Hot Dogs and Sausages Market Size, Share, and Analysis by 2030

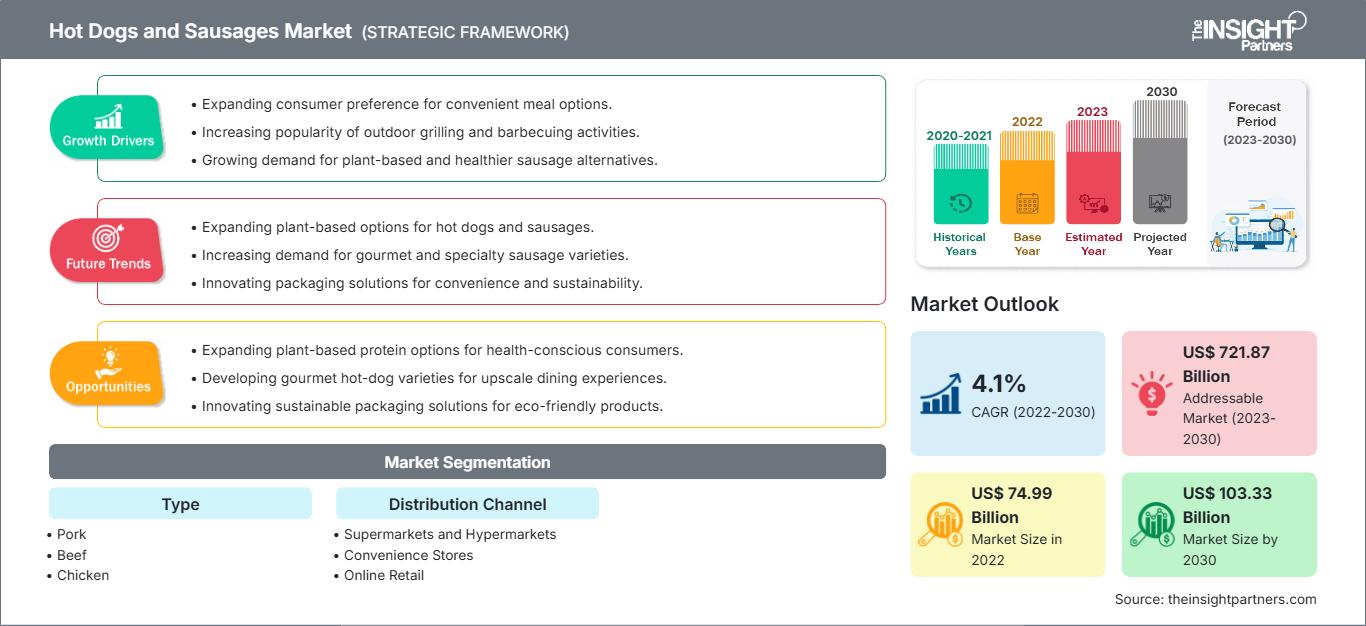

Hot Dogs and Sausages Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Pork, Beef, Chicken, and Others) and Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPRE00007547

- Category : Food and Beverages

- No. of Pages : 145

- Available Report Formats :

The hot dogs and sausages market size is projected to grow from US$ 74,990.90 million in 2022 to US$ 103,331.63 million by 2030; the market is expected to record a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View

Hot dog is a type of sausage that is usually boiled or grilled and served in a bun. Sausages are made with ground meat (often beef, pork, or veal), spices, salt, breadcrumbs, onion, cereal grains such as rice or cornmeal, and other ingredients. They are usually smoked or cured before being cooked. Hot dogs and sausages are an important part of many cuisines and are popular across the world. Rising preference for convenience food products and strategic initiatives by key manufacturers to provide a diversified product portfolio drive the growth of the hot dogs and sausages market.

Growth Drivers and Challenges

The consumption of high-quality convenience food is increasing among the working population and teenagers. Convenience food, such as ready-to-eat products, saves consumers’ time and efforts associated with ingredient shopping, meal preparation, and cooking. According to the US Department of Agriculture, convenience food products have become a staple in the American diet. The inclination toward convenience foods such as packaged meat products, including hot dogs and sausages, has upsurged owing to busy lifestyles, preference for on-the-go food products, and rapid urbanization.

The growing demand for protein-rich food and changes in food habits and meal patterns further boost the demand for convenience food. Dual-income households, the expansion of the middle class, and the elevating number of single-person households have significantly impacted purchasing behaviors, with a marked shift toward time-saving food options. Hot dogs and sausages require minimal or no preparation and offer immediate consumption value. These products also serve well as quick meals, snacks, or ingredients in more elaborate dishes, making them highly versatile. The food service industry, including fast-food chains, delis, and cafeterias, has further contributed to the growing popularity of sausages and hot dogs. Their inclusion in ready-to-cook or prepackaged meal kits is also gaining momentum. Additionally, the expansion of convenience stores, supermarkets, and online grocery platforms has made these products more accessible to a broader customer base.

Manufacturers are also innovating with healthier versions—such as low-fat, organic, or plant-based alternatives—to appeal to the health-conscious demographic without compromising convenience. This adaptability and alignment with evolving consumer expectations continue to position hot dogs and sausages as leading products in the global convenience food sector.

Hot dog and sausage contamination can occur due to various reasons, such as issues in the production process, improper storage, or harmful substances in the products. Government agencies and food safety associations, such as the Canadian Food Inspection Agency and the US Department of Agriculture’s Food Safety and Inspection Service (FSIS), closely monitor product labeling and branding.

In America, hot dogs and sausages are contaminated with products other than those listed in the ingredient list, including other types of meat and human DNA. The products are also contaminated with bacteria either during the manufacturing process or during the handling of products. In September 2021, Espi’s Sausage and Tacino Co. recalled more than 2,000 pounds of frozen ready-to-eat chicken and pork hot dog products. The FSIS announced the recall, as the products were contaminated with Listeria monocytogenes contamination.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHot Dogs and Sausages Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

The global hot dogs and sausages market is segmented on the basis of type, distribution channel, and geography. Based on type, the hot dogs and sausages market is segmented into beef, pork, chicken, and others. Based on distribution channel, the hot dogs and sausages market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Segmental Analysis

Based on type, the hot dogs and sausages market is segmented into beef, pork, chicken, and others. The pork segment holds a significant share of the market. Pork is the most popular meat consumed in North America and Europe. Americans prefer pork over any other meat on a daily basis. Pork has the highest protein content among other red meat. It is an excellent nutritional source that provides vitamin B6, thiamin, phosphorus, niacin, zinc, and protein. Thus, the high preference for pork meat drives the demand for pork-based hot dogs and sausages among consumers. In June 2020, the Meat Industry Association of Ukraine declared a “New Pig Production-2025 Program” to support pig farming in the country to address the global pork shortage. Thus, the active participation of government bodies to support pork meat-related business drives the hot dogs & sausages market for the pork segment.

Regional Analysis

The hot dogs and sausages market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global hot dogs and sausages market was dominated by Europe; the market in this region was valued at US$ 26,374.30 million in 2022. North America is the second major contributor to the market, which holds around 20% of the global market. South & Central America is expected to register a CAGR of 4.5% in the hot dogs and sausages market during the forecast period. The western part of Europe is known for its better living standards, with people displaying a higher income level. It is one of the wealthiest regions globally, with more per capita Gross Domestic Product (GDP) than the other regions. European consumers display variations in preferences and reflect different countries' economic status, culinary practices, and consumption habits. According to Food and Agriculture Organization (FAO), more processed meat and ready-to-eat meals will be included in European countries as consumer taste changes frequently, increasing the demand for processed packaged meat products such as hot dogs and sausages. Further, Europe is a well-established and potential market for hot dogs and sausages, with the growing popularity of ready-to-eat convenience products. Rising demand for packaged meat products and increasing buying power of consumers in Europe will drive the hot dogs and sausages market growth in the coming years.

Industry Developments and Future Opportunities

Various initiatives taken by key players operating in the hot dogs and sausages market are listed below:- In 2021, Applegate Farms, LLC, announced the launch of Do-Good Dog Hot Dog, the first nationally available hot dog made with beef raised on verified regenerative grasslands in the US.

- In 2022, Johnsonville, LLC purchased the 190,000 square-foot facility from sock maker Wigwam Mills, which vacated the facility in late 2020. Johnsonville’s domestic and international sales of its fully cooked sausage product portfolio have increased significantly over the last few years, maxing out manufacturing capacity at its headquarters campus in Johnsonville. The facility name (Lakeside) was determined by its local members, keeping in theme with its three other manufacturing locations in Johnsonville (Countryside, Meadowside, and Riverside).

Hot Dogs and Sausages Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 74.99 Billion |

| Market Size by 2030 | US$ 103.33 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Hot Dogs and Sausages Market Players Density: Understanding Its Impact on Business Dynamics

The Hot Dogs and Sausages Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

COVID-19 Pandemic Impact

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the food & beverage industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies reported delays in product deliveries and a slump in product sales in 2020.

Increasing demand for meat protein coupled with rapid growth and development in food processing technology drove the demand for hot dogs and sausages before the onset of the COVID-19 pandemic. In addition, rising consumption of convenience products and surging demand from the working population due to busy lifestyles further contributed to the market growth. However, the food & beverages industry experienced an adverse impact of the pandemic during the first quarter of 2020. Many industries had to slow down their operations due to value chain disruptions caused by the shutdown of national and international boundaries. The pandemic led to social distancing norms and a severe negative economic impact, hindering manufacturing and distribution processes of hot dogs and sausages. The COVID-19 pandemic also led to an economic recession in the initial months of 2020, which created financial difficulties for low-income and mid-income consumers.

Many businesses recovered as the governments of various countries eased the restrictions after the initial months of lockdown in 2020. The introduction of the COVID-19 vaccine offered further relief from the distressing pandemic situation, leading to a rise in business activities. The resumption of operations in the manufacturing units positively impacted the hot dogs and sausages market and led to the recovery of the production of hot dogs and sausages products. Manufacturers overcame the demand and supply gap as they were permitted to operate at total capacity.

Competitive Landscape and Key Companies

Bar-S Foods Co, Carolina Packers Inc, Conagra Brands Inc, Hormel Foods Corp, Johnsonville LLC, Kunzler & Co Inc, Smithfield Foods Inc, The Kraft Heinz Co, Tyson Foods Inc, and Vienna Beef Inc are among the prominent players operating in the global hot dogs and sausages market. These market players are adopting strategic development initiatives to expand, further driving the market growth.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For