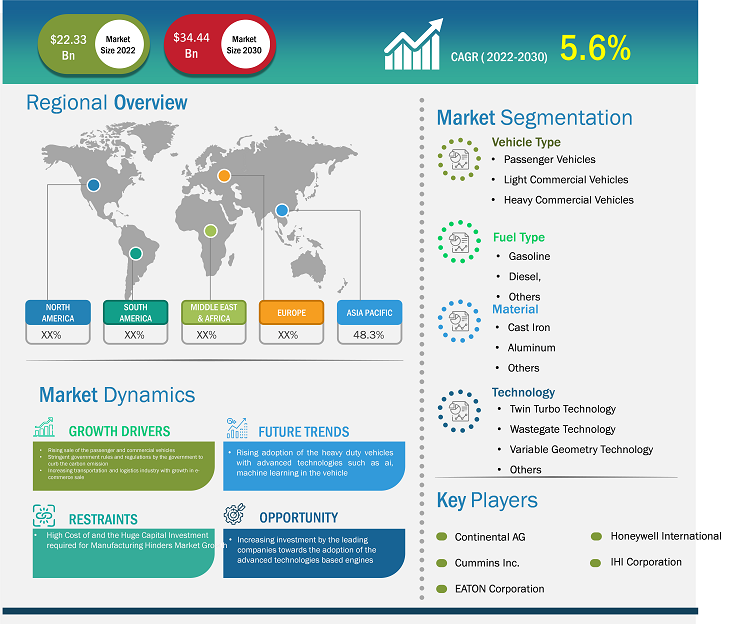

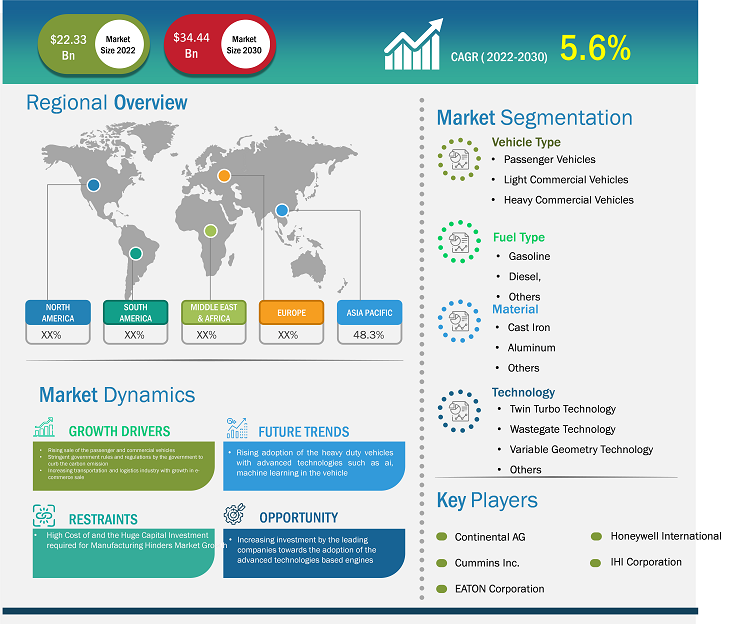

The turbocharger market is expected to grow from US$ 22.33 billion in 2022 to US$ 34.44 billion by 2030; it is estimated to grow at a CAGR of 5.6% from 2022 to 2030.

Analyst Perspective:

The global turbocharger market has witnessed significant market growth in recent years, driven by rising demand for low-carbon emission-based vehicles, rising air pollution, and increasing reliance on heavy-duty vehicle production and sale. The automotive sector is gaining popularity in manufacturing energy-efficient and new-energy vehicles. Also, the aerospace and defense sector vehicles are growing the use of these turbochargers to enhance fuel efficacy and improve power output. Increasing energy efficiency and technological advancement in the automotive turbochargers is a major driving factor for reducing low carbon emissions base vehicles and saving vehicle energy. China is responsible for 30% of the world’s population. The automotive industry is responsible for high carbon emissions.

The India turbochargers market is growing at the highest CAGR of 14.0% during the forecast period 2022-2030, according to the Indian Group of Automotive Manufacturers. Strict regulatory standards and greater value-added solutions such as variable geometry turbines and dual spool turbo promote higher content per vehicle, which propelled the global turbocharger market growth. The total turbocharger market is driven by a rising percentage of turbocharged petrol engines and better realization, even if the share of diesel cars in India is anticipated to decline. The automotive industry's turbocharger has grown significantly in Asia Pacific due to increasing heavy-duty commercial vehicle production.

Market Overview:

The definition of a turbocharger market has shown significant growth owing to rising sales of heavy-duty commercial vehicles such as buses, trucks, caches, and vans. A turbocharger is a device that enhances the fuel efficiency of the internal combustion engine with increased intake air pressure by connecting a compressor wheel. It consists of the exhaust gas turbine wheel through a solid shaft. The air entering a diesel engine using the turbocharger is compressed before the fuel is injected. It is a key distinction between a turbocharged diesel engine and a conventional, normally aspirated gasoline engine. The turbocharger is vital in the diesel engine's power production and efficiency. More air is compressed before entering the engine cylinder thanks to the turbocharger. The oxygen molecules are squeezed closer together when air is compressed. With more air, a normally aspirated engine of the same capacity can accommodate more fuel.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Turbocharger Market: Strategic Insights

Market Size Value in US$ 22.33 billion in 2022 Market Size Value by US$ 34.44 billion by 2030 Growth rate CAGR of 5.6% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Turbocharger Market: Strategic Insights

| Market Size Value in | US$ 22.33 billion in 2022 |

| Market Size Value by | US$ 34.44 billion by 2030 |

| Growth rate | CAGR of 5.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Increased Sale of Heavy-Duty Commercial Vehicles to Drive Growth of Turbocharger Market

The increased sale of heavy-duty commercial vehicles around the globe has created massive demand for the turbocharger market. Turbochargers are widely used to curb engine emissions and significantly enhance fuel efficiency. As per the International Organization of Motor Vehicle Manufacturers, global heavy-duty commercial vehicle sales in 2021 reached 4.27 million units, increasing by 3.3% compared to 2020. Further, rising strict rules and regulations imposed by several countries' governments on vehicle emissions, advancement in vehicle safety, and rapidly increasing logistics drive the market growth. Further, increasing e-commerce and retail sectors around the globe at a rapid pace is expected to drive the global demand for the turbocharger market. Rising demand for heavy-duty, powerful vehicles that carry capacity using fuel-efficient vehicles and trucks is propelling the market growth. Also, stringent government rules and regulations imposed by several countries’ authorities for manufacturing fuel-efficient vehicles around the globe are propelling the market growth. The National Highway Traffic Safety Administration in the US has imposed new standards for the vehicle manufacturers of heavy-duty vehicle engines driven by natural gas, diesel, and other fuels. Also, in February 2022, India’s Union Ministry of the Road Transport and Highway allowed using the fuel-efficient BS IV engine-based vehicles.

Furthermore, heavy-duty vehicles with turbochargers offer higher fuel efficiency for convenient, secure transportation. The rapid growth of the construction, logistics, and transportation industry that uses heavy-duty vehicles around the globe is driving the turbocharger market growth. Moreover, rising demand for heavy-duty trucks, trailers, and buses in the automotive sector is driving the turbocharger market growth.

Asia-Pacific is growing rapidly for the global turbocharger market owing to increased commercial and passenger vehicle production and sales in countries such as India, Japan, and China. The increasing construction industry in India, Japan, and ASEAN countries further drives the region’s turbocharger demand. Also, several automotive manufacturers, such as Volvo, Freightliner Corporation, Kenworth International, and Peterbilt, are producing turbochargers-based vehicles. The rising adoption of turbochargers for manufacturing of the automotive is expected to drive the market growth. Further, turbochargers offer better fuel efficiency and power for heavy-duty commercial vehicles. The turbochargers are combined with high-power compressors and turbines for offering fuel efficacy. Rising adoption of electric turbochargers to offer better fuel efficiency drives the market growth. Several key players, including BorgWarner Corporation, Garrett Motion, and Continental AG, launched advanced 48 Volt e-turbo chargers. This e-turbo charger offers better fuel efficiency and better power output. Hence, the demand for these electric turbochargers is growing rapidly around the globe.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

Based on vehicle type, the market is segmented into passenger, light, and heavy commercial vehicles. Based on the fuel type, the market consists of gasoline, diesel, and others. Depending on the material, the market is divided into cast iron, aluminum, and others. Based on the technology, the global market is divided into twin-turbo technology, wastegate technology, variable geometry technology, and others. Among these, twin-turbo technology is growing rapidly, with rising demand for the production of premium luxury vehicles around the globe. Also, the rising sale of these premium vehicles with the surge in the disposable income of the people in countries such as the US, India, China, Germany, France, the UK, and Italy are driving the market growth. Luxury vehicle companies such as BMW Group, Mercedes-Benz, and Audi have shown significant sales in the first half of 2023, reaching 8,528 units sold by Mercedes-Benz in India. Similarly, brands such as BMW and other luxury brands recorded cumulative sales of 5,867 luxury cars.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Regional Analysis:

Asia Pacific is expected to have the largest share in 2022, attributed to the increasing number of heavy-duty commercial vehicles with the increasing transportation industry at a rapid pace. In Asia-Pacific, the demand for these vehicles is significant owing to the presence of leading manufacturers, availability of low-cost workforce, and access to raw materials. The rapid growth of the automotive construction sectors across major countries such as Thailand, Japan, Malaysia, India, and Indonesia is expected to drive the turbocharger market growth.

The increasing government rules and regulations for improving vehicle efficiency and the rapid adoption of turbochargers by OEMs and suppliers to manufacture fuel-efficient vehicles are driving market growth. For instance, the Chinese government planned to phase out diesel and gasoline-based vehicles by 2040.

Also, these turbochargers are widely used in aerospace and defense vehicles in order to increase fuel efficiency. Aircraft and marine engines use turbochargers to enhance fuel efficacy and deliver higher power output of these engines. Turbocharger brands are making partnerships with turbocharger car OEMs in order to offer turbo at a competitive price.

Key Player Analysis:

The turbocharger market analysis consists of players such as Continental AG, Cummins Inc., EATON Corporation, Honeywell International Corporation, IHI Corporation, Mitsubishi Heavy Industries, Precision Turbo & Engine, Rotomaster International, Turbo Dynamics Ltd., GARRETT MOTION INC. Also, players such as Continental AG and Cummins Inc. are the top two players owing to the diversified product portfolio offered.

MAN Energy Solutions, a diesel and gasoline engine manufacturer, is headquartered in Germany, Europe. MAN Energy Solutions employed more than 14,000 individuals in more than 120 countries globally. In June 2021, Rolls-Royce and MAN Energy Solutions partnered to develop advanced vehicle turbochargers. The companies combined their technologies of Rolls-Royce's high-efficient MTU turbocharger for high-speed gas and diesel and engines for turbochargers.

Recent Developments:

The companies are adopting several strategies, such as collaborations, partnerships, mergers & acquisitions, and new product developments in the global turbocharger market. A few recent key market developments are listed below:

- In August 2022, Cummins Inc. launched the eighth generation holset series HE400VGT turbocharger technology. Also, in 2021, Cummins Turbo Technologies launched seventh generation 400 series-based variable geometry turbochargers that help the engine manufacturers meet carbon emission standards and offer the class fuel-efficient vehicles. Cummins, Inc. continues advancing turbocharger technologies for the top-class heavy-duty truck vehicle.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vehicle Type, Fuel Type, Material, Technology

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The List of Companies

1. BorgWarner Inc.

2. BMTS TECHNOLOGY

3. Continental AG

4. EATON Corporation

5. Honeywell International Inc.

6. Mitsubishi Heavy Industries

7. Precision Turbo and Engine

8. Rotomaster International

9. Turbo Energy Ltd

10. ZOLLERN GmbH and Co. KG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Turbocharger Market

Apr 2024

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Apr 2024

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Apr 2024

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Apr 2024

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Apr 2024

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Apr 2024

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Apr 2024

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Apr 2024

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)