Middle East and Africa Fillings, Toppings, and Glazes Market Forecast & Analysis (2025-2031)

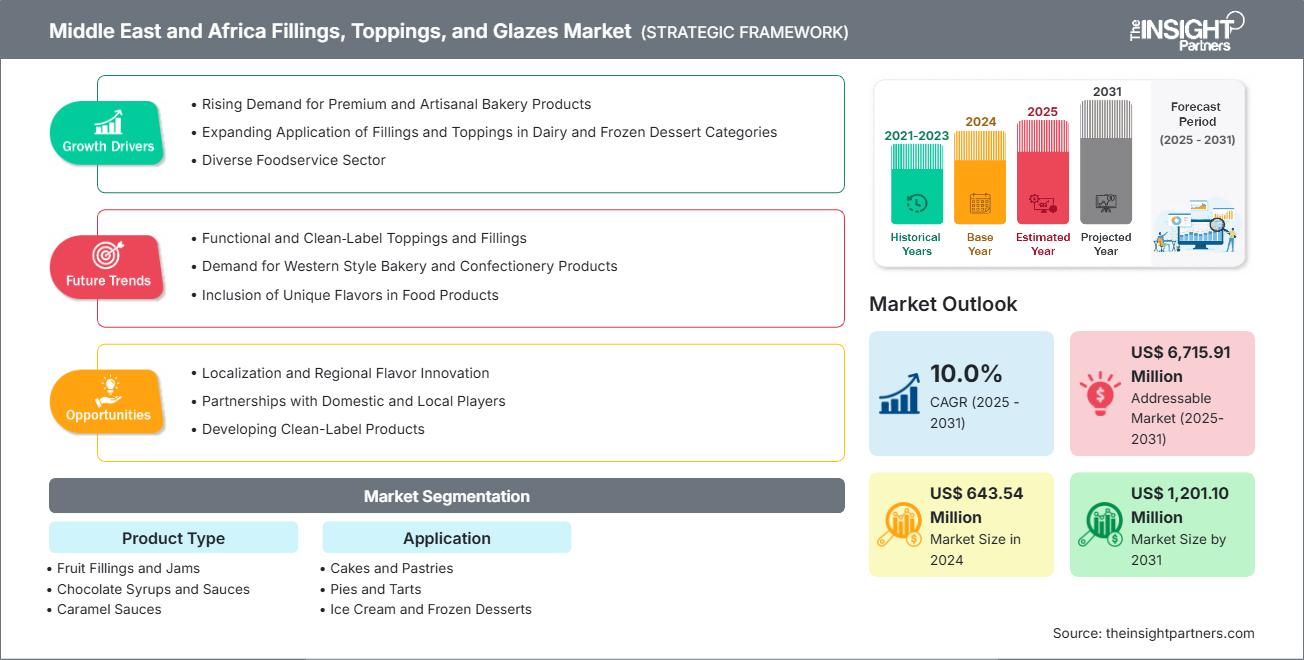

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031Middle East and Africa Fillings, Toppings, and Glazes Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Fruit Fillings and Jams (Berries, Apple, Pineapple, Cherry, Peach, Citrus, and Others), Chocolate Syrups and Sauces, Caramel Sauces, Sugar Glazes, Fruit Glazes, and Others], Application (Cakes and Pastries, Pies and Tarts, Ice Cream and Frozen Desserts, Chocolate and Confectionery, Waffles and Pancakes, and Others), and Country

- Report Date : Aug 2025

- Report Code : TIPRE00040993

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 138

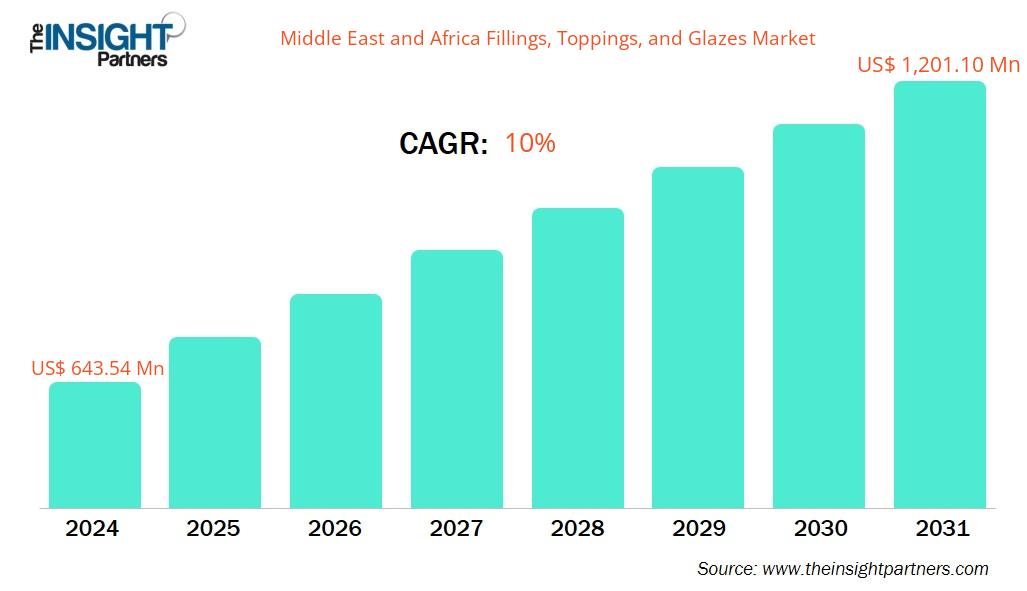

The Middle East and Africa fillings, toppings, and glazes market size is projected to reach US$ 1,201.10 billion by 2031 from US$ 643.54 billion in 2024. The market is expected to register a CAGR of 10.0% during 2025–2031.

Middle East and Africa Fillings, Toppings, and Glazes Market Analysis

The Middle East and Africa (MEA) fillings, toppings, and glazes market is witnessing steady growth, driven by expanding bakery, confectionery, and dairy sectors. Urbanization, rising disposable incomes, and growing consumer preference for indulgent and premium products are fueling its demand. Countries such as Saudi Arabia, the UAE, South Africa, and Egypt are key contributors due to their robust foodservice and retail infrastructure. Regional manufacturers are increasingly innovating with localized flavors, such as date and cardamom fillings, to cater to cultural tastes. Additionally, the rise of Western-style baked goods and increased café culture are boosting consumption. However, supply chain challenges and dependency on imports for raw materials pose hurdles. The market is also witnessing a gradual shift toward clean-label and sugar-reduced options, reflecting global health trends. As international players expand their footprint through partnerships and acquisitions, competition is intensifying, particularly in urban centers.

Middle East and Africa Fillings, Toppings, and Glazes Market Overview

The Middle East and Africa (MEA) fillings, toppings, and glazes market is growing steadily, supported by the expansion of the bakery, confectionery, and dairy industries. Increasing urbanization, a young population, and rising disposable incomes are driving the demand for premium and convenient food products. Consumers are showing a preference for visually appealing and indulgent desserts, fueling the use of innovative fillings and decorative glazes. The influence of Western food trends, coupled with a strong café culture in countries such as the UAE, Saudi Arabia, and South Africa, is accelerating market development. Additionally, local flavor adaptations, such as date, pistachio, and rose, are gaining popularity. While the market is fragmented, it is becoming increasingly competitive with the entry of international players and strategic partnerships. Challenges include supply chain disruptions and a reliance on imported ingredients. However, the growing demand for clean-label, plant-based, and low-sugar alternatives presents opportunities for product innovation and differentiation in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Middle East and Africa Fillings, Toppings, and Glazes Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Middle East and Africa Fillings, Toppings, and Glazes Market Drivers and Opportunities

Market Drivers:

- Urbanization and Changing Lifestyles Rising urban populations and busy lifestyles are increasing the demand for ready-to-use and premium dessert components.

- Growth of Bakery and Confectionery Industry The expanding bakery and confectionery sectors across the MEA are fueling consistent demand for innovative fillings and decorative toppings.

- Cultural and Regional Flavor Innovations Manufacturers are incorporating local tastes such as date, saffron, and rose to cater to traditional flavor preferences.

- Influence of Western Food Trends The popularity of Western desserts, cafés, and quick-service restaurants is boosting the consumption of glazes and dessert toppings.

- Health and Wellness Trends Consumer interest in clean-label, low-sugar, and plant-based ingredients is driving innovation in healthier product offerings.

Market Opportunities:

- Expansion of the Foodservice Sector The growing number of cafés, bakeries, and quick-service restaurants offers new avenues for product adoption and volume growth.

- Rising Demand for Premium and Exotic Flavors Introducing unique and luxurious flavor profiles can attract affluent consumers seeking indulgent experiences.

- Innovation in Healthier Product Options Developing sugar-free, low-fat, and plant-based fillings and toppings meets increasing health-conscious consumer needs.

- Increasing E-Commerce and Retail Penetration Digital sales channels provide opportunities for broader market reach and direct consumer engagement.

- Localization and Customization Tailoring products to regional tastes and dietary preferences enhances market relevance and consumer loyalty.

Middle East and Africa Fillings, Toppings, and Glazes Market Report Segmentation Analysis

The Middle East and Africa fillings, toppings, and glazes market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Fruit Fillings and Jams Fruit fillings and jams are widely used in bakery and confectionery products for their natural sweetness and flavor variety. Their demand is driven by consumer preference for authentic, fruit-based ingredients and their increasing use in traditional and fusion desserts.

- Chocolate Syrups and Sauces Chocolate syrups and sauces enhance the flavor and visual appeal of desserts and beverages, making them popular in cafés and quick-service restaurants. Their demand is driven by the increasing trend of indulgence and the growing variety of chocolate-based products.

- Caramel Sauces: Caramel sauces are favored for their smooth texture and sweet, buttery taste, and are often used in premium desserts and beverages. The rising interest in gourmet and specialty desserts fuels their consumption in the region.

- Sugar Glazes: Sugar glazes provide a shiny, sweet coating primarily on baked goods, enhancing both appearance and taste. The increasing bakery production and growing demand for visually appealing products drive the use of sugar glazes.

- Fruit Glazes: Fruit glazes provide a shiny finish with added fruity flavor, often used on pastries and cakes to maintain freshness and improve presentation. The expanding bakery sector and consumers' preference for natural ingredients drive their demand.

- Others: This segment includes various specialty toppings and fillings such as nut pastes and cream-based toppings. The demand for these products is propelled by innovation and diversification of bakery and confectionery products to meet the evolving consumer tastes.

By Application:

- Cakes and Pastries: Fillings, toppings, and glazes are essential for enhancing the taste, texture, and appearance of cakes and pastries. Their demand is driven by growing café culture and celebratory occasions, with new trends focusing on artisanal, health-conscious, and exotic flavor profiles.

- Pies and Tarts: Fillings, toppings, and glazes are used to add richness and moisture. Manufacturers of pies and tarts rely heavily on fruit fillings and glazes for visual appeal and freshness. The increasing preference for homemade-style and gourmet pies, along with innovative fillings such as date and nut blends, is fueling market growth.

- Ice Creams and Frozen Desserts: Toppings and sauces enhance the complexity and indulgence of ice creams and frozen desserts. The rise in consumption due to warmer climates and the expansion of dessert parlors, along with an inclination toward vegan and low-sugar options, are key drivers.

- Chocolate and Confectionery: Fillings and glazes enhance chocolates and confections with creamy textures and a variety of flavors. Their demand increases during festive seasons and gift-giving occasions, while trends include premium, artisanal, and ethically sourced ingredients.

- Waffles and Pancakes: Toppings such as syrups and fruit glazes add sweetness and texture, making them popular on breakfast and dessert menus. The expanding café culture and social media-driven food presentation trends are increasing their consumption, alongside the rise of plant-based and organic options.

- Others: This includes applications in snacks, dairy desserts, and savory items using specialty glazes and fillings. Innovation in fusion foods and convenience snacks is opening new market opportunities in this diverse segment.

By Country:

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

The fillings, toppings, and glazes market in the UAE is expected to witness the fastest growth.

Middle East and Africa Fillings, Toppings, and Glazes Market Report Scope| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 643.54 Million |

| Market Size by 2031 | US$ 1,201.10 Million |

| CAGR (2025 - 2031) | 10.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

Middle East and Africa Fillings, Toppings, and Glazes Market Players Density: Understanding Its Impact on Business Dynamics

The Middle East and Africa Fillings, Toppings, and Glazes Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Middle East and Africa Fillings, Toppings, and Glazes Market top key players overview

Middle East and Africa Fillings, Toppings, and Glazes Market Share Analysis by Geography

The UAE market is expected to witness the fastest growth in the next few years.

The Middle East and Africa fillings, toppings, and glazes market grows differently in each country owing to factors such as consumer preference, emerging trends, consumer buying behavior, and product availability. Below is a summary of market share and trends by country:

1. South Africa

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Well-established bakery and confectionery industries fuel demand

- Increasing urbanization and rising disposable incomes

- Growing demand for healthier and artisanal bakery products

- Trends: Rising consumer interest in locally inspired flavors such as rooibos and marula-infused fillings

2. Saudi Arabia

- Market Share: Largest share due to the presence of a well-established customer base

-

Key Drivers:

- Strong café culture and high consumption of premium desserts

- Government initiatives promoting food industry diversification

- Expansion in the foodservice sector targeting the luxury and gourmet dessert segments

- Trends: Growing preference for sugar-reduced and clean-label toppings and glazes

3. UAE

- Market Share: Fastest-growing country with a rising market share every year

-

Key Drivers:

- High expatriate population driving demand for diverse international flavors

- Robust retail and foodservice infrastructure supporting product availability

- Increasing e-commerce penetration for gourmet and specialty dessert products

- Trends: Innovation in visually striking and Instagram-worthy dessert toppings

4. Rest of Middle East and Africa

- Market Share: Growing market with steady progress

-

Key Drivers:

- Rising middle-class population with increasing access to modern retail

- Growing influence of Western food trends and café culture

- Localization of products incorporating traditional regional flavors and ingredients

- Trends: Emergence of plant-based and vegan-friendly fillings and glazes

Middle East and Africa Fillings, Toppings, and Glazes Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Agrana, Puratos, Bakels Worldwide, and Barry Callebaut. Regional and niche providers such as Lemonconcentrate S.L.U and La Crema are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Innovative and unique flavor combinations tailored to regional and global tastes

- Clean-label and health-conscious product options, including sugar-reduced and plant-based varieties

- Premium quality and visually appealing products that enhance the aesthetic of desserts

- Customizable solutions for foodservice and retail clients to meet specific consumer preferences

- Sustainable and ethically sourced ingredients to attract environmentally aware consumers

Opportunities and Strategic Moves

- Expansion into emerging markets within the MEA, with rising urbanization and disposable income

- Development of health-oriented products such as low-sugar, organic, and plant-based options

- Leveraging e-commerce and digital platforms for wider product distribution and direct consumer engagement

- Forming partnerships or joint ventures with local manufacturers and distributors to enhance market presence

- Investing in research & development to create customized and innovative formulations.

- Launching marketing campaigns focused on premium quality and clean-label attributes

Major Companies operating in the Middle East and Africa Fillings, Toppings, and Glazes Market are:

- Bakels Worldwide (Norway)

- Dawn Food Products, Inc (US)

- Agrana (Austria)

- Puratos (Belgium)

- Lemonconcentrate S.L.U (Spain)

- La Crema (UAE)

- Barry Callebaut (Switzerland)

- Rich Products Corporation (US)

- Symrise (Germany)

- Olam International Limited (Singapore)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Nadec

- Almarai

- Al Islami Foods

- Americana Group

- Al Dahra Agriculture

- Bakels Middle East

- Safi Organics

- Bakhresa Group

- Ameriab Agro

- Chef's Choice

- Eurostar Group

- Bateel International

- Fine Foods Group

- Al Ghurair Foods

- Food Specialties Company (FSC)

Middle East and Africa Fillings, Toppings, and Glazes Market News and Recent Developments

- Barry Callebaut Acquires Moroccan Confectionery Manufacturer Attelli In October 2022, Barry Callebaut partnered with Attelli, a Moroccan confectionery products manufacturer and distributor, to acquire the latter's assets. This strategic move enables Barry Callebaut to enter the Moroccan market and expand its presence across North Africa.

- Dawn Foods Launches Delifruit Xtra Fruit Fillings In February 2023, Dawn Foods introduced Delifruit Xtra Fruit Fillings, featuring low sugar content and natural fruits. These fillings are available in various flavors, catering to the growing demand for healthier and more natural dessert ingredients.

- Bakels Acquires Orley Foods in South Africa In March 2023, Bakels Worldwide announced the acquisition of Orley Foods, a Cape Town-based provider of sweet ingredient solutions. This acquisition strengthens Bakels' position in the South African market and enhances its product offerings.

- Puratos UK Acquires Fourayes Jam Manufacturer In March 2022, Puratos UK acquired Fourayes, a UK-based jam manufacturer. This acquisition complements Puratos' product lines and allows them to strengthen their position in the market further, particularly in the fruit fillings segment.

- Dawn Foods Acquires JABEX, a Polish Fruit-Based Product Manufacturer In April 2021, Dawn Foods completed the acquisition of JABEX, a fruit-based product manufacturer based in Poland. This strategic acquisition enhances Dawn Foods' production capabilities and aids in expanding its share across Eastern Europe.

Middle East and Africa Fillings, Toppings, and Glazes Market Report Coverage and Deliverables

The "Middle East and Africa Fillings, Toppings, and Glazes Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Middle East and Africa fillings, toppings, and glazes market size and forecast at the regional and country levels for all the key market segments covered under the scope

- Middle East and Africa fillings, toppings, and glazes market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces analysis and SWOT analysis

- Middle East and Africa fillings, toppings, and glazes market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Middle East and Africa fillings, toppings, and glazes market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the Middle East and Africa fillings, toppings, and glazes market?

Which are the leading players operating in the Middle East and Africa fillings, toppings, and glazes market?

What are the future trends in the Middle East and Africa fillings, toppings, and glazes market?

What are the factors driving the Middle East and Africa fillings, toppings, and glazes market?

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For