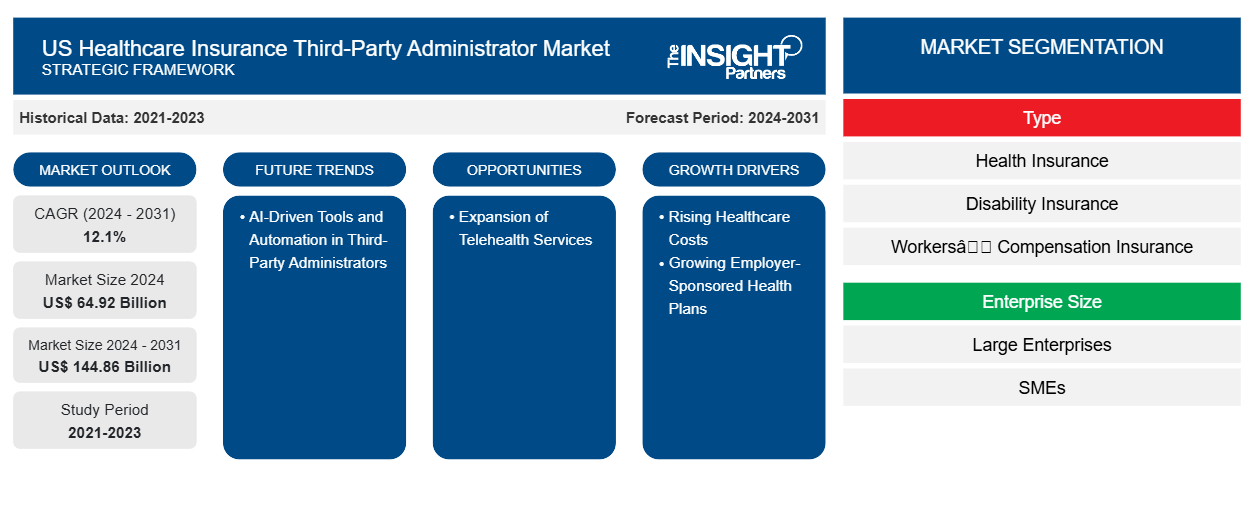

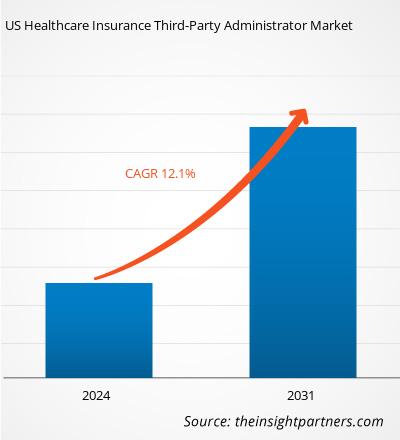

The US Healthcare Insurance Third-Party Administrator market size was valued at US$ 64.92 billion in 2024 and is expected to reach US$ 144.86 billion by 2031. The market is estimated to record a CAGR of 12.1% from 2024 to 2031. The adoption of AI-driven tools and automation is likely to be a key trend in the market.

US Healthcare Insurance Third-Party Administrator Market Analysis

The growth of the healthcare insurance third-party administrator (TPA) market in the US is driven by several key factors, including the rising healthcare costs, increasing adoption of self-funded insurance plans by employers seeking cost savings, the growing complexity of healthcare management and regulatory compliance, and the rising demand for specialized administrative services such as claims processing, analytics, and member support. Additionally, the expansion of telehealth services and employer-sponsored health plans, the need for enhanced efficiency in claims adjudication, and the ability of third-party administrators to offer customized solutions for diverse healthcare needs further fuel the market. The shift toward AI-driven tools and automation in third-party administrators also contributes to the rising reliance on third-party administrators to streamline operations and reduce overall costs for insurers and employers.

US Healthcare Insurance Third-Party Administrator Market Overview

A third-party administrator (TPA) is an entity that manages the administrative and operational functions of an insurance plan. These responsibilities typically include processing claims, enrolling participants, collecting premiums, and ensuring compliance with federal regulations. While TPAs do not establish the policies of insurance plans, they play a crucial role in ensuring that the policies are effectively implemented. TPAs may collaborate with multiple insurers, providing services across different plans and organizations. Though often associated with health insurance, TPAs are used in various other insurance sectors. For example, commercial liability insurers and retirement plan administrators often hire TPAs to act as claims adjusters or to offer customer support services. TPAs can range from large multinational corporations to individual contractors who hold TPA certification. Insurance companies and employers with self-funded health plans often outsource their claims management to TPAs, a process known as outsourcing.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Healthcare Insurance Third-Party Administrator Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Healthcare Insurance Third-Party Administrator Market Drivers and Opportunities

Rising Healthcare Costs

The increasing costs of healthcare services, medications, and insurance premiums are pushing both insurers and employers to seek more efficient and cost-effective ways to manage healthcare plans. Third-party administrators can help streamline claims processing and administrative functions, reducing operational costs for insurers and employers. According to the Peter G. Peterson Foundation, the US has a high healthcare expenditure, with US$ 4.5 trillion spent in 2022, equating to an average of US$ 13,493 per person. This is significantly higher than the healthcare spending in other developed countries, where the costs per person are less than half of what they are in the US. This immense spending burden has created pressures on insurers, employers, and consumers, driving the need for more efficient and cost-effective ways to manage healthcare systems. Third-party administrators help businesses manage employer-sponsored health insurance plans by taking on the burden of tasks such as claims processing, eligibility verification, and benefits administration. By outsourcing these responsibilities to third-party administrators, companies can focus on their core operations while still offering competitive healthcare benefits to employees.

Growing Employer-Sponsored Health Plans

The significant role of employer-sponsored health insurance (ESI) in the US as the primary source of health coverage for non-elderly residents highlights the crucial impact that employers and insurance providers have on the nation's healthcare system. According to KFF, in 2023, approximately 60.4% of individuals under age 65, or 164.7 million people, were covered through ESI. Unlike many other countries where national healthcare systems dominate, the US relies heavily on voluntary, private health insurance, making employer-based plans essential for offering health coverage to working families.

US Healthcare Insurance Third-Party Administrator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the US Healthcare Insurance Third-Party Administrator market analysis are type and enterprise size.

- In terms of type, the market is segmented into health insurance, disability insurance, workers' compensation insurance, and others.

- In terms of enterprise size, the market is bifurcated into large enterprises and small and medium-sized enterprises.

US Healthcare Insurance Third-Party Administrator Market Share Analysis

The US healthcare insurance third-party administrator market is a dynamic sector that includes a variety of companies and associations working to streamline healthcare administration and reduce costs for insurers, employers, and plan participants. Third-party administrators are critical to managing tasks such as claims processing, enrollment, customer support, and regulatory compliance, allowing health insurance companies and self-insured employers to focus on core business functions. Several well-known companies, such as Sedgwick, Crawford & Company, Meritain Health, UMR Inc., and Gallagher Bassett Services Inc, play a significant role in the US healthcare insurance third-party administrator market. These companies not only manage claims but also offer additional services such as access to healthcare networks and vendor sourcing, which enhances the overall efficiency of health plan administration. Similarly, associations such as the Society of Professional Benefit Administrators (SPBA), Self-Insurance Institute of America (SIIA), and the National Association of Third-Party Administrators (NATPA) play a key role in shaping the landscape of the US healthcare insurance third-party administrator market by advocating for policies that support the self-insurance industry, offering education and certification for third-party administrators, and promoting best practices.

US Healthcare Insurance Third-Party Administrator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 64.92 Billion |

| Market Size by 2031 | US$ 144.86 Billion |

| CAGR (2024 - 2031) | 12.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

US

|

| Market leaders and key company profiles |

|

US Healthcare Insurance Third-Party Administrator Market Players Density: Understanding Its Impact on Business Dynamics

The US Healthcare Insurance Third-Party Administrator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the US Healthcare Insurance Third-Party Administrator Market top key players overview

US Healthcare Insurance Third-Party Administrator Market News and Recent Developments

The US Healthcare Insurance Third-Party Administrator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the US Healthcare Insurance Third-Party Administrator market are listed below:

- Sedgwick announced a strategic investment from Altas Partners. Current investors, including funds managed by global investment firm Carlyle (NASDAQ: CG) and Stone Point Capital LLC, will remain as investors and continue to make significant new investments in the business. Carlyle will maintain its control position in partnership with the investor group and the Sedgwick management team. (Source: Sedgwick, Press Release, Sep 2024)

- Sedgwick has announced several new updates to its artificial intelligence-powered (AI) technology program. The technology's goal is to expedite the claims process by predicting, addressing, and automating steps in the claim lifecycle, thereby enhancing consumer experiences and streamlining claim resolutions. (Source: Sedgwick, Press Release, May 2024)

US Healthcare Insurance Third-Party Administrator Market Report Coverage and Deliverables

The "US Healthcare Insurance Third-Party Administrator Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- US Healthcare Insurance Third-Party Administrator market size and forecast at country levels for all the key market segments covered under the scope

- US Healthcare Insurance Third-Party Administrator market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- US Healthcare Insurance Third-Party Administrator market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US Healthcare Insurance Third-Party Administrator market

- Detailed company profiles

Frequently Asked Questions

What are the driving factors impacting the US Healthcare Insurance Third-Party Administrator market?

What are the future trends of the US Healthcare Insurance Third-Party Administrator market?

Which are the leading players operating in the US Healthcare Insurance Third-Party Administrator market?

What would be the estimated value of the US Healthcare Insurance Third-Party Administrator market by 2031?

What is the expected CAGR of the US Healthcare Insurance Third-Party Administrator market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For