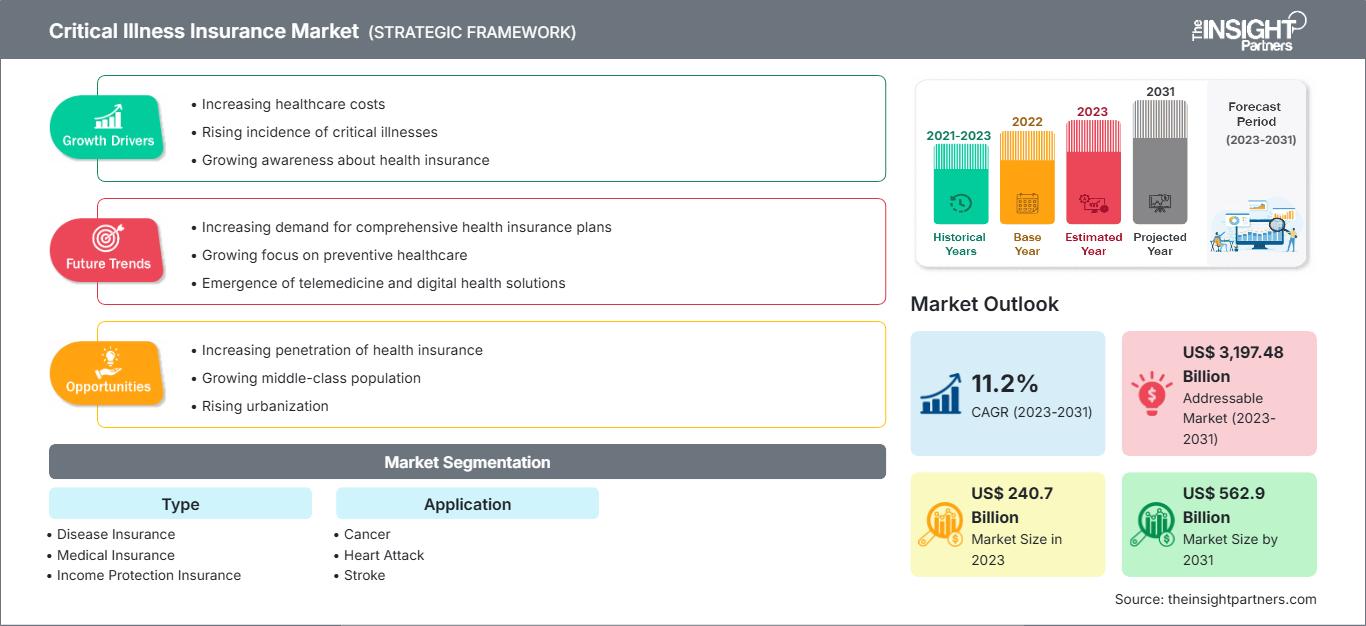

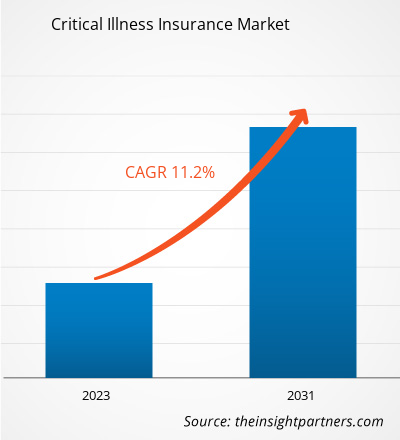

Se prevé que el mercado de seguros de enfermedades graves crezca de 240.700 millones de dólares en 2023 a 562.900 millones de dólares en 2031, con una tasa de crecimiento anual compuesta (TCAC) del 11,2% entre 2023 y 2031. El aumento de la incidencia de enfermedades graves como cardiopatías, cáncer y accidentes cerebrovasculares impulsará el crecimiento de este mercado.

Análisis del mercado de seguros de enfermedades graves

Varios factores clave impulsan el mercado de seguros de enfermedades graves. En primer lugar, existe una creciente concienciación entre la población y los pacientes sobre las ventajas de este tipo de seguro, lo que conlleva un aumento de la demanda de cobertura para aliviar los costes del tratamiento y la recuperación. La creciente frecuencia de enfermedades graves como infartos, accidentes cerebrovasculares, trasplantes de órganos y cáncer también es un factor determinante para el mercado.

Mercado de seguros de enfermedades graves

Descripción general

- El seguro de enfermedades graves es un tipo de seguro que proporciona un pago único o prestaciones mensuales en caso de un diagnóstico futuro de una enfermedad grave. Este tipo de seguro está diseñado para complementar la cobertura del seguro médico existente, proporcionando fondos adicionales para afrontar las necesidades derivadas de emergencias médicas graves.

- Esta cobertura puede ayudar a sufragar gastos no cubiertos por otros seguros, como gastos médicos, facturas del hogar y gastos cotidianos que puedan surgir a raíz de un diagnóstico de enfermedad grave.

- Además, el creciente envejecimiento de la población, los avances en la tecnología médica y las mejores tasas de supervivencia en enfermedades críticas están contribuyendo al crecimiento del mercado.

Obtendrá personalización gratuita de cualquier informe, incluyendo partes de este informe, análisis a nivel de país y paquetes de datos de Excel. Además, podrá aprovechar excelentes ofertas y descuentos para empresas emergentes y universidades.

Mercado de seguros de enfermedades graves: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado que se describen en este informe.Esta muestra GRATUITA incluirá análisis de datos, que abarcarán desde tendencias de mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de seguros de enfermedades graves

El aumento de la incidencia de enfermedades graves impulsará el crecimiento del mercado de seguros de enfermedades graves.

- El aumento de enfermedades graves como el cáncer, los accidentes cerebrovasculares y las cardiopatías impulsa significativamente el mercado. A medida que las personas toman mayor conciencia del costo económico que implican estas enfermedades, aumenta la demanda de cobertura de seguros.

- Según un informe de healthinsurance.org, la mayoría de las pólizas de enfermedades graves cubren afecciones como infarto, derrame cerebral, insuficiencia orgánica/trasplante y cánceres internos, entre otras. La Sociedad Americana Contra El Cáncer también destaca que cada año en Estados Unidos se diagnostican más de 1,7 millones de casos de cáncer, lo que la convierte en la segunda causa principal de muerte.

- A medida que aumenta la prevalencia de estas enfermedades graves, las personas reconocen la necesidad de protección financiera, lo que conlleva una mayor demanda de seguros contra enfermedades graves.

Análisis de segmentación del informe de mercado de seguros de enfermedades graves

- Según el tipo, el mercado se segmenta en seguros de enfermedades, seguros médicos y seguros de protección de ingresos. Se prevé que el segmento de seguros de enfermedades mantenga una cuota de mercado sustancial en el sector de seguros de enfermedades graves en 2023.

- El seguro de enfermedades, en el contexto del mercado de seguros de enfermedades graves, se refiere a una póliza que proporciona un beneficio directo a tanto alzado tras el diagnóstico de enfermedades específicas que ponen en peligro la vida, como infarto, derrame cerebral, cáncer, insuficiencia renal, parálisis y otras enfermedades especificadas.

- Este tipo de seguro está diseñado para complementar la cobertura del seguro médico existente, ofreciendo apoyo financiero para gastos no cubiertos por el seguro médico estándar, incluyendo facturas médicas, gastos del hogar y otros costos asociados con enfermedades graves.

Análisis de la cuota de mercado de los seguros de enfermedades graves por geografía

El alcance del informe sobre el mercado de seguros de enfermedades graves se divide principalmente en cinco regiones: Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica. Norteamérica está experimentando un rápido crecimiento y se prevé que mantenga una cuota de mercado significativa en este sector. Estados Unidos ostenta la mayor cuota de mercado, mientras que el mercado canadiense de seguros de enfermedades graves es el de mayor crecimiento en la región. El mercado observa un creciente interés en la cobertura específica para el cáncer, en consonancia con las altas tasas de incidencia de esta enfermedad en la región. Además, las aseguradoras ofrecen pólizas más personalizables para adaptarse a las necesidades y preferencias individuales.

Perspectivas regionales del mercado de seguros de enfermedades graves

Los analistas de The Insight Partners han explicado en detalle las tendencias y los factores regionales que influyen en el mercado de seguros de enfermedades graves durante el período de previsión. Esta sección también analiza los segmentos y la geografía del mercado de seguros de enfermedades graves en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe sobre el mercado de seguros de enfermedades graves

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 240.700 millones |

| Tamaño del mercado para 2031 | 562.900 millones de dólares estadounidenses |

| Tasa de crecimiento anual compuesto global (2023 - 2031) | 11,2% |

| Datos históricos | 2021-2023 |

| período de previsión | 2023-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de los participantes en el mercado de seguros de enfermedades graves: comprensión de su impacto en la dinámica empresarial.

El mercado de seguros de enfermedades graves está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las nuevas tendencias, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una visión general de los principales actores del mercado de seguros de enfermedades graves.

El análisis del mercado de seguros de enfermedades graves se realizó en función del tipo, la modalidad de aplicación y la geografía. En cuanto al tipo, el mercado se segmenta en seguros de enfermedades, seguros médicos y seguros de protección de ingresos. Según la aplicación, el mercado se segmenta en cáncer, infarto, accidente cerebrovascular y otros. Geográficamente, el mercado se segmenta en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica.

Noticias y novedades recientes del mercado de seguros de enfermedades graves

Las empresas adoptan estrategias de crecimiento inorgánico y orgánico, como fusiones y adquisiciones. El pronóstico del mercado de seguros de enfermedades graves se estima a partir de diversos hallazgos de investigación primaria y secundaria, como publicaciones de empresas clave, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los principales desarrollos recientes del mercado:

- En octubre de 2023, AXA Hong Kong y Macao (AXA) anunció el lanzamiento de su nuevo plan de enfermedades graves, CareForAll Critical Illness Plan (“CareForAll”), que brinda tranquilidad a las comunidades desatendidas que enfrentan riesgos para la salud. Con requisitos de suscripción menos estrictos, CareForAll busca atender a clientes con enfermedades crónicas, personas mayores y sobrevivientes de enfermedades graves, permitiéndoles acceder a un seguro de enfermedades graves cuando lo necesiten.

[Fuente: AXA Hong Kong, sitio web de la empresa]

Cobertura y resultados del informe de mercado de seguros de enfermedades graves

El informe de mercado sobre “Tamaño y pronóstico del mercado de seguros de enfermedades graves (2021-2031)” proporciona un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño y pronóstico del mercado a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos por el alcance.

- Dinámica del mercado: factores impulsores, restricciones y oportunidades clave.

- Tendencias clave futuras.

- Análisis detallado de PEST y SWOT

- Análisis de mercado global y regional que abarca las principales tendencias del mercado, los actores clave, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia, incluyendo la concentración del mercado, análisis de mapas de calor, actores clave y novedades recientes.

- Perfiles detallados de las empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de seguros de enfermedades graves

Obtenga una muestra gratuita para - Mercado de seguros de enfermedades graves