GCC Ice Cream Market Growth (2025–2031) – Size, Trends & Forecast

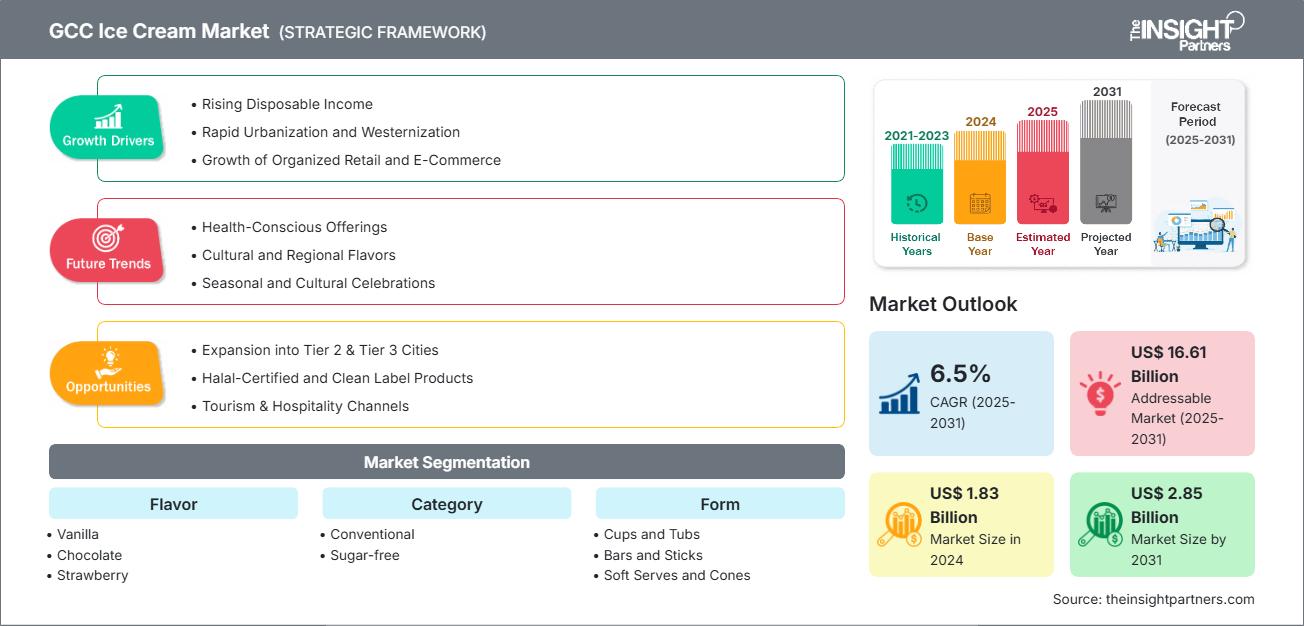

GCC Ice Cream Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Flavor (Vanilla, Chocolate, Strawberry, Raspberry, Mango, Blueberry, and Others), Category (Conventional and Sugar-free), Form (Cups and Tubs, Bars and Sticks, Soft Serves and Cones, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Vending Machines, and Others), and Country

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00007896

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 161

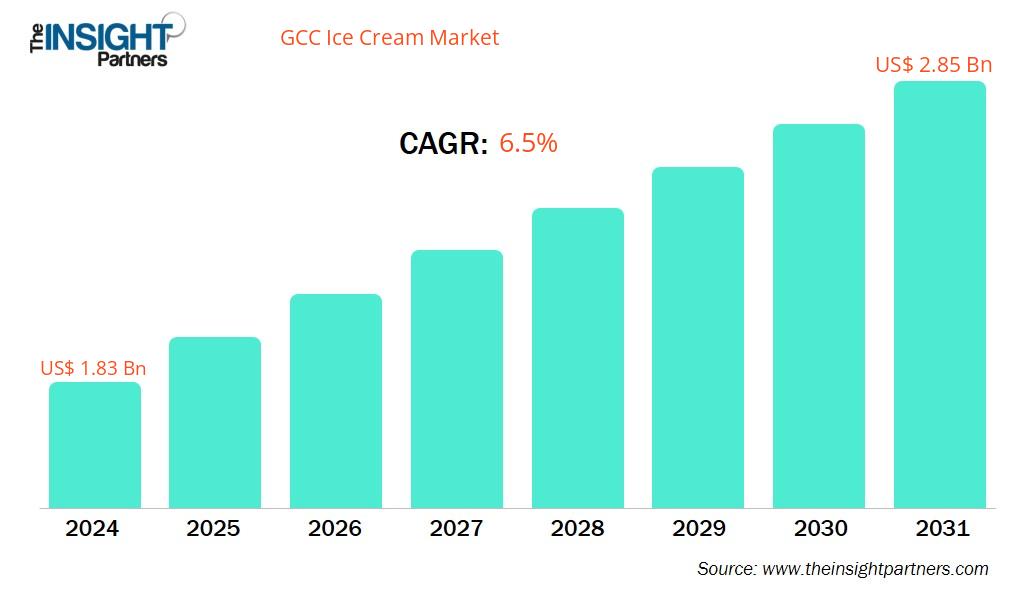

The GCC ice cream market size is projected to grow from US$ 1.83 billion in 2024 to US$ 2.85 billion by 2031; the market is expected to register a CAGR of 6.5% during 2025–2031.

GCC Ice Cream Market Analysis

Health-focused trends are reshaping the ice cream market in the GCC, with rising interest in lactose-free, low-fat, and vegan products as consumers become more mindful of lactose intolerance. To cater to these preferences, producers are incorporating natural and organic ingredients. Additionally, the expansion of e-commerce—driven by initiatives such as Dubai's digital commerce programs and Bahrain's National E-commerce Strategy—has improved access to ice cream via online platforms and delivery services. Although the industry faces hurdles such as fluctuating ingredient costs and stringent food safety regulations, it continues to grow, fueled by innovation, premium product offerings, and a broad consumer base that includes a sizeable expatriate population with diverse flavor preferences.

GCC Ice Cream Market Overview

The ice cream market in the GCC is experiencing strong growth, primarily due to the region's consistently warm climate, which drives demand for cold treats, especially between April and September. This expansion is further supported by increasing disposable incomes, urban development, and a booming tourism industry in Saudi Arabia and the UAE. Consumers prefer high-end and artisanal ice creams featuring distinctive flavors such as saffron, dates, and rosewater, reflecting a blend of local heritage and Western influences. Government programs, including Saudi Arabia's "Made in Saudi" initiative, are bolstering the sector by encouraging domestic production, reducing import dependence, and generating employment through new manufacturing ventures.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGCC Ice Cream Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

GCC Ice Cream Market Drivers and Opportunities

Market Drivers:

- Rising Disposable Incomes: Growing affluence, particularly in Saudi Arabia, the UAE, and Qatar, increases consumer spending on premium and indulgent products such as ice cream.

- Rapid Urbanization and Westernization: Urban populations are adopting Western lifestyles and eating habits, which include regular consumption of desserts and frozen treats.

- Year-Round Hot Climate: The consistently hot and humid weather across the GCC boosts demand for cold refreshments, especially ice cream.

- Growth of Organized Retail and E-Commerce: Expansion of modern supermarkets, hypermarkets (e.g., Carrefour, Lulu), and delivery apps has increased accessibility to various ice cream products.

- Rising Demand for Premium & Artisanal Products: Consumers seek gourmet, clean-label, and locally crafted ice creams; this includes gelato, organic, or exotic-flavored products.

Market Opportunities:

- Health-Conscious & Functional Ice Creams: Develop low-calorie, sugar-free, lactose-free, plant-based (vegan), high-protein, or probiotic-enriched ice cream.

- Expansion into Tier 2 & Tier 3 Cities: Targeting underserved but growing cities in Saudi Arabia, Oman, and Kuwait is creating lucrative opportunities.

- Halal-Certified and Clean Label Products: Providing Halal, non-GMO, and clean-label options to appeal to conscious families contributes to the market growth.

- Sustainable Packaging and Ethical Branding: Offering frozen or shelf-stable wraps with a long shelf life for rural and remote areas with limited cold-chain logistics.

- Tourism & Hospitality Channels: Growing tourism and hospitality channels create a growth opportunity for key players in the region.

GCC Ice Cream Market Report Segmentation Analysis

The GCC ice cream market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Flavor:

- Vanilla: Preferred for its smooth, classic flavor, it is made with real vanilla beans or extract as a base for other mix-ins.

- Chocolate: Preferred for its rich, indulgent flavor, it is made using cocoa powder or melted chocolate for a deep taste.

- Strawberry: Popular for its sweet, fruity appeal, it is made using real strawberries or purée for natural color and flavor.

- Raspberry: Valued for its tangy, refreshing profile, it is made with raspberry purée or juice for a vibrant taste.

- Mango: A tropical favorite made with ripe mango pulp, offering a creamy and exotic sweetness.

- Blueberry: Known for its antioxidant appeal and subtle sweetness, it is made from whole blueberries or syrup.

- Others: These cater to niche or premium tastes and are often made using specialty ingredients such as roasted nuts, espresso, or cooked sugar syrups.

By Category:

- Conventional Conventional ice cream is produced by blending milk, cream, sugar, and stabilizers, followed by pasteurization, homogenization, and controlled freezing to achieve a smooth, aerated texture.

- Sugar-Free: Sugar-free ice cream replaces traditional sucrose with alternative sweeteners such as stevia, erythritol, or allulose, combined with milk or non-dairy bases, stabilizers, and flavorings to maintain texture and taste.

By Form:

- Cups and Tubs: Ice cream cups and tubs are preferred for their convenience, portion control, and suitability for individual and family consumption.

- Bars and Sticks: Ice cream bars and sticks are favored due to their portability, convenience, and strong spontaneous purchase potential, which makes them an ideal choice for on-the-go consumption.

- Soft Serves and Cones: Soft-serve and cone-based ice creams are favored for their light texture, freshly dispensed appeal, and engaging sensory experience.

- Bars and Sticks: Ice cream bars and sticks are highly favored due to their portability, convenience, and strong spontaneous purchase potential, which makes them an ideal choice for on-the-go consumption.

- Others: Other ice cream forms include sandwiches and bricks. The ice cream sandwich features a scoop of ice cream between two soft and chewy cookies, wafers, or other sweet treats, offering a twist on traditional ice cream and adding a textural element to the eating experience.

By Distribution Channel:

- Supermarkets and Hypermarkets: Supermarkets and hypermarkets are key distribution channels for ice cream due to their extensive reach, broad product assortment, and strong consumer footfall.

- Specialty Stores: Specialty stores are a preferred retail channel for ice cream, offering curated selections, premium positioning, and personalized customer experiences.

- Online Retail: Online retail is emerging as a high-growth channel for ice cream sales, driven by rising digital adoption, convenience-led shopping behavior, and improved cold chain logistics.

- Vending Machines: Vending machines are a strategic distribution channel for ice cream, offering 24/7 accessibility, minimal staffing needs, and placement flexibility in high-traffic locations such as malls, airports, and universities.

- Others: Other distribution channels for ice cream include gas stations, convenience stores, discount stores, and small independent stores.

By Country:

- Saudi Arabia

- UAE

- Kuwait

- Qatar

- Bahrain

- Oman

Saudi Arabia recorded the largest market share in the GCC ice cream market, which is expected to register the fastest growth rate.

GCC Ice Cream Market Report Scope| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.83 Billion |

| Market Size by 2031 | US$ 2.85 Billion |

| CAGR (2025 - 2031) | 6.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Flavor

|

| Regions and Countries Covered |

GCC

|

| Market leaders and key company profiles |

|

GCC Ice Cream Market Players Density: Understanding Its Impact on Business Dynamics

The GCC Ice Cream Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the GCC Ice Cream Market top key players overview

GCC Ice Cream Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of established players such as General Mills Inc., Unilever plc, Nestle SA, Pure Ice Cream Co. LLC (Kwality), Bulla Dairy Foods, Saudia Dairy & Foodstuff Company (SADAFCO), BR IP Holders LLC (Baskin-Robbins), Thrriv LLC, IFFCO Group, and IFFCO Group.

The high level of competition urges companies to stand out by offering:

- Innovative product offering

- Sustainable and ethical sourcing

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- Focusing on research and development activities to distinguish themselves in the market

- Expanding global footprint and capabilities through acquisitions of confectionery brands

- Expanding product portfolio with the launch of innovative flavors

Major Companies operating in the GCC ice cream market are:

- General Mills Inc

- Unilever plc

- Nestle SA

- Pure Ice Cream Co LLC (Kwality)

- Bulla Dairy Foods

- Saudia Dairy & Foodstuff Company (SADAFCO)

- BR IP Holders LLC (Baskin-Robbins)

- Thrriv LLC

- IFFCO Group

- Unikai Foods PJSC

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Baladna Food Industries – Qatar

- Galadari Ice Cream Company LLC – UAE

- Mars – GCC

- Milky Ice Cream – Saudi Arabia

- Morelli's Gelato – UAE

- The Saudi Ice Cream Factory Company Ltd – Saudi Arabia

- Batterjee Ice Cream & Juice Factory – Saudi Arabia

- Kalleh Dairy – UAE

- Almarai – UAE

- MADO - UAE

GCC Ice Cream Market News and Recent Developments

- Saudia Dairy & Foodstuff Company (SADAFCO) – Partnership In 2022, Saudia Dairy & Foodstuff Company (SADAFCO), the market leader in long-life milk, tomato paste, and ice cream, announced a strategic digital transformation partnership with SAP and NTT DATA-IGSA, marking a significant milestone in its digital transformation journey.

- Bulla Dairy Foods - Product Launch In 2022, Bulla Dairy Foods, an Australian dairy company, partnered with Perfetti Van Melle through brand extension agency Asembl to launch a Chupa Chups Strawberry & Cream ice cream. The product features crushed candy and strawberry sauce, combining Bulla's dairy expertise with the iconic lollipop brand's global appeal. Andrew Noisette, Bulla's Head of Marketing, and Asembl's Managing Director, Justin Watson, highlighted the synergy and excitement of this collaboration, which targets fans of both brands in Australia and New Zealand.

- Saudia Dairy & Foodstuff Company (SADAFCO) - Expansion In 2022, Saudi Sadafco opened a new ice cream factory, covering over 45,000 sq m and boasting the highest output per square meter in the Middle East. The 1,570 sq m facility, which was officially opened by the Minister of Industry and Mineral Resources, is part of Sadafco's existing milk factory.

GCC Ice Cream Market Report Coverage and Deliverables

The "GCC Ice Cream Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- GCC ice cream market size and forecast at the regional and country levels for all the key market segments covered under the scope

- GCC ice cream market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's five forces and SWOT analysis

- GCC ice cream market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the GCC ice cream market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For