Industrial Robotics Market Size, Share, Trends & Growth Analysis by 2030

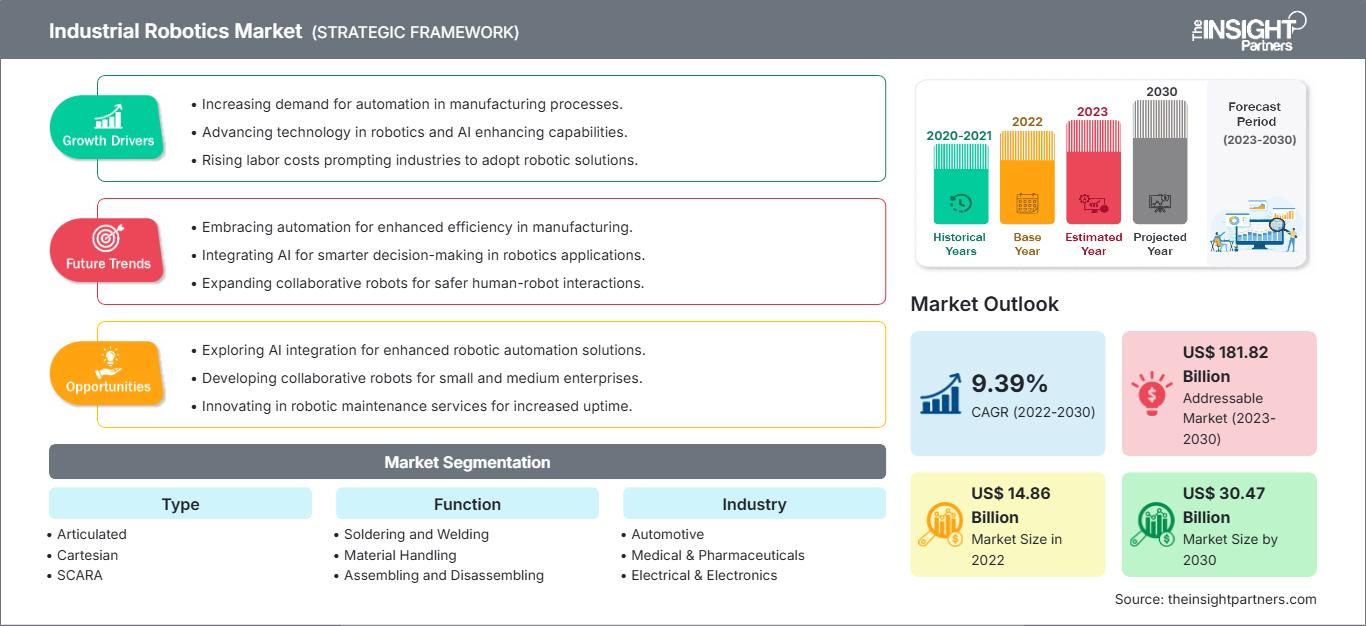

Industrial Robotics Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Articulated, Cartesian, SCARA, Collaborative, Parallel, and Others), Function (Soldering and Welding, Material Handling, Assembling and Disassembling, Painting and Dispensing, Milling, and Cutting and Processing), and Industry (Automotive, Medical & Pharmaceuticals, Electrical & Electronics, Rubber & Plastics, Metal & Machinery, and Food & Agriculture), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Aug 2023

- Report Code : TIPTE100000635

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 249

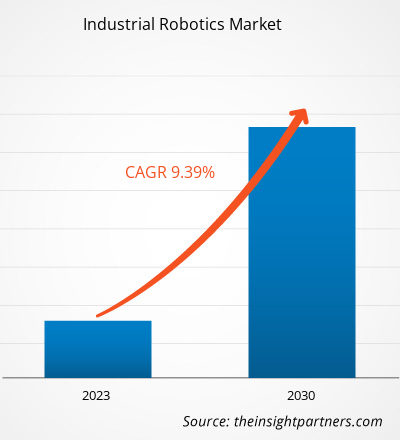

The industrial robotics market size is projected to reach US$ 30.47 billion by 2030 from US$ 14.86 billion in 2022. The market is expected to register a CAGR of 9.39% during 2022–2030. The rising demand for 5G technology and edge computing is likely to remain a key trends in the market.

Industrial Robotics Market Analysis

The evolution of the Industry 4.0 Concept and the growing demand for collaborative robots for enhancing operational efficiency are driving the market. The market is anticipated to grow during the forecast period due to the growing demand for automation in the manufacturing, warehouse, and logistics industries. Moreover, the integration of artificial intelligence technology in robotics is creating lucrative opportunities for the market.

Industrial Robotics Market Overview

Industrial robotics can be defined as robotic arms equipped with sensors and controls that can execute a variety of functions and operations in the creation of industrial products. They are programmed to perform repetitive tasks in cycles. These robots drastically reduce the human elements involved in production while also increasing processing speed, quality, and production capacity. The most significant component of the robot is undoubtedly the arm, which is made up of joints and connections. The end-of-the-arm tool (EOAT) is the most critical component of the robotic arm. They undertake a variety of tasks, including marking, cutting, welding, drilling, painting, and cleaning.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIndustrial Robotics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Robotics Market Drivers and Opportunities

Evolution of the Industry 4.0 Concept to Favor the Market

Industry 4.0 represents the ongoing transformation of the manufacturing and industrial landscape, characterized by the convergence of advanced technologies such as robotics, automation, artificial intelligence (AI), and the Internet of Things (IoT). This fourth industrial revolution marks a shift from traditional automation to intelligent, interconnected systems that enable data-driven decision-making and real-time process optimization. One of the most significant developments under the Industry 4.0 framework is the integration of industrial IoT (IIoT) and AI into robotic systems. These technologies are enabling the emergence of autonomous and collaborative robots (cobots) capable of operating independently, interacting safely with human workers, and adapting to dynamic production environments. Unlike earlier generations of robots, which were limited to fixed, repetitive tasks, modern robotic systems are highly flexible and responsive to changes in operational conditions.

The Industry 4.0 powers innovative maintenance strategies, particularly predictive and condition-based maintenance, which rely on real-time data analytics and machine learning. These approaches minimize unplanned downtime, optimize asset utilization, and reduce maintenance costs—delivering substantial operational efficiencies. These advancements are expected to accelerate the adoption of robotics across various industries, including automotive, electronics, logistics, and pharmaceuticals. The ability to automate previously manual, labor-intensive tasks not only enhances productivity but also addresses growing challenges such as labor shortages and rising wage pressures.

Further, the deployment of smart robotic systems is enhancing machine management and production visibility, allowing businesses to respond more swiftly to demand fluctuations and production anomalies. As manufacturers continue to invest in digital transformation, the demand for intelligent robotic solutions is anticipated to grow significantly over the coming years. By harnessing the power of connectivity, AI, and automation, businesses are poised to achieve greater agility, efficiency, and competitiveness in an increasingly digital economy. Thus, the evolution of Industry 4.0 is redefining the role of robotics in industrial environments, in turn, bolstering the industrial robotics market.

Integration of Artificial Intelligence Technology in Robotics

AI is driving remarkable progress in the robotics and automation sector. As AI in robotics evolves and blooms, numerous industries are capitalizing on these cutting-edge technologies, such as implementing intelligently automated processes to fuel sophisticated data collection and analysis, allowing businesses, services, and manufacturers to make data-driven decisions, or implementing self-learning robots to facilitate work processes and tasks. The adoption of AI-based self-learning robots is expected to create opportunities in the market during the forecast period.

Industrial Robotics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial robotics market analysis are type, function, and industry.

- Based on type, the industrial robotics market is divided into articulated, cartesian, SCARA, collaborative, parallel, and others. The articulated segment held the largest market share in 2022.

- By function, the market is segmented into soldering and welding, material handling, assembling and disassembling, painting and dispensing, milling, and cutting and processing. The material handling segment held the largest market share in 2022.

- In terms of industry, the market is divided into automotive, medical & pharmaceuticals, electrical & electronics, rubber & plastics, metal & machinery, and food & agriculture. The food & agriculture segment held the largest market share in 2022.

Industrial Robotics Market Share Analysis by Geography

The geographic scope of the industrial robotics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The market in Europe is projected to expand during the forecast period due to the increasing demand for industrial robots. Industrial robot installations climbed 33% in 2021 compared to 2020. In 2021, industrial robot usage increased by 22% in the electronics industry, 57% in the automotive industry, and 29% in the metal and machinery business, compared to 2020. According to IFR, in January 2023, China, Japan, and South Korea were among the top five most advanced countries in terms of yearly industrial robot installations, with China's industrial robotics market experiencing the highest development.

Industrial Robotics Market Regional InsightsThe regional trends and factors influencing the Industrial Robotics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Industrial Robotics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Industrial Robotics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 14.86 Billion |

| Market Size by 2030 | US$ 30.47 Billion |

| Global CAGR (2022 - 2030) | 9.39% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Industrial Robotics Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Robotics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Industrial Robotics Market top key players overview

Industrial Robotics Market News and Recent Developments

The industrial robotics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the industrial robotics market are listed below:

- ABB Ltd reaffirmed its commitment to one of its most important client markets, the US, by beginning construction on expanding its current robotics headquarters and production plant in Auburn Hills, Michigan. The project will be completed by November 2023 and is expected to cost US$ 20 million. The expansion will create 72 new highly skilled jobs in the area, backed by a US$ 450,000 performance-based grant from the Michigan Business Development Program. (Source: ABB Ltd, Company Website, March 2023)

Industrial Robotics Market Report Coverage and Deliverables

The “Industrial Robotics Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Industrial robotics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Industrial robotics market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Industrial robotics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the industrial robotics market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For