Off-Highway Vehicle Telematics Market Dynamics and Trends by 2028

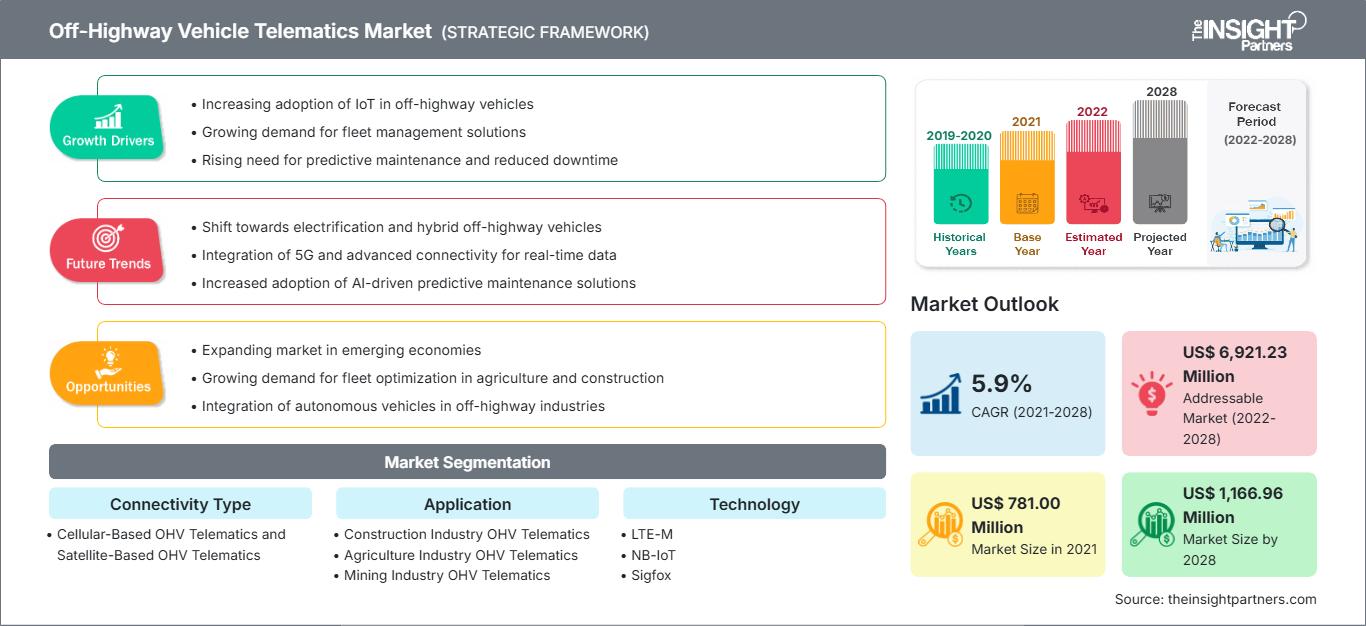

Off-Highway Vehicle Telematics Market Forecast to 2028 - Analysis By Connectivity Type (Cellular-Based OHV Telematics and Satellite-Based OHV Telematics), Application (Construction Industry OHV Telematics, Agriculture Industry OHV Telematics, Mining Industry OHV Telematics and Others), and Technology (LTE-M, NB-IoT, Sigfox and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Feb 2022

- Report Code : TIPRE00009893

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 173

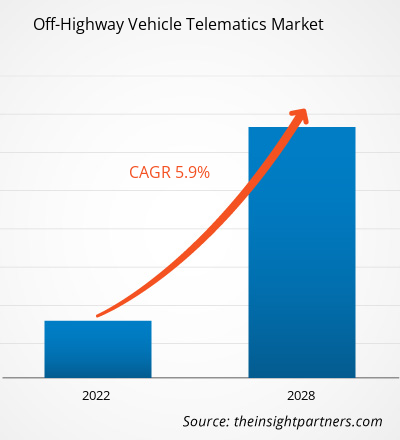

The off-highway vehicle telematics market was valued at US$ 781.00 million in 2021 in and is expected to reach US$ 1,166.96 million by 2028; it is estimated to register a CAGR of 5.9% during the forecast period from 2021 to 2028.

The telematics business has been evolving rapidly due to advancements in technologies. Some new trends on the horizon that must be investigated to stay ahead of the competition are:-

- Swift Interconnected Network: Upgrading to 4G and 5G networks offer a completely new experience in terms of bandwidth, faster data uploads, and feedback downloads, resulting in more real-time data sets, real-time driver safety, fleet maintenance, and fleet efficiency.

- Cloud Enablement: Sensors are attached to different sub-systems in a vehicle. These systems are constantly exchanging massive amounts of data. Sensors for tire pressure monitoring, video capture, and temperature monitoring are just a few examples. Advances in cloud technology have made it possible to store, handle, and successfully use huge amounts of data.

- Adoption by Small Businesses: Telematics has become more than just a trend for service providers and small fleet owners. Many start-ups deliver low-cost yet effective telematics solutions that may be found on the local market for smaller fleet owners.

- Direct Data Access and Intuitive Dashboards: Users get direct access to data for decision-making. Individual drivers, dispatch managers, a central fleet agency or local office, and franchisees benefit from this data. All stakeholders are given personalized role-based dashboards with restricted access to make informed real-time decisions based on their specific service needs, delivery or arrival times, handling constraints, and other factors. This also aids fleet management businesses to maintain a behavior-based driver scorecard and has legal implications. Many companies also exchange data with the shipping and carriage industry to improve dock scheduling. This aids in effective planning and results in happier and productive drivers.

Thus, rising technological advancements in off-highway vehicle telematics will drive the growth of the off-highway vehicle telematics market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOff-Highway Vehicle Telematics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The construction industry's rapid digital transformation urges the adoption of new technologies that offer new prospects for the off-highway vehicle telematics market. Construction equipment telematics helps companies track their equipment's location and performance, monitor asset utilization, and verify that assets are being used effectively. If equipment is underutilized, it might be moved to another location where it is needed. This is how telematics for construction equipment improves overall efficiency which would, in turn, positively impact on the off-highway telematics market.

Furthermore, rising construction activity in both private and public sectors is likely to enhance market growth. Several infrastructure-related projects are underway or planned in countries such as India, the Philippines, the UAE, Saudi Arabia, Egypt, Nigeria, and the US. For instance, the Government of India allotted a budget of US$ 1.12 billion for the current fiscal year as part of the 'One Hundred Smart Cities' program in the Union Budget of 2014–2015. Moreover, the government plans to invest US$ 650 billion in various urban and infrastructural projects throughout the country over the next 20 years, which would, in turn, support the growth of the off-highway vehicle telematics market. Various infrastructure projects in the Middle East are in process, including Jeddah Economic City (Saudi Arabia), Masdar City (UAE), and Dubailand (UAE). This rapid rise in infrastructure projects is likely to increase demand for construction equipment.

Impact of COVID-19 Pandemic on North America Off-Highway Vehicle Telematics Market

North America is one of the leading regions in terms of the development and adoption of new technologies due to favorable government policies that boost innovation and strengthen the infrastructure capabilities. Hence, any adverse impact on the growth of industrial sector hampers the economic growth of the region. At present, the US is the world’s worst-affected country due to COVID-19 outbreak. The off-highway vehicle telematics market reliance on manufacturing players, such as automobile companies and automobile component manufacturers, has been highlighted by the recent pause in manufacturing units due to COVID-19 outbreak. Even before the COVID-19 outbreak, the automobile sector faced challenges such as electric mobility, driverless cars, automated factories, and ridesharing. The automobile industry is suffering a major setback because of severe restrictions on travel, closing of international manufacturing, declining sales of car, and large layoffs. The overall demand for off-highway vehicle telematics is likely to increase once the industries attain normal operational conditions. Owing to the rise in demand for automobiles, favorable government policies, and ever-increasing investments by North American countries in advanced technology, North America has the large demand for off-highway vehicle telematics.

Off-Highway Vehicle Telematics Market Insights

Rising Integration of IoT

Microelectromechanical systems, the internet, and wireless technologies have all come together to form the Internet of Things (IoT). Fleet owners can utilize IoT to remotely monitor vehicle speed, tire air pressure, fuel usage, and driver behavior, further improving vehicle and driver efficiency. Developers of telematics systems can use this technology to create telematics solutions tailored to specific needs in the mining, agriculture, and construction industries, where operational costs are high. Service providers and fleet operators can embrace predictive analytics by combining IoT and fleet management technology. This gives the context to accomplish proactive management and a competitive edge in several critical operational areas. IoT sensors in service-oriented products, such as air conditioners, can only notify a service call when required, rather than at regular intervals. Condition-based monitoring lowers service costs while boosting accuracy and customer service. One of the most significant expenses for any fleet is fuel. If IoT sensors are integrated into the telematics system, fleet managers can get a near-real-time view of vehicle fuel use and expenditures. This enables managers to see who needs to be educated on effective driving behaviors and track unlawful operating expenditures and driving patterns, such as idling, which can waste gasoline. Furthermore, all fleets place a high focus on safety. With rising incidents of speeding, forceful braking, and aggressive driving, fleet managers can use driver coaching and safety education to address undesirable driving behaviors. Thus, the growing integration of the IoT can open up new commercial possibilities.

Connectivity Type-Based Market Insights

Based on connectivity type, the off-highway vehicle telematics market is segmented into cellular-based OHV telematics and satellite-based OHV telematics. The cellular-based OHV telematics segment led the off-highway vehicle telematics market with a share of 77.6% in 2020.

Application-Based Market Insights

Based on application, the off-highway vehicle telematics market can be segmented into construction industry OHV telematics, agriculture industry OHV telematics, mining industry OHV telematics, and others. The construction industry OHV telematics segment led the off-highway vehicle telematics market with a share of 64.3% in 2020.

Off-Highway Vehicle Telematics Market Regional InsightsThe regional trends and factors influencing the Off-Highway Vehicle Telematics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Off-Highway Vehicle Telematics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Off-Highway Vehicle Telematics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 781.00 Million |

| Market Size by 2028 | US$ 1,166.96 Million |

| Global CAGR (2021 - 2028) | 5.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Connectivity Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Off-Highway Vehicle Telematics Market Players Density: Understanding Its Impact on Business Dynamics

The Off-Highway Vehicle Telematics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Off-Highway Vehicle Telematics Market top key players overview

Technology-Based Market Insights

Based on technology, the off-highway vehicle telematics market can be segmented into LTE-M, NB-IoT, Sigfox, and others. The LTE-M led the off-highway vehicle telematics market with a share of 82.3% in 2020.

The players operating in the off-highway vehicle telematics market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In January 2022, Stoneridge and Valens semiconductor have formed partnerships for development of the Tractor-Trailer Safety Through Advanced Connectivity and Vision Solutions which in turn positively impact on the off-highway telematics market.

- In August 2020, HY-TTC 500 controller family certified for road use. HY-TTC 500 consists of high-end safety-control units, designed to build up a safe, centralized electronic architecture. Certification of HY-TTC 500 controller, a product of TTControl gets certified for road use under ISO 26262.

Company Profiles

- Omnitracs, LLC

- ORBCOMM

- Stoneridge, Inc.

- Teletrac Navman

- TomTom International BV

- Trackunit A/S

- Wacker Neuson

- Zonar Systems Inc.

- TTCONTROL GMBH

- ACTIA Group

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For