Bioprocessing Market Analysis and Opportunities by 2031

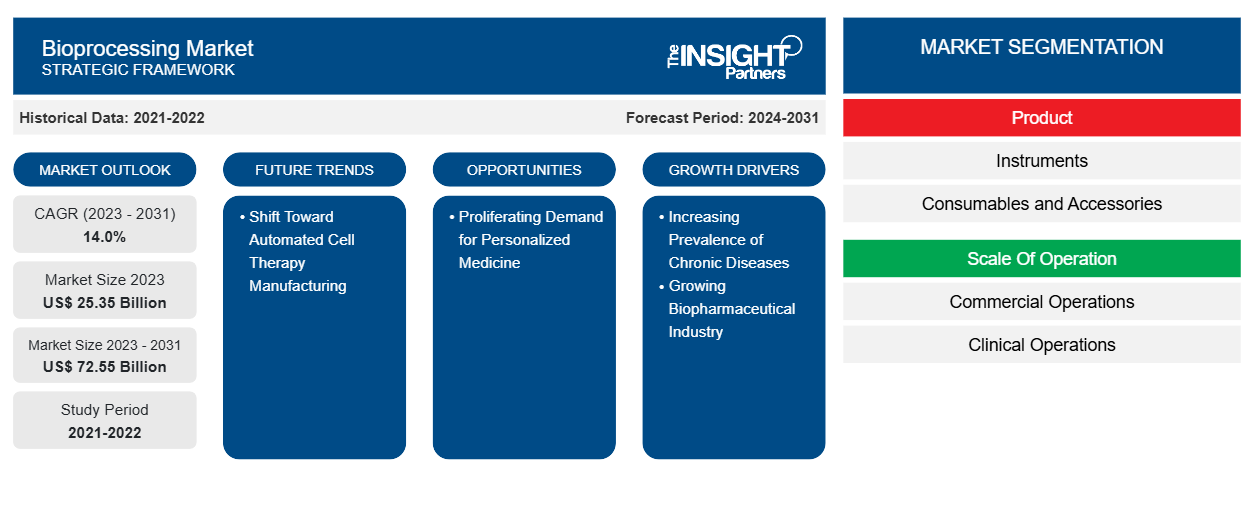

Bioprocessing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Instruments, and Consumables and Accessories), Scale of Operation (Commercial Operations and Clinical Operations), Process (Downstream Bioprocess and Upstream Bioprocess), Application (Monoclonal Antibodies, Vaccines, Recombinant Protein, Cell and Gene Therapy, and Others), End User (Biopharmaceutical Companies, Contract Manufacturing Organization, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Apr 2024

- Report Code : TIPRE00039016

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 300

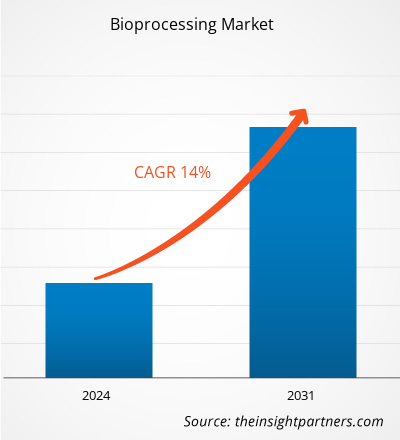

The bioprocessing market size is projected to surge from US$ 25.35 billion in 2023 to US$ 72.55 billion by 2031; the market is estimated to register a CAGR of 14.0% during 2023–2031.

Analyst Perspective:

The report includes growth prospects owing to the current bioprocessing market trends and their foreseeable impact during the forecast period. The growing cases of chronic diseases are one of the major factors increasing the demand for new drugs, which creates a need for bioprocessing. In addition, personalized treatment of diseases such as cancer increases the demand for various bioprocessing technologies, including cell therapy. The importance of research and development in the life sciences industry has been greatly promoted in recent years. Due to this trend, government support for the pharmaceutical and biotech industries is also increasing. Additionally, a growing focus on preventative measures and alternative medicines for specific applications drives the market for bioprocessing. Additionally, increasing investment in new technologies to overcome performance and quality issues associated with manufacturing bioprocess products is expected to drive bioprocessing market growth.

Market Overview

The expansion of biopharmaceutical industry, which is highly focused on biologics, results in a higher demand for research services than before. Increased collaborations between industry players and academic institutions facilitate resource sharing and accelerated bioprocessing. An increase in funding for research and development of bioprocess technology is estimated to drive the growth of the global bioprocessing market. Furthermore, increasing support from governments of various countries in biofuel production is expected to drive the growth of the bioprocess technology market. Due to an increase in the number of infectious and chronic diseases such as cancer, bioprocessing is expected to experience significant demand from the biopharmaceutical sector. The developments in the biopharmaceutical industries, increase in research and development spending, an escalation in vaccine production, and technological advancements are likely to have a significant impact on the bioprocessing market forecast in the next few years. However, strict regulatory guidelines and high technology costs hinder the growth of bioprocess technologies.

The bioprocessing market is experiencing significant growth, driven by several key factors. The expansion of the biopharmaceutical industry, particularly in the development of biologics, has led to a higher demand for advanced research services. Collaborations between industry players and academic institutions facilitate resource sharing and accelerate bioprocessing advancements. Increased funding for research and development in bioprocess technology further propels market growth. Governments worldwide are also supporting biofuel production, contributing to the expansion of the bioprocess technology market. The rise in infectious and chronic diseases, such as cancer, has increased the demand for bioprocessing in the biopharmaceutical sector. Developments in biopharmaceutical industries, increased research and development spending, escalated vaccine production, and technological advancements are expected to significantly impact the bioprocessing market in the coming years. However, strict regulatory guidelines and high technology costs pose challenges to the growth of bioprocess technologies.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBioprocessing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver

Increasing Prevalence of Chronic Diseases Propel Market Growth

The sedentary life of older people has boosted the prevalence of lifestyle disorders, such as obesity and diabetes. Inherited genes can also express these conditions along with other health concerns such as cardiovascular disease (CVDs), Alzheimer’s disease, and depression. As per the National Council on Aging, Inc., 80% of adults (aged 65 and more) are reported to suffer from at least one chronic condition in their lifetime. According to the Centers for Disease Control and Prevention (CDC), approximately 6 of 10 people in the US suffered from at least one serious disease, and 4 of 10 people had two or more chronic conditions in 2020.

CVDs, such as angina pectoris, atherosclerosis, and acute myocardial infarction caused because of hectic lifestyles, are among the significant causes of mortality across the world. As per the World Heart Foundation, mortality caused due to CVD has surged by 60% over the past 30 years (1990–2020). 20.5 million deaths were recorded in 2021 due to CVDs. Diabetes is one of the life-threatening chronic diseases with no functional cure. According to the International Diabetes Federation, the number of diabetic cases in North America is anticipated to grow from 46 million in 2017 to 62 million by 2045. As per the Global Cancer Observatory (GLOBOCAN) estimates published in 2020, 19.3 million cancer cases were reported across the world. The number of cases was significantly high in the US, China, and India. The GLOBOCAN further estimates that cancer cases in India would reach ~2.08 million by 2040, representing a rise of 57.5% from 2020. Similarly, as per the World Health Organization data published in February 2022, ~10 million people across the world have succumbed to death due to cancer. An upsurge in the incidence of cancer indicates the need for innovative cancer treatments. Monoclonal antibodies represent a promising class of targeted anticancer agents that enhance the natural ability of immune systems to suppress cancer cell activity and eliminate cancer cells. Antibody–drug conjugates (ADCs) have also shown promising results in cancer treatment.

The recognition of biosimilars as efficient and safe by specialists, patients, primary care clinicians, and other healthcare professionals is propelling its demand. Biosimilars have proven to improve the quality of life for millions of patients. They are impactful and cost-effective options for treating many diseases, including chronic skin conditions (such as psoriasis and atopic dermatitis), bowel diseases (such as Crohn’s disease, irritable bowel syndrome, and colitis), diabetes, autoimmune disease, cancer, kidney conditions, and arthritis. Biosimilar developers are adopting advanced bioprocessing technologies to achieve lower manufacturing costs, which is an important factor in determining the final consumer prices. Nearly all biosimilar developers are using modern, cutting-edge bioprocessing techniques. Therefore, with the growing prevalence of chronic diseases, the demand for biosimilars to treat life-threatening illnesses is spurring, thereby propelling the demand for bioprocessing leading to bioprocessing market growth.

Segmental Analysis

The bioprocessing market analysis has been carried out by considering the following segments: product, scale of operation, process, application, and end user.

Based on product, the bioprocessing market is segmented into instruments, and consumables and accessories. The instruments segment held a larger market share in 2023 and is likely to register the highest CAGR of 14.5% during 2023–2031.

By scale of operation, the market is segmented into commercial operations and clinical operations. The commercial operations segment held a larger bioprocessing market share in 2023 and is anticipated to register a higher CAGR during the forecast period.

Based on process, the bioprocessing market is divided into downstream bioprocess and upstream bioprocess. The downstream bioprocess segment held a larger market share in 2023 and is anticipated to register a higher CAGR of 14.4% during 2023–2031. Downstream bioprocessing is the stage where the upstream bioproduct is recovered, concentrated, and purified to meet quality requirements. Downstream bioprocessing is applicable in the purification of monoclonal antibodies or proteins and manufacturing of oligonucleotides, polysaccharides, and various vaccines. The steps associated with downward bioprocessing are harvest and filtration, capture, ultrafiltration, purification, bioconjugation, and formulation.

The bioprocessing market, based on application, is divided into monoclonal antibodies, vaccines, recombinant protein, cell and gene therapy, and others. The monoclonal antibodies segment dominated the market share in 2023. The cell and gene therapy segment is anticipated to register the highest CAGR of 16.5% during the forecast period. Cell and gene therapy are the overlapping fields in biomedical treatment and research. Both therapies aim to prevent, treat, or potentially cure diseases. Moreover, both cell and gene therapies have the potential to alleviate the underlying cause of genetic and acquired diseases. Cell therapy intends to treat diseases by restoring or modifying several sets of cells outside the body before being injected into the patient or by using cells to carry a therapy across the body. Gene therapy aims to treat diseases by restoring or introducing new genes into cells—either outside of the body (ex vivo) or inside the body (in vivo).

Based on end user, the bioprocessing market is divided into biopharmaceutical companies, contract manufacturing organization, and others. The biopharmaceutical companies segment held the largest bioprocessing market share in 2023; the contract manufacturing organization segment is anticipated to register the highest CAGR of 14.7% during 2023–2031. The number of biopharmaceutical companies is increasing worldwide, leading to a high number of collaborations and agreements between the companies. Investments by companies in the research and development of drugs and other biosimilars have been increased. The advancement in biotechnology has improved the identification of possible targets for a drug. The rising application of bioprocessing in cancer therapeutics and the ability of biopharmaceuticals to address untreatable conditions are expected to accelerate the market growth.

Regional Analysis

The scope of the bioprocessing market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 12.44 billion in 2023 and is projected to reach US$ 35.95 billion by 2030; it is expected to register a CAGR of 14.2% during 2023–2031. Market growth in the region is due to the increasing incidence of rare diseases and the rising trend of cell and gene therapy (CGT). Growing incidences of genetic and cellular disorders are leading to increasing demand for cell therapies. In April 2023, Cytiva launched X-platform bioreactors to simplify upstream bioprocessing operations with single-use products. The increasing R&D investments by US-based biopharmaceutical and biotechnology companies to improve outcomes of clinical trials and ensure patient safety, and the growing traction toward precision medicine with rising investments by the US government contribute to the growth of the bioprocessing market in the US. Asia Pacific is expected to register the highest CAGR of 15.1% during 2023–2031. The Asia Pacific bioprocessing market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. China held the largest market share in 2023, and India is expected to show a significant growth rate in the market. The biopharmaceutical industry in China is undergoing a tremendous shift, evolving from a generics-focused landscape to a thriving innovation hub. India's bioprocessing capability is highly dependent on its qualified workforce and cost efficiencies, which creates growth opportunities for the market. Indian businesses such as Piramal Enterprises Ltd. and Aurigene Pharmaceutical Services Ltd. are global biopharmaceutical companies offering solutions and services such as antibody discovery and engineering, linker-payload chemistry, conjugation, and characterization to develop drugs. The presence of such companies in the country contributes significantly to the market growth.

Key Player Analysis

Cytiva (Danaher Corporation), Sartorius AG, Thermo Fisher Scientific Inc., Repligen Corporation, Merck KgaA, 3M Company, Getinge AB, Eppendorf SE, Corning Incorporated, Entegris, Agilent Technologies, and Bio-Rad Laboratories are among the key players profiled in the bioprocessing market report.

Bioprocessing Market Regional InsightsThe regional trends and factors influencing the Bioprocessing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Bioprocessing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Bioprocessing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 25.35 Billion |

| Market Size by 2031 | US$ 72.55 Billion |

| Global CAGR (2023 - 2031) | 14.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Bioprocessing Market Players Density: Understanding Its Impact on Business Dynamics

The Bioprocessing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Bioprocessing Market top key players overview

Recent Developments

Companies operating in the bioprocessing market adopt strategic initiatives such as mergers and acquisitions, and partnerships. As per company press releases, a few recent market developments are listed below:

- In February 2024, Cytiva and LevitasBio collaborated to deliver an innovative single-cell workflow for genomics researchers in academia and industry. This collaboration marked a significant milestone in improving how samples are prepared, enabling researchers to quickly perform tasks like breaking down tissues and purifying individual cell suspensions for single-cell analysis and other downstream applications. This is particularly important for advancing personalized medicine by providing insights into disease mechanisms and therapeutic targets, supporting oncology research, and accelerating scientific discovery.

- In February 2024, Thermo Fisher Scientific Inc announced the expansion of its manufacturing facility in St Louis, which will support manufacturing biological therapies for rare diseases. Through the expansion, the company has doubled its biologics manufacturing capacity for complex biologic treatments, intending to enhance production from 2,000l to 5,000l for diseases, including cancer, autoimmune conditions, and rare disorders. The total area of the expanded site is 33,000ft² (3,065m²) and is equipped with four Thermo Scientific DynaDrive single-use bioreactors, each having a capacity of processing up to 5,000l.

- In January 2024, Agilent Technologies Inc. announced an agreement with Incyte to bring together Agilent’s expertise and proven track record in developing companion diagnostics (CDx) to support the development and commercialization of Incyte’s hematology and oncology portfolio.

- In November 2023, Cytiva introduced the innovative Cytiva Protein Select technology, designed to streamline and accelerate recombinant protein purification. The self-cleaving traceless tag and complementary affinity chromatography resin standardize purification for any protein, rendering it unnecessary to use specific affinity binding partners for each protein. Protein purification is integral to basic research, drug discovery, process development, and bioprocessing.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For