Orthopedic Navigation Systems Market Key Players and Forecast by 2030

Orthopedic Navigation Systems Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Technology (Electromagnetic, Optical, and Others), Application (Knee, Hip, Spine, and Others), End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Nov 2023

- Report Code : TIPRE00020497

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 152

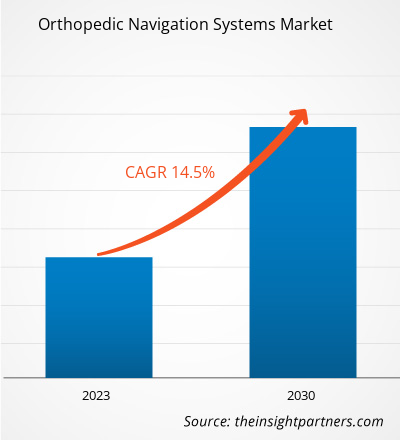

[Research Report] The orthopedic navigation systems market size is expected to grow from US$ 2,532.47 million in 2022 to US$ 7,477.32 million by 2030; it is estimated to register a CAGR of 14.5% from 2022 to 2030.

Analyst’s Viewpoint

The orthopedic navigation systems market analysis explains market drivers such as growing advantages of computer-assisted orthopedic surgeries and increasing incidence of orthopedic conditions. Further, rising interest in minimally invasive surgery is expected to introduce new trends in the market during 2022–2030. Based on technology, the orthopedic navigation systems market is segmented into electromagnetic, optical, and others. The electromagnetic segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 15.4% during 2022–2030. By application, the market is segmented into knee, hip, spine, and others. The knee segment held the largest market share in 2022. The hip segment is anticipated to register the highest CAGR of 14.9% during 2022–2030. By end user, the market is categorized into hospitals, ambulatory surgical centers (ASCs), and others. The hospital segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 14.8% in the market during 2022–2030.

Orthopedic navigation systems allow surgeons to precisely track instrument position and then project while performing orthopedic surgeries. The system comprises a computer workstation, along with hardware for tracking the position of instruments.

Market Insights

Growing Advantages of Computer-Assisted Orthopedic Surgeries Drive Orthopedic Navigation Systems Market

According to an article titled "Computer-assisted preoperative planning of bone fracture fixation surgery" published in the National Library of Medicine in October 2022, bone fracture fixation surgery is known to be one of the most commonly performed surgical procedures in the orthopedic field. The source stated that computer-assisted surgical techniques have been developed in recent years. The techniques are helpful in the preoperative planning of bone fracture fixation operations.

Benefits of computer-assisted surgery (CAS) such as low blood loss, short hospital stays, and easy rehabilitation propel its demand. CAS is instrumental in precise alignment of the implant. It provides improved functionality, improves quality-adjusted lifespan, causes less pain and tissue damage, and can lead to fewer complications. Surgical navigation allows surgeons to develop detailed clinical plans for joint replacements and spinal procedures. The platforms provide computer-aided measurements from individual patients' preoperative computerized tomography (CT) scans to help surgeons provide personalized surgical care. Thus, advantages of computer-assisted orthopedic surgeries drive the orthopedic navigation systems market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOrthopedic Navigation Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Future Trend

Rising Interest in Minimally Invasive Surgery to Emerge as Trend in Coming Years

In minimally invasive spine surgery (MISS), use of computer-assisted navigation technology allows surgeons to better visualize bone and soft tissue anatomy through limited minimally invasive surgery (MIS) incisions. In addition, due to smaller incisions, postoperative wound healing takes longer in conventional surgeries than in MIS. Interest in MISS increases tremendously as its core principle is to minimize insertion-related injuries while achieving similar results to traditional open spine procedures. With technical and technological advances, MISS can expand its utility to simple spinal stenosis and complex spinal pathologies such as metastasis, trauma, or spinal deformity in adults.

In August 2023, Orthofix Medical Inc. announced the full commercial launch and successful completion of the first cases in the US with the 7D FLASH Navigation System Percutaneous Module 2.0. The system enables Orthofix to continue to operate MIS for the spine. Speed, accuracy, and efficiency of image processing technology are expected to provide significant economic added value and reduced radiation exposure for staff and patients in open procedures. This launch expands the clinical functionality and utility of the navigation system by providing surgeons with a fully integrated procedural solution for MIS, including implant planning and an expanded suite of navigated tools. The growing preference of patients and healthcare professionals for minimally invasive procedures that offer faster recovery times and reduced postoperative pain would support the adoption of orthopedic navigation systems. Thus, the rising adoption of orthopedic navigation systems in practice benefits patients and hospitals, which is expected to boost the orthopedic navigation system market growth in the coming years.

Technology-Based Insights

Based on technology, the orthopedic navigation systems market is segmented into electromagnetic, optical, and others. The electromagnetic segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 15.4% during 2022–2030. In electromagnetic tracking systems (EMTs), magnetic fields are generated, sensors are used to detect them, and finally, software is used to process them. In an electromagnetic field of known geometry, the coordinates of the pre-interventional patient scan and the coordinates of the tracking system are registered. By utilizing the sensor, the corresponding points in the image coordinates can be measured, and the electromagnetic tracking coordinates can plan about five to nine landmarks. EMTs utilize fluoroscopy to screen the patient without using ionizing radiation, and it does not expose the patient to any energy fields that are more harmful than ultrasounds.

In July 2021, TT Electronics—a provider of engineered electronics for performance-critical applications—partnered with US-based Radwave Technology to develop advanced electromagnetic tracking technology. This partnership will help bring a customizable electromagnetic tracking platform with minimally invasive diagnostic and therapeutic devices during orthopedic surgical procedures. In addition, Joimax, a Germany-based market leader in technologies and training methods for fully endoscopic and minimally invasive spine surgery, announced that the FDA cleared its Intracsem Navigation System, an electromagnetic navigation tracking and control system, in July 2020.

Application-Based Insights

Based on application, the global orthopedic navigation systems market is segregated into knee, hip, spine, and others. The knee segment held the largest market share in 2022. The hip segment is anticipated to register the highest CAGR of 14.9% during 2022–2030. Surgery is required if the knee has structural damage. The most common knee surgeries include arthroscopy or knee replacement. Hip arthroplasty or hip replacement surgery is a procedure in which an orthopedist replaces the affected hip joint parts with new artificial parts. HipNav is an image-guided surgical navigation system used in hip replacement surgery. With this system, prosthetic components can be measured and guided during total hip replacement surgery (THR). The system consists of a 3-dimensional preoperative planner, a simulator, and an intraoperative surgical navigator.

According to the American Academy of Orthopedic Surgeons, nearly one million knee and hip replacements are performed every year. An aging population and an increase in obesity and osteoarthritis will cause that number to rise to 4 million by 2050. Computer- and robot-assisted navigation is expected to continue to play an increasingly important role in helping patients' outcomes and lengthening the life of their implants as these procedures become increasingly common. DePuy Synthes offers a technology-assisted VELYS Hip Navigation platform for hip replacement. The surgeons use real-time data to improve surgical outcomes. Thus, the growing advancement in orthopedic surgery navigation systems boosts the growth of the global orthopedic navigation systems market for the hip segment.

End User-Based Insights

In terms of end user, the orthopedic navigation systems market is segmented into hospitals, ambulatory surgical centers (ASCs), and others. The hospital segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR of 14.8% in the market during 2022–2030.

Orthopedic navigation systems are routinely used in orthopedic surgeries to reach the target place more precisely. Hospitals are a vital part of the development of health systems. They play an important role in offering support to other healthcare providers. An increasingly large number of hospitals are attaining expertise to use orthopedic navigation systems for surgeries. With the rising number of orthopedic surgeries, the use of orthopedic navigation systems is expected to increase in hospital settings. Moreover, owing to rising number of hospitals worldwide, the hospitals segment is expected to continue its dominance in the global orthopedic navigation system market during 2022–2030.

Regional Analysis

North America held the largest share of the orthopedic navigation system market in 2022. The orthopedic navigation system market in North America is expected to grow due to rising acceptance of the latest medical device technologies and increasing incidence of spinal disorders. Moreover, the growing prevalence of chronic diseases, rising cases of sports injury, and the increasing number of orthopedic procedures and ailments, especially among the aging population, propels the market's expansion. The US holds the largest share of the North America orthopedic navigation system market. The increasing aging population, growing prevalence of arthritis, and increasing number of sports injury cases drive the US orthopedic navigation system market growth. According to the United Nations Economic Commission for Europe (UNECE), around 2,740,000 people were injured in traffic accidents in the US in 2019. Additionally, the increasing prevalence of spinal diseases such as degenerative disc disease, spinal stenosis, and herniated discs in the US propels the demand for orthopedic spinal navigation systems. According to the 2021 National Spinal Cord Injury Statistical Center (NSCSC) estimates, ∼30% of individuals affected by spinal cord injuries are readmitted to hospitals within a year of their injury, with the average hospital stay for those requiring readmission being 22 days. Additionally, according to an article published by the University of Washington in January 2021, traumatic spinal cord injuries affect over 18,000 Americans annually. According to McLeod Health, the number of orthopedic procedures performed in the US was ∼18.6 million in 2022.

Asia Pacific would register the highest CAGR for the global orthopedic navigation systems market during the forecast period. The market in Asia Pacific is segmented into China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. China holds the largest market share of the global orthopedic navigation system market. The orthopedic navigation system market in China is expected to grow during 2020–2030 owing to advancements in the Chinese healthcare system, an increasing number of robotic surgeries, and rising government funding in the healthcare system. The healthcare system in China provides clinical care and public health services to one-fifth of the world's population and has grown significantly. Chinese surgeons use robotic devices and artificial intelligence (AI) to perform minimally invasive surgeries for primary operations such as knee replacement surgeries. For instance, a study published in January 2022 by PubMed Central stated that 106 patients in China underwent hip and knee replacement surgeries where computer navigation significantly improved the accuracy of prosthesis implantation. Moreover, technological advancements related to surgical navigation system is rising in China.

Orthopedic Navigation Systems Market Regional InsightsThe regional trends and factors influencing the Orthopedic Navigation Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Orthopedic Navigation Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Orthopedic Navigation Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.53 Billion |

| Market Size by 2030 | US$ 7.48 Billion |

| Global CAGR (2022 - 2030) | 14.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Orthopedic Navigation Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Orthopedic Navigation Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Orthopedic Navigation Systems Market top key players overview

The report profiles leading players operating in the global orthopedic navigation systems market. B. Braun SE, Stryker Corporation, Medtronic PLC, Zimmer Biomet, DePuy Synthes, Smith & Nephew, Siemens Healthineers, Brainlab AG, Metronor, and Naviswiss AG are a few market players.

- In June 2023, Brainlab AG collaborated with AO Foundation to extend reality technology for best practices in education and training. This collaboration will increase knowledge acquisition, enhance decision making, and improve coordination of skills, all within a safe and engaging setting.

- In May 2023, DePuy Synthes demonstrated Reality Based Navigation (RBN), a new addition to their hip offering throughout Europe and the Middle East & Africa. Professor David Beverland MD, FRCS Consultant Orthopedic Surgeon, pioneered the concept in Belfast, Northern Ireland, during the last three decades, beginning with a fellowship with Mike Wroblewski in 1988 and growing into a collaborative endeavor supported by over 40 fellows. The goal of RBN is for surgeons to be able to obtain more reproducible results with a simple, low-cost approach, guaranteeing that every patient has access to the same high-level standard of care. RBN was created to limit the number of outliers in component positioning1, potentially increasing accuracy during THA. As one of the key goals underlying the notion of RBN is to reduce or eliminate outliers, the implementation of RBN is designed to assist surgeons in reducing any such outliers in their practices.

- In February 2023, Naviswiss received clearance from the FDA to market Naviswiss Knee in the US. The Naviswiss Knee solution is a landmark-based navigation tool that helps the surgeon insert and align the knee replacement implants in the best possible way. An orthopedic surgeon can use Naviswiss Knee to select between an express workflow that just navigates Varus/Valgus alignment and Flexion/Extension, or an advanced workflow that also navigates Medial and Lateral resection height and Range of Motion overviews.

- In November 2022, Corin Australia Pty Ltd and Naviswiss AG signed an exclusive distribution agreement for Australia and New Zealand. Corin Australia Pty Ltd is a major inventor in miniaturized navigation for joint replacement surgery. The addition of this technology will strengthen the OPS offering and value to customers.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For