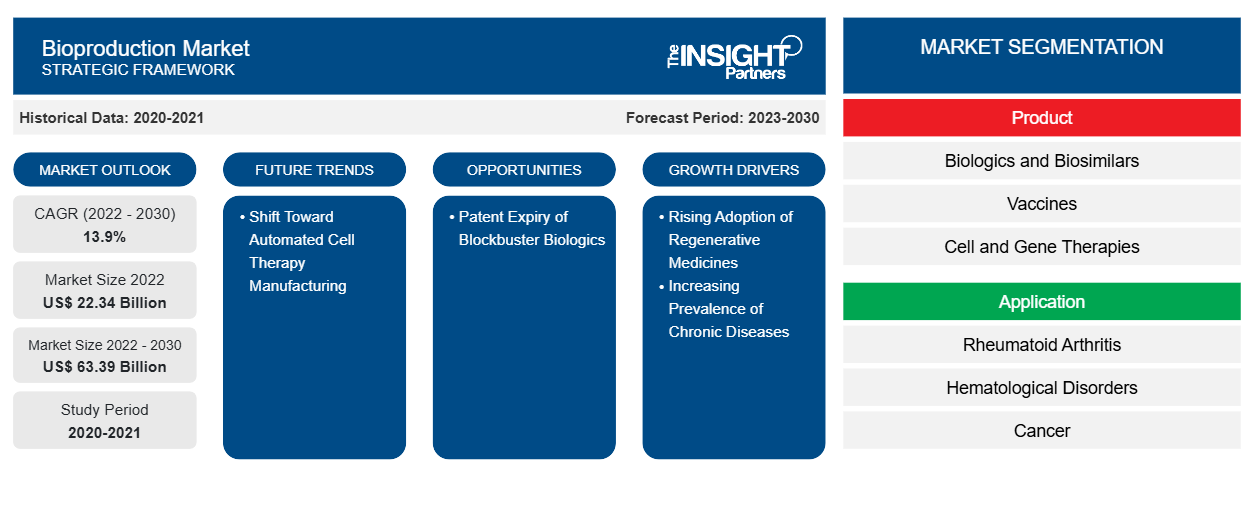

Bioproduction Market Analysis and Opportunities by 2030

Bioproduction Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product (Biologics and Biosimilars, Vaccines, Cell and Gene Therapies, Nucleic Acid Therapeutics, and Others), Application (Rheumatoid Arthritis, Hematological Disorders, Cancer, Diabetes, Cardiovascular Diseases, and Others), Equipment (Upstream Equipment, Downstream Equipment, Bioreactors, and Consumables and Accessories), End User (Biopharmaceutical Companies, Contract Manufacturing Organizations, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Nov 2023

- Report Code : TIPRE00030322

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 209

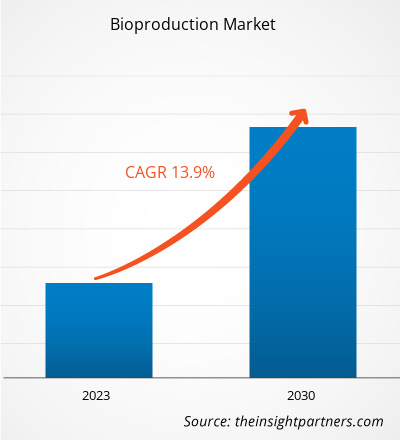

[Research Report] The bioproduction market size is projected to grow from US$ 22,337.24 million in 2022 to US$ 63,393.93 million by 2030; the market is estimated to record a CAGR of 13.9% during 2022–2030.

Market Insights and Analyst View:

Automation can deliver many benefits for cell therapy developers, including reduced risk of contamination, improved consistency, and reduced cost of production. Many companies have offered devices to enable automation, such as the Lonza Cocoon and the CliniMACS Prodigy system from Miltenyi, which are designed to enable automation in most sequential unit operations for a CAR-T process within a single system. A rising number of cell therapies have shifted the production of cell therapy products from a small volume to a large volume worldwide. In addition, the evolution of cell therapy, from an academic and clinical setting to mass production and commercialization, is increasing the demand for automation in manufacturing. Increasing research activities in cell therapies have led to a rise in demand for advanced manufacturing solutions. In view of this, many players are offering products to meet the digital needs of academic researchers and large biotechnology companies. For instance, in May 2019, GE Healthcare launched the Chronicle web application to support the complete cell therapy workflow. Chronicle automation software is a good manufacturing practice (GMP)-compliant digital solution designed to optimize complex cell therapy process development and manufacturing.

Companies are also entering into strategic and technological developments for automation in cell therapy. For instance, in July 2020, Thermo Fisher Scientific Inc. and Lyell Immunopharma partnered to develop and manufacture processes to design effective cell therapies for cancer patients. Under this partnership, the companies aim to improve the fitness of T-cells and support the development of an integrated current good manufacturing practice (cGMP)-compliant platform (system and software) along with reagents, consumables, and instruments. In March 2019, Lonza partnered with Israel’s Sheba Medical Center to provide automated and closed CAR-T manufacturing using its point-of-care Cocoon cell therapy manufacturing platform. Thus, the increasing adoption of automation among cell therapy manufacturers is anticipated to drive the bioproduction market.

Growth Drivers:

Patent Expiry of Blockbuster Biologics Creates Opportunities for Bioproduction Market

Biologicals represent promising new therapies for previously incurable diseases and are becoming highly important in the pharmaceuticals market. Patents on originator biologicals are expected to expire in the coming years.

Estimated patent and exclusivity expiry dates for best-selling biologicals are given in the following table.

Biologicals |

Expiry Dates |

|

Avastin |

January 2022 |

|

Cyramza |

May 2023 |

|

Adcetris |

August 2023 |

|

Abthrax |

October 2024 |

|

Gazyva/Gazyvaro |

November 2024 |

|

Darzalex |

May 2026 |

|

Ocrevus |

April 2027 |

|

Emgality |

September 2028 |

|

Hemlibra |

February 2028 |

|

Llumetri |

March 2028 |

|

Imfinzi |

September 2028 |

|

Mylotarg |

April 2028 |

|

Imfinzi |

September 2028 |

|

Mylotarg |

April 2028 |

|

Sylvant |

July 2034 |

Source: Generics and Biosimilars Initiative (GaBI) Journal

The patent expiration and other intellectual property rights for originator biologicals will create a need to introduce new biosimilars in the future. As a result, competition among market players will surge in the industry in the coming years. Thus, the patent expiry of blockbuster biologics is expected to create lucrative opportunities for the bioproduction market during the forecast period.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBioproduction Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “bioproduction market” is segmented on the basis of product, application, equipment, and end user. The bioproduction market, by product, is subsegmented into biologics and biosimilars, vaccines, cell and gene therapies, nucleic acid therapeutics, and others. The biologics and biosimilars segment held the largest market share in 2022; the cell and gene therapies segment is estimated to register the highest CAGR in the market during 2022–2030. Based on application, the bioproduction market is divided into rheumatoid arthritis, hematological disorders, cancer, diabetes, cardiovascular diseases, and others. The cancer segment held the largest market share in 2022 and is predicted to register the highest CAGR during 2022–2030. In terms of equipment, the bioproduction market is segmented into consumables and accessories, downstream equipment, bioreactors, and upstream equipment. The consumables and accessories segment held the largest market share in 2022 and is anticipated to grow at the fastest rate during 2022–2030. The bioproduction market, by end user, is segmented into biopharmaceutical companies, contract manufacturing organizations, and others. The biopharmaceutical companies segment held the largest market share in 2022. The contract manufacturing organizations segment is projected to register the highest CAGR in the market during 2022–2030.

Segmental Analysis:

The bioproduction market, by product, is segmented into biologics and biosimilars, vaccines, cell and gene therapies, nucleic acid therapeutics, and others. The biologics and biosimilars segment held the largest market share in 2022. The cell and gene therapies segment is estimated to register the highest CAGR in the market during 2022–2030. Cell therapy and gene therapy are the overlapping fields in biomedical treatment and research. Both therapies aim to prevent, treat, or potentially cure diseases. Moreover, both therapies can improve the underlying cause of genetic and acquired diseases. Cell therapy intends to treat diseases by restoring or modifying several sets of cells outside the body before being injected into the patient or by using cells to carry a therapy across the body. Gene therapy aims to treat diseases by restoring or introducing new genes into cells—either outside of the body (ex vivo) or inside the body (in vivo). The gene therapies work by adjusting genes in specific types of cells and incorporating them into the body.

By application, the bioproduction market is segmented into rheumatoid arthritis, hematological disorders, cancer, diabetes, cardiovascular diseases, and others. The cancer segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. The rise in healthcare expenses has coincided with advancements in cancer care. The development of biosimilars has resulted from strategies to reduce the overall cost of costly oncology drugs and cost-containment techniques being prioritized in the US and globally. For a number of reasons, biologics are crucial in the treatment of cancer. Biologic medications can help the patient's body recognize and combat cancer cells. Certain biologics directly target cancer cells by interfering with their growth signals. After chemotherapy, various biologics can aid in the battle against infection. In the US, colon, stomach, and breast cancers, among other malignancies, can be treated with FDA-approved biosimilars. They can also be utilized to address adverse effects of cancer therapies, for instance, decreased white blood cell counts that heighten the vulnerability to infections. Biologicals are being used as both therapeutic and supportive care agents in the treatment of cancer. Trastuzumab (Herceptin) is an example of a biological medicine, a targeted cancer drug that is used to treat advanced stomach cancer and breast cancer. The biosimilars for this drug include Herzuma and Ontruzant.

Regional Analysis:

Geographically, the global bioproduction market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest share of the global bioproduction market. Asia Pacific is expected to register the highest CAGR during 2022–2030. Market growth in this region is ascribed to growing need for superior treatment solutions, increasing focus on research and development activities, and favorable regulatory scenarios. Additionally, increasing investments and developing healthcare infrastructure to boost research activities are estimated to drive the Asia Pacific bioproduction market during 2022–2030.

The bioproduction market in North America is further split into the US, Canada, and Mexico. The market growth in this region can be attributed to the increasing incidence of diabetes and infertility, as well as rising product developments in biosimilars.

Growing incidences of genetic and cellular disorders are leading to increasing demand for cell therapies. A 2020 PhRMA report on the cell and gene therapy pipeline revealed that there are 400 cell and gene therapies in development to target a variety of diseases and conditions from cancer to genetic disorders to neurologic conditions in the US. As of February 2020, nine cell or gene therapy products were approved in the US to treat cancer, eye diseases, and rare hereditary diseases. Also, an increasing number of start-ups are innovating cell therapies in the country.

In the US, biosimilars are used to treat patients with cancers, kidney diseases, diabetes, and other autoimmune diseases such as Crohn's disease and rheumatoid arthritis. According to Cardinal Health, a total of 33 biosimilars have been approved by the FDA in the US and 21 are commercially available. Of the 21 biosimilars in the market, 17 are used for treatments associated with cancers, 3 for treating autoimmune conditions, and 1 is used to treat diabetes. Biosimilars are anticipated to be priced 15% to 30% lower than the biologics. In 2020 alone, biosimilars saved US$ 7.9 billion, with savings estimated to grow substantially in the next few years as more biosimilars enter the market. According to Cardinal Health, biosimilars are expected to reduce US drug expenditure by US$ 133 billion by 2025. In addition, growing support from the government is enhancing the growth of cell therapies, which is influencing the growth of the bioproduction market.

According to Cancer Medical Science, cancer is ranked third as the leading cause of death in Mexico in 2020. The most common types of cancer among Mexican men are prostate, colorectal, testicular, lung, and gastric, while women have majorly reported to have suffered from breast, thyroid, cervical, uterine corpus, and colorectal cancer. In Mexico, biosimilars are also known as biocomparables. According to GaBI, 13 biocomparables have been currently approved in Mexico in the following therapeutic classes: erythropoiesis-stimulating agent, granulocyte colony-stimulating factor, endogenous growth hormone, follicle-stimulating hormone (FSH), insulin, tumor necrosis factor (TNF) inhibitor, and antivirals and interferon. Thus, the increasing number of cancer disease conditions and biosimilar product approvals are driving the growth of the bioproduction market in Mexico.

Bioproduction Market Regional InsightsThe regional trends and factors influencing the Bioproduction Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Bioproduction Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Bioproduction Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 22.34 Billion |

| Market Size by 2030 | US$ 63.39 Billion |

| Global CAGR (2022 - 2030) | 13.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Bioproduction Market Players Density: Understanding Its Impact on Business Dynamics

The Bioproduction Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Bioproduction Market top key players overview

Industry Developments and Future Opportunities:

Various strategic developments by leading players operating in the bioproduction market are listed below:

- In March 2023, Lonza declared that its intended cGMP clinical and commercial drug product production line in Visp (CH) has been completed. Customers with a range of production demands for drug products, for both clinical and commercial supply, will be served by the new line. Modern liquid and lyophilized vial filling isolator line for multiple modalities that satisfies the GMP Annex 1 requirement for the manufacture of sterile products is part of this 1,200 square meter cGMP facility. The line is already completely operating and has a cGMP license; in April 2023, the first client batches are scheduled to be filled.

- In May 2022, FUJIFILM Irvine Scientific Inc, a world leader in the development and manufacture of serum-free and chemically defined cell culture media for bioproduction and cell therapy manufacturing, announced the completion of its Innovation and Collaboration Center in Suzhou New District, China.

- In December 2021, FUJIFILM Irvine Scientific Inc, a world leader in the development and manufacturer of serum-free and chemically defined cell culture media for bioproduction and cell therapy manufacturing, announced the establishment of an Innovation and Collaboration Center in Suzhou New District, China. Through this new center, experts will collaborate with customers to design upstream cell culture processes that meet their biomanufacturing needs.

- In March 2023, BiVACOR Inc’s Cormorant Asset Management and OneVentures, through OneVentures Healthcare Fund III, funded the company with US$ 18 million in capital. The funds will help the business hire important executives and support its ongoing R&D as well as early feasibility studies in human trials. Using this financial aid, the company would hire candidates for important roles, such as research and development professionals and the C-suite, as a part of its efforts to double its operations in size. The BiVACOR Inc further hopes to conduct an early feasibility study of its Total Artificial Heart for the first time in human subjects by the end of 2023.

Competitive Landscape and Key Companies:

Lonza Group AG, bbi-biotech GmbH, Danaher Corp, Sartorius AG, FUJIFILM Irvine Scientific Inc, Thermo Fisher Scientific Inc, Merck KGaA, F. Hoffmann-La Roche Ltd, and Bio-Rad Laboratories Inc are the prominent companies in the bioproduction market. These companies focus on new technologies, upgrading existing products, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For