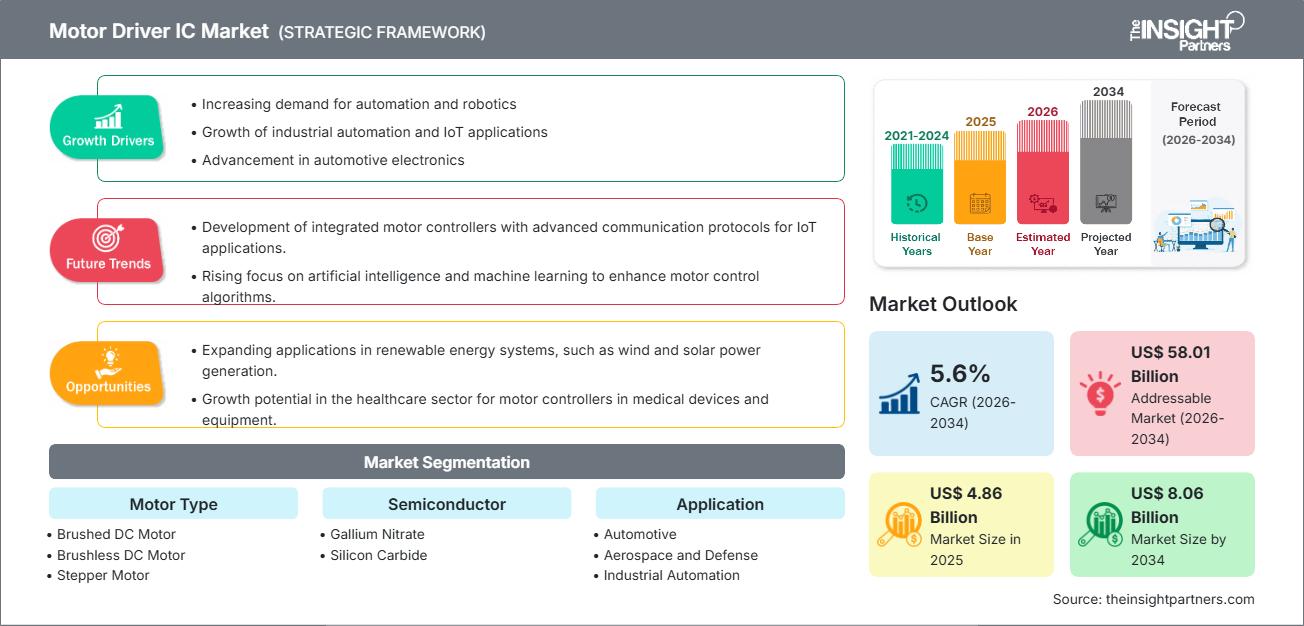

Motor Driver IC Market Share, Growth Drivers & Forecast 2034

Motor Driver IC Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Motor Type (Brushed DC Motor, Brushless DC Motor, and Stepper Motor), Semiconductor (Gallium Nitrate (GaN) and Silicon Carbide (SiC)), and Application (Automotive, Aerospace and Defense, Industrial Automation, Consumer Electronics and Home Appliances, and Healthcare)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00019788

- Category : Electronics and Semiconductor

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

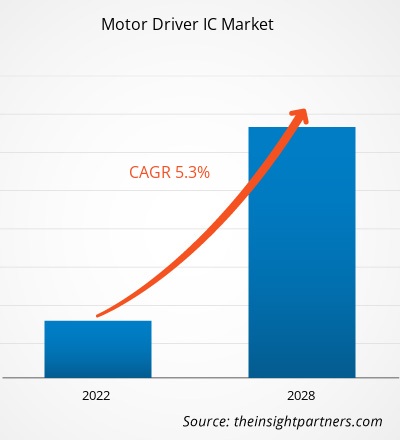

The Motor Driver IC market size was valued at US$4.86 billion in 2025 and is expected to reach US$8.06 billion in 2034, growing at a CAGR of 5.6% from 2026 to 2034.

Motor Driver IC Market Analysis

The global Motor Driver IC market forecast indicates steady growth, driven by increasing industrial automation, rising adoption of electric vehicles (EVs), growing demand in consumer electronics and robotics, and increasing need for energy‑efficient motor control solutions. According to some estimates, the market is expected to expand significantly over the next several years.

The expansion is further facilitated by emerging applications across sectors such as automotive (EVs, HVAC, power steering), industrial machinery and automation, consumer appliances, robotics, and renewable‑energy systems. The need for compact, power‑efficient, and reliable motor driver ICs (for BLDC motors, brushed DC motors, stepper motors, etc.) is fueling market demand globally.

Motor Driver IC Market Overview

Motor driver ICs are integrated circuits used to control and drive electric motors: they act as the bridge between low‑current control logic (e.g., microcontrollers) and high‑current motors (e.g., DC, BLDC, stepper motors). These ICs manage current amplification, voltage/current regulation, direction control, speed control, and often provide protections and diagnostics, enabling precise, efficient, and reliable motor operation.

Because motors are used in a wide variety of applications, from automotive systems, industrial automation, and robotics, to consumer electronics and home appliances, motor driver ICs form a critical component in many modern systems. Their role in enabling efficient motor control, energy savings, reliable performance, and integration with digital control systems makes them the backbone of numerous industries.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMotor Driver IC Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Motor Driver IC Market, Drivers and Opportunities

Market Drivers:

- Rising adoption of electric vehicles (EVs), EVs and hybrid vehicles requires advanced motor driver ICs for traction motors, power steering, HVAC, and other subsystems, boosting demand significantly.

- Growth in industrial automation and robotics, as factories shift toward automation (Industry 4.0), demand for motor drivers for conveyor belts, robotic arms, actuators, and manufacturing equipment is increasing.

- Proliferation of consumer electronics, smart appliances, home automation, and IoT devices. Many of these require compact motor driver ICs for motors in devices such as drones, smart home appliances, fans, robotic vacuums, etc.

- Demand for energy‑efficient and miniaturized motor control solutions, Efficiency requirements, power savings, and integration with digital control logic push for improved IC designs.

Opportunities:

- Expansion in emerging markets (Asia‑Pacific, etc.) with growing automotive, electronics manufacturing, and industrial sectors, providing large growth potential for motor driver ICs.

- Demand for advanced ICs with integrated diagnostics, current‑sensing, functional‑safety, and thermal management, as industries demand reliability, lower maintenance, and longer motor/IC life.

- Growth in renewable energy and infrastructure, Use of motor drivers in renewable energy systems (e.g., for panel trackers, wind turbines), smart building systems, and automation.

- Rising demand in niche & specialized applications, such as robotics, medical devices, and drones, where tailored motor driver IC solutions are needed, is creating opportunities for differentiation.

Motor Driver IC Market, Report Segmentation Analysis

The market is commonly analyzed across the following segments (by type, application, technology/semiconductor, voltage/output, geography):

By Motor Type:

- Brushed DC Motor Drivers

- Brushless DC (BLDC) Motor Drivers

- Stepper Motor Drivers

By Application:

- Automotive (EVs, Hybrid, conventional vehicles)

- Aerospace and Defence

- Industrial Automation

- Consumer Electronics and Home Appliances

- Healthcare

By Semiconductor:

- Gallium Nitrate

- Silicon Carbide

By Geography / Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa / Rest of World

Motor Driver IC Market, Regional / Geographic Trends

- Asia-Pacific: Often identified as the fastest-growing and largest region, driven by a strong manufacturing base, rising electronics production, growing EV adoption, and expanding industrial automation.

- North America: Significant share due to established automotive, industrial automation, and electronics sectors; early adoption of EVs, robotics, and automation drives demand.

- Europe: Moderate share with demand from automotive (including EVs), industrial machinery, renewable energy systems, and stringent regulations pushing energy-efficient motor control.

- Middle East & Africa / Other Regions: Emerging demand as infrastructure, industrial automation, and renewable energy adoption grow, but still lag behind the major regions.

Regional growth trajectories differ based on industrialization pace, EV adoption rate, manufacturing base strength, and regulatory environment related to energy efficiency and automation.

Motor Driver IC Market, Competitive Landscape & Key Players

- Allegro Microsystems

- Dialog Semiconductor PLC

- Mitsubishi Electric Corporation

- ON Semiconductor

- Rohm Co Ltd

- Analog Devices

- STMicroelctronics

- Texas Instruments

- Toshiba Corporation

Other companies analysed during the course of research are:

- Infineon Technologies

- NXP Semiconductors

- Maxim Integrated

- Monolithic Power Systems

- Panasonic Corporation

- Renesas Electronics Corporation

- Fairchild Semiconductor

- Power Integrations, Inc.

- Elmos Semiconductor SE

Because of growing competition, vendors are differentiating through:

- Advanced designs supporting multiple motor types (BLDC, stepper, brushed, servo)

- Efficient power management, thermal management, diagnostics, and safety features

- Support for varied voltage/current ranges to cater to consumer electronics to EVs, and industrial motors

- Focus on reliability, scalability, and integration with digital control systems (microcontrollers, IoT hardware, robotics controllers)

These strategies help vendors to stay competitive, capture diverse end‑use markets, and benefit from rising global demand.

Motor Driver IC Market, News, and Recent Developments

- The recent surge in EV adoption globally has significantly increased demand for motor driver ICs, EV traction systems, power steering, HVAC, and other motorized components that require reliable, high‑current driver ICs.

- Industrial automation and robotics demand continues to rise, pushing for more motor driver ICs used in robotics, conveyor belts, actuators, and manufacturing equipment.

- Growing integration of motor driver ICs in consumer electronics, home appliances, smart home devices, and IoT-driven products broadens the market beyond traditional automotive and industrial sectors.

- Innovation trends: Manufacturers increasingly focus on designing ICs with built-in diagnostics, current‑sensing, functional-safety, thermal‑management, and multi‑motor-type support to meet advanced application requirements.

Motor Driver IC Market, Report Coverage and Deliverables

The hypothetical “Motor Driver IC Market Size and Forecast (2024–2032/2035)” report would ideally cover:

- Global market size and forecast (overall and by region) for all key segments under scope

- Market dynamics: drivers, restraints, challenges, and opportunities

- Detailed segmentation analysis covering type (motor type/technology), application / end‑use, semiconductor/technology attributes, output current/voltage ranges, and geography

- Regional analysis and outlook, major regions such as Asia‑Pacific, North America, Europe, the Middle East & Africa, etc.

- Competitive landscape and vendor analysis with key players, market shares, and differentiating strategies

- Recent market developments, technology trends, and industry innovations (e.g., high‑efficiency ICs, diagnostics, multi‑application driver ICs)

- SWOT and PEST analysis (macro‑economic, regulatory, technological factors influencing the market)

- Future outlook, growth opportunities, potential risks (e.g., supply‑chain constraints, raw material shortages, competition, design complexity)

Motor Driver IC Market Regional Insights

The regional trends and factors influencing the Motor Driver IC Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Motor Driver IC Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Motor Driver IC Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 4.86 Billion |

| Market Size by 2034 | US$ 8.06 Billion |

| Global CAGR (2026 - 2034) | 5.6% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Motor Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Motor Driver IC Market Players Density: Understanding Its Impact on Business Dynamics

The Motor Driver IC Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Motor Driver IC Market top key players overview

Frequently Asked Questions

Growth in industrial automation, robotics, and manufacturing industries

Expansion of consumer electronics, home appliances, IoT, and smart devices requires motor-driven components.

Demand for energy efficiency, compactness, and reliable motor control electronics across multiple sectors

North America and Europe remain significant, supported by mature automotive, industrial automation, and electronics sectors.

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For