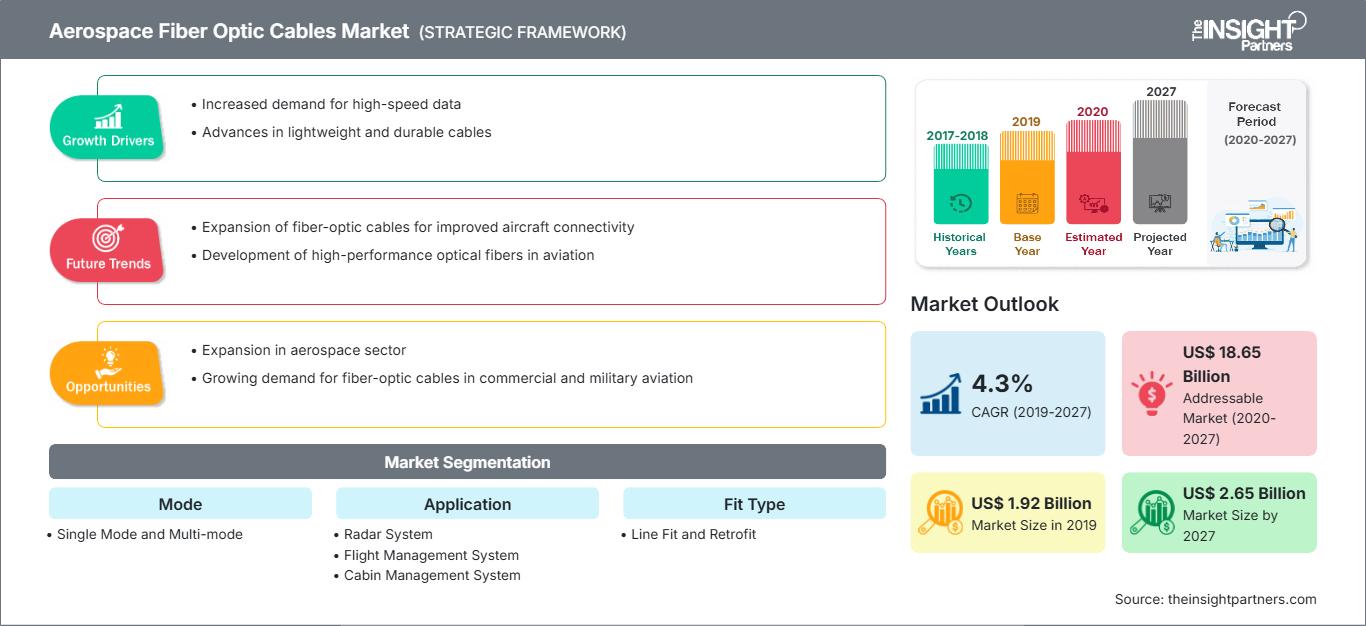

Aerospace Fiber Optic Cables Market Growth Drivers and Forecast by 2027

Aerospace Fiber Optic Cables Market Forecast to 2027 - Analysis by Mode (Single Mode and Multi-mode); Application (Radar System, Flight Management System, Cabin Management System, In-flight Entertainment System, Electronic Warfare, Avionics, Others); Fit Type (Line Fit and Retrofit); End User (Commercial and Military)

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027- Report Code : TIPRE00006619

- Category : Aerospace and Defense

- No. of Pages : 203

- Available Report Formats :

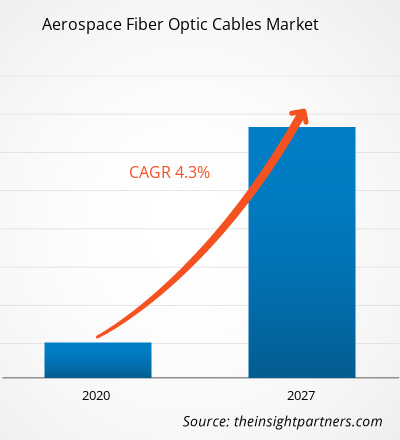

In terms of revenue, the aerospace fiber optic cables market was valued at US$ 1,924.65 million in 2019 and is projected to reach US$ 2,645.86 million by 2027; it is expected to grow at a CAGR of 4.3% during the forecast period.

The growth of the aerospace fiber optic cables market is majorly attributed to significant investments toward advanced technologies in the aerospace industry. Over the past few decades, the aviation (commercial and military) industry has grown immensely; the rate of technological transformation has been outstanding, which has stimulated the demand for various products and services. Pertaining to the fact that the fiber optic cables overcome the challenges by its predecessors, and has showcased significant benefits in the military aviation industry, the demand for the same is growing in the commercial aviation industry, which is driving the growth of the aerospace fiber optic cables market.

Geographically, the aerospace fiber optic cables market is analyzed on the basis of five strategic regions, namely North America, Europe, Asia Pacific, Middle East and Africa, and South America. The aerospace industry in North America is witnessing the existence of a large number of aircraft manufacturers, MRO service providers, and US DoD. The demand for advanced technologies is tremendous in the region, with all the end users mentioned above are well aware of newer technologies. The US DoD continuously invests time and amounts towards the advancements of existing fleet and development of robust technology aircraft with an objective to maintain a mission-ready force. Owing to this, the adoption of fiber optic cables on military aircraft begun decades ago in the region, and are still continuing to integrate the technology on the newer military aircraft fleet. Similarly, the commercial aerospace sector in the region is majorly dominated by Boeing, which is also integrating its B787 and B777 models with fiber optic cables. This integration pertains to the rising demand for high-speed data transfer from the cockpit and cabin. The MRO service providers and airlines with in-house MRO centers have started exercising retrofitting of older aircraft with fiber optic cables, which is also a catalyzer for the North American aerospace fiber optic cables market. The presence of a large number of fiber optic cable manufacturers in the region is supporting the ever-rising demand, which is thereby boosting the aerospace fiber optic cables market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAerospace Fiber Optic Cables Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Aerospace Fiber Optic Cables Market

The aircraft production industry is heavily dependent on manual labor despite robotic technology. In the wake of strong lockdown regulations imposed by several countries, the aircraft-manufacturing sector is experiencing lack of labors in respective aircraft and component manufacturing facilities. Since the aircraft-manufacturing sector is majorly concentrated in North America and Europe, and the two regions are facing a tremendous challenge in maintaining its manufacturing pace with the outbreak. The European countries manufacture various aircraft components; however, increasing number of COVID-19 infected patients is posing a significant challenge to a majority of European countries. The plane makers across the globe are witnessing a severe downfall in component procurement, which is reflecting downfall in the production of aircraft.

Attributing to the fact that the aerospace fiber optic cables market players are scattered across North America, Europe, and APAC region, the outbreak across these regions has resulted in disruption in adequate manufacturing quantity of fiber optic cables and supply chain. This has negatively affected the aerospace fiber optic cables market.

Market Insights

Rising Demand for Higher Bandwidth over Long Distance is propelling the growth of Aerospace Fiber Optic Cables Market

The commercial airlines in recent times are opting for long haul flights owing to increasing passenger traffic on long haul routes. The long haul flights demand high-speed connectivity; Ethernet has been the best choice for network infrastructure protocol among the commercial airlines over the years, owing to its high performance, reliability, and universally accepted open standard. However, the Ethernet network connectivity has limitations to transmit high bandwidth data over longer distances. Attributing to this, several aircraft cabling system manufacturers have ventured into fiber optic cable industry, which has been benefiting the commercial airlines over the recent years. This is positively influencing the aerospace fiber optic cables market.

Mode-Based Insights

In terms of mode, multi-mode segment captured the largest share of the global aerospace fiber optic cables market in 2019. Single-mode fiber optic cable allows a single type of light mode to be dispersed at a time. Though, in a multimode fiber optical cable, light can be dispersed in multiple modes. The variances between single-mode and multimode fiber optic cables are mostly built on fiber core diameter, bandwidth, wavelength & light source, distance, and cost.

Application-Based Insights

In terms of application, avionics segment captured the largest share of the global aerospace fiber optic cables market in 2019. Advancements in technology that would be highly required for applications in avionics comprises bend-insensitive fiber, connector compatibility, increased-bandwidth fibers, high-density interconnections, high-power laser beam delivery, as well as acceptance of commercial off-the-shelf components. Avionics designers are focused continuously on outing more computing power into embedded systems, which are capable of handling navigation, communications, as well as other critical functions. Thus reducing weight, accelerating data transmission rates and bandwidth, together with boosting robustness and security.

Fit Type-Based Insights

Based on fit type, the aerospace fiber optic cables market is segmented into line fit and retrofit. The retrofit captured a dominating share in the global aerospace fiber optic cables market in 2019. Aerospace fiber optic cables are already fully-deployed into new aircraft models, such as the Airbus A380 and Boeing B787. Airlines are operating several other older models commercial aircraft are replacing conventional copper cables with fiber optic cables owing to the rising need for high bandwidth. The trend is gaining immense traction, propelled by the continuing demand for smaller, light-weighted wiring that offers an enhanced level of performance compared to legacy copper wiring. With the rising demand for high bandwidth aircraft, the deployment of optical fiber is expected to increase in the older military as well as commercial aircraft.

End user-Based Insights

Based on end user, the aerospace fiber optic cables market is segmented into commercial and military. The military segment captured a dominating share in the global aerospace fiber optic cables market in 2019. Fiber networks and cable assemblies’ providers are assisting military aircraft designers in meeting their constant need for new competencies and improved performance to preserve the improvement over potential enemies. These fiber networks are becoming gradually more advanced for supporting new generations of advanced vision systems, avionics, and other emerging technologies.

The existence of a large number of well-established players and emerging companies in the aerospace fiber optic cables market across the globe is supporting the uprising demand from the end users. The constant supply of fiber optic cables to aircraft manufacturers, aircraft component manufacturers, and retrofitting end users, are playing a vital role in maturing aerospace fiber optic cables market. A few of the recent acquisitions in the aerospace fiber optic cables market are listed below:

2019:Amphenol Aerospace partnered with Samtec in order to design and develop the new Centaur High-Speed Cable Assembly, which makes use of both the advantages of Amphenol’s broad portfolio of mil-spec connectors and the latest in high-speed contact and connector technology and Samtec’s ExaMAX high-speed backplane system for offering durable, fully-tested high-bandwidth connections that are ideal for use in aerospace, military, and other ruggedized applications..

2018:W. L. Gore & Associates U.K. Ltd. introduced rugged 1.8-millimeter Simplex aerospace fiber optic cables for transferring mission-critical data on military high-speed avionics networks as fast as 10 gigabits per second.

Aerospace Fiber Optic Cables Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 1.92 Billion |

| Market Size by 2027 | US$ 2.65 Billion |

| Global CAGR (2019 - 2027) | 4.3% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Mode

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aerospace Fiber Optic Cables Market Players Density: Understanding Its Impact on Business Dynamics

The Aerospace Fiber Optic Cables Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market Segmentation

Aerospace Fiber Optic Cables Market – By Mode

- Single mode

- Multi-mode

Aerospace Fiber Optic Cables Market – By Application

- Radar Systems

- Flight Management Systems

- Cabin Management Systems

- In-flight Entertainment Systems

- Electronic Warfare

- Avionics

- Others

Aerospace Fiber Optic Cables Market – By Fit Type

- Line Fit

- Retrofit

Aerospace Fiber Optic Cables Market – By End-user

- Commercial

- Military

Aerospace Fiber Optic Cables Market by Region

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

-

Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

-

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Companies Profiled in Aerospace Fiber Optic Cables Market are as Follows:

- Amphenol Corporation

- AFL

- Carlisle Interconnect Technologies

- Collins Aerospace (Raytheon Technologies Corp.)

- Nexans S.A.

- W. L. Gore & Associates, Inc.

- Timbercon, Inc.

- TE Connectivity

- Prysmian Group

- OFS Fitel, LLC

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For