Respiratory Inhalers Market Size and Competitive Analysis by 2028

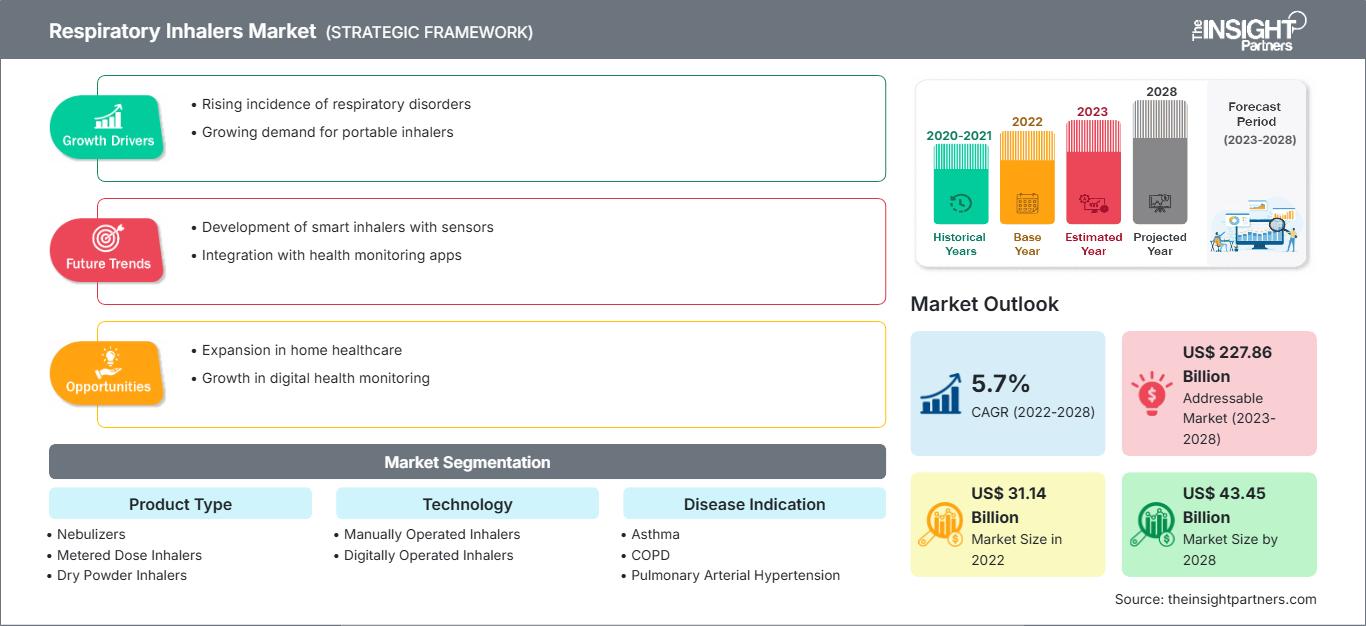

Respiratory Inhalers Market Forecast to 2028 - Analysis By Product Type [Nebulizers, Metered Dose Inhalers (MDI), and Dry Powder Inhalers], Technology (Manually Operated Inhalers and Digitally Operated Inhalers), and Disease Indication (Asthma, COPD, Pulmonary Arterial Hypertension, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Mar 2023

- Report Code : TIPRE00003093

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 254

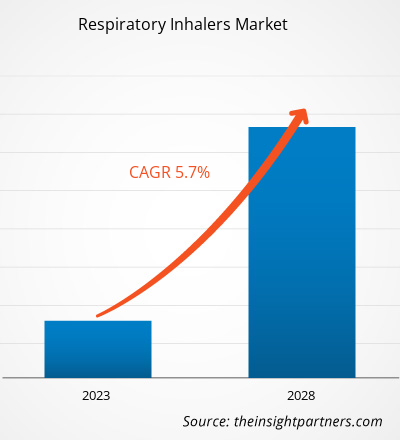

The respiratory inhalers market is expected to grow from US$ 31,144.56 million in 2022 to US$ 43,446.19 million by 2028; it is estimated to record a CAGR of 5.7% from 2022 to 2028.

Respiratory inhalers are used to inhale drugs that are an essential part of treating chronic lung diseases. They are used both to prevent and treat exacerbations of these chronic diseases. They offer the advantage of avoiding systemic drug exposure while ensuring the drugs reach the lungs directly. Numerous products deliver drugs directly into the airways, such as dry powder inhalers, metered dose inhalers (MDIs), nebulizers, and soft mist inhalers. The respiratory inhalers market is expected to grow due to the rising prevalence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), cystic fibrosis, asthma-COPD overlap syndrome, and others.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONRespiratory Inhalers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Respiratory Inhalers Market Insights

Growing Adoption of Generic Inhalers Drives Growth of Respiratory Inhalers Market

Inhaled medicines involving a wide range of inhalation devices are the mainstay of pharmacological treatment of asthma and COPD. Patients suffering from asthma and COPD often need one or more inhalers daily to keep their airways healthy. Therefore, healthcare professionals are concerned about switching between medications as it can negatively impact disease control through low adherence and misuse of aerosol delivery device types. With increasing pressure on healthcare budgets and the simultaneous expiration of patents on established inhalation treatments, several generic replacement products are being manufactured and supplied across the globe. Several inhalants that are used to treat asthma include generic formulations, such as albuterol, levalbuterol, ipratropium, budesonide, and fluticasone/salmeterol. The generic inhalers are bioequivalent to the branded versions and have the same effect on the body. The number of generic asthma inhalers continues to increase as patents expire. On March 3, 2020, the Food and Drug Administration (FDA) cleared generic asthma inhalers and generic inhaled corticosteroid powder. In April 2020, the FDA approved a generic inhaler, based on albuterol sulfate, to cater to the needs of COVID-19 patients having breathing difficulties. As more generic drugs are entering the market, increased competition is expected, which, in turn, leads to reduced costs of drugs. Cost reductions can also result from the launch of an “approved generic drug.” Thus, the growing adoption of generic inhalers and asthma medications is improving medication adherence, thereby driving the respiratory inhalers market.

Product Type-Based Insights

Based on product type, the respiratory inhalers market is segmented into nebulizers, metered dose inhalers, and dry powder inhalers. The dry powder inhalers segment is further bifurcated into multi-dose dry powder inhalers and single-dose dry powder inhalers. The metered dose inhalers (MDI) segment is further divided into pressured metered dose inhalers and connected metered dose inhalers. The nebulizers segment is sub segmented into compressed air nebulizers, mesh air nebulizers, and ultrasonic air nebulizers. In 2022, the dry powder inhalers segment accounted for the largest market share. However, the metered dose inhalers (MDI) segment is anticipated to register the highest CAGR during the forecast period.

Technology-Based Insights

Based on technology, the respiratory inhalers market is bifurcated into manually operated inhalers and digitally operated inhalers. The manually operated inhalers segment held a larger market share in 2022 and is expected to register a higher CAGR during the forecast period.

Respiratory Inhalers Market Regional InsightsThe regional trends and factors influencing the Respiratory Inhalers Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Respiratory Inhalers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Respiratory Inhalers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 31.14 Billion |

| Market Size by 2028 | US$ 43.45 Billion |

| Global CAGR (2022 - 2028) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Respiratory Inhalers Market Players Density: Understanding Its Impact on Business Dynamics

The Respiratory Inhalers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Respiratory Inhalers Market top key players overview

Disease Indication-Based Insights

Based on disease indication, the global respiratory inhalers market is segmented into asthma, COPD, pulmonary arterial hypertension, and others. The asthma segment held the largest share of the market in 2022 and is expected to grow at the highest CAGR during the forecast period.

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the respiratory inhalers market. A few recent key market developments are listed below:

- In September 2022, Beximco Pharmaceuticals launched ONRIVA TRIO BEXICAP, which is a dry inhaler capsule. ONRIVA TRIO BEXICAP is the preparation of Indacaterol (150 µg), Glycopyrronium (50 µg), and Mometasone (160 µg). It works in 3 ways to control asthma symptoms. Indacaterol and Glycopyrronium help the muscles of lung airways to stay relaxed to prevent bronchoconstriction, while Mometasone helps to decrease inflammation. ONRIVA TRIO BEXICAP is indicated as maintenance therapy in severe persistent asthma.

- In June 2021, Cipla announced that it had received final approval for its Abbreviated New Drug Application (ANDA) for Arformoterol Tartrate Inhalation Solution 15 mcg/2 mL from the US Food and Drug Administration. Cipla's Arformoterol Tartrate Inhalation Solution 15 mcg/2 mL is an AN-rated generic therapeutic equivalent version of Sunovion Pharmaceuticals Inc.'s Brovana.

- In February 2022, AstraZeneca and Honeywell announced their plans to partner for the development of next-generation respiratory inhalers using the propellant HFO-1234ze, which has up to 99.9% less Global Warming Potential (GWP) than propellants currently used in respiratory medicines.

- In January 2023, FDA approved Airsupra [pressurized metered-dose inhaler (pMDI)] in the US for the as-needed treatment or prevention of bronchoconstriction. Airsupra is a first-in-class, pressurized metered-dose inhaler (pMDI), fixed-dose combination rescue medication containing albuterol, a short-acting beta2-agonist (SABA), and budesonide, an anti-inflammatory inhaled corticosteroid (ICS) in the US.

Company Profiles

- AstraZeneca Plc

- Beximco Pharmaceuticals Ltd.

- Boehringer Ingelheim International GmbH

- Cipla Ltd.

- GSK Plc

- Koninklijke Philips NV

- OMRON Corp

- PARI Respiratory Equipment, Inc.

- Teva Pharmaceutical Industries Ltd.

- OPKO Health, Inc.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For