T Cell Therapy Market Drivers and Forecasts by 2030

T Cell Therapy Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Modality (Research and Commercialized), Therapy Type [CAR T-cell Therapy and T-cell Receptor (TCR)-based], Indication (Hematologic Malignancies and Solid Tumors), and Geography (North America, Europe, Asia Pacific, and South and Central America)

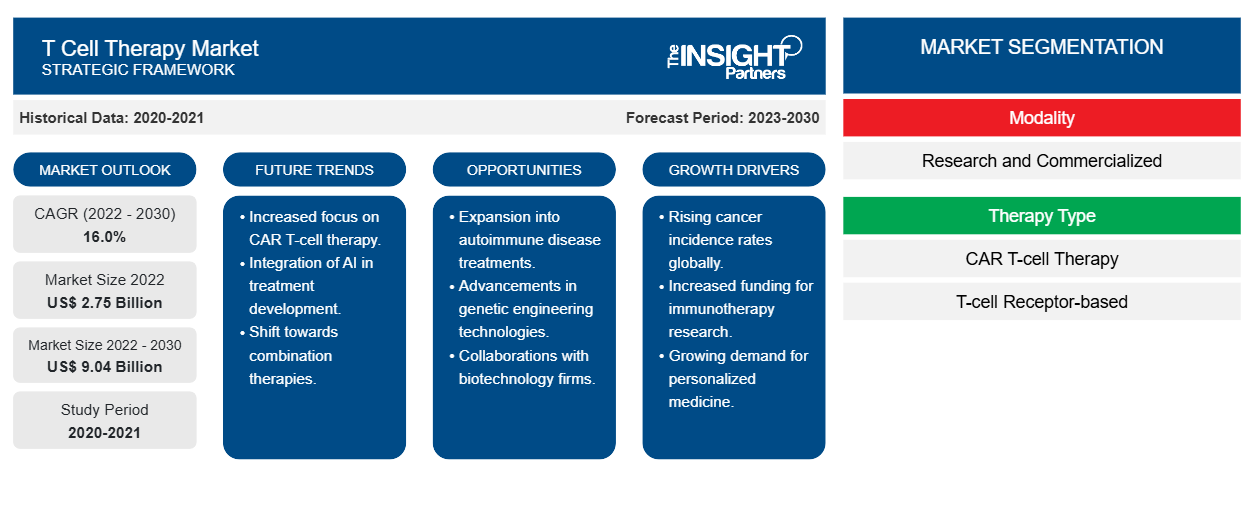

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPRE00024331

- Category : Life Sciences

- No. of Pages : 138

- Available Report Formats :

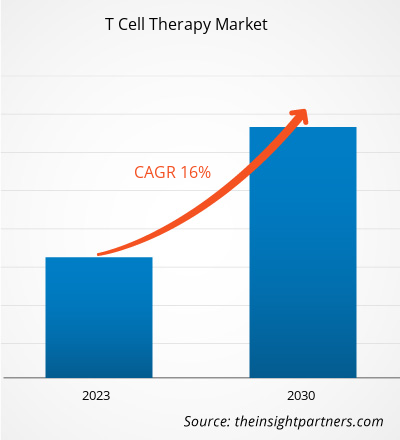

[Research Report] The T cell therapy market size was valued at US$ 2,754.0 million in 2022 and is expected to reach US$ 9,035.01 million by 2030. It is estimated to register a CAGR of 16.0% during 2022–2030.

Market Insights and Analyst View:

One of the most promising procedures of cancer treatment is chimeric antigen receptor (CAR) T cell therapy, and every year, an increasing number of pre-clinical and clinical research is being conducted to increase its application. CAR T cell therapy has also generated interest among oncologists and academics. Immune checkpoint inhibitors are more common and widely used than CAR T cell treatments, even though CAR T cell therapy demonstrated the same capacity to destroy extremely advanced leukaemias and lymphomas and hold the disease away for many years. Hospitals are anticipated to adopt CAR-T cell therapy extensively; however, to deliver such therapy, the manufacturing and medical fields must set up an ecosystem for gathering raw materials, processing the product, dispensing it, and monitoring patients. The demand for T cell therapy is continuously growing due to the growing burden of cancer worldwide and an increasing number of T cell therapy approvals.

Companies operating in the T cell therapy market focus on strategic developments such as collaborations, agreements, and investments to improve their sales, expand their geographic reach, and enhance their capacities to cater to a larger than existing customer base. For instance, in August 2023, Astellas invested US$ 50 million in Poseida’s CAR T cell therapy. Astellas will have exclusive negotiation and first refusal for licensing P-MUC1C-ALLO1 in solid tumors as part of the agreement.

Growth Drivers and Challenges:

According to the World Health Organization (WHO), in 2020, cancer was a primary cause of death worldwide, account for ~10 million deaths. According to the International Agency for Research on Cancer, in 2040, 30.2 million new cases will be added to the global cancer burden. Chimeric antigen receptor (CAR) T cell therapies can potentially treat a new type of cancer treatment that uses the immune system to fight cancer. CAR T cells are innovative drugs that have turned the tables for treating hematologic malignancies, such as diffuse large B-cell lymphoma (DLBCL) and B-cell acute lymphoblastic leukemia (B-ALL) by achieving approval from the FDA based on their successful clinical outcomes. According to the Leukemia & Lymphoma Society, around one person every 3 minutes in the US is diagnosed with leukemia, lymphoma, or myeloma. In 2023, nearly 180,000 people in the US are expected to be diagnosed with lymphoma and leukemia.

T cell-based techniques are frequently used in cancer immunotherapy due to their higher success rate. In 2021, Labiotech.eu (a leading online media for the European biotech industry) stated that more than 500 CAR T cells clinical trials for cancer treatment are being carried out globally. Most are being carried out in East Asia, the US, and Europe. Thus, the growing burden of cancer is driving the T cell therapy market growth.

As CAR T cell therapy is complex, some high-risk side effects are associated. One of the most common and serious side effects caused by CAR T cell therapy is cytokine release syndrome (CRS). The other side effects of CAR T cell therapies are neurologic effects, including severe confusion, seizure-like activity, and impaired speech. Neurotoxicity is a side effect in most anti-CD19 CAR T cell therapy patients. ICANS is a common and challenging adverse effect of CAR T cell therapy, which occurs in 25–44% of children with hematologic malignancies. ICANS usually occurs within 7–10 days, sometimes up to 3 weeks after CAR T cell infusion and can occur concurrently or shortly after CRS. Thus, the challenges of side effects of the therapy limit the T cell therapy market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONT Cell Therapy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global T cell therapy Market” is segmented based on the modality, therapy type, and indication. Based on the modality, segment into research and commercialized. In 2022, the commercialized segment held the larger share of the market. Based on therapy type, the T cell market is bifurcated into CAR T cell therapy and T cell receptor (TCR)-based. In terms of indication, the T cell therapy market is divided into hematologic malignancies and solid tumors. The T cell therapy market, based on geography, is segmented into North America (US, Canada, and Mexico), Europe (France, Germany, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, Israel, and Rest of Middle East & Africa), and South & Central America (Brazil).

Segmental Analysis:

By modality, the T cell therapy market is segmented into research and commercialized. In 2022, the commercialized segment held the largest share of the market. Moreover, the same segment is expected to grow fastest during the forecast period. An increase in product launches and a rise in awareness about the benefits of T cell therapy for cancer treatment fuelling the growth of the commercialized segment. Following are a few products commercialized for cancer treatment.

- In 2022, FDA approved CARVYKTI manufactured by Janssen Biotech, Inc. It is an autologous CAR-T cell engineered with lentivirus to attack BCMA-expressing tumor cells to treat certain kinds of refractory multiple myeloma.

- In January 2022, the US FDA approved a KIMMTRAK manufactured by Immunocare. It is used to treat unresectable or metastatic uveal melanoma.

Based on therapy type, the T cell therapy market is bifurcated into CAR T cell therapy and T cell receptor (TCR)-based. In 2022, the CAR T cell therapy segment held the larger share of the market. Moreover, the same segment will grow at a significant growth rate during the forecast period. In the chimeric antigen receptor (CAR) T cell therapy technique, T cells obtained from patients are artificially bioengineered to express CARs that can identify and attach to the tumour cells. The companies are entering into strategic developments such as collaborations, expansions, agreements, partnerships, and new product launches by companies operating in the CAR T cell segment, fuelling the T cell therapy market growth. For instance, in 2022, FDA approved CARVYKTI manufactured by Janssen Biotech, Inc. CARVYKTI is a kind of therapy called CAR-T—which stands for chimeric antigen receptor T cell. CARVYKTI (ciltacabtagene autoleucel) is a treatment used for adult patients with bone marrow cancer called multiple myeloma. CARVYKTI treats adult patients with relapsed or refractory multiple myeloma after four or more former lines of therapy, comprising of a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody.

The T cell therapy market is divided into hematologic malignancies and solid tumors based on indication. In 2022, the hematologic malignancies segment held the largest market share; the same segment is projected to grow at a significant growth rate during the forecast period. Hematologic malignancies are cancer types that affect the human body's blood, bone marrow, and lymph nodes. Leukemia, lymphoma, myeloid, and myeloma are some hematologic malignancies. According to Leukemia and Lymphoma Society, in 2023, ~184,000 people in the US are expected to be diagnosed with leukemia, lymphoma, or myeloma. According to the same source, ~1.629,000 people in the US are affected by or in remission from hematologic malignancies. Due to an increase in the prevalence of hematologic malignancies worldwide, treatment approaches have developed rapidly.

Regional Analysis:

Based on geography, the T cell therapy market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The market in North America has been analyzed with a prime focus on three major countries—the US, Canada, and Mexico. North America held the largest T cell therapy market share in 2022. The T cell therapy market in North America is expected to grow due to the increasing burden of chronic disorders such as cancer and autoimmune disorders, growth in research and development activities, and strong and established market players. Also, with increased clinical studies in CAR T cell therapies, the market in North America is expected to grow during the forecast period.

T Cell Therapy Market Opportunity:

Growing Investment in T Cell Therapy

Companies operating in the T cell therapy market focus on strategic developments such as collaborations, expansions, agreements, and investment that help them improve their sales, expand their geographic reach, and enhance their capacities to cater to a larger than existing customer base. A few noteworthy developments in the T cell therapy market are mentioned below.

- In May 2023, Laurus Labs’ stake in ImmunoACT will now increase to 33.86% on a fully diluted basis post-completion of the deal. The company had already acquired 26.62% of stakes in ImmunoACT in November 2021. ImmunoACT has a portfolio of CAR T cell therapy assets under various development stages for treating multiple autoimmune diseases and oncology indications. This investment further strengthens Laurus Labs’ commitment to accessing novel Cell and Gene Therapy technology and enhances its affordability for patients. This investment will further help ImmunoACT to gear up for the manufacture of more treatments.

- In January 2023, the California Institute for Regenerative Medicine (CIRM) invested US$ 4 million to develop and test a CAR T cell therapy to treat various B-cell malignancies, ranging from lymphomas to leukemias.

- In November 2021, Autolus Therapeutics plc (a clinical-stage biopharmaceutical company developing next-generation programmed T cell therapies) and Blackstone Life Sciences entered into a collaboration and financing agreement under which funds are managed by Blackstone. Up to US$ 250 million in equity and product financing was provided by Blackstone to support Autolus’ development of its CD19 CAR T cell investigational therapy product, obecabtagene autoleucel (obe-cel), as well as the next-generation product therapies of obe-cel in B-cell malignancies.

Thus, these investments create lucrative opportunities in the T cell therapy market.

T Cell Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.75 Billion |

| Market Size by 2030 | US$ 9.04 Billion |

| Global CAGR (2022 - 2030) | 16.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Modality

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

T Cell Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The T Cell Therapy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global T cell therapy market are Immunocore Holdings Plc, Legend Biotech Corp, Janssen Global Services LLC, Gilead Sciences Inc, Bristol-Myers Squibb Co, Bluebird Bio Inc, Novartis AG, JW (Cayman) Therapeutics Co Ltd, Cartesian Therapeutics Inc, and Innovent Biologics Inc. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. The companies implementing various inorganic and organic developments in the global T cell Therapy market. Below are few instance:

- In May 2023, Legend Biotech Corporation announced that a Type II variation application was submitted to the European Medicines Agency (EMA) for CARVYKTI based on data from the CARTITUDE-4 study (NCT04181827), which investigates the treatment of adult patients with relapsed and lenalidomide-refractory multiple myeloma who have received one to three prior lines of therapy.

- In March 2023, JW Therapeutics, an independent and innovative biotechnology company focusing on developing, manufacturing and commercializing cell immunotherapy products, has initiated the clinical study of Carteyva (relmacabtagene autoleucel injection) for first-line treatment in patients with high-risk large B-cell lymphoma and the first patient infusion.

- In June 2022, The U.S. Food and Drug Administration (FDA) approved Breyanzi (lisocabtagene maraleucel), a CD19-directed chimeric antigen receptor (CAR) T cell therapy, for the treatment of adult patients with large B-cell lymphoma (LBCL), including diffuse large B-cell lymphoma (DLBCL) not otherwise specified (including DLBCL arising from indolent lymphoma), high-grade B-cell lymphoma, primary mediastinal large B-cell lymphoma, and follicular lymphoma grade 3B.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For