Hardware Security Module Market Overview and Growth by 2031

Hardware Security Module Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (LAN Based, PCIe Based, and USB Based), Application (Payment Processing, Secure Socket Layer, Authentication, Code and Document Signing, Database Encryption, Credential Management, and Application-Level Encryption), and Industry (BFSI, Government, IT & Telecom, Healthcare, Manufacturing, Retail & Consumer Goods, and Others)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Jun 2024

- Report Code : TIPRE00004282

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 201

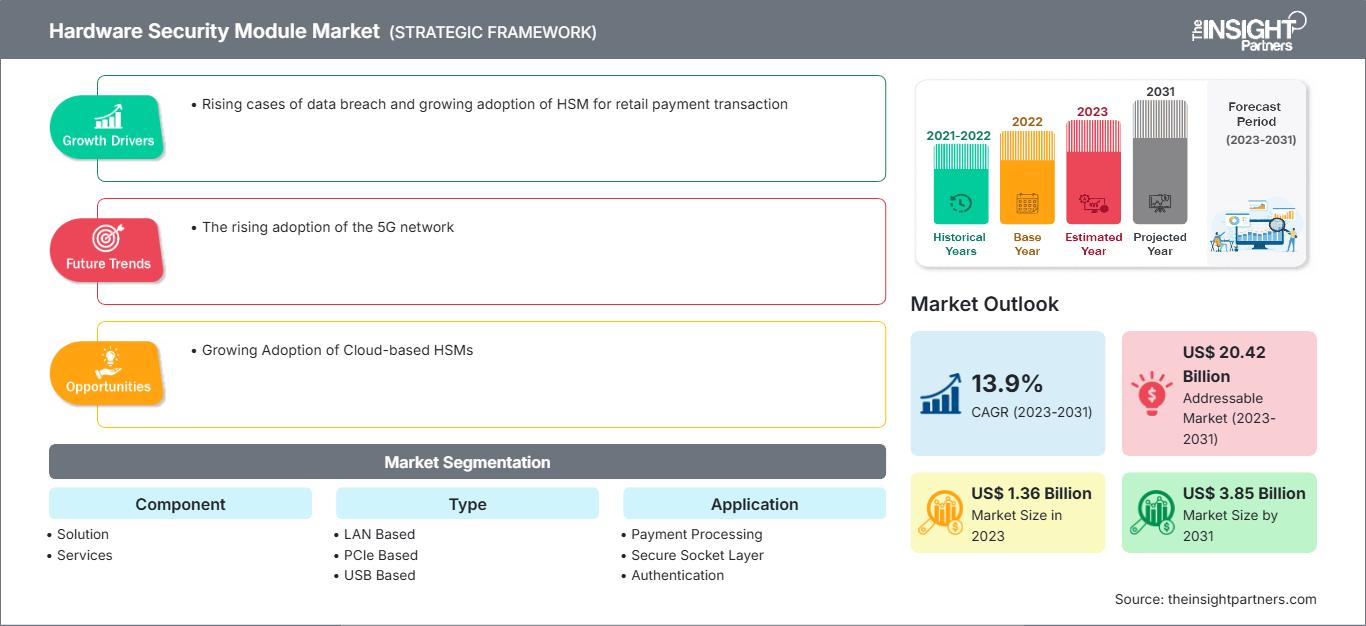

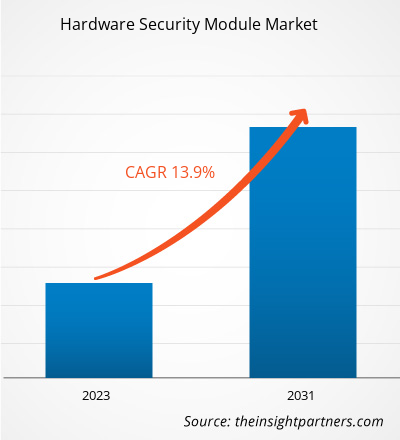

The hardware security module market size is projected to reach US$ 3.85 billion by 2031 from US$ 1.36 billion in 2023. The market is estimated to record a CAGR of 13.9% during 2023-2031. The rising adoption of the 5G network is likely to remain one of the key trends in the market.

Hardware Security Module Market Analysis

Many large-sized businesses and corporations work with a huge volume of sensitive and confidential data. The demand for HSM has grown in response to enhanced data protection as a result of rising cases of cyberattacks. Thus, the growth in data breaches and cyberattacks propels the hardware security module market growth. Moreover, the growing adoption of cloud-based HSMs is expected to create an opportunity for market growth in the coming years. HSMs using cloud-based technologies offer physical data access protection, generation of keys, secure management of key material, and a secure execution environment for cloud applications.

Hardware Security Module Market Industry Overview

A hardware security module (HSM) is a dedicated crypto processor that is specifically built for crypto key lifecycle protection. Hardware security modules securely manage, process, and store cryptographic keys within a hardened, tamper-resistant device, acting as trust anchors to safeguard the cryptographic infrastructure of the most security-conscious enterprises across the globe. It helps reduce risk and satisfy compliance requirements using PKI, blockchain, code signing, document signing, database encryption, eIDAS, GDPR, DNSSEC, PCI DSS, and other solutions. Also, it helps safeguard cryptographic keys wherever the companies' applications and workloads operate at scale, providing more flexibility. Furthermore, HSM protects digital transition with equipment built for modern data centers.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHardware Security Module Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hardware Security Module Market Driver and Opportunities

Rising Cases of Data Breach

Many large-sized businesses and corporations work with a huge volume of sensitive and confidential data. The rise in digitalization has encouraged several businesses across various industry verticals to digitalize their business to gain competitive advantage, enhance operational workflow, and reach more targeted audiences. However, the adoption of digital solutions makes critical data vulnerable and accessible to hackers, leading to the loss of critical information, financial losses, and loss of customer trust, among others. The rise in the number of data breach cases affects the overall business performance. A few of the data breach incidents are mentioned below:

- In June 2023, a Telegram bot uploaded the data of people who registered on the COWIN app in India, leading to a massive data breach incident. The data leak included mobile numbers, Aadhar card IDs, passports, and other critical customer information.

- In July 2023, IBM Security released the Cost of a Data Breach report for 2023. The report indicated that the global average data breach cost reached US$ 4.45 million in 2023, a 15% increase over the previous three years.

- In July 2023, MOVEit, the file transfer tool, experienced a massive data hack, which impacted 200 organizations and 17.5 million individuals. The data of multiple critical organizations and government bodies, such as the Department of Agriculture, Department of Energy, and Department of Health and Human Services, were leaked.

- In May 2023, Deutsche Telekom AG's brand T-Mobile experienced its second data breach case for 2023, where over 800 customer's PINs, full names, and phone numbers were leaked.

To protect data and boost their network security, businesses are using hardware security module (HSM) solutions. Thus, the rise in the number of data breach cases generates the demand for enhanced security solutions, such as hardware security modules, which drives the hardware security module market.

Growing Adoption of Cloud-Based HSMs

HSMs using cloud-based technologies offer physical data access protection, generation of keys, secure management of key material, and a secure execution environment for cloud applications. A few of the major market players are focusing on developing advanced hardware security modules for cloud-based applications. For instance, in September 2022, Marvell unveiled its LiquidSecurity 2 (LS2) hardware security module adapter, an advanced solution that offers encryption, key management, authentication, and other hardware security module services in the cloud. Furthermore, LS2 is a converged security platform for payment, privacy compliance, and general-purpose applications. It is powered by Marvell OCTEON, a cloud-optimized data processing unit (DPU), which is proven at scale across the world as the largest hyperscale cloud. The new adapter offers the highest-performing cryptographic acceleration and processing, as well as hardware-secured storage of up to one million keys for AES, RSA, and ECC encryption algorithms and 45 partitions for robust multi-tenant use cases. Also, in August 2023, Thales announced the launch of its new payShield Cloud HSM service, aimed to boost the adoption of cloud payments infrastructure. The solution, built on its payShield 10k Payment Hardware Security Module (HSM), focuses on providing clients with improved flexibility, scalability, and speed-to-market solutions. Thus, the growing adoption of cloud-based HSMs is expected to create lucrative opportunities for the hardware security module market growth during the forecast period.

Hardware Security Module Market Report Segmentation Analysis

Key segments that contributed to the derivation of the hardware security module market analysis are type, application, and industry.

- Based on type, the market is divided into LAN-based, PCIe based, and USB based. The LAN based segment held the largest hardware security module market share in 2022; however, the PCIe based segment is anticipated to register the highest CAGR during 2022–2030.

- In terms of application, the market is categorized into payment processing, secure socket layer, authentication, code and document signing, database encryption, credential management, and application-level encryption. The payment processing segment held the largest share of the hardware security module market in 2023.

- Based on industry, the market is segmented into BFSI, government, IT & telecom, healthcare, manufacturing, retail & consumer goods, and others. The BFSI segment held the largest share in the hardware security module market in 2023.

Hardware Security Module Market Share Analysis by Region

The geographic scope of the hardware security module market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Europe held the largest hardware security module market share in 2022. The Europe market is expected to grow during the forecast period due to the rising awareness about the data security benefits provided by HSMs. The growing BFSI, IT & telecommunication, healthcare, and other industries in the region are raising the need for hardware security modules to protect their business information. Furthermore, the increasing digital advancements in Germany, the UK, and other European countries and the growing adoption of cloud based HSMs are creating an opportunity for the hardware security module market growth in Europe.

Hardware Security Module Market Regional Insights

The regional trends and factors influencing the Hardware Security Module Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Hardware Security Module Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Hardware Security Module Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.36 Billion |

| Market Size by 2031 | US$ 3.85 Billion |

| Global CAGR (2023 - 2031) | 13.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Hardware Security Module Market Players Density: Understanding Its Impact on Business Dynamics

The Hardware Security Module Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Hardware Security Module Market top key players overview

Hardware Security Module Market News and Recent Developments

The hardware security module market has been evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the hardware security module market are listed below:

- Thales Trusted Cyber Technologies (TCT) announced the launch of the new version 7.13.0 of the Luna Network and PCIe HSMs. It includes different features such as remote initialization of the Remote PED Vector Key, enabling fully remote HSM administration, support for LACP 802.3ad protocol to enhance multi-NIC port bonding in the Network HSM appliance, and Luna Client support for Windows Server 2022 and Ubuntu 22 LTS. (Source: HDI Global, Press Release, June 2023)

Hardware Security Module Market Report Coverage & Deliverables

The market report "Hardware Security Module Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas:

- Hardware security module market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Hardware security module market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Hardware security module market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the hardware security module market

- Detailed company profiles.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For