Radioactive Tracer Market Growth and Recent Trends by 2030

Radioactive Tracer Market Size and Forecast to 2030 - Industry Analysis by Tracer Type [Technetium-99m & Tc-97m, Iodine-131, Iron-59, Lutetium-171, Rubidium (Rb-82) Chloride & Ammonia (N-13), Scandium-46, Seaborgium-269, Hassium-269, Gallium Citrate Ga 67, Prostate-Specific Membrane Antigen (PSMA) (Ga-68), FDDNP (F-18) & FDOPA (F-18), Phosphorus-32 & Chromium-51, Thallium-201, F-18 FDG, F-18 FAPI, Ga-68 FAPI, F-18 PSMA, DOTATOC/DOTANOC/DOTATATE (Ga-68), and Others], Test Type (PET, SPECT, and Others), Application (Oncology, Pulmonary, Neurology, Cardiology, and Others) End User (Hospitals & Clinics, Diagnostic Centers, Academic & Research Institutes, And Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Aug 2023

- Report Code : TIPRE00030001

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 150

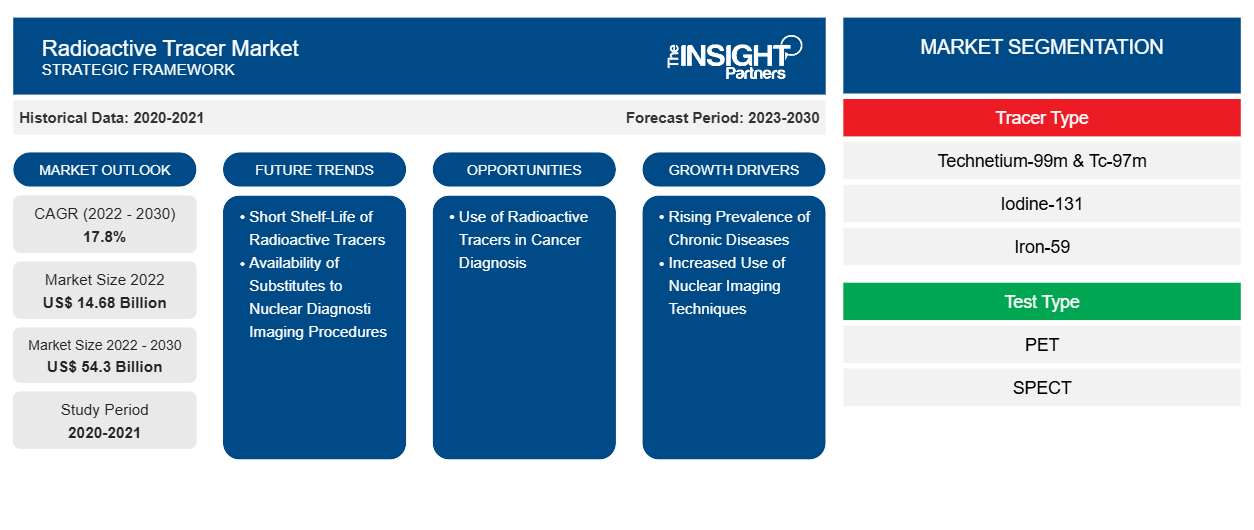

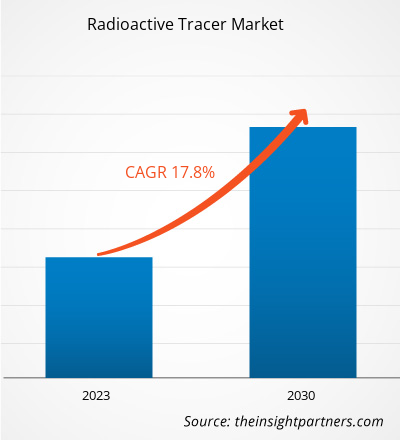

[Research Report] The radioactive tracer market is expected to grow from US$ 14,675.73 million in 2022 to US$ 54,296.57 million by 2030; it is expected to grow at a CAGR of 17.8% from 2022 to 2030.

Market Insights and Analyst View:

The rising prevalence of chronic diseases and increasing use of nuclear imaging techniques drive the radioactive tracer market growth. The rising focus on research and development in the field of diagnosis using radioactive tracer is also expected to boost the radioactive tracer market growth. A radioactive tracer is a chemical compound in which one or more atoms are replaced by a radioisotope. Radiotracer can be used to study chemical reactions based on the monitoring of their radioactive decay. They are also used to visualize flow in techniques such as single photon emission computed tomography (SPECT), positron emission tomography (PET), and computed radioactive particle tracking (CARPT).

The radioactive tracer market key players focus on strategic initiatives by collaborations to expand their geographic reach and enhance capacities to cater to a large customer base. In May 2022, Invicro opened a new global headquarters and laboratory in Needham, Massachusetts, to provide more resources to support pharmaceutical and biotechnology companies and their development of life-changing drugs.

Growth Drivers and Challenges:

Increasing aging population, changing social behavior, rising sedentary lifestyle, and accelerating urbanization are the key factors boosting the prevalence of obesity and other chronic diseases such as diabetes. Further, studies have long established that genes can cause chronic conditions such as cardiovascular disease (CVD), diabetes, obesity, Alzheimer's disease (AD), and depression.

According to the National Council on Aging, Inc., 80% of adults aged 65 and above suffer from at least one chronic condition, while 68% suffer from two or more. According to the Centers for Disease Control and Prevention (CDC), in 2020, ~6 in 10 people in the US suffer from at least one chronic disease, and 4 in 10 people suffer from two or more chronic conditions.

CVDs, such as atherosclerosis, angina pectoris, and acute myocardial infarction, caused due to hectic lifestyles have become significant reasons for mortality worldwide. As per the data provided by the WHO, CVDs are the predominant cause of death worldwide, recording ~17.9 million deaths each year. Diabetes is a life-threatening chronic disease with no functional cure. Diabetes of all types can lead to various complications in different body parts and increase the overall risk of premature death. Heart attack, stroke, kidney failure, leg amputation, vision loss, and nerve damage are among the major complications associated with diabetes. According to the International Diabetes Federation (IDF), diabetic cases in North America are expected to reach 62 million by 2045 from 46 million in 2017. The data further reported that 425 million people had diabetes in 2017, and the count is expected to reach 629 million worldwide by 2045. The disease prevalence will likely increase by nearly 35% during the forecast period. Thus, an effective examination is a must for properly treating chronic diseases; therefore, nuclear substances are used for diagnosis and examination purposes. These nuclear substances are used in diagnostic tests such as positron emission tomography (PET) and single-photon emission computerized tomography (SPECT) to diagnose chronic diseases such as neurological, cardiovascular, chronic lung, and chronic kidney diseases. The availability of several radiotracer makes selection easy depending on the type of disease and its prognosis. Thus, the increasing incidences of chronic diseases are surging the demand for radioactive tracer , positively favoring market expansion.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONRadioactive Tracer Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Radioactive Tracer Market Segmentation and Scope:

The “Global Radioactive Tracer Market” is segmented based on tracer type, test type, application, end user, and geography. The radioactive tracer market, by tracer type, is segmented into Technetium-99m & Tc-97m, Iodine-131, Iron-59, Lutetium-171, Rubidium (Rb-82) Chloride & Ammonia (N-13), Scandium-46, Seaborgium-269, Hassium-269, Gallium Citrate Ga 67, Prostate-Specific Membrane Antigen (PSMA) (Ga-68), FDDNP (F-18) & FDOPA (F-18), Phosphorus-32 & Chromium-51, Thallium-201, F-18 FDG, F-18 FAPI, Ga-68 FAPI, F-18 PSMA, DOTATOC/DOTANOC/DOTATATE (Ga-68), and others. Based on test type, the radioactive tracer market is segmented into PET, SPECT, and others. By application, the radioactive tracer market is segmented into oncology, pulmonary, neurology, cardiology, and others. In terms of end user, the radioactive tracer market is segmented into hospitals & clinics, diagnostic centers, academic & research institutes, and others. Geographically, the radioactive tracer market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on tracer type, the radioactive tracer market is segmented into Technetium-99m & Tc-97m, Iodine-131, Iron-59, Lutetium-171, Rubidium (Rb-82) Chloride & Ammonia (N-13), Scandium-46, Seaborgium-269, Hassium-269, Gallium Citrate Ga 67, Prostate-Specific Membrane Antigen (PSMA) (Ga-68), FDDNP (F-18) & FDOPA (F-18), Phosphorus-32 & Chromium-51, Thallium-201, F-18 FDG, F-18 FAPI, Ga-68 FAPI, F-18 PSMA, DOTATOC/DOTANOC/DOTATATE (Ga-68), and others. The others segment held the largest market share in 2022, and Seaborgium-269 and PSMA GA68 is anticipated to register the highest CAGR of 28.4% from 2022 to 2030. As F-18 FDG is one of the most common radioactive tracer used to diagnose cancer in the human body using PET scan technique, the F-18 FDG segment held the second-largest share in the market in 2022. FDA has approved F-18 FDG PET for measuring regional glucose metabolism in the human brain to assist in diagnosing seizures. Under steady-state conditions, F-18 FDG is taken up by cells in competition with other sugars. Once inside cells, F-18 FDG is phosphorylated by hexokinase. This phosphorylation results in a polar entity that cannot diffuse from the cell. The entity can be dephosphorylated to F-18 FDG by glucose-6-phosphatase, but dephosphorylation occurs slowly. Therefore, the cellular concentration of F-18 FDG is closely representative of the accumulation of F-18 FDG and the glycolytic activity of exogenous glucose. The amount that accumulates in the tissue over a specific period allows for calculating the glucose uptake rate by that tissue. Accelerated glycolysis and decreased ability to make energy aerobically are features of malignant and epileptogenic brain cells. These features cause high rates of glucose uptake required to sustain the cells. The aforementioned factors drive the radioactive tracer market growth for the segment.

Regional Analysis:

Based on geography, the radioactive tracer market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2020, North America held the largest share of the global radioactive tracer market, and Asia Pacific is estimated to register the highest CAGR from 2022 to 2030.

North America is the largest market for radioactive tracer , with the US holding the largest market share, followed by Canada. The radioactive tracer market in the US is primarily driven by increasing demand for PET scanners in cancer diagnosis, rising demand for imaging modalities such as SPECT and PET, and a high adoption rate of radioactive tracer . Demand for SPECT and PET scanners in cancer diagnosis has increased remarkably over the past few years. The SPECT and PET offer a sophisticated diagnostic tool that can detect disease progression at each stage, helping in the early diagnosis of disease. Immuno-PET is a technique that uses radioactive tracer to target specific cancer cells. This technique aids in visualizing the distribution and accumulation of immunotherapy drugs in tumors, allowing for personalized treatment planning. Thus, owing to the wide range of benefits, there is a significant demand for radioactive tracer in the US.

Nuclear medicine in the US has grown significantly owing to advancements in technology, such as hybrid imaging, the introduction of novel radiopharmaceuticals for diagnosis and treatment, and the development of molecular imaging based on the tracer principle.

Several market players are adopting organic strategies to stay competitive in the market. For instance, in March 2023, Telix Pharmaceuticals received FDA approval for a supplementary New Drug Application (sNDA) for Illuccix, a kit designed to prepare gallium Ga 68 gozetotide injection. The approval allows Illuccix to select patients with metastatic prostate cancer who could benefit from 177Lu 177 PSMA-directed therapy.

Industry Developments and Future Opportunities:

The European Union Committee has taken various initiatives to boost R&D activities in radioactive tracer and radioisotopes. The DOE Isotope Program (DOE IP) and its former organizations have been leading the development and production of radioactive and stable isotopes worldwide. Under the Atomic Energy Act of 1954, the DOE IP supplies isotope and related services to the US and has the exclusive authority within DOE to produce isotopes for distribution and sale. The mission of the DOE IP is to conduct R&D in order to develop transformative isotope production, separation, and enrichment technologies to allow academic, federal, and industrial innovation, research, and emerging technologies.

The Isotope Production and Distribution Program (IPDP) was established within the DOE's Office of Nuclear Energy to enhance the production and marketing of DOE-produced isotopes for research and commercial purposes. The IPDP was established on a condition that its operations were to be financially self-supporting.

PRISMAP is a European medical radionuclide program that was started to provide medical research access to novel radioisotopes of high purity grade. According to the data provided under this program, out of the ~3,000 different radioisotopes synthesized by scientists in laboratories under European Union, only a handful are used regularly for medical procedures, mostly for imaging. Many hospitals and research institutes focus on developing and using different radioactive tracer to diagnose chronic diseases. Massachusetts General Hospital (MGH) is focused on using a new PET tracer [18F]3F4AP to diagnose multiple sclerosis, Alzheimer's disease, mild cognitive impairment, and traumatic brain injury. According to the National Library of Medicine (ClinicalTrials.gov), [18F]3F4AP is used in Phase 1 clinical trial to diagnose multiple sclerosis, Alzheimer's disease, mild cognitive impairment, and traumatic brain injury. The ongoing research for discovering new radioactive tracer for diagnosing neurological disorders is anticipated to fuel the growth of the radioactive tracer market in the coming years.

COVID-19 Impact:

The COVID-19 pandemic has profoundly changed hospital activities, including nuclear medicine (N)M practice across the globe. A literature search on PubMed was performed covering COVID-19 studies published until January 2021. As per the findings, the pandemic strongly challenged NM departments, and a reduction in the workforce has been experienced in every center in Europe. NM departments introduced restriction measures to limit COVID-19 transmission, including rescheduling non-high-priority procedures. Also, some departments experienced a delay in the supply of radiopharmaceuticals or technical assistance due to the pandemic. As a result, the pandemic resulted in a significant reduction of diagnostic and therapeutic NM procedures and a reduced level of care for patients affected by diseases other than COVID-19. According to the British Nuclear Medicine Society (BNMS) COVID-19 survey results, ~97% of NM departments introduced procedures to limit SARS-CoV-2 transmission; at 68% of sites, standardized operating procedures were developed for running departments in pandemic situations. The pandemic influenced workflows in a substantial proportion of NM departments. As per the global survey by Freudenberg et al., nearly 15% of the respondent departments modified working hours for less than 20% of the staff and reported a mean decline of 54.4% in diagnostic procedures. PET/CT scans decreased by a mean of 36%; thyroid scans decreased by 67%; myocardial studies by 66%; bone scans by 60%; lung scans by 56%; and sentinel lymph node procedures by 45%. Nearly all (97%) participating centers in the survey from Germany, Austria, and Switzerland reported a decline in diagnostic NM procedures. In addition, nuclear cardiology was one of the most affected branches of NM during the COVID-19 pandemic in the region. All non-urgent examinations were postponed, and a decrease of 32% and 31% in activity was observed in NHS England PET/CT services in April and May 2020, respectively. However, European centers did not experience significant disruption in supplies of radioisotopes, generators, and kits. The BNMS survey reported that 81% of participants did not experience any problem with radiopharmaceutical supply, 13.9% had occasional issues, and 5.1% experienced disruptions to supply.

Apart from this, new findings supporting COVID-19 diagnosis are expected to accelerate the growth of radiopharmaceuticals in the region. For instance, as per the research study by Chentao Jin et al., published in the European Journal of Nuclear Medicine and Molecular Imaging in May 2021, PET is expected to offer pathophysiological alternations of COVID-19 and facilitate the clinical management of patients. With the role of PET during the COVID-19 pandemic, the research studies can also pave the way in combating other epidemics in the future.

Radioactive Tracer

Radioactive Tracer Market Regional InsightsThe regional trends influencing the Radioactive Tracer Market have been analyzed across key geographies.

Radioactive Tracer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 14.68 Billion |

| Market Size by 2030 | US$ 54.3 Billion |

| Global CAGR (2022 - 2030) | 17.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Tracer Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Radioactive Tracer Market Players Density: Understanding Its Impact on Business Dynamics

The Radioactive Tracer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

Some prominent players operating in the global radioactive tracer market are Rotem Industries Ltd, ABX advanced biochemical compounds GmbH, Invicro LLC, Cardinal Health Inc, Newcastle University, Novartis AG, Curium, Blue Earth Diagnostics Limited, General Electric Co, and IBA Radiopharma Solutions. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve a large set of customers and subsequently increase their market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For