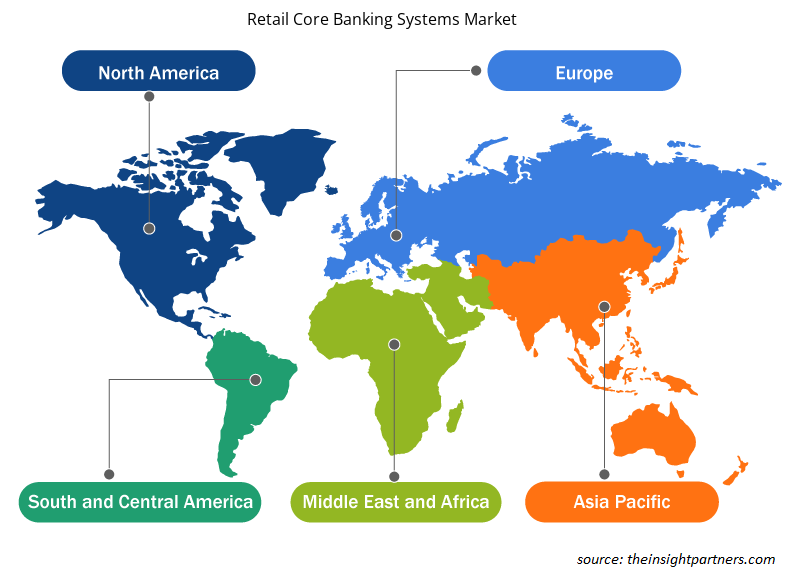

Analisi della quota di mercato dei sistemi bancari core al dettaglio per area geografica

L'ambito geografico del rapporto di mercato sui sistemi di core banking al dettaglio è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa e Sud America/Sud e Centro America. In termini di fatturato, il Nord America ha rappresentato la quota di mercato più grande dei sistemi di core banking al dettaglio. Grazie ai grandi progressi tecnologici in corso nelle soluzioni di core banking e all'adozione da parte di grandi aziende, come Canadian Western Bank e HSBC Holdings plc, si prevede che il predominio persisterà nel periodo previsto.

Approfondimenti regionali sul mercato dei sistemi bancari core al dettaglio

Le tendenze regionali e i fattori che influenzano il mercato Retail Core Banking Systems durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato Retail Core Banking Systems in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America centrale e meridionale.

- Ottieni i dati specifici regionali per il mercato dei sistemi bancari core al dettaglio

Ambito del rapporto di mercato sui sistemi bancari core al dettaglio

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 14,69 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 55,07 miliardi di dollari USA |

| CAGR globale (2023-2031) | 18% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Offrendo

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato Retail Core Banking Systems Market sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dei sistemi bancari core al dettaglio sono:

- Società Oracle

- SAP SE

- Servizi di consulenza Tata Limited

- Finastra International Limited

- Soluzioni bancarie di capitale

- Sistemi EdgeVerve limitati

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dei sistemi bancari core al dettaglio

Notizie di mercato e sviluppi recenti sui sistemi bancari core al dettaglio

Il mercato dei sistemi di retail core banking viene valutato raccogliendo dati qualitativi e quantitativi post-ricerca primaria e secondaria, che includono importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco degli sviluppi nel mercato dei disturbi del linguaggio e della parola e delle strategie:

- Nell'aprile 2023, Oracle FS ha aggiornato il software bancario di base della OMO Bank con sede in Etiopia in collaborazione con Profinch, partner di implementazione FLEXCUBE di Oracle, e ha incorporato nuove tecnologie antiriciclaggio (AML) e di prevenzione delle frodi.

(Fonte: Oracle, Comunicato stampa)

- Nell'ottobre 2023, una startup fintech chiamata Sopra Banking Software (SBS) ha introdotto una piattaforma di core banking Software-as-a-Service (SaaS) all'avanguardia. Questa piattaforma è una soluzione completamente cloud-native abilitata per l'intelligenza artificiale che opera in tempo reale.

Copertura e risultati del rapporto di mercato sui sistemi bancari core al dettaglio

Il rapporto "Dimensioni e previsioni del mercato dei sistemi bancari core al dettaglio (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Principali tendenze future

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi di mercato globale e regionale che copre le principali tendenze di mercato, i principali attori, le normative e gli sviluppi recenti del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei sistemi bancari core al dettaglio

Ottieni un campione gratuito per - Mercato dei sistemi bancari core al dettaglio